3 Recognition of elements

Chapter 2

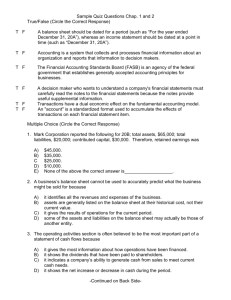

Objective test

On 1 April ABC Ltd purchased and received equipment to be used in the production of items that will be sold.

The equipment was purchased for cash for R400 000.

REQUIRED

Discuss whether the equipment will be recognised as an asset

2

Objective test

The equipment satisfies the definition of an asset as follows:

An asset is a resource controlled by the entity as a result of past events, and from which future economic benefits are expected to flow to the entity.

3

Recognition criteria

- Probability

- Reliably measured

4

Recognition criteria:

Asset

- Probable that future economic benefits associated with the item will flow to the entity, and

- The item has a cost or value that can be measured reliably.

5

Recognition criteria

Asset

Example

Trade inventory was purchased at an invoice price of R50 000. The trade inventory meets the definition requirements of an asset and will be sold at a profit in the future.

6

Example

Probable that future economic benefits associated with the item will flow to the entity, and

The inventory will be sold at a profit, which will result in an inflow of cash and future economic benefits

The item has a cost or value that can be measured reliably.

Measured reliably at historical cost price namely the invoice price.

7

Recognition criteria

Liability

- Probable that future economic benefits associated with the item will flow from the entity, and

- The item has a cost or value that can be measured reliably.

8

Recognition criteria

Liability

Example

The entity obtained a loan from ABC Bank for R1 million. The loan will be repaid in equal annual installments at the end of each year. The loan meets the definition of a liability.

9

Example

Probable that future economic benefits associated with the item will flow from the entity, and

The loan will be repaid in equal annual installments, so it is probable that future economic benefits will flow out.

The item has a cost or value that can be measured reliably.

Measured reliably at the value of the loan received (R1 million). Refer to contract.

10

Example p. 36

The owner of a business contributes

R4 500 000 cash as his capital contribution to the entity.

Discuss with reference to the definition and recognition criteria whether the bank amount of R4 500 000 is an asset

11

Example p. 36 - Definition

An asset is a resource controlled by the entity as a result of past events, and from which future economic benefits are expected to flow to the entity.

12

Example p. 36 - Definition

An asset is a resource controlled by the entity as a result of past events, and from which future economic benefits are expected to flow to the entity.

Cash is a resource that can be utilised by AC Entity, for example to buy other assets.

Cash is controlled because it has already been received in the bank account.

Cash can be used to generate future economic benefits by funding the entity’s operations – for instance to purchase more assets or pay for salaries.

13

Example p. 37 –

Recognition criteria

It is probable that future economic benefits associated with the item will flow to the entity, and the item has a cost or value that can be measured reliably.

14

Example p. 37 –

Recognition criteria

It is probable that future economic benefits associated with the item will flow to the entity, and the item has a cost or value that can be measured reliably.

The cash has already been received, therefore it is probable that when it is used it will lead to an inflow of future economic benefits

The cash can be measured reliably at the amount of

R4 500 000.

15

The accounting equation

Example p. 37

ASSETS = EQUITY + LIABILITIES

+ 4,5m = +4,5m

Classification

0

Capital

16

Example p. 37

On 4 January 20.7 AC Entity received a bank loan of R800 000. The contract was signed on 19 December 20.6

Discuss with reference to the definition and recognition criteria whether the bank loan amount of R800 000 is a liability.

17

Example p. 38 - Definition

A liability is a present, legal obligation arising from past events, and of which the settlement is expected to result in an outflow of resources embodying economic benefits/cash.

18

Example p. 38 - Definition

A liability is a present, legal obligation arising from past events, and of which the settlement is expected to result in an outflow of resources embodying economic benefits/cash.

The loan agreement that was signed results in a legal obligation,

The signing of the loan agreement together with the transfer of the funds from the bank, causes the bank to have an enforceable right to claim,

The loan amount will be settled in cash in the future at the end of the loan term.

19

Example p. 38 –

Recognition criteria

It is probable that future economic benefits associated with the item will flow from the entity, and the item has a cost or value that can be measured reliably.

20

Example p. 38 –

Recognition criteria

It is probable that future economic benefits associated with the item will flow from the entity, and the item has a cost or value that can be measured reliably.

The existence of a legal obligation (due to the contract together with the loan received) leaves the entity with no alternative but to settle the loan.

The cost of the loan can be measured at the historical cost thereof, namely the amount received according to the contract of R800 000.

21

The accounting equation

Example p. 39

ASSETS = EQUITY + LIABILITIES

+ 0,8m = 0 + 0,8m

(Bank) (Bank loan)

22

Recognition criteria

Income

An income item that satisfies the definition of income is recognised when an increase in economic benefits associated with an increase in an asset, can be measured reliably.

I.e. simultaneously with the asset item at the same amount as the asset.

23

Recognition criteria

Expense

An expense item that satisfies the definition of an expense is recognised when a decrease in an asset or increase in a liability, can be measured reliably.

I.e. simultaneously with the decrease in the asset item or the increase in the liability item, at the same amount as the asset or liability.

24

Example p. 45 – Recognition criteria

AC Entity had its delivery vehicle repaired on credit by Payable M on 3 March 20.7

and payment would be deferred by 30 days.

The expense item for Maintenance will be recognised together with the increase in the liability item Payable M.

25

Example p. 47 – Definition of expense

Expenses are decreases in economic benefits during the reporting period in the form of an outflow/decrease in assets or increase in liabilities, that result in a decrease in equity, excluding those decreases that relate to distributions to the owner.

26

Example p. 47 – Definition of expense

Expenses are decreases in economic benefits during the reporting period in the form of an outflow/decrease in assets or increase in liabilities, that result in a decrease in equity, excluding those decreases that relate to distributions to the owner.

Maintenance is a decrease in economic benefits during the reporting period, in the form of an incurrence of a liability.

The maintenance decreases the profit of the entity and results in a decrease in retained earnings.

27

Example p. 47 – Definition of expense

Subsequently the definition and recognition criteria for a liability are discussed because the maintenance is incurred on credit.

The expense item is recognised on the same day as the liability item.

28

The accounting equation

ASSETS = EQUITY + LIABILITIES

0 = - 11 000

Classification

+ 11 000

(Payable M)

Retained earnings expense

(maintenance)

29

Derecognition of assets and liabilities

If an element no longer meets definition and/or recognition criteria – derecognise.

Examples:

-

-

Debtor settles his debt, derecognise the debtor.

Pay of a loan or creditor, derecognise the loan or creditor.

30

Accrual accounting

- Transactions are accounted for in the period to which it relates and not necessarily when cash flow takes place.

- Elements of financial statements are recognised when they meet the definition and recognition criteria.

Basis on which F/S are prepared

31

Accrual accounting

Example

- Buy inventory on credit on 5 March for R10 000 from ABC Payable.

- Pay the R10 000 to ABC Payable on 30 April to settle the debt.

Indicate the above effect on the Accounting equation

32

Accrual accounting

ASSETS = EQUITY + LIABILITIES

5 March

+ 10 000 = 0

(Inventory)

+ 10 000

(ABC Payable)

30 April

- 10 000 = 0

(Bank)

- 10 000

(ABC Payable)

33

Going concern

- FS are prepared on the assumption that the entity will carry on operating in the foreseeable future.

- For instance: entity will carry on buying and selling at “normal” prices/market related prices.

- Entity is able to settle its debts and collect from its debtors “as usual”.

What would the effect be on a factory if the factory can’t carry on manufacturing?

34

Measurement basis

- Initial measurement versus subsequent measurement.

Initial = on the date of the transaction

Subsequent = at the end of each reporting period

- Historical cost model versus fair value model.

Historical cost = invoice price/amount received

Fair value model = amount at which an asset can be exchanged in an arm’s length

35

Explain – Sales vs COS

Purchase trade inventories cash R400

- Trade inventory (Asset) +

- Bank (Asset) –

Sell the trade inventory for cash R700

- Sales (Equity/Income) +

- Bank (Asset) +

- Trade inventory (Asset) –

- Cost of sales (Equity/Expense) -

36

Self-study

p 17 – p 20

- Users of financial statements,

- Qualitative characteristics,

Example 2.1 & Example 2.2 (p 57 – p 66)

37