microeconomics

advertisement

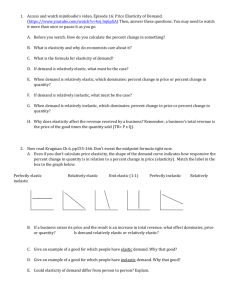

Mr. Dunn, Room 221 90 Economics/Business/Free Enterprise Periods 3, HONORS 80 70 60 50 East West North 40 30 20 10 0 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr MICROECONOMICS MICROECONOMICS THE STUDY OF THE INTERACTION BETWEEN INDIVIDUAL COMPONENTS OF AN ECONOMY INCLUDING • • • • INDIVIDUALS (RESOURCE OWNERS) HOUSEHOLDS (CONSUMERS) BUSINESSES (FIRMS) (PRODUCERS) INSTITUTIONS (BANKS, LABOR, PACS, C of C, ORGS, etc) SIMPLE CIRCULAR FLOW COMPONENTS OF SIMPLE CIRCULAR FLOW SECTORS HOUSEHOLDS-RESOURCE SUPPLIERS-CONSUMER BUSINESSES-RESOURCE DEMANDERS-PRODUCER MARKETS FACTOR—EXCHANGE RESOURCES FOR PAYMENTS PRODUCT—PAYMENTS FOR GOODS/SERVICES DEMAND The quantities of a good or service consumers are willing and able to buy at different possible prices at a particular time LAW OF DEMAND CONSUMERS ARE WILLING TO BUY MORE AT LOWER PRICES. SHIFTING DEMAND • PRICE EFFECT/SUBSTITUTION EFFECT =MOVEMENT ALONG THE CURVE • CHANGES IN DEMAND PRICES OF RELATED GOODS CHANGES IN CONSUMER INCOME CONSUMER EXPECTATIONS POPULATION CONSUMER TASTES AND ADVERTISING =SHIFT OF ENTIRE DEMAND CURVE SHIFT RIGHT—INCREASED DEMAND SHIFT LEFT—DECREASED DEMAND SUPPLY The various amounts of something producers are willing and able to sell at different possible prices at a particular time LAW OF SUPPLY PRODUCERS ARE WILLING TO PRODUCE MORE AT HIGHER PRICES. SHIFTING SUPPLY CAUSES FOR SHIFTS IN SUPPLY INPUT COSTS CHANGES IN TECHNOLOGY REGULATORY POLICY NUMBER OF SUPPLIERS PRODUCER EXPECTATIONS ECONOMIC REALITIES PRICE CEILINGS-SETTING A MAXIMUM PRICE-CAUSE SHORTAGES. EXAMPLES INCLUDE RENT CONTROL AND OPEN-SPACE LAWS. PRICE FLOORS-SETTING A MINIMUM PRICE-CAUSE SURPLUSES. EXAMPLES INCLUDE MINIMUM WAGE AND FAIR TRADE PRICING. PRICE SYSTEM • COMPETITION • COSTS OF PRODUCTION FIXED-(RENT, MANAGEMENT, INTEREST, OBLIGATIONS) VARIABLE-(PRODUCTION-BASED, LABOR COSTS, SHIPPING COSTS) • SUPPLYAND DEMAND • CONSUMER DRIVEN--MARKET FORCES THE ROLE OF PRICE • INCENTIVE TO CONSUME/PRODUCE • INFORMATION FOR BUYERS/SELLERS • SIGNAL TO CONSUME/PRODUCE • RATIONS GOODS AND SERVICES • VOLUNTARY EXCHANGE PRICE ELASTICITY • SENSITIVITY OF QUANTITY TO CHANGES IN PRICE • ELASTICITY = % CHANGE IN QUANTITY DEMANDED % CHANGE IN PRICE • NEW NUMBER(y2) – OLD NUMBER(y1) X 100 OLD NUMBER(y1) To ensure the same percentage whether quantities and prices increase or decrease, economists use the ARC formula as shown below: Price elasticity of demand = (Q2-Q1)/[(Q1+Q2)/2] / (P2-P1)/[(P1+P2)/2] % CHANGE= IF THE QUANTITY DEMANDED OR SUPPLIED INCREASES OR DECREASES GREATLY DUE TO MINOR CHANGES IN PRICE, IT IS SAID TO BE RELATIVELY “ELASTIC” WITH THE ELASTICITY VALUE BEING > 1. IF THE QUANTITY DEMANDED OR SUPPLIED DOES NOT INCREASE OR DECREASE SIGNIFICANTLY DUE TO MINOR CHANGES IN PRICE, IT IS SAID TO BE RELATIVELY “INELASTIC” WITH THE ELASTICITY VALUE BEING < 1. IF THE QUANTITY DEMANDED OR SUPPLIED DOES NOT CHANGE DUE TO CHANGES IN PRICE, IT IS SAID TO BE “UNITARY ELASTIC” AND THE ELASTICITY VALUE = 1 DETERMINANTS OF ELASTICITY AVAILABILITY OF SUBSTITUTES NECESSITY OR LUXURY PRICE AS PERCENTAGE OF INCOME TIME TO COMPARE OR REACT TO PRICE CHANGES Lowering the price on elastic goods increases total revenue. Raising prices on inelastic goods increases total revenue. NOTE: All products are elastic in demand in the long run. P EXAMPLE OF INELASTIC DEMAND 7 5-4/[(5+4)/2)] = .22 / 7-5/[(5+7)/2] = .33 .22 / .33 = .67 .67 < 1 INELASTIC 5 4 5 Q P EXAMPLE OF RELATIVELY ELASTIC DEMAND 12-5/[(5+12)/2] = .82 / 5-3/[(3+5)/2] = .50 .82 / .50 = 1.6 1.6 > 1 ELASTIC 5 3 Q 5 12 EXAMPLES OF ELASTICITY INELASTIC DEMAND (SALT, MEDICINE, etc) < 1 D ELASTIC DEMAND (CARS, SODA, etc) > 1 D UNITARY ELASTIC (PERFECTLY ELASTIC) = 1 PERFECTLY INELASTIC (SUPPLY OF TICKETS) S D THE REVENUE BOX EFFECT OF ELASTICITY OF DEMAND 7 PRICE = 7 TR = 14 3 PRICE = 3 TR =18 2 6 PROFIT: BUSINESS INCENTIVE BUSINESS INCOME IS REVENUE BUSINESS SPENDING IS COSTS INCOME TR = P x Q (PRICE X QUANTITY=TOTAL REVENUE) COSTS (EXPENDITURES) TC = FC + VC (FIXED COSTS + VARIABLE COSTS = TOTAL COSTS) Profit = TR – TC(PROFIT = TOTAL REVENUE – TOTAL COSTS) BOTTOM LINE IN BLACK OR IN RED PROFIT (+) OR LOSS (-) BREAK-EVEN POINT MR = MC NO PROFIT/LOSS TYPES OF BUSINESS ORGANIZATIONS • • • SOLE PROPRIETORSHIP (75%/20% $) --OWNER KEEPS PROFIT/MAKES ALL DECISIONS --PERSONAL TAX RETURN/NO LEGAL PAPERWORK --UNLIMITED LIABILITY—LIMITED LIFE PARTNERSHIP (7%/10% $) --GENERAL—UNLIMITED LIABILITY FOR PARTNERS --LIMITED—(SILENT PARTNER(S) CONTRIBUTE(S) $) --LIMITED LIABILITY (LLP) ALL PARTNERS --SPECIALIZATION/DIVISION OF LABOR --PROVIDES LARGER POOL OF CAPITAL CORPORATION (18%/70% $) -LIMITED LIABILITY/UNLIMITED LIFE AND $ --DOUBLE TAXATION/CORPORATE TAX RETURN --BOARD OF DIRECTORS/LEGAL PAPERWORK BUSINESS FINANCING • SHORT-TERM LOANS LESS THAN ONE YEAR • MEDIUM-TERM LOANS 1-10 YEARS • LONG-TERM LOANS MORE THAN TEN YEARS MARKET STRUCTURE • PERFECT COMPETITION • MONOPOLISTIC • OLIGOPOLY • MONOPOLY MARKET STRUCTURE How businesses compete in a market economy • PERFECT COMPETITION --”PRICE TAKERS”-(NO CONTROL OVER PRICE) --IDENTICAL PRODUCTS/MANY SELLERS --NO BARRIERS TO ENTRY • IMPERFECT COMPETITION – MONOPOLISTIC COMPETITION --SIMILAR PRODUCTS/MANY SELLERS --FEW IF ANY BARRIERS TO ENTRY --DIFFERENTIATED PRODUCTS – OLIGOPOLY -- “PRICE SEARCHERS” --DIFFERENTIATED PRODUCTS/FEW SELLERS --PRICE LEADERSHIP (A FEW FIRMS DOMINATE INDUSTRY) – MONOPOLY --PRICE MAKER-(TOTAL CONTROL OVER PRICE) --ONLY SELLER --SIGNIFICANT BARRIERS TO ENTRY $$ MONEY $$ • MEDIUM OF EXCHANGE • STORE OF VALUE • UNIT OF ACCOUNT $$ MONEY $$ • PORTABLE • DURABLE • DIVISIBLE • RECOGNIZABLE • ACCEPTED AS PAYMENT • STABLE