International Financial Reporting Standards (IFRS) - Part 2

advertisement

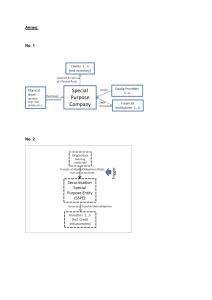

SPVs and Securitisations Disclaimer Merrill Lynch is providing the information contained in this presentation to you for information purposes only and without representation or warranty, express or implied, by Merrill Lynch as to its accuracy or completeness and without any responsibility on Merrill Lynch’s part to revise or update the information. Furthermore, Merrill Lynch is not providing this information to you in any form of fiduciary or advisory capacity and you will make your own analysis of the information and in doing so will consult with your own, independent financial, accounting and other advisors as you consider necessary. 1 Agenda US GAAP vs IAS 39; different but similar Securitisations under IFRS Securitisations under IFRS - Examples Collateralised debt obligation Residential mortgage backed securitisations Credit linked notes 2 US GAAP vs IAS 39 FAS 140 derecognition is based on a control approach which centers on legal isolation FIN 46 consolidation based on a risk and rewards approach Consider consolidation of SPV after determine derecognition SPV consolidation is determined by status of SPV; QSPE vs VIE Determination of derecognition is based on meeting specific criteria 3 IAS 39 derecognition is based on risk and rewards with control Prior to derecognition must consider if consolidate the SPV Consolidation of SPV is based on a risk/rewards and control model A pass-through concept is present but no use of QSPV No specific exceptions to guidance Derecognition is based on answer to specific questions through a flow chart IAS 39 - Derecognition Introduction and background IAS 39, Financial Instruments: Recognition and Measurement Includes derecognition of financial assets and liabilities – Decision tree introduced – Risks and rewards tests applied before control test – Accounting treatment – three possible outcomes • Derecognition • Continued recognition • Continued recognition to the extent of continuing involvement SIC 12, Consolidation – Special Purpose Entities Provides explicit guidance on the consolidation of SPEs – SPE should be consolidated when indicators of control are present – No “qualifying” special purpose entities 5 Consolidation first, then possible derecognition First step is to consolidate all subsidiaries (including SPVs under SIC 12) If consolidation required; derecognition of assets and liabilities may be possible, if (decision tree on next slide): Entity has transferred its rights to receive cash flows from the assets Entity has assumed obligation to pay cash flows from assets to “eventual recipients” Entity has transferred substantially all risks and rewards Three possible outcomes of derecognition test: Derecognition of assets and liabilities Continued recognition of assets and liabilities Continued recognition of assets and liabilities to the extent of continuing involvement 6 Derecognition of securitised assets 2. Has the entity transferred its right to receive the cash flows from the asset? 1. Consolidate all subsidiaries (including any SPEs) No 3. Has the entity assumed an obligation to pay the cashflows from the assets that meets the pass-through criteria Yes Determine whether the derecognition principles are applied to a part or all of an asset (or group of similar assets) No Continue to recognise the asset Yes Derecognise the asset Yes Continue to recognise the asset No Derecognise the asset Yes 4. Has the entity transferred substantially all risks and rewards? No No Have the rights to the cash flows from the asset expired? Yes 5. Has the entity retained substantially all risks and rewards? No 6. Has the entity retained control of the asset? Yes Derecognise the asset 7 7. Continue to recognise the asset to the extent of the entity’s involvement Consolidate all subsidiaries First step is to assess all subsidiaries for consolidation (IAS 27); includes determining if SPEs must be consolidated (SIC 12): To avoid consolidation, following indicators of control must not be present (for the reporting entity): – activities being conducted on its behalf from which it draws benefits – decision making powers to control or obtain control of the SPE or its assets – rights to obtain majority of benefits of the SPE – majority of risks of each party engaging in transactions with the SPE Must every SPE be consolidated by someone? – SIC 12 notion that SPE’s activities must be conducted on somebody’s behalf and so as to meet somebody’s business needs 8 Derecognition Even if SPE must be consolidated due to SIC 12, may still be able to derecognise assets but must achieve pass through When entity collects cash flows on an asset and passes some or all to another entity, must fulfil all three requirements: Have no obligation to pay amounts unless it collects equivalent amounts from the original asset, Entity is prohibited from selling or pledging the original asset, and Entity is obligated to remit any cash flows it collects without material delay. No investment for own benefit, only in cash and cash equivalents. Reinvestment in similar assets (securitisations involving short term assets) will most likely not qualify 9 Securitisations under IFRS - Examples Example securitisations – Collateralised Debt Obligations (CDOs) Asset manager Underlying collateral (eg. bonds/loans) Trustee Aaa floating/fixed rate notes Underlying securities Issued securities SPV Cash Cash Swap provider 11 Baa floating/fixed rate notes Unrated notes/ equity Example securitisations – Collateralised Debt Obligations (CDOs) Overview of structure: Assets are transferred directly to the SPV by the arranger, or sourced directly from the market Assets are actively managed within predetermined guidelines SPV will inter into a swap transaction to modify the cash flows Note holders will receive a market interest rate and their notes are secured on the underlying portfolio of assets; and Structure will include several tranches of debt from the AAA notes to the subordinated debt piece, which, along with the equity will absorb the “first loss” on the underlying assets. Consequently the risks of the different note holders will vary. 12 Example securitisations – Collateralised Debt Obligations (CDOs) Accounting analysis – applying the flow chart Consolidation of the SPE? – If the party that transferred the assets to the vehicle owns a majority of the equity or purchased subordinated debt it will be hard for the transferor to prove he/she does not consolidate the vehicle – If the asset manager is subject to a significant performance related fee (manager exposed to variability in earnings) the manager may have to consolidate Has the entity transferred its rights to receive cash flows from the assets? – Transfer may be through a true sale of the underlying instrument. Should the transferor consolidate the SPE then the asset would need to satisfy the pass-through criteria Have the pass-through conditions been met? – For the party who controls the vehicle, must be met from the perspective of the reporting group Has the entity transferred substantially all the risks and rewards? – Requires a detailed assessment of the position of the transferor of the assets, the swap provider, the asset manager, and the note holders 13 Example securitisations – Residential Mortgage-Backed Securitisations Assignment of mortgages Originator Cash Issued note SPV Cash Loan Note Subordinated loan Overview of Structure: Originator transfers the residential mortgages to the SPV by equitable assignment, at an agreed upon value plus an amount of deferred consideration; Deferred consideration enables the excess profit in the SPV to be transferred back to the originator; Structure is credit enhanced by a subordinated loan from the originator to the SPV Originator continues to administer loans under a servicing agreement for an arm’s length fee; and SPV issues loan notes secured by the mortgages to third parties who receive a market interest rate for their investment 14 Example securitisations – Residential Mortgage-Backed Securitisations Accounting analysis – applying the flow chart Consolidation of the SPE? – Originator is exposed to the first loss of the SPV through its subordinated loan, while it receives the excess spread through the deferred consideration – Therefore, originator has “rights to the majority of the benefits and may be exposed to risks incident to the SPV” and would most likely consolidate Has the entity transferred its rights to receive cash flows from the assets? – No, originator continues to receive the underlying cash flows from the mortgages Have the pass-through conditions been met? – Cash flows received by SPV are only paid out as they are received – Cash must be held only until next coupon date with no interest earned by originator Has the entity transferred substantially all the risks and rewards? – Originator exposed to the first loss and receives excess spread, unlikely to be considered a transfer 15 Example securitisations – Credit Linked Notes Sale of collateral Investment Bank Cash Credit default swap on underlying reference name Issued note SPV Cash Structured Note Overview of Structure: SPV issues the note to the investor. Investor receives a return commensurate with the risk of the reference name and is at risk of losing the principal amount if there is a “credit event” on the underlying reference name; Proceeds are used to purchase high quality collateral (e.g., government bonds); and Through the credit default swap, the SPV receives the additional coupon necessary to pay the note holder, in excess of the income on the collateral. SPV pays investment bank nothing unless there is a “credit event” on the underlying reference name. If there is a credit event the nominal value of the note will be paid to the investment bank. 16 Example securitisations – Credit Linked Notes Accounting analysis – applying the flow chart Consolidation of the SPE? – Structure generally setup on “autopilot” by investment bank – CDS must be transacted at market rates to prove the investment bank does not control SPV Has the entity transferred its rights to receive cash flows from the assets? – Assuming investment bank does not control SPV, it must assess whether the sale of collateral qualifies for derecognition Have the pass-through criteria been met? – If investment bank does not control SPV, pass-through criteria must be considered from the perspective of the group – The timing mismatch between when the cash flows are received and paid out by the SPV must not be greater than the time until the next coupon date – All interest earned during the timing mismatch must be paid out to the note holders – CDS will be recorded at fair value in accordance with IAS 39 17 QUESTIONS?