Public's assets 2015 Q3

advertisement

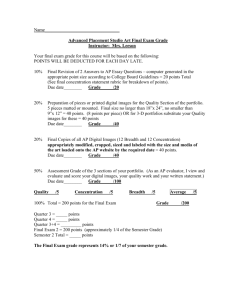

BANK OF ISRAEL Office of the Spokesperson and Economic Information December 15, 2015 PRESS RELEASE The public's financial assets portfolio in the third quarter of 2015 During the third quarter of 2015, the value of the public's financial assets portfolio declined by about NIS 28 billion (-0.9 percent compared with the balance at the end of the second quarter), to about NIS 3.26 trillion at the end of September. From the beginning of the year, the value of the portfolio has increased by NIS 86 billion (2.7 percent), deriving from an increase in the value of nontradable assets. The decline in the portfolio value during the third quarter derived mainly from the decline in the value of shares in Israel (about NIS 48 billion, 8.9 percent) and abroad (about NIS 11 billion, 4 percent), which were partially offset by an increase in the balance of cash and deposits (NIS 30 billion, 2.8 percent). The value of the asset portfolio managed by institutional investors declined by about 0.5 percent (NIS 6.5 billion) in the third quarter, to about NIS 1.31 trillion at the end of September. There were declines in the value of shares in Israel (NIS 6.6 billion, 6.2 percent) and abroad (NIS 5.1 billion, 2.8 percent), which were partially offset by an increase in the balance of cash and deposits (NIS 3.2 billion, 3.8 percent). The trend of net withdrawals from money market funds continued in the third quarter of 2015 (withdrawals of NIS 9.6 billion, 3.9 percent). 1. The total assets portfolio In the third quarter of 2015, the value of the public’s financial assets portfolio declined by about NIS 28 billion (0.9 percent) to about NIS 3.26 trillion at the end of September. The decline in the third quarter was due primarily to the decline in the value of shares in Israel (about NIS 48 billion, 8.9 percent) and abroad (about NIS 11 billion, 4 percent), which were partially offset by an increase in the balance of cash and deposits (NIS 30 billion, 2.8 percent). From the beginning of the year, the value of the portfolio has increased by NIS 86 billion (2.7 percent), deriving from an increase in the value of nontradable assets (Figure 1). The share of the public’s financial assets portfolio relative to GDP declined during the quarter by about 6.6 percentage points, to about 287 percent at the end of September 2015 (Figures 2 and 3). This followed a decline of about 7.5 percentage points in the previous quarter. The decline was a result of the combination of a decrease in the value of the assets portfolio and an increase in GDP. Bank of Israel - The public's financial assets portfolio in the third quarter of 2015 Page1 Of7 Bank of Israel - The public's financial assets portfolio in the third quarter of 2015 Page2 Of7 Asset portfolio composition: Since the beginning of 2015, there was a decrease of about 1.4 percentage points in the share of tradable assets, primarily against the background of price decreases on markets around the world. In contrast, there was a slight increase in the share of foreign and foreign-currency assets, mainly the result of the weakening of the shekel vis-a-vis the dollar. 2. The securities portfolio, by main components Shares in Israel During the third quarter of 2015, the balance of shares held in Israel by the public decreased by about NIS 48 billion (8.9 percent), to about NIS 497 billion at the end of September, mainly due to price declines on the Tel Aviv Stock Exchange. This follows an increase of about NIS 51 billion in the first half of 2015, so that for the year to date the balance of shares held in Israel has increased by NIS 3 billion. Bonds During the third quarter of 2015, the value of tradable corporate bonds in Israel increased by about NIS 7 billion, to about NIS 270 billion at the end of September. The increase derived mainly from net investments and from price increases. Bank of Israel - The public's financial assets portfolio in the third quarter of 2015 Page3 Of7 The balance of the tradable government bonds increased by about NIS 5.4 billion (0.8 percent), and in contrast there was a decline of about NIS 11.3 billion (14.2 percent) in the value of makam holdings. Cash and deposits The balance of the cash and deposits component increased in the third quarter by about NIS 30 billion (2.8 percent), further to an increase of NIS 36 billion in the first half of the year. Most of the increase during the quarter derived from an increase in the public’s cash and current accounts balances, in parallel with an increase in the value of foreign currency indexed deposits and unindexed deposits. The assets portfolio abroad During the third quarter of 2015, the value of the portfolio held abroad by Israelis declined by about NIS 3 billion (0.6 percent), to about NIS 472 billion at the end of September, which accounts for about 14.5 percent of the total asset portfolio. The decline was affected by price decreases in markets abroad, which were partly offset by net investments abroad and by the depreciation of the shekel vis-à-vis the dollar (4.1 percent), which increases the shekel value of the portfolio. The shares held abroad component declined by about NIS 11.5 billion (4.1 percent), to about NIS 267 billion at the end of September. In contrast, the value of the tradable bonds portfolio abroad increased by about NIS 3.4 billion (1.9 percent), to about NIS 179 billion at the end of September. In addition, there was an increase of about NIS 5 billion (25 percent) in the value of deposits at banks abroad. 3. The portfolio managed by institutional investors The value of the assets portfolio managed by institutional investors declined in the third quarter of 2015 by about 0.5 percent (NIS 6.5 billion), to about NIS 1.31 trillion at the end of September. The trends in the portfolio managed by institutional investors are similar to the trends in the rest of Bank of Israel - The public's financial assets portfolio in the third quarter of 2015 Page4 Of7 the portfolio during the quarter. There were declines in the value of shares traded in Israel (NIS 6.6 billion, 6.2 percent) and abroad (NIS 5.1 billion, 2.8 percent), which were partly offset by an increase in the value of cash and deposits (NIS 3.2 billion, 3.8 percent) and in the bonds portfolio in Israel and abroad. The share of the portfolio managed by institutional investors out of the public’s total assets portfolio remained unchanged during the third quarter, at about 40.3 percent at the end of September. Exposure1 of the portfolio managed by the institutional investors to foreign assets and to foreign exchange In the third quarter of 2015, institutional investors’ rate of exposure to foreign assets declined slightly, (by about 0.3 percentage points), to 24.2 percent of the portfolio at the end of September (a combination of a decline in the value of foreign assets and the effect of the depreciation on total investment assets). Among the most notable changes, insurance companies and provident and advanced training funds reduced their exposure to foreign assets by about 0.6 percentage points each, to about 34.5 percent and 25.1 percent, respectively. The rate of exposure to foreign exchange, which is measured by the share of assets denominated in and indexed to foreign currency (including derivatives) out of total institutional investors’ assets, declined by about 1.1 percentage points to 13.3 percent at the end of September. The decline in the Estimates of members’ exposure (rather than exposure of the institutional investors themselves) to various risks in the portfolio managed for them by the institutional investors (excluding insurance policies with a guaranteed yield, where the risk is taken on by the institutional investors). 1 Bank of Israel - The public's financial assets portfolio in the third quarter of 2015 Page5 Of7 rate of exposure derives from a decline in the balance of exposure to foreign currency in shekel terms (about 8 percent), while the total balance of investment assets remained essentially unchanged. The decline in the balance of exposure derived from a decline in prices of securities in markets abroad, which was partially offset by the depreciation of the shekel vis-à-vis the dollar and net purchases of foreign exchange. The most significant change during the third quarter was focused on insurance companies that reduced their exposure to changes in the exchange rate by about 2.1 percentage points while in parallel, new and old pension funds reduced their exposure during the quarter by about 1.2 percentage points, on average. An analysis of estimates of net transactions indicates that in the third quarter, institutional investors continued to partially hedge their investments in foreign currency assets. They invested around $2.2 billion in assets denominated in and indexed to foreign exchange. In contrast, they sold foreign exchange totaling about $1.6 billion net through derivative instruments. *Beginning this month, long-term tables of monthly data on institutional investors’ exposure to foreign currency and to foreign assets can be found on the Bank of Israel website. 4. Mutual funds The value of the portfolio managed by Israeli mutual funds was about NIS 236 billion at the end of September 2015, about 7.3 percent of the public's total asset portfolio and about 14.2 percent of the tradable portfolio. In the third quarter of 2015, the trend of net redemptions (surplus of redemptions over issues, net of dividends) continued, at about NIS 9.6 billion, continuing the downward trend in net new investment since the second quarter of 2014. As a result of the combination of net redemptions and the decline in asset prices, the value of mutual fund balances declined by about NIS 10.9 billion. A breakdown of mutual funds by specialization shows that net redemptions in the quarter were concentrated in government bond assets (NIS 4.9 billion, 10 percent), in money market funds (NIS 2.1 billion, 6.7 percent), and in general bond funds (NIS 1.8 billion, 2.4 percent). Bank of Israel - The public's financial assets portfolio in the third quarter of 2015 Page6 Of7 Further information and details on this subject are available here. Bank of Israel - The public's financial assets portfolio in the third quarter of 2015 Page7 Of7