13

Current Liabilities and Contingencies

PowerPoint Authors:

Susan Coomer Galbreath, Ph.D., CPA

Charles W. Caldwell, D.B.A., CMA

Jon A. Booker, Ph.D., CPA, CIA

Cynthia J. Rooney, Ph.D., CPA

McGraw-Hill/Irwin

Copyright © 2011 by the McGraw-Hill Companies, Inc. All rights reserved.

Characteristics of Liabilities

Probable

future

sacrifices of

economic

benefits.

13 - 2

Arise from

present

obligations

to other

entities.

Result from

past

transactions

or events.

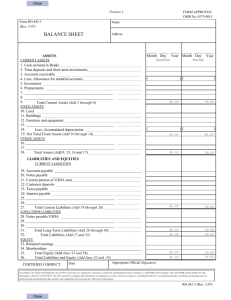

What is a Current Liability?

LIABILITIES

Current Liabilities

Obligations payable within

one year or one operating

cycle, whichever is longer.

Expected to be satisfied

with current assets or by

the creation of other current

liabilities.

13 - 3

Long-term Liabilities

Current Liabilities

Accounts

payable

Taxes

payable

Unearned

revenues

13 - 4

Cash dividends

payable

Current

Liabilities

Accrued

expenses

Short-term

notes payable

Open Accounts and Notes

•

•

•

•

Accounts Payable

Obligations to suppliers for goods

purchased on open account.

Trade Notes Payable

Similar to accounts payable, but

recognized by a written promissory note.

Short-term Notes Payable

Cash borrowed from the bank and

recognized by a promissory note.

Credit lines

Prearranged agreements with a bank that

allow a company to borrow cash without

following normal loan procedures and

paperwork.

13 - 5

Interest

Interest on notes is calculated as follows:

Face

Amount

Amount

borrowed

13 - 6

×

Annual

Rate

Interest rate is

always stated

as an annual

rate.

×

Time To

Maturity

Interest owed is

adjusted for the

portion of the year

that the face

amount is

outstanding.

Interest-bearing Notes

On September 1, Eagle Boats borrows $80,000 from

Cooke Bank. The note is due in 6 months and has a

stated interest rate of 9%. Record the journal entry.

September 1:

Cash ....................................................

Notes payable .......................

80,000

80,000

To record short-term note payable to Cooke Bank.

How much interest is owed to Cooke Bank at year-end,

on December 31?

$80,000 × 9% × 4/12 = $2,400

13 - 7

Interest-bearing Notes

Assume Eagle Boats’ year-end is December 31.

Record the necessary adjustment at year-end.

December 31:

Interest expense ...................................

Interest payable .......................

2,400

2,400

To accrue interest on note due to Cooke Bank.

Record the journal entry for the loan repayment

when the note matures on February 28.

February 28:

Interest payable ...................................

Interest expense ...................................

Note payable …………………………….

Cash ……………………………

To pay off note and interest.

13 - 8

2,400

1,200

80,000

83,600

Noninterest-bearing Notes

Notes without a stated

interest rate carry an

implicit, or effective

rate.

The face of the note

includes the amount

borrowed and the

interest.

13 - 9

Noninterest-bearing Notes

On May 1, Batter-Up, Inc. issued a one-year,

noninterest-bearing note with a face amount

of $10,600 in exchange for equipment

valued at $10,000.

How much interest will Batter-Up pay on the note?

Interest = Face Amount - Amount Borrowed

=

$10,600

$10,000

=

$600

13 - 10

Noninterest-bearing Notes

On May 1, Batter-Up, Inc. issued a one-year,

noninterest-bearing note with a face amount

of $10,600 in exchange for equipment

valued at $10,000.

What is the effective interest rate on the note?

Amount

Interest

Interest ÷

=

Borrowed

Rate

$ 600 ÷ $ 10,000 = 6.00%

13 - 11

Commercial Paper

Commercial paper is a term used for

unsecured notes issued in minimum

denominations of $25,000 with maturities

ranging from 30 days to 270 days.

Issued directly to the lender

and is backed by a line of

credit with a bank.

Recorded in the

same manner as notes

payable.

13 - 12

Salaries, Commissions, and Bonuses

Compensation expenses such as

salaries, commissions, and bonuses

are liabilities at the balance sheet

date if earned but unpaid.

These accrued

expenses/accrued liabilities

are recorded with an

adjusting entry prior to

preparing financial

statements.

13 - 13

Vacations, Sick Days, and Other

Paid Future Absences

An employer should accrue an expense and the related liability

for employees’ compensation for future absences (such as

vacation pay) if the obligation meets all four of these conditions:

1. The obligation is for services already performed.

2. The paid absence can be taken in a later year—the benefit

vests or the benefit can be accumulated over time.

3. Payment is probable.

4. The amount can be reasonably estimated.

Sick pay quite often meets the conditions for accrual, but

accrual is not mandatory because future absence depends on

future illness, which usually is not a certainty.

13 - 14

Liabilities from Advance Collections

Refundable deposits

Advances from customers

Gift cards

Collections for third parties

13 - 15

Gift Cards

During their December 2010 Christmas promotion, MegloMart

sold 20,000 gift cards at $25 each. All gift card sales were for

cash. On December 31, 2010, only 1,000 gift cards had been

redeemed. Unused gift cards expire on December 31, 2011, if

not used to purchase MegloMart merchandise.

Prepare the journal entries on December 31, 2010 to record the

December 2010 sale and redemption of gift cards.

December 31, 2010:

Cash (20,000 × $25) ...................................

Unearned revenue ….......................

500,000

500,000

To record cash received from gift card sales.

December 31, 2010:

Unearned revenue (1,000 × $25) ...............

Sales revenue ….............................

To record revenue from gift card redemptions.

13 - 16

25,000

25,000

Gift Cards

By December 31, 2011, 18,500 additional gift cards had been

redeemed. Prepare the journal entry on December 31 to

record the 2011 redemptions.

December 31, 2011:

Unearned revenue (18,500 × $25) ….................

Sales revenue (18,500 × $25) ….........

462,500

462,500

To record revenue from gift card redemptions.

On December 31, 2011, the 500 remaining cards had not been

redeemed. Prepare the journal entry on December 31 to

record the gift card expirations.

December 31, 2011:

Unearned revenue (500 × $25) ….....................

Gift card breakage revenue ………..…..

To record revenue from gift card expirations.

13 - 17

12,500

12,500

A Closer Look at the Current and

Noncurrent Classification

Current maturities of long-term obligations usually

are reclassified and reported as current liabilities if

they are payable within the upcoming year (or

operating cycle, if longer than a year).

Debt that is callable by the lender in the coming

year (or operating cycle, if longer) should be

classified as a current liability, even if the debt is

not expected to be called.

13 - 18

Short-Term Obligations

Expected to be Refinanced

A company may reclassify a short-term liability

as long-term if two conditions are met:

It has the intent to

refinance on a

long-term basis.

and

It has demonstrated

the ability to

refinance.

The ability to refinance on a long-term basis

can be demonstrated by an:

existing refinancing agreement, or

actual financing prior to issuance of the

financial statements.

13 - 19

U.S. GAAP vs. IFRS

Classification of Liabilities to be Refinanced

• Liabilities payable within the

coming year are classified as

long‐term liabilities if

refinancing is completed

before date of issuance of the

financial statements.

13 - 20

• Liabilities payable within the

coming year are classified as

long‐term liabilities if

refinancing is completed

before the balance sheet date.

Loss Contingencies

A loss contingency is an existing uncertain

situation involving potential loss depending

on whether some future event occurs.

Two factors affect whether a loss

contingency must be accrued and reported

as a liability:

1. the likelihood that the confirming

event will occur.

2. whether the loss amount can be

reasonably estimated.

13 - 21

Loss Contingencies

Likelihood of occurrence:

Probable

A confirming event is likely to occur.

Reasonably Possible

The chance the confirming event will occur

is more than remote, but less than likely.

Remote

The chance the confirming

event will occur is slight.

13 - 22

Loss Contingencies

Dollar Amount of Potential Loss

Likelihood

Probable

Reasonably possible

Remote

Known

Reasonably

Possible

Liability accrued

Liability accrued

and disclosure note and disclosure note

Disclosure note

Disclosure note

only

only

No disclosure

No disclosure

required

required

Not Reasonably

Estimable

Disclosure note

only

Disclosure note

only

No disclosure

required

A loss contingency is accrued only if a loss is probable

and the amount can reasonably be estimated.

13 - 23

Product Warranties and Guarantees

Product warranties inevitably entail costs.

The amount of those costs can be reasonably

estimated using commonly available estimation

techniques.

The estimate requires the following entry:

Warranty expense .........................................

Estimated warranty liability ..............

To accrue warranty expense.

13 - 24

$,$$$

$,$$$

Extended Warranty Contracts

Extended warranties are sold

separately from the product.

The related revenue is not earned

until:

Claims are made against the

extended warranty, or

The extended warranty period expires.

13 - 25

Premiums

Premiums included with the

product are expensed in the

period of sale.

Premiums that are contingent

on action by the customer

require accounting similar to

warranties.

13 - 26

Litigation Claims

The majority of medium

and large-size corporations

annually report loss

contingencies due to

litigation.

The most common

disclosure is a note to the

financial statements.

13 - 27

Subsequent Events

Events occurring between the fiscal yearend date and report date can affect the

appearance of disclosures on the

financial statements.

Cause of Loss Contingency

Fiscal Year Ends

13 - 28

Clarification

Financial Statements

Subsequent Events

Events occurring after the year-end date

and report date can also affect the

appearance of disclosures on the

financial statements.

Cause of Loss Contingency

Fiscal Year Ends

13 - 29

Clarification

Financial Statements

Unasserted Claims and Assessments

Unasserted

claim

No

disclosure

needed

No

Is a claim

or assessment

probable?

Yes

Evaluate (a) the likelihood of an unfavorable outcome and

(b) whether the dollar amount can be estimated.

An estimated loss and contingent liability would be

accrued if an unfavorable outcome is probable and the

amount can be reasonably estimated.

13 - 30

U.S. GAAP vs. IFRS

Contingencies

• Defines probable as an event

is likely to occur.

• Refers to both accrued and

non-accrued obligations as

contingent liabilities.

• Requires use of low end of a

range of equally likely

outcomes.

• Allows using present value

under some circumstances.

13 - 31

• Defines probable as more

likely than not, a lower

threshold than U.S. GAAP.

• Refers to accrued liabilities as

provisions and non-accrued as

contingent liabilities.

• Requires use of midpoint of a

range of equally likely

outcomes.

• Requires reporting present

values when material.

Gain Contingencies

Note that the prior rules have

supported the recording of LOSS

contingencies.

As a general rule, we

never record GAIN

contingencies.

13 - 32

Appendix 13

Payroll-Related Liabilities

Employers incur

several expenses

and liabilities

from having

employees.

13 - 33

Payroll-Related Liabilities

Gross Pay

FICA

Taxes

Medicare

Taxes

Federal

Income Tax

State and Local Voluntary

Income Taxes Deductions

Net Pay

13 - 34

Employees’ Withholding Taxes

State and Local

Income Taxes

Federal

Income Tax

Amounts withheld depend on the employee’s earnings,

tax rates, and number of withholding allowances.

Employers must pay the taxes withheld

from employees’ gross pay to the

appropriate government agency.

13 - 35

Employees’ Withholding Taxes

Federal Insurance Contributions Act (FICA)

FICA Taxes

6.2% of the first $106,800

earned in the year.

Medicare Taxes

1.45% of all wages

earned in the year.

Employers must pay withheld taxes

to the Internal Revenue Service (IRS).

13 - 36

Voluntary Deductions

Amounts withheld

depend on the

employee’s

request.

Examples include union dues, savings accounts,

pension contributions, insurance premiums, charities.

Employers owe voluntary amounts withheld from

employees’ gross pay to the designated agency.

13 - 37

Employers’ Payroll Taxes

FICA Taxes

Medicare

Taxes

Federal and

State

Unemployment

Taxes

Employers pay amounts equal to that

withheld from the employee’s gross pay.

13 - 38

Federal and State

Unemployment Taxes

Federal

Unemployment Tax

Act (FUTA)

State

Unemployment Tax

Act (SUTA)

13 - 39

6.2% on the first

$7,000 of wages paid

to each employee (A

credit up to 5.4% is

given for SUTA paid.)

Basic rate of 5.4% on

the first $7,000 of

wages paid to each

employee (Merit

ratings may lower

SUTA rates.)

Fringe Benefits

In addition to salaries and wages,

withholding taxes, and payroll taxes,

most companies provide a variety

of fringe benefits.

Health

insurance

premiums

Life

insurance

premiums

Retirement

plan

contributions

Employers must pay the amounts promised to fund

employee fringe benefits to the designated agency.

13 - 40

End of Chapter 13