General Fund Revenues - Berkeley County School District

Berkeley County School

District

Financial Audit Presentation

Year Ended June 30, 2014

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

• HIGHLIGHTS

Unmodified opinion

General Fund – fund balance increased $4.9 million

Significant savings through the

SAFE debt refunding

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

• OPINION

The School District’s responsibility:

Effective internal controls

Financial statements

GF&H responsibility:

Opinion-reasonable assurance that financial statements are materially correct

Issued unmodified opinion

BEST OPINION THE SCHOOL DISTRICT CAN

RECEIVE

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

• General Fund

Total fund balance increased $4.9 million

Non-spendable fund balance of $1.3 million related to prepaid items and inventory

GENERAL FUND

$45 000 000

$40 000 000

$35 000 000

$30 000 000

$25 000 000

$20 000 000

$15 000 000

$10 000 000

$5 000 000

$0

2010 2011 2012 2013 2014

Fund Balance

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

• General Fund

• Unassigned fund balance is $42.4 million, which is

20.0% of 2014 actual expenditures and 19.0% of 2015 budgeted expenditures

• GFOA recommends a minimum of 16.7% (two months)

14

12

10

8

6

4

2

0

20

18

16

GENERAL FUND

2010 2011 2012 2013 2014

Unassigned Fund Balance as a % of General Fund Expenditures

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

• Major Reasons To Maintain An Adequate

Fund Balance:

• Cash flow through second half of calendar year; property taxes are cyclical

• Significant emergencies and unanticipated expenditures

• Flexibility for discretionary funding needs

• Potential for better interest rates on debt issues (can save the School District money).

• To cover potential shortfalls from the state

• Extremely important given the uncertain economic times

• Unique financing requirements of a coastal School

District

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

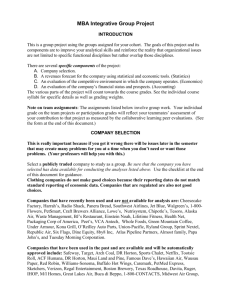

General Fund Revenues:

• $208.7 million for 2014:

• $74.2M from property taxes

• $132.7M from the state gov’t

• $174K from the federal gov’t

• $1.6M for all other revenues

• $13.2M (6.7%) increase from

2013

• $6.0M (8.8%) increase in local property taxes due to a 5.0 mill (3.6%) increase from 137.9 in 2013 to 142.9 in 2014 and a 2.7% increase in assessed values.

• $6.2M (4.9%) increase in state revenues due to a $91 (4.5%) increase in base student cost from 2013 to

2014

$250 000 000

$200 000 000

$150 000 000

$100 000 000

$50 000 000

$0

2010 2011 2012 2013 2014

Property Taxes State

Federal

GENERAL FUND

REVENUES

Other Revenues

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

General Fund Revenues:

• $3.4M (1.6%) over budget

• $2.2M over budget in taxes due to

FILOT revenues coming in $1.7M more than estimated

• $1.6M over budget in state revenues due to fringe benefits state revenues exceeding budget by $1.4M

$250 000 000

$200 000 000

$150 000 000

$100 000 000

GENERAL FUND

REVENUES

$50 000 000

$0

2010 2011 2012 2013 2014

Property Taxes State

Federal Other Revenues

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

General Fund Expenditures:

• $212.3 million for 2014:

• $125.2M in instruction

• $86.7M in support services

• $385K in other expenditures

• $14.3M (7.2%) increase from

2013

• $7.5M increase in salaries and a

$3.9M increase in fringe benefits due to a two-step increase to teachers and a one-step increase to non-teachers.

• Continued increases in required retirement contributions and health insurance benefit costs

• $11K (0.0%) under budget

$250 000 000

$200 000 000

$150 000 000

$100 000 000

$50 000 000

$0

GENERAL FUND

EXPENDITURES

2010 2011 2012 2013 2014

Instruction

Support

Community

Capital Outlay

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Special Revenue Fund

• The Special Revenue fund is used to account for most of the School

District’s grant activities:

• Total revenues decreased $1.2M (4.1%) due to a $522K decrease in E-Rate revenues, a $516K decrease in Title I School Improvement revenues, and a $341K decrease in Title I revenues

• The Special Revenue fund included 35 individual sub-funds/special revenue programs.

EIA Fund

• The EIA Fund is used to account for the School District’s state receipts related to the Education Improvement Act:

• Total state revenues were $22.1M – a decrease of $1.4M or 5.8% from 2013 primarily due to a $1.2M decrease in EIA At Risk funding.

• The EIA Fund had 23 individual sub-funds/EIA programs.

10

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Food Service

• The Food Service fund had a decrease in fund balance of

$12K, compared to a $350K increase in the prior year:

• Total revenues decreased approximately $35K, or 0.2%, from the prior year. This decrease was primarily due to local revenues decreasing $99K offset by federal revenues increasing by $62K.

• Expenditures increased $353K or 2.4%, due to a $173K increase in salaries and a $39K increase in related fringe benefits as well as

$233K increase in supplies and materials (mostly food costs).

Debt Service – District Fund

• The Debt Service – District fund is used to account for property taxes collected and held by the County Treasurer to make annual principal and interest payments on the District’s debt:

• Total revenues of $46.9M, an increase of $8.2M or 21.1% from the prior year primarily due to a $7.9M increase in property taxes as a result of a 20.4% increase in millage (49.0 in 2013 to 59.0 in 2014) and a 3.7% increase in assessed values.

• Total fund balance of $9.0M, an increase of $2.9M. Fund balance is restricted for

Debt Service activities.

11

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Debt Service – Berkeley Facilities Group Fund

• The Debt Service – Berkeley Facilities Group fund is used to account for the debt service reserve funds related to the School District’s blended component unit:

• No changes in fund balance as transfers in from the General Fund (representing property tax revenues) equaled principal and interest payments made on the 2008

Refunding COPS debt.

Debt Service – SAFE Fund

• The Debt Service – SAFE Fund is used to account for the debt service reserve funds related to the School District’s SAFE blended component unit:

• Issued $183.0M in refunding debt and used $23.5M in debt service reserve funds to refund the outstanding 2003 SAFE Bonds. This refunding reduced total debt service payments over the next 15 years by $27.1M and will provide an estimated economic gain of $22M.

12

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Capital Projects – District Fund

• The Capital Projects – District fund is used to account for most of the

District’s capital improvement activities:

• Only revenue was a loss on investments of $308k due to the District investing in government bonds, which have seen decreases in the market over the past year. .

• Issued $100.0M in GO Bonds approved through referendum and $52.0M in Special

Obligation Bonds for referendum projects.

• Total fund balance of $157.3M, an increase of $156.6M due to the proceeds from debt mentioned above.

Enterprise Fund – Child Care Fund

• The Child Care Enterprise Fund is used to account for the School

District’s before and after school programs:

• Total revenues were $3.5M – an increase of $111K or 3.3% from 2013 primarily due to an overall increase in attendance for the program.

• Total expenses were $3.3M – an increase of $65K or 2.0% from 2013 primarily due to increased salaries and benefits as a result of increased staffing needed to monitor the increased number of attendees as well as the salary increases approved by the

Board.

• As a result, the Enterprise Fund net position of $1.6M increased $173K or 11.8% from the prior year.

13

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Other Items of Note:

• Total capital assets were $467.8M at 6/30/14 – increase of $556K from 6/30/13:

• Various construction in progress additions related to the start of referendum projects and use of short-term debt proceeds

• Construction in progress is $10.4M at 6/30/14 with the new construction projects of Nexton Elementary

School, Goose Creek High School Renovations,

Stratford High School Renovations, and Timberland

High School Construction.

• Construction commitments total $137.0M at 6/30/14, which does not include $38.0M awarded subsequent to year end.

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Other Items of Note:

• Total long-term obligations outstanding at 6/30/14 were

$592.4M – increase of $139.3M from 6/30/13:

• $183.0M in 2013 Series – SAFE Refunding Bonds used to refund the $200.5M balance of the Series 2003

SAFE Installment Purchase Revenue Bonds.

• $52.0M in 2013 Series – Special Obligation Bonds issued to fund various equipment purchases related to referendum projects.

• $100.0M in 2014A Series - General Obligation Bonds used to fund the referendum projects.

• Compensated Absences – $6.0M

• Total debt service payments for 2015 on outstanding debt is expected to be $39.9M

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Other Items of Note:

• Implemented GASB #65: Items Previously Reported as

Assets and Liabilities. Impacts on the government-wide statements: (1) Beginning net position was decreased as bond issuance costs were written off; (2) Deferred refunding charges were reclassified to a deferred outflow of resources from a contra-liability. Impacts on the fund financial statements: (1) Unavailable property taxes were reclassified from deferred revenues to a deferred inflow of resources; (2) Deferred revenues were renamed unearned revenues.

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

AUDITING/ACCOUNTING UPDATE:

• Future Significant Changes in Accounting Principles:

• GASB #68: Accounting and Financial Reporting for

Pension Plans and Pensions. Becomes effective in 2015 for cost-sharing multiple-employer plans. Since the

District participates in the state multiple-employer pension plans (SCRS and PORS), the District will be required to record its pro-rata portion of the net pension liability associated with these plans in its

Statement of Net Position which will decrease the

District’s net position for its governmental activities by an estimated $311.9 million and its business-type activities (child care fund) by an estimated $1.8 million based on the most recent estimates by the

PEBA.

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Compliance

• No financial statement findings to report

• Single Audit was required for 2014

• Title I

• National School Lunch and Breakfast Program

Management Letter

• Required communications to management and those charged with governance

• Timely preparation of bank reconciliations

2014 FINANCIAL AUDIT

Berkeley County School District

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Consideration of future financial risks

• Future continued increases in salaries and benefits

• Efficiency/effectiveness improvements

• Increased operating costs due to new facilities

These should be addressed in long-term strategic and financial planning

2014 FINANCIAL AUDIT

BERKELEY COUNTY SCHOOL DISTRICT

____________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Summary

• Unmodified opinion on the Financial Statements from GF&H

• Very good financial condition as of June 30, 2014