Course Summary - Faculty Directory | Berkeley-Haas

advertisement

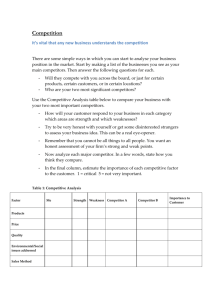

Ryanair (A) & (B) Key Take-Aways Haas School of Business University of California, Berkeley How can we anticipate competitor’s moves? Ryanair vs Aer Lingus / BA Will these players retaliate against Ryanair? If so, how? Given the assumption of retaliation, should Ryanair enter? If so, how? How can we anticipate competitor’s moves? Game Theory Identify structure of the game that is being played In static setting, predicts limited competitive response of AL / BA to Ryanair’s entry---but it’s a close call With targeted response, retaliation starts to look attractive With non-pecuniary incentives, retaliation starts to look attractive Competitor analysis Develop model of pecuniary and non-pecuniary incentives, views of the “game”, etc. based on “Competitor response profile” Competitor analysis Competitor analysis can be helpful in anticipating competitor moves A competitor profile includes an assessment of a competitor’s strengths and weaknesses, its strategic intent, and its behavioral predispositions Competitor analysis is inherently qualitative Complements quantitative analyses Competitor analysis (II) Questions to ask: What are the goals of my competitor? What is the strategy of my competitor? Do the prior strategic actions (or statements) of the competitor suggest a direction that the competitor now might take? What are the resources and capabilities of my competitor? May be different from pure greed (profit maximization) Does the competitor have a particular set of strengths or weaknesses that might make some of its reactions more or less likely to succeed? What assumptions is the competitor making about the business? Competitors may hold a set of assumptions about the industry that lead it to make systematically different choices from the ones that you would make, were you in their shoes A Framework for Competitor Analysis What Drives the Competitor What the Competitor Is Doing and Can Do Future Goals Current Strategy How the business is currently competing At all levels of management and in multiple dimensions Competitor’s Response Profile Is the competitor satisfied with its current position? What likely moves or strategy shifts will the competitor make? Where is the competitor vulnerable? What will provoke the greatest and most effective retaliation by the competitor? Assumptions Held about itself and the industry Capabilities Both strengths and weaknesses Source: Michael E. Porter, Competitive Strategy, p. 49 Competitor profile of British Airways (1986) Goals Successful flotation / privatization Key step for Thatcher’s program Focus on near term profitability Resources and Capabilities Government interest Heathrow Extensive network Reputation for safe, reliable service; improving reputation for customer service (neg) still operationally inefficient (neg) needs capex to upgrade int’l fleet Strategy Differentiation in service: “The world’s favorite airline” Focus on business class customers Assumptions Competition is coming to Europe BA will benefit from airline deregulation in Europe given extensive international experience What does this tell us about how BA is likely to respond? Competitor profile of Aer Lingus (1986) Goals “Safety, efficiency, reliability, and profitability” Promote national interests Strategy Break even on air services and profit from diversification Provide service levels comparable to flag carriers Resources and Capabilities Government backing Reputation & reliability among Irish Established operations in EU, Boston, NY Shannon airfield Technical skills that other airlines need (neg) inefficient (neg) needs capex Assumptions Airline service is a public good government will pay One true way to run an airline Airlines cooperate ‘Gentlemanly’ competition What does this tell us about how AL is likely to respond? Ryanair’s 1986 entry strategy Initial success Expansion 100% load factor on Dublin-London Route AL & BA dropped restricted fares to I₤95 vs. Ryanair’s I₤95 unrestricted fare: a rather mild reaction Positive press – managers believed they had a winning strategy 27 routes; 5 jets by 1991 rapidly increasing customer volumes strategy: “driven by customer service” Aer Lingus responds matches prices, increases capacity on routes served by Ryanair Problems with Ryanair’s 1986 entry strategy Limited cost advantage in high fixed cost, low marginal cost industries competition is intense for incremental customers even though Ryanair may have had a cost advantage, AL was willing to produce below average costs (but above marginal costs) to pay off fixed costs AL had deeper pockets and other sources of profit No service advantage “first rate customer service” – no difference from BA or AL potential disadvantages flying into Luton rather than Gatwick or Heathrow flying turboprops rather than jets A me-too strategy In the words of Porter, Ryanair attempted to compete on operational effectiveness without making any explicit tradeoffs “we tried to be all things to all people” – Kevin Osborne, CFO, Ryanair (B) case Not differentiated and not enough of a cost advantage to profit from the restructuring of the industry that they began Comparison to Dell’s Entry “Compaq was very strong in retail. A new marketing an distribution strategy was something new, however.” --Michael Dell Dell’s entry: Not head-to-head with established players Achieved significant variable cost advantage (7 versus 65 days inventory) “Stealth” strategy --- direct channel undervalued by established players Ryanair rising from the ashes O’Leary, 29, appointed Deputy CEO “No one else was left to take the position” Focus on cost reduction & cash generation Drop loss-making routes No in-flight amenities Renegotiated labor contracts to pay based on productivity Emphasized duty-free sales Become 1/3 of flight attendant compensation Sell advertisements on seat-backs Goal: “become a low-cost, low-fare airline” Senior managers visit Herb Kelleher at Southwest Even more frugal than Southwest No free snacks or drinks Not even peanuts! No “air bridges” linking plans with airport terminals All boarding via metal stairs No frequent flier program Average fare falls to I£42 / passenger Average cost ~ I£25 In 1999, O’Leary claimed marginal cost was - I£2 Ryanair’s Route Map Today http://www.ryanair.com/site/EN/dests.php?flash=yes Relative Efficiency of Major Airlines Employees (approx) Revenue per employee (est) Market Value of Equity Ryanair 2,302 Euro 450,000 $6.7 Billion Southwest 31,011 $210,570 $11.3 Billion Continental 38,255 $254,607 $855 Million Delta 69,150 $217,919 $566 Million Strategy or “being on the right side of history” i.e., luck?