Walter Energy Enters Chapter 11

advertisement

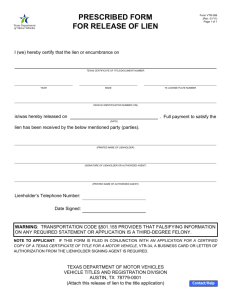

Debtwire Broadcast: Walter Energy Enters Chapter 11 Debtwire’s team of reporters and analysts hosts a roundtable discussion exploring the legal arguments and valuation variables likely to shape Walter Energy’s bankruptcy case | 17 July 2015 Agenda Opening Remarks: Andrew Descent into Chapter 11: Madalina – – – Overview Dual track plan Sector Impact – Prepetition Capital Structure Overview – Projection – Company Valuation – – Plan/Sale Dual Track Process Venue Union and Pension Issues Coal Company Legacy Liabilities Strategies for Investor Involvement Achieving an Equity Slice Maximizing Out-of-the Money Recoveries Official Committee Concerns Other Considerations Collateral Packages Blue Creek Administrative Priority Claims Executory Contract Assumption NOLs Intercompany Transfers Customer Relationships Appendix: – Proprietary News – Legal Analysis – Financial Research The Road Ahead: Jack – – – – – Financial Analysis: Tim Biographies 2 Descent into Chapter 11 Ch. 11 filing is the culmination of: – Slump in metallurgical coal prices – Idling mines, slashing capex to extend liquidity runway – Futile debt offerings – Bondholder Leapfrogging 3 Descent into Chapter 11 Dual track plan – Equitize first lien debt, or, – Complete an auction 4 Descent into Chapter 11 Sector Impact – Consolidation – Alpha Natural Resources, Arch Coal, Murray Energy, Blackhawk Mining, Patriot Coal, James River Coal, Walter Energy 5 The Road Ahead Plan/Sale Dual Track Process – Plan: First lien creditors using fulcrum status to receive reorganized equity on account of claims. – Sale: First lien credit bid would impose high hurdle for competing bids. Toggle: The toggle between the two revolves around the ability to achieve union concessions whether the Bankruptcy Court will permit a sale that leaves union liabilities behind. Administrative Claims and Chapter 7: High administrative claims plus no cash proceeds might mean a chapter 7 conversion post-sale, but will the Bankruptcy Court allow it? – Cash Collateral: Seven month timeline with guiding milestones. Second lien silence. 6 The Road Ahead Venue – Importance for coal and union liability issues. – Barriers to efforts to transfer. Union and Pension Issues – – – – Concessions required by first lien creditors. USW looming CBA expiration. The 1113/1114 fight. USD 661m pension withdrawal liability threat. Coal Company Legacy Liabilities – AROs, Black Lung and MSHA. – Surety involvement. 7 The Road Ahead Strategies for Investor Involvement – Achieving an Equity Slice: Hurdles to becoming a successful plan sponsor or asset purchaser will tip the scale to maximizing litigation leverage in order to get a piece of the action. Chiseling away at first lien position by attacking liens, lender liability claims and securing a second lien position. – Maximizing Out-of-the Money Recoveries: Potentially small pot of unencumbered assets. Leverage in seeking avoidance of the reconsidered prepetition first lien interest payment. Official Committee Concerns – Membership: Indenture trustees, PBGC and a few trade. – Cash Collateral Fights: Monthly fee cap, investigation budget/timeframe and liens on avoidance action proceeds. 8 The Road Ahead Other Considerations – Collateral Packages: Investigating the holes in US and Canadian guarantees, pledges and collateral overlap between debt issuances. – Blue Creek: Rights underlying significant future development prospects are unencumbered. – Administrative Priority Claims: Potentially significant IRS, WARN and other employee-related liability exposure may threaten plan feasibility. – Executory Contract Assumption: Exploring anti-assignment concerns. – NOLs: Valuable assets to be preserved (USD 550m federal income tax, USD 425m federal alternative minimum tax) – Intercompany Transfers: Co-owned vendors and intercompany accounting to be considered, including approximately USD 2bn in “hybrid financing” between US and Canadian entities. – Customer Relationships: Small, foreign customer base. 9 Financial Analysis – Pre Petition Capital Structure Pre-Petition Capital Structure USD 76.9m First Lien Revolver (73m LC) First Lien Term Loan B First Lien Notes 1 1 Capital Lease & Equip. Financing Second Lien PIK Notes 1 1 Coupon Face Amount Price Market Amount Yield Maturity Est. Annual Interest L + 5.5% 0 67.0 0 64.0% 01 Oct 2017 - L + 6.25% 978 51.0 499 34.6% 01 Apr 2018 71 9.5% 970 52.0 504 30.3% 15 Oct 2019 92 - 14 - 14 - - - 11%/12% 361 5.5 20 - 01 Apr 2020 40 Secured Obligations 2,323 1,037 203 Senior Unsecured Notes 9.875% 388 1.5 6 - Senior Unsecured Notes 8.5% 383 3.0 11 249.5% Consolidated Debt Less: Cash as of 6/30/15 Net Debt 2 3,094 1,055 270 270 2,824 785 15 Dec 2020 15 Apr 2021 38 33 274 (1) The Canadian guarantors only guarantee the obligations incurred under the Canadian Revolver. According to the lender presentation (pg.23), the Canadian obligations comprise approximately 70% of revolver availability, of which USD 24m is committed to undrawn LC's. The term loan, 9.5% first lien notes ,and the second lien PIK notes all have a 65% residual stock pledge of the Canadian assets. (2) USD 270m cash balance disclosed in CFO declaration, as of 30 June 2015. Source: SEC Filings, MarketAxess, Markit, Debtwire Analytics, Court Documents 10 Financial Analysis – Projections Financial Forecast (USDm) Benchmark Met Price Total Revenue Cash Cost of Sales Transportation Minimum Penalties SG&A Postretirement Benefits Other Savings Initiatives 1113 EBITDA Impact EBITDA Working Capital Capex Sales of Investment Unlevered Free Cash Flow Cash Interest Professional Fees Admin. & Other Claims Adequate Protection Payments Emergence Proceeds Restructuring Adjustments/Other Free Cash Flow Revolver Draw Cash Flow TBD Beginning Cash Ending Cash 2015 $104 999 (1,014) (4) (67) (54) 6 (134) 37 (82) (2) (181) (109) (55) (54) (399) (399) 2016 $107 978 (943) (8) (64) (55) 39 (53) 31 (87) (109) (55) (26) (11) (201) (201) 2017 $109 1,073 (1,069) (3) (64) (55) 39 (79) 2 (116) (193) (193) (193) 469 70 70 (131) (131) (324) Source: 8-K Filed 7/15/15, Ex. 99.2 "Project Diamond Lender Presentation" Pg.40 * See lender presentation pg. 44-45 for monthly income statement projections. Pro Forma Balance Sheet (USDm) Cash & Equivalents Restricted Cash Net Receivables Inventories Other Current Assets Total Current Assets Long Term Assets Total Assets FYE15 69 42 207 158 74 549 4,213 4,762 FYE16 (131) 20 207 160 74 328 4,161 4,489 FYE17 (325) 20 214 177 74 160 4,133 4,293 63 219 282 45 219 264 50 219 269 - - - Long Term Liabilities Liabilities Subject to Compromise Total Liabilities 912 3,834 5,028 940 1,205 967 1,236 Beginnings Stockholder Equity Plus: Net Income Other Total Stockholder Equity 283 (540) (9) (266) (266) 3,550 3,284 3,284 (227) 3,057 4,762 4,489 4,293 10 (18) (43) Accounts Payable & Accrued Expenses Accum. Postretirement Benefits Other Current Liabilties Total Current Liabilties Revolver Term Loan B 9.5% Sr. Sec. Notes 11/12% PIK Notes 9.875% Unsecured Notes 8.5% Unsecured Notes Other Debt, Net of Discount Total Liabilties & Stockholder Equity Memo: Proj. Canadian & UK Cash Balance Source: 8-K Filed 7/15/15, Ex. 99.2 "Project Diamond Lender Presentation" Pg.41-42 * See lender presentation for monthly projections. Projected Cash Flows (USDm) Net Income (Loss) Adjustments Depreciation & Depletion Deferred Income Tax Expense (Benefit) Deferred Taxes Payable Postretirement Benefits/Capital Lease Amort. Receivables Inventories Prepaid Expenses/Other Current Assets Accounts Payable Accrued Expenses/Other Current Liabilties Cash Flows Provided by Operating Activities 2015 (539) 2016 3,550 2017 (227) 224 0 (26) (621) 12 44 (1) 6 (133) (1,076) 139 28 0 (2) (2) (16) 3,720 144 27 (7) (18) 5 (77) (82) (2) (84) (87) (87) (116) (116) Cash Flows Provided by Financing Activities (978) (970) (350) (388) (383) (12) 3,834 8 761 (3,834) (3,834) 0 Cash Flows Provided by Continuing Operations (400) (200) (193) 469 (400) 69 69 (200) (131) (131) (193) (325) Investing Activities Capex Sale of Investments Other Cash Flows Used in Investing Activities Financing Activities Revolver Term Loan B 9.5% Sr. Sec. Notes 11/12% PIK Notes 9.875% Unsecured Notes 8.5% Unsecured Notes Other Debt, Net of Discount Liabilities Subject to Compromise Dividends Share Issuance Beginning Cash Change in Cash Ending Cash Source: 8-K Filed 7/15/15, Ex. 99.2 "Project Diamond Lender Presentation" Pg.46-47 * See lender presentation for monthly projections. 11 Financial Analysis – Valuation EV Waterfall (Based on historical EBITDA Range) Waterfall Assumptions: (1) Bankruptcy administrative fees of USD 100m. (2) Existing cash excluded from recovery. (3) Outstanding LC's included in Sr. Sec. Obligations. Admin Claims Senior Secured Obligations USD 76.9m First Lien Revolver (73m LC) 1 73 First Lien Term Loan B 1 978 First Lien Notes 1 970 Capital Lease & Equip. Financing 14 2,035 Multiple 4.0x 4.5x 5.0x 5.5x 6.0x 6.5x $50 200 225 250 275 300 325 $100 400 450 500 550 600 650 EBITDAX (USD m) $150 $200 600 800 675 900 750 1,000 825 1,100 900 1,200 975 1,300 $250 1,000 1,125 1,250 1,375 1,500 1,625 $300 1,200 1,350 1,500 1,650 1,800 1,950 1,100 1,250 1,400 1,550 1,700 1,850 54% 61% 69% 76% 84% 91% $100 4.0x 4.5x 5.0x 5.5x 6.0x 6.5x 100 125 150 175 200 225 Residual Value for Senior Secured Obligations 300 500 700 900 350 575 800 1,025 400 650 900 1,150 450 725 1,000 1,275 500 800 1,100 1,400 550 875 1,200 1,525 $2,035 4.0x 4.5x 5.0x 5.5x 6.0x 6.5x 5% 6% 7% 9% 10% 11% % Coverage for Senior Secured Obligations 15% 25% 34% 44% 17% 28% 39% 50% 20% 32% 44% 56% 22% 36% 49% 63% 25% 39% 54% 69% 27% 43% 59% 75% 12 Financial Analysis – DCF Valuation Mine #4 Tonnes Produced (000's) Price ($/Ton) Revenue (USDm) 2014 2,468 $112 276 2015 2,945 $98 289 2016 2,671 $102 272 2017 2,720 $105 286 Cash Cost of Sales ($/Ton) Cost (USDm) $105 (281) $95 (280) $101 (270) $102 (277) EBITDA ($/Ton) EBITDA 7 (4) 3 9 1 3 3 8 Capex (29) (21) (33) (61) Mine #7 Tonnes Produced (000's) Price ($/Ton) Revenue (USDm) 2014 4,741 $118 559 2015 3,998 $99 396 2016 3,811 $104 396 2017 4,506 $107 482 Cash Cost of Sales ($/Ton) Cost (USDm) $92 (443) $98 (392) $91 (347) $104 (469) 26 117 1 4 13 50 3 14 EBITDA ($/Ton) EBITDA West Virginia Maple Surface Tonnes Produced (000's) Price ($/Ton) Revenue (USDm) 2014 2015 2016 2017 454 $74 34 280 $66 18 442 $72 32 424 $74 31 Cash Cost of Sales ($/Ton) Cost (USDm) $63 (29) $71 (20) $63 (28) $63 (27) EBITDA ($/Ton) EBITDA (USDm) 11 5 (5) (1) 9 4 11 5 Maple Underground Tonnes Produced (000's) Price ($/Ton) Revenue (USDm) Walter Gas EBITDA Cash Cost of(USDm) Sales ($/Ton) Cost (USDm) (44) (49) (39) 255 $98 25 2015 $105 (40) EBITDA ($/Ton) EBITDA (3) 418 $85 36 2016 $104 (27) 3 413 $82 34 2017 6 $96 (40) $97 (40) 1 0 (6) (2) (11) (5) (15) (6) (20) (6) (9) (8) 2015 (3) 2016 3 2017 6 Low Price ($/Ton) Mid Price ($/Ton) High Price ($/Ton) 8.0 $80.00 $100.00 $120.00 Cash Cost of Sales ($/Ton) Capex (USDm) SG&A (USDm) $95.00 90 60 Low Case Margin (USDm) Mid Case Margin (USDm) High Case Margin (USDm) -270 -110 50 Assigned Reserve Life Discount Rate 15 10% Est. High DCF Value (+) Est. Value of Gas Ops Est. Total Value Est. Recovery for First Liens 380 25 405 20% Source: Debtwire Analytics Total Capex (USDm) Capex 381 $106 40 US Coal DCF Analysis Annual Production (Million Tons) (41) Walter Gas EBITDA (USDm) Source: Lender presentation, Pg. 33-36 13 Financial Analysis Source: Lender presentation, Pg. 22 14 Debtwire Broadcast: Walter Energy Enters Chapter 11 Appendix Appendix: Debtwire Proprietary News Article Link Date Published Walter Energy taps local Alabama counsel for restructuring 21-May-15 Walter Energy unsecureds enlist Davis Polk, Houlihan; management mulls venue options 04-May-15 Walter Energy first lien bonds tap FA ahead of unsecured coupon payments 08-Apr-15 Walter Energy first lien recoveries could diverge on Canadian collateral 26-Mar-15 Walter Energy adds to restructuring advisory roster 20-Mar-15 Walter Energy selects advisor as first liens tap legal 11-Mar-15 16 Appendix: Legal Analysis Analysis Link Date Published ANALYSIS: Debtwire reviews common coal company restructuring issues to guide stakeholder strategy 20-May-15 ANALYSIS: Walter Energy venue choice will determine leverage with unions 08-May-15 17 Appendix: Financial Research Analysis Link RESEARCH: Walter Energy first liens price in turnaround optionality Date Published 16-Jul-15 18 Debtwire Broadcast: Walter Energy Enters Chapter 11 Biographies Biographies Tim Hynes Head of Distressed Research, North America | Timothy.Hynes@debtwire.com Prior to joining Debtwire he was Head of Debt Capital Markets at Gleacher and Company. Mr. Hynes has also held positions at Cerberus Capital, Bankers Trust and GE Capital. Mr. Hynes received a BA in Finance from Michigan State University. Andrew Ragsly Managing Editor, North America| Andrew.Ragsly@debtwire.com The team of journalists Andrew manages in New York routinely breaks news in restructuring, distressed and primary market situations. Editorial content also delves into detailed analysis of recovery scenarios, relative value and buyside strategy. Andrew joined Debtwire in 2007 as a reporter covering industrial sectors. He became deputy editor of Debtwire North America in 2011, and took over as managing editor in 2012. 20 Biographies Jack M. Tracy II Senior Legal Analyst, North America | Jack.Tracy@Debtwire.com Jack is a former practicing restructuring attorney. Prior to joining Debtwire as Senior Legal Analyst, Jack practiced in the New York offices of Akin Gump Strauss Hauer & Feld LLP and Willkie Farr & Gallagher LLP. He has represented debtors, official committees and ad hoc groups in several high-profile restructurings, including James River Coal, Energy Future Holdings, Edison Mission Energy, Nortel Networks, Cengage Learning, Otelco and Broadview Networks. Madalina Iacob Senior Reporter, North America | Madalina.Iacob@debtwire.com Madalina Iacob is a senior distressed debt reporter for Debtwire, covering the energy sector and telecommunications. She writes breaking news stories and analytical articles on distressed borrowers and debtors including Energy Future Holdings, ATP Oil & Gas, Samson Resources, Patriot Coal and Nortel. She received a M.A. in Business and Economic Reporting from New York University and an M.A. in European Politics & Policy from Manchester University, UK, where she was an Open Society Foundation/George Soros scholarship recipient. 21