Financial Accounting and Accounting Standards

advertisement

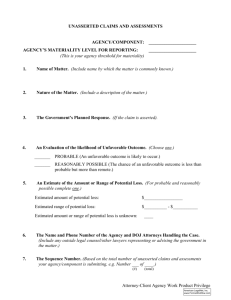

Current Liabilities and Contingencies Liability Defined Probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities in the future as a result of past transactions or events (page 702 of text) Current Liability Defined Current liabilities are obligations whose liquidation is reasonably expected to require use of existing resources properly classified as current assets, or the creation of other current liabilities (page 702 of text) Examples of Current Liabilities Accounts payable Notes payable Current maturities of long-term debt Dividends payable Customer advances and deposits Unearned revenues Sales taxes payable Income taxes payable Employee-related liabilities Measurement of Current Liabilities • Theoretically, they should be measured at the present value of the amounts owed, taking into consideration the timing of the payment(s) and an appropriate interest rate • For convenience, GAAP allows them to be measured at their face amount (i.e., not discounted) Current Maturities of Long-Term Debt • General rule – should be included in current liabilities • Exceptions If the debt will be paid off with assets that appropriately have not been classified as current assets (e.g., a bond “sinking fund” that can be used for no purpose other than to pay off the bonds If the debt is “refinanced on a long-term basis” Short-Term Obligations Expected to be Refinanced Exclude from current liabilities (include in l.t. liab.) if Management intends to refinance the obligation on a long-term basis. Management, by the date the financial statements are issued, demonstrates the ability to refinance on a long-term basis by either: Actually refinancing on a long-term basis or Enter into a qualifying financing agreement Short-Term Obligations Expected to be Refinanced See E13-3 of text Short-Term Obligations Expected to be Refinanced See E13-4 of text Contingencies An existing condition, situation, or set of circumstances involving uncertainty as to possible gain (gain contingency) or loss (loss contingency) to an enterprise that will ultimately be resolved when one or more future events occur or fail to occur Gain Contingencies Typical Gain Contingencies are: Possible receipts of monies from gifts, donations, and bonuses. Possible refunds from the government in tax disputes. Pending court cases with a probable favorable outcome. Gain contingencies are not recognized (recorded) until realized May be necessary to disclose, however Loss Contingencies Likelihood of confirming event FASB uses three classifications of likelihood: Probable – likely to occur Reasonably possible – chance is more than remote but less than probable Remote – chance of occurring is slight Loss Contingencies Common loss contingencies: • • • • Litigation, claims, and assessments. Guarantee and warranty costs. Premiums and coupons. Environmental liabilities. Determinable Liabilities vs. Contingent Liabilities Determinable liabilities – the transaction or other event obligating the entity has already occurred • Liability is known – amount may be known (e.g., salaries payable) or may have to be estimated (e.g., income taxes payable) • “Confirming” critical event has already occurred • Recognize liability at known or estimated amount Contingent Liabilities Contingent liabilities – “confirming” critical event has not yet occurred • Example – lawsuit resulting from employee having accident in company’s delivery truck • A first event has occurred (the accident) but the confirming event has not occurred – the judge or jury has not yet decided if the company is at fault Recognize (Record) Contingent Liability • Probable that liability has been incurred (or asset impaired) at the date of the balance sheet • Amount of the loss can be reasonably estimated May be necessary to disclose Only Disclose Contingent Liability • Reasonably possible that liability has been incurred (or asset impaired) at the date of the balance sheet • Amount of the loss can be reasonably estimated Generally No Disclosure Necessary • Likelihood that liability has been incurred (or asset impaired) is remote Examples of Loss Contingencies See E13-13 of text Compensated Absences Nature of compensated absences: Paid absences for vacations, illnesses, and holidays. Accounting for Compensated Absences Accrue (record) a liability if all the following conditions are met The employer’s obligation is attributable to employees’ services already rendered The obligation relates to rights that vest or accumulate Payment of the compensation is probable The amount can be reasonably estimated Litigation, Claims and Assessments Companies must consider the following factors, in determining whether to record a liability with respect to pending or threatened litigation and actual or possible claims and assessments. Time period in which the action occurred Probability of an unfavorable outcome Ability to make a reasonable estimate of the loss. Asserted Litigations, Claims & Assessments Recognize (record) in current year if • Related critical event occurred by balance sheet date • Probable that contingent loss will be incurred • Can reasonable estimate loss amount Unasserted Litigations, Claims & Assessments Recognize (record) in current year only if • Related critical event occurred by balance sheet date • Probable that unasserted LCA will be asserted (filed) • Probable that the “asserted” claim will result in a loss • Amount of the loss can be reasonably estimated Unasserted Litigations, Claims & Assessments Disclose in current year (but do not record) if • Related critical event occurred by balance sheet date • Only reasonably possible that unasserted LCA will be asserted (filed) • Probable that the “asserted” claim will result in a loss • Amount of the loss can be reasonably estimated Asset Retirement Obligations A company must recognize an asset retirement obligation (ARO) when it has an existing legal obligation associated with the retirement of a long-lived asset and when it can reasonably estimate the amount of the liability. Asset Retirement Obligations • See illustration on page 724 of text • See E13-14 Presentation Presentation of Current Liabilities Usually reported at their full maturity value. Difference between present value and the maturity value is considered immaterial. Presentation of Contingencies Disclosure should include: Nature of the contingency. An estimate of the possible loss or range of loss. Other See E13-16 of text