Diapositiva 1

advertisement

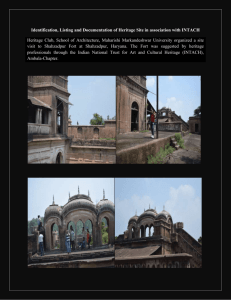

1 II LECTURE THE VALUE OF CULTURAL HERITAGE: DEFINITIONS AND METHODS HOW WE CAN ESTIMATE THE VALUE OF CULTURAL GOODS? 2 THE VALUE AND ECONOMICS (1) The problem of value in economics has traditionally confronted two interconnected issues: • • how to estimate the value of an economic object (the “evaluation” issue); how to analyze the process of the formation of value (the “value creation” issue). The two problems are related in many ways (Pennisi and Scandizzo, 2004). HOW WE CAN ESTIMATE THE VALUE OF CULTURAL GOODS? 3 THE VALUE AND ECONOMICS (2) 1) First, evaluating something is the necessary point of departure for any analysis of its value creation function or potential. 2) Second, value reflects “willingness to pay”; in turn, this is justified by the creation of utility or value for the subject who intends to be the potential acquirer/consumer. HOW CAN WE ESTIMATE THE VALUE OF CULTURAL GOODS? 4 THE VALUE AND ECONOMICS (3) 3) Third, the sources of value lie both in the desire to use a good or a service or to hold it for other reasons (“non-use values”), including the expectation that its value may increase. 4) Fourth, rights and responsibilities in a modern society are regulated by “contracts”; these almost invariably imply that their object has a value contingent upon the successful completion of what the contract stipulates. AIM OF THIS SEMINAR 5 The aim of this seminar is to explore the methods for valuing cultural heritage goods. AIM OF THIS SEMINAR 6 MAIN QUESTIONS What is the economic definition of cultural heritage? What are the main characteristics of cultural heritage? How do economists define the value that an individual (or the community) receives from cultural heritage? How can we estimate this value? What are the characteristics of cultural good projects? In particular, how can we estimate the benefits and the costs of projects in the field of cultural heritage? ECONOMIC CHARACTERISTICS OF CULTURAL GOODS 7 Local Global Heritage as a local and global public good Cultural heritage is a local public good, in that it is often linked to a localized concentration of human or social capital, such as a monumental site or a cultural district. Cultural heritage may also be a global public good, if it overcomes geographic barriers, generating values for people who live in distant countries. ECONOMIC CHARACTERISTICS OF CULTURAL GOODS 8 Are cultural goods private or public goods? “Private goods are goods held in private ownership. The right of ownership gives the right to exclude others from enjoying the fruits of the goods and, when a market exists for the good, to transfer the ownership of the good to others. The ownership can be shared in the sense that several individuals have a claim to the ownership. The ownership is well defined legally in the sense that a court of law should be able to determine what is whose” (Klamer, 2004). “Public or collective goods are goods held in ownership by a collective, usually a state or another political entity. Their possession has a legal status. They are marked by non-rivalry in consumption and nonexcludability. Their benefits are quasi universal in terms of countries, people and generations. Global public goods benefit humanity in its entirety” (Klamer, 2004). In order to be a pure public good, a good must have two properties: • first, non-excludability; • second, non-rivalry in consumption. ECONOMIC CHARACTERISTICS OF CULTURAL GOODS 9 Cultural goods as mixed goods In general, cultural heritage goods are mixed goods, showing both public and private good characteristics. ECONOMIC CHARACTERISTICS OF CULTURAL GOODS 10 Cultural goods as non-market goods “Cultural heritage goods are typically public goods, meaning they have two precisely defined characteristics. First, the benefits (values) generated by cultural heritage goods are typically non-rival, that is the benefit enjoyed by one individual does not come at the expense of the next individual’s enjoyment. This is in contrast to market goods, where a given unit of the good can be consumed by one individual only. Second, it is often difficult to force people to pay a price before they can enjoy the benefits from the cultural heritage good. Even where an entrance fee can regulate entrance to a building, the non-user benefits accrue regardless of whether they have been paid for. We say that the good, or that enjoyment of the good, is non-excludable.” Source: Ståle Navrud (2004, p. 1) ECONOMIC CHARACTERISTICS OF CULTURAL GOODS 11 Cultural goods as non-market goods “These two conditions lead to a situation where markets cannot be trusted to provide an adequate supply of cultural heritage goods. It is for this reason that such goods are usually provided collectively, either by governments or by groups of people working cooperatively.” Source: Ståle Navrud (2004, p. 1) ECONOMIC CHARACTERISTICS OF CULTURAL GOODS 12 Economic value and willingness to pay "The economic value to an individual of an increment in any good or amenity is the maximum amount of money he/she is willing to pay for it. These value measures are conceptually valid whether or not an adequate market exists in the good or amenity of interest." Source: Randall (1986, p. 83) ECONOMIC CHARACTERISTICS OF CULTURAL GOODS 13 The willingness to pay principle (WTP) WTP denotes a theoretical price, dependent on the preferences of the consumer, or on the technology, that assigns a subjective value to a given quantity (taken as a unit) of an economic (public or private) good. It is related to the concept of a demand function, or rather of a correspondence between quantities consumed and prices. If a market for the good in question does not exist or its prices are distorted, the WTP is the principal source of estimation for the social benefit of the production of the good under consideration. ECONOMIC CHARACTERISTICS OF CULTURAL GOODS 14 The willingness to pay principle (WTP) Numerous simplified procedures can be used to develop WTP estimates. The most common procedures consist of: the analysis of consumers’ response to price changes; the analysis of the consumption basket of the consumer; the analysis of the best alternatives to obtain the good. In all these methods, a concept related to WTP is the so called consumer surplus. CATEGORIES OF VALUE 15 The total value of a cultural heritage good is divided into a number of categories, summarized in the following figure: Total Economic Value Use Value Non-Use Value Direct Use Value Indirect Use Value Option Value Existence Value Other non-use Value Direct Benefits Indirect Benefits Preserving Option for Future Use Value (direct and/or indirect); Future Direct & Indirect Benefits Intrisic Value Bequest Value Income/Revenue Residential Space Commercial Space Industrial Space Circulation Space (vehicle, pedestrian) Economic Activity Tourism Recreation Leisure Entertainment Community Image Environmental Quality Aesthetic Quality Valorization of Existing Assets Social Interaction Identity Uniqueness Significance Decreasing “tangibility” of value to individuals Source: Serageldin (1999, p. 27). Historic legacy CATEGORIES OF VALUE 16 TOTAL ECONOMIC VALUE Total value can be divided into the following categories of value: Extractive, or consumptive, use value; Non-extractive use value; Non-use value. CATEGORIES OF VALUE 17 VALUES AND CULTURAL HERITAGE Let us examine value categories using “cultural heritage sites” as an example. In-depth study n. 7 “Definition of cultural heritage sites” Based on: UNESCO (www.unesco.org/culture/) CATEGORIES OF VALUE 18 USE VALUE or ACTIVE USE VALUE (the case of heritage sites) Extractive and non-extractive values are generally referred to as “use values”. “Each is often further subdivided into additional categories. By disaggregating the value of a cultural heritage site into various components, the problem generally becomes far more intelligible and tractable”. Source: Pagiola (1996, p. 2). CATEGORIES OF VALUE 19 EXTRACTIVE USE VALUE (the case of heritage sites) “Extractive use value derives from goods which can be extracted from the site. This category of value is generally the easier to measure, since it involves observable quantities of products whose prices can usually also be observed”. Source: Pagiola (1996, p. 2). CATEGORIES OF VALUE 20 EXTRACTIVE USE VALUE (the case of heritage sites) For example: “In the context of a forest, extractive use value would be derived from timber and other harvests. In historic living cities, there are direct uses being made of the building, for living, trading and renting or selling spaces. Many of these categories of use are captured by markets and transactions in markets. Unlike a forest, the use of a historic city does not deplete it unless the use is inappropriate or excessive, denaturing the beauty of the site or the character of the place. At some level a parallel exists to extractive use of a forest being kept at sustainable levels”. Source: Serageldin (1999, p. 27). CATEGORIES OF VALUE 21 NON-EXTRACTIVE USE VALUE (the case of heritage sites) “Non-extractive use value derives from the services which the site provides [...] Measuring non extractive use value is considerably more difficult than measuring extractive use value”. Source: Pagiola (1996, p. 2). For example: “Wetlands offer filter water, improving water quality for downstream users and national parks provide opportunities for recreation. These services have value but do not require any good to be harvested. The parallel for historic cities is clear, some people just pass through the city and enjoy the scenery without spending money there, and their use of the place is not captured by an economic or financial transaction”. Source: Serageldin (1999, p. 27) CATEGORIES OF VALUE 22 AESTHETIC AND RECREATIONAL VALUE (the case of heritage sites) “Among the non-extractive use values generally considered in environmental economics, those which are likely to have the most relevance to cultural heritage sites are the aesthetic and recreational values: Aesthetic value [...] Recreational value [...]”. Source: Pagiola (1996, p. 3). CATEGORIES OF VALUE 23 AESTHETIC AND RECREATIONAL VALUE (the case of heritage sites) “Aesthetic value. Aesthetic benefits are obtained when ‘the fact of sensory experience is separate from material effect on the body or possessions’ (Graves, 1991). Aesthetic effects differ from non-use value because they require a sensory experience. However, aesthetic benefits are often closely linked to physical ones. Recreational value. Although the recreational benefits provided by a site are generally considered together as a single source of value, they are the result of different services which a site might provide. The extent of recreational benefits depends on the nature, quantity of these services [...]”. Source: Pagiola (1996, p. 3). CATEGORIES OF VALUE 24 AESTHETIC AND RECREATIONAL VALUE (the case of heritage sites) “Non-use value. Non use value tries to capture the enrichment derived from the continued existence of major parts of world heritage [...]”. Source: Serageldin (1999, p. 27). “Non use-value derives from the benefits that a site may provide which do not involve using the site in any way. In many cases, the most important benefit of this type is existence value: the value that people derive from the knowledge that the site exists, even if they never plan to visit it”. Source: Pagiola (1996, p. 3). Bequest value reflects the desire to conserve cultural heritage for the benefit of future generations. CATEGORIES OF VALUE 25 OPTION VALUE AND QUASI OPTION VALUE (the case of heritage sites) “Other aspects of non-use value include: - option value, which is the value obtained from maintaining the option of taking advantage of the good use value at a later date (akin to an insurance policy), and - quasi-option value, which derives from the possibility that even though a site appears unimportant now, information received later might lead us to re-evaluate it. Non-use value is the most difficult type of value to estimate, since in most cases it is not, by definition, reflected in people’s behavior and is thus wholly unobservable [...]”. Source: Pagiola (1996, p. 3). “Use” and “non use” value: Existence, option and quasi option values in museums (Arrow, Krutilla 1960) Existence values are assigned to museum objects for the very fact that they exist and testify of the existence of the past. Option values are generated by the fact that the objects collected offer a partly uncertain set of opportunities for knowledge, aesthetic fruition, emotions, and entertainment REFERENCES 27 •Carson R.T. (2000) “Contingent valuation: A user's guide”, in Environmental Science & Technology, 34(8), pp. 14131418. •Combris P, Lecocq S., Visser M. (1997), “Estimation for Hedonic price Equation for Bordeaux Wine: Does Quality Matter?”, The Economic Journal, 107 (441), pp. 390-402. •European Commission (1997), “Guide to Cost-Benefit Analysis of Major Projects In the context of EC Regional Policy”, Bruxelles. •European Commission (2005), Evaluating Socio Economic Development, SOURCEBOOK 2: Techniques and Tools Cost-Benefit analysis (www.evalsed.info) •European Commission DG IS (2002), The DigiCULT Report – Technological Landscapes for tomorrow’s Cultural Economy. Unlocking the Value of Cultural Heritage, Bruxelles. •Fleischer A. and Felsenstein D. (2002), “Cost-benefit analysis using economic surpluses: A case study of a televised event”, Journal of Cultural Economics, 26, pp. 139–156. •Gittinger P. (1982), Economic analysis of agricultural projects, The Johns Hopkins Press Baltimore. •Graves P.E. (1991), “Aesthetics”, in J.B. Braden and C.D. Kolstad (eds), Measuring the Demand for Environmental Quality, Contributions to Economic Analysis No.198. Amsterdam: North-Holland. •Hansen J. (1978), Guide to practical project appraisal, Unido, Vienna. •Helmers L. (1979), Project Planning and income distribution, Nijhoff Publishers Boston. •Henry C. (1974), "Investment Decisions under Uncertainty: The Irreversibility Effect", in American Economic Review, 64 (December), pp. 1006-1012. •Hirschman A. (1968), Development projects observed, The Johns Hopkins Press, Baltimore. REFERENCES 28 •Klamer A. (2004), “Art as a common good”, Paper presented at the bi-annual conference of the Association of the Cultural Economics, Chicago, 3-5 June. •Knudsen O.K. and Scandizzo P.L. (2005), “Values and choices”, in Knudsen O.K. and Scandizzo P.L., The Artful Face of Uncertainty: How to Manage Opportunities and Threats, The World Bank, Washington DC (forthcoming). •Krutilla J.V. (1967), “Conservation Reconsidered”, in American Economic Review, vol. 57, pp. 777-786. •Knudsen O.K. and Scandizzo P.L. (2004), “Bringing Social Standards into Project Evaluation Under Dynamic Uncertainty”, CEIS Tor Vergata - Research Paper Series, Vol. 21, No. 63, University of Rome “Tor Vergata”, November. •Knudsen O.K. and Scandizzo P.L. (2003), Evaluating Public Policies and Projects Under Uncertainty Through the Application of Real Options, Research proposal, The World Bank, Washington, August. •Little J. and Mirrlees (1974), Project Appraisal and Planning for the Developing Countries, Heinemann, London. •Moreno Y., Santagata W. and Tabassum A. (2004), Material Cultural Heritage, Cultural Diversity, and Sustainable Development, ACEI, 13th International Conference on Cultural Economics, University of Illinois at Chicago Department of Economics, Chicago, Illinois USA, June 3-4-5. •Paganetto L. and Scandizzo P.L. (2001), Crescita endogena ed economia aperta, Il Mulino, Bologna, Italy. •Paganetto, L. and Scandizzo, P.L. (2000), La Banca Mondiale e l’Italia: dalla ricostruzione allo sviluppo, Il Mulino, Bologna, Italy. •Paganetto L. and Scandizzo P.L. (1996), "Economic Development, Reciprocity and Industrial Growth ", Rivista di Politica Economica, 3, pp. 105-118. •Paganetto L. and Scandizzo P.L. (1992), "Quality International Trade and Endogenous Growth", Rivista di Politica Economica, 11, pp. 155-176, 1992. REFERENCES 29 •Pagiola S. (1996), Economic Analysis of Investments in Cultural Heritage: Insights from Environmental Economics, Working Paper The World Bank, Washington D.C.. •Pennisi G. and Scandizzo P.L. (2003), Valutare l'incertezza, L'analisi costi benefici del XXI secolo, G. Giappichelli Editore, Turin, Italy. •Pennisi G. and Scandizzo P.L. (2004), “Policy, program, project and governance: Economic evaluation in the age of uncertainty”, Working paper 6th ees Biennial Conference Governance, democracy and evaluation, European evaluation society, Berlin, 30 September - 2 October. •Pera A. and Scandizzo P.L. (1988), "La valutazione delle performance delle imprese pubbliche", Rivista Internazionale di Scienze Sociali, 1, pp. 84-107. •Pollicino M. and Maddison D. (2001), “Valuing the Benefits of Cleaning Lincoln Cathedral”, Journal of Cultural Economics, 25, pp. 131–148, •Poor P.J. and Smith J.M. (2004), “Travel Cost Analysis of a Cultural Heritage Site: The Case of Historic St. Mary’s City of Maryland”, Journal of Cultural Economics, 28, pp. 217–229. •Posner R.A. (1973), Economic Analysis of Law, Little Brown, Boston (2th and 4th edition). •Randall A. (1986), “Human Preferences, Economics and Preservation”, in Bryan G. Norton (ed.), The Preservation of Species. The Value of Biological Diversity, Princeton University Press, Princeton, New Jersey. •Ready R.C. and Navrud Ståle (2002) "Methods for Valuing Cultural Heritage" (chap. 1), in Ståle Navrud and Ready R.C. (eds.), Valuing Cultural Heritage: Applying Environmental Valuation Techniques to Historic Buildings, Monuments and Artifacts, Edward Elgar, Cheltenham. REFERENCES 30 •Santagata W. (2004), “Cultural districts and economic development”, in Victor Ginsburgh and David Throsby (eds.), Handbook on the Economics of Art and Culture”, Series “Handbooks in Economics”, General Editors K. Arrow and M.D. Intriligator, Elsevier Science, North Holland, Amsterdam. •Santagata W. and Signorello G. (2000), Contingent Valuation of a Cultural Public Good and Policy Design: The Case of “Napoli Musei Aperti”, Journal of Cultural Economics, 24, pp. 181–204. •Scandizzo P.L. (2000), “Economic development, culture and music”, in Sviluppo Economico, 4(2), pp. 9 – 34. •Scandizzo P.L. (1999), "Ownership, Appropriation and Risk", in Property Rights, Risk, & Livestock Development in Africa, McCarthy N., Swallow B., Kirk M. and Hazell P. (eds.), pp. 211-239, IFPRI, Washington D.C.. •Scandizzo, P.L. (1992), "Cultural Goods and Economic Growth", Ricerche Economiche, XLVI (1-2), pp. 91-110. •Scandizzo, P.L. (1988), "I giacimenti culturali: lineamenti di una analisi costi-benefici", Economia & Lavoro, 22 (3), pp. 135-144. •Sen A.K. (1970), Collective Choice and Social Welfare, North Holland. •Serageldin I. (2005), Culture And Development At The World Bank, World Bank (http://www.worldbank.org/html/fpd/urban/urb_age/culture/cultdev.html) •Serageldin I. (1999), Very Special Places. The Architecture and Economics of Intervening in Historic Cities , The World Bank, May. •Ståle Navrud (2004), “Valuing cultural heritage applying non-market valuation techniques and cost-benefit analysis to cultural heritage: a review of studies and new approaches”, Paper submitted to the Applied Econometrics Association (AEA) conference on ”Econometrics of cultural goods”, Padova, Italy, April 22-23 2004. REFERENCES 31 •Ståle Navrud and Richard C. Ready (2002), “Why Value Cultural Heritage?” (chap. 1), in Ståle Navrud and Richard C. Ready (eds), Valuing cultural goods. Applying Environmental Valuation Techniques to Historic Buildings, Monuments and Artifacts, Edward Elgar Publishing Ltd., UK, June. •Thompson E., Berger M., Blomquist G. and Allen S. (2002), “Valuing the Arts: A Contingent Valuation Approach”, Journal of Cultural Economics, 26, pp. 87–113. •Throsby D. (2003), “Determining the Value of Cultural Goods: How Much (or How Little) Does Contingent Valuation Tell Us?”, Journal of Cultural Economics, 27, pp. 275–285. •Throsby D. (2001), Economics and Culture, Cambridge University Press. •Throsby D. (1994), “The Production and Consumption of the Arts: A View of Cultural Economics”, Journal of Economic Literature, XXXII (1). •Trine Bille Hansen (1997), “The Willingness-to-Pay for the Royal Theatre in Copenhagen as a Public Good”, Journal of Cultural Economics, 21, pp. 1–28. •Unido (1989), Project management system, Vienna. •World Bank (1994), “Cultural heritage in Environmental Assessment”, in Environmental Assessment Sourcebook, Update n. 8, Washington: World Bank, Environment Department, September. RELEVANT LINKS 32 • ORGANIZATION OF WORLD HERITAGE CITIES (OWHC) http://www.ovpm.org/ • BIBLIOTHECA ALEXANDRINA – CENTER FOR DOCUMENTATION OF CULTURAL AND NATURAL HERITAGE http://www.cultnat.org/ • UNESCO – CULTURE http://portal.unesco.org/culture