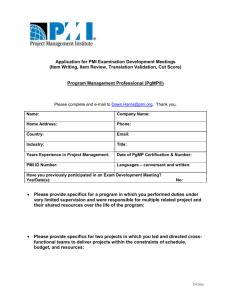

Philip Morris

advertisement

Ticker: Sector: Industry: PM Consumer Goods Cigarettes Recommendation: HOLD Pricing Closing Price $49.30 52-wk High $52.35 (10/20/09) 52-wk Low $32.04 (3/5/09) Market Data Market Cap Total assets Valuation EPS (ttm) P/E (ttm) $93.04B $34.52B RECOMMEDATION: HOLD $3.24 15.21 Profitability & Effectiveness (ttm) ROA 18.64% ROE 95.98% Part Profit Margin 25.33% Oper Margin 40.22% Our fund is currently holding 600 shares of Philip Morris Morris International, accounting for 2.58% of our portfolio. We are investing in Philip Morris International which is not a participant in the US smoking industry. This company offers ability for global growth and is paying good dividends. Although there are risks associated with strict government regulation ANALYST NAME p Anh Phan Anpx93@mail.missouri.edu regarding smoking, I don’t think that we should cut back on our current position in this stock. About Philip Morris International PMI is an international tobacco company. The company along with its subsidiaries is engaged in the manufacture and sale of cigarettes and other tobacco products in markets outside of the US. PMI's products are sold in 160 countries. It has 58 manufacturing facilities in 32 countries. The company operates in European Union, Middle East & Africa, Asia and Latin America. The company operates globally, with manufacturing and sales facilities throughout the world. The company’s product portfolio includes a range of blends and styles, across 150 distinct brands and over 1,900 variants. PMI's leading brands include Marlboro, L&M, Philip Morris, Bond Street, Chesterfield, Parliament, Lark, Merit and Virginia Slims. PMI owns seven of the top 15 international cigarette brands worldwide, led by Marlboro. In March 2008, PMI was spun-off from Altria Group and it started operating as an independent company. The company owns the trademark rights for all its principal brands, including Marlboro, in all countries other than the US. While, PM USA (a subsidiary of Altria owns the trademark rights to its brands, including Marlboro, within the US, its territories and possessions. The chart below gives an overview of PMI’s brand portfolio, as of the end of 2008: The company has continuously increased its market share in markets around the world. As the end of 2009, PMI’s market share in the OECD markets is roughly 34.9%, while that in the nonOECD market slightly increased to 21%. In markets other than the US and China, PMI accounts for roughly 25.8% of the market share. Although China has been a market targeted by tobacco companies for years with its 350 million smokers, China national tobacco Corporation has a virtual monopoly over the Chinese market. Currently, PMI’s top competitors are: British American Tobacco plc Imperial Tobacco Canada Limited Imperial Tobacco Group PLC Japan Tobacco Inc. Reynolds American Inc. Universal Corporation Altadis SA Philip By geographic segment, although PM is trying to grow in the emerging markets, the EU is still the largest market of the company, with roughly 49% of its revenues coming from this particular region. Revenue breakdown by geographic regions : EU – 49%; Eastern Europe, Middle East, Africa – 21% ; Asia – 21%; Latin America and Canada – 10%. However, PMI is growing dramatically in emerging markets: PMI’s 2009 financial results Net revenues of $25.0 billion were down by 2.6% for the full-year 2009, due to unfavorable currency of $2.6 billion. Excluding currency, net revenues increased by 7.5% for the full year, driven by favorable pricing of $2.0 billion across all business segments, and the favorable impact of the 2008 Rothmans Inc.,Canada acquisition, partly offset by unfavorable volume/mix of $620 million, primarily in the EU and EEMA Regions. Excluding currency and acquisitions, net revenues increased by 5.3%. PMI’s cigarette shipment volume of 864.0 billion units was down by 0.7% in 2009, as gains in Asia, primarily driven by Indonesia and double-digit growth in Korea, and in Latin America & Canada, from the acquisition of Rothmans Inc., Canada, were more than offset by declines in the EU and EEMA, mainly due to the impact of the economic crisis, primarily in the Baltic States, Spain and Ukraine. On an organic basis, which excludes acquisitions, PMI’s cigarette shipment volume was down by 1.5%. 2009 FINANCIAL RESULTS BY REGIONS EUROPE In the EU, net revenues declined by 6.7% to $9.0 billion, mainly due to unfavorable currency of $856 million. Excluding the impact of currency, net revenues increased by 2.2%, primarily reflecting higher pricing of $520 million across most markets, which more than offset unfavorable volume/mix of $372 million largely due to total market declines and to adverse product mix. Excluding the impact of currency and acquisitions, net revenues increased by 1.5%. PMI’s market share in the EU was down by 0.3 share points to 38.8%. Adjusted for the trade Inventory movements in the Czech Republic, PMI’s market share was down by 0.2 share points, as gains, primarily in Austria, Belgium and the Netherlands, were offset by share declines in Germany, Italy, and Poland. EASTERN EUROPE, MIDDLE EAST & AFRICA In EEMA, net revenues decreased by 9.4% to $6.8 billion, due to unfavorable currency of $1.4 billion. Excluding the impact of currency, net revenues increased by 8.8%, driven by favorable pricing of $820 million, primarily in Russia, Turkey and Ukraine, which more than offset unfavorable volume/mix of $197 million. Excluding the impact of currency and acquisitions, net revenues grew by 8.3%. PMI’s cigarette shipment volume decreased by 1.5%, principally due to: Ukraine, which suffered from the unfavorable impact of a series of tax-driven price increases that raised PMI’s prices by between 38% and over 100% during the year, and worsening economic conditions; and PMI Duty Free, primarily reflecting the unfavorable impact of the global economy on travel. This decline was partially offset by strong cigarette shipment volume growth in Algeria, Egypt and Turkey. ASIA In Asia, net revenues increased by 5.5% to $6.5 billion. Excluding the impact of unfavorable currency of $41 million, net revenues grew by 6.2%, driven by favorable pricing. PMI’s cigarette shipment volume increased by 1.1%, mainly due to gains in Indonesia and double-digit growth in Korea. Shipment volume of Marlboro grew by 4.3%, reflecting a strong market share performance across the region, particularly in Indonesia, Japan, Korea and the Philippines. LATIN AMERICA AND CANADA In Latin America & Canada, net revenues increased by 14.7% to $2.7 billion. Excluding the impact of unfavorable currency of $328 million, net revenues increased by 28.8%, primarily driven by the 2008 Rothmans Inc., Canada, acquisition and higher pricing of $276 million. Excluding the impact of currency and acquisitions, net revenues increased by 9.0%. Cigarette shipment volume of 103.8 billion units increased by 4.4%, reflecting the Canadian acquisition. SWOT ANALYSIS Strengths Leading market position PMI is the market leader and the second largest player in many international markets. It is the leading international tobacco company, with ownership of seven of the world's top 15 brands worldwide. PMI has leading presence in several countries including Russia, Germany, Ukraine and Italy. Its brands, led by Marlboro and L&M, are sold in approximately 160 countries around the world. A strong market position allows the company to derive economies of scale in purchasing, manufacturing and distribution. Wide geographic presence PMI has a wide geographic base. The company sells its products in 160 countries and has 58 manufacturing facilities in 32 countries. In addition, the company is well diversified in terms of revenue generation from these geographies. The diversified geographic presence would reduce the business risk for the company and makes it resilient to significant weak performance from any of the region. Strong brand equity PMI owns some of the best recognized cigarette brands worldwide. Marlboro is the world's preeminent cigarette brand. Marlboro is PMI's best asset and it is an important driver of longterm shareholder value. In the mature markets of continental Europe, for example, Marlboro is the leading brand in nearly every major market and accounted for around 30% of the overall revenues for the company. Marlboro is the leading cigarette brand and is valued at $21,283 million in 2008. Weaknesses Lack of product diversification PMI is wholly dependent on tobacco and tobacco-related products for generating revenues. Contrary to the global trend of tobacco companies diversifying into other businesses, PMI has not diversified into any other business segment. As a result, its revenues are highly vulnerable to tobacco-related litigation across the world. PMI has faced number of litigations in the past with international governments alleging that tobacco products intend to harm human life in general. Damages claimed in some of the tobacco-related litigation range into billions of dollars. PMI has been unable to effectively counter allegations that its products are carcinogenic and are causing irreparable damage to human life. Lack of product diversification increases the business risk of the company. Tobacco related litigations PMI faces significant governmental action aimed at reducing the incidence of smoking. It faces a number of legal cases in which the plaintiffs are seeking substantial compensation for the damage caused by tobacco products. There are presently 123 cases on Individual Smoking and Health. The company could be held responsible for failing to inform consumers about the adverse health effects associated with both smoking and exposure to environmental tobacco smoke. Tobacco litigation could adversely affect the revenues and the profitability of the company. Opportunities Growing Chinese and Indian markets The Chinese and Indian markets provide a huge potential for tobacco manufacturers. The top 20 brands in China, the world's largest cigarette market, increased their combined cigarette sales at a rate of 14.8% in 2008. Moreover, as a result of increasing income levels and health concerns about smoking local, hand rolled high-nicotine cigarettes, manufactured cigarette volumes are expected to increase in China. According to the Tobacco Board of India, production of cigarettes in India rose 13% to 285 million Kg in 2008. Spending on food, drinks and tobacco is expected to grow at a Compounded Annual Growth of 12.2% in India during the period 2008–11. Given its strong position, PMI could benefit from growth opportunities in China and India. Rising popularity of smokeless tobacco In response to health concerns and lawsuits against the tobacco industry, a number of tobacco manufacturers have launched 'snus', a form of smokeless oral tobacco. Snus is a pasteurized tobacco product that resembles a small teabag. Markets with a strong smokeless tobacco tradition include India, Algeria, Pakistan, South Africa, Sweden and Norway. In order to cater to the growing consumer preference, the company launched Marlboro Snus, a smoke-free, spit-free tobacco pouch product into the Dallas/Fort Worth area. Further In February 2009, Swedish Match and Philip Morris International established an exclusive joint venture company to commercialize Swedish Snus and other smokefree tobacco products worldwide, outside of Scandinavia and the US. PMI could further explore the market for snus in other countries to improve its performance and generate additional revenues. Threats Growing health consciousness Due to increasing health concerns worldwide, there has been a general decline in the consumer demand for tobacco products in markets worldwide. There has been a strong increase in the amount of research linking active and passive smoking, which has led to an increase in legislation designed to discourage smoking. There is strong evidence that suggests that tobacco products contain carcinogens, leading to fatal diseases like cancer and heart disease in both active and passive smokers. Furthermore, Pfizer introduced an oral drug Chantix (varenicline), the first prescription medication designed to aid individuals in stopping smoking. Chantix joins an already lengthy list of smoking cessation products like nicotine-replacement patches and chewing gum. Increased health consciousness is likely to reduce demand for PMI’s tobacco products and adversely affect its top line. Contraband and counterfeit cigarettes PMI's cigarettes brands are threatened by the increased availability of contraband and counterfeit cigarettes. Large quantities of counterfeit cigarettes are sold in the international market. Approximately 10% of all cigarettes sold in the UK are believed to be contraband or counterfeit. Since these cigarettes are cheaper (they are not taxed), an increase in the availability of such illicit cigarettes could deprive the potential customers for the company. For instance, a survey from Trading Standards North West found that 28% of 14 to 17 year olds had bought counterfeit cigarettes. The company's Marlboro is the most heavily counterfeited international cigarette brand. The increasing incidence of contraband and counterfeit cigarettes reduce revenues of the company and damage its brand equity. Increasing advertising restrictions Advertising, promotion and brand building, which are critical to the tobacco industry, are facing increasing regulatory obstacles across the globe. For instance, the EU's Advertising and Promotion Act, adopted in 2002, prohibits the advertising and promotion of tobacco products. This includes press, billboards, free distribution of samples, and in-pack promotion schemes. Also, the Tobacco Advertising and Promotion Act ensured a total ban on sponsorship and brand sharing in global events by tobacco companies. These measures may negatively impact the company’s sales, as advertising is important in driving tobacco sales. VALUATION I completed a discounted cash flow analysis, which estimated the present value of the Company’s future cash flows. Since PMI is just spun off from Altria Group in 2008, there is not enough history data to evaluate the company’s Beta. I therefore used a discount rate of 10% to be conservative. I believe the discount rate of 10% is appropriate. I ran several models with growth rates for years 1-10 ranging from 5% in a conservative case to 10% for a more aggressive case. My base case utilized a growth rate of 7% for years 1-10. My second stage growth rate is estimated to be 3%. Based on my analysis, I calculated a value range of approximately $54.67 per share for Philip Morris International Corporation. At the time of the analysis (2/23/2010), the Company’s shares were trading at $49.30, which means a little bit undervalued. CONCLUSION Based on the above analysis, I believe that Philip Morris International is currently trading at the appropriate level. As a result, I recommend that we hold our shares of PMI.