Vertical Integration: Owning the Channel

advertisement

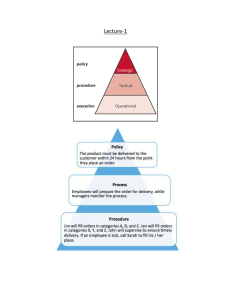

Vertical Integration: Owning the Channel Chp. 7 with Duane Weaver VERTICAL INTEGRATION • Should only one organization do all the work? • Downstream integration (manufacturer integrates a distribution function) • Upstream integration (channel member such as retailer may assume its own brand or product) • ULTIMATE QUESTION: Integrate or Outsource?? COSTS & BENEFITS OF VERTICAL INTEGRATION (VI) • Degrees of VI (see Fig. 7.1) – Classical – Quasi-Vertical – Vertical • Costs & Benefits – – – – Opportunity cost of personnel (from manufacture to distribution) Lack of channel expertise (underestimation of channel needs) Insufficient managerial resources More Control (psychologically appealing), but is it over economic results – Increased profit potential – New Growth Opportunities (e.g. maintenance) – Amortization of “knowhow” throughout the stream • Terms of Payment/3rd Parties – Margin, commission, royalty, future rights or barter – Exchange of Vertical channel risks in return for increased profit VI Forward: Economic Framework • Efficiency – …to maximize overall efficiency for the long run (ratio of next effectiveness to overhead- results to resources) • Outsourcing as a Startpoint – – – – – – Motivation Specialization Economically Fittest Economies of Scale Heavier Market Coverage Independence from any single manufacturer • When Competition is Low “the accumulation of company-specific assets creates an economic rationale to vertically integrate” – Company specific capabilities (barriers to entry) – Lack of leverage (threat) – Opportunism avoidance Company-Specific Capabilities • Idiosyncractic knowledge – cannot be readily redeployed • Relationships – distributor/manufacturer personnel expeditious in nature • Brand Equity – in those instances where downstream channel members have an influence on the brand’s equity • Dedicated Capacity – represents overcapacity in lieu or channel partner • Site Specificity – e.g. distribution outlet near a remote manufacturer or manufacturer needing a warehouse in a market void of distributors • Customized physical facilities – proprietary hardware and software and other physical adaptations that binds an upstream or downstream channel partner (e.g. SHIPPING) • SWITCHING COSTS – set-up/take-down (1 time) VI for Environmental Uncertainty • When an environment is difficult to forecast due to dynamics or complexities. Volatile. A OR B? A. Manufacturer should take control to cope with volatility (3rd party switching?) B. Do not commit to any distribution system until uncertainty is reduced (litotes difficulty of organization change to match market volatility). VI to reduce Performance Ambiguity • The latter discussions focused on the failure of a market to produce alternate bidders, necessitating some VI (thus you can afford to perform poorly) • What about: a failure of information? – Normal: Bid Monitor Reconsider Re-bid – Performance Ambiguity: • No baselines to measure against (radically new, innovative, inability to measure) • Poor quality measures (untimely, inaccurate) Summary of Decision Framework • Fig. 7.3, p. 190 • Fig. 7.4, p. 191 Group Discussion Questions • P. 196 Questions: –2 –4 –5 THANKS! • Have a great day!