Capital Cost Allowance (CCA) - McGraw-Hill

advertisement

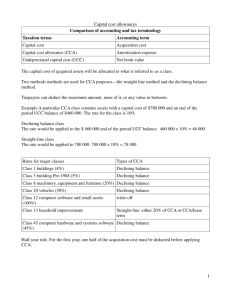

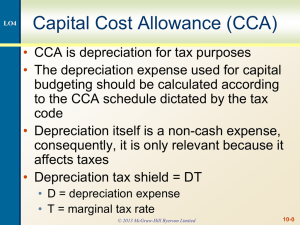

Learning Objectives 4. Appraise the use of the cost of capital as the discount rate in capital budgeting analysis. (LO4) 5. Integrate the cash flows that result from an investment decision, including the after tax operating benefits and the tax shield benefits of capital cost allowance (amortization). (LO5) 6. Perform NPV analysis to assist in the decisionmaking process concerning long-run investments. (LO6) 1 of 45 ©2012 McGraw-Hill Ryerson Limited LO5 Capital Cost Allowance • Amortization for income tax purposes • Capital Cost Allowance (CCA) is the maximum amount of amortization allowable under the tax act • Capital assets are divided into a number of classes (pools) • Each class is assigned a CCA rate; – ex. Class 8 is Machinery with a rate of 20% • CCA is calculated on the Un-depreciated Capital Cost (UCC) in the pool (declining balance) • CCA provides a tax shield over the life of the investment • A formula provides the present value of the CCA tax shield 2 of 45 ©2012 McGraw-Hill Ryerson Limited LO5 Capital Cost Allowance: tax savings Before CCA Expense Income (cash flow)……………. After CCA Expense $12,000 Income (cash flow)…………. Tax @ 40%............................... 4,800 Income (cash flow) after taxes $ 7,200 CCA……………………… ….. 5,000 Taxable Income…………….. 7,000 Tax @ 40%........................... 2,800 Income after taxes…………. Add back CCA……………… 3 of 45 $12,000 $4,200 5,000 Income/cash flow after $9,200 taxes ©2012 McGraw-Hill Ryerson Limited LO5 Table 12-8 Some declining balance CCA classes Class Rate Assets Class 1 4% Bridges, buildings, dams Class 3 5 Class 6 10 Greenhouses, hangars, wood jetties Class 7 15 Boats, ships Class 8 20 Most machinery, radio communications equipment Class 9 25 Aircraft Class 10 30 Automobile equipment, computer hardware, feature films Class 12 100 Class 16 40 Class 17 8 Class 30 40 Telecommunications spacecraft Class 33 15 Timber resource property Class 42 12 Fibre optic cable Class 45 55 Computer equipment and systems (increase from 45%) 4 of 45 Windmills, telegraph poles Cutlery, television commercials, computer software Taxicabs, autos for short-term rental, video games (coin) Roads, storage area ©2012 McGraw-Hill Ryerson Limited LO5 Table 12-9 Capital Cost Allowance for investment A or B Year 1: Net original cost…………………………………………………………………………………………. $10,000 Less: Capital cost allowance ½ ($10,000 x 0.20)……………………………………………………. 1,000 Undepreciated capital cost*……………………………………………………………………………. $ 9,000 Year 2: Less: Capital cost allowance ($9,000 x 0.20)………………………………………………………… 1,800 Undepreciated capital cost……………………………………………………………………………... $ 7,200 Year 3: Less: Capital cost allowance ($7,200 x 0.20)………………………………………………………… 1,440 Undepreciated capital cost……………………………………………………………………………... $ 5, 760 Year 3: Less: Capital cost allowance ($5,760 x 0.20)………………………………………………………… 1,152 Undepreciated capital cost……………………………………………………………………………... $ 4,608 Year n: Undepreciated capital cost (for year n – 1)…………………………………………………………… Less: Capital cost allowance (UCC in year n – 1 x 0.20)…………………………………………… Equals: Undepreciated capital cost (for year n)……………………………………………………… 5 of 45 ©2012 McGraw-Hill Ryerson Limited LO5 Table 12-10 Liquidation of Asset Pool Outcome 1 Outcome 2 Outcome 3 Outcome 4 $12,960 $12,960 $12,960 $12,960 Sale price – A………………………… 5,000 7,000 7,500 12,000* Sale price – B………………………… 5,000 5,960 7,500 7,200 Balance in pool……………………….. $ 2,960 $ 0 $ (2,040) $(4,240) Capital gain…………………………… $ 0 $ 0 $ $ 2,000 From CCA pool………………………….. $ 1,184 $ 0 $ (816) $ (1,696) From capital gain………………………... $ 0 $ 0 $ 0 $ $ 1,184 $ 0 $ (816) Year 3: UCC…………………………………… Year 4: 0 Tax consequences (@ 40%) Positive values are tax savings: (400) $ (2,096) *Only original cost of $10,000 is deducted from pool; excess of $2,000 is capital gain 6 of 45 ©2012 McGraw-Hill Ryerson Limited