Discussion Slides

advertisement

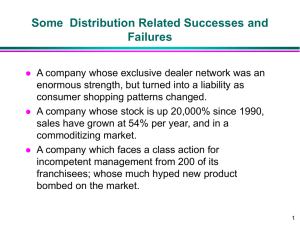

Discussion of “Who's Getting Globalized? The Size and Implications of Intranational Trade Costs” By David Atkin and Dave Donaldson By Tim Bresnahan An Approach to a Price Theory for a Changing Economy Moses Abramovitz (1939) “The chief questions with which the data were approached were: what are the relations in these markets between prices and marginal costs and why do they have such relations? No direct measurement was attempted but reliable indirect evidence was sought.” “…whatever the importance of the questions, they proved, as in retrospect it appears they had to prove, a tactical mistake for the program of study in hand. An empirical study could throw only the most oblique and faint light on marginal costs and the state of demand, and even less on businessmen's notions of these conditions…” This Paper: Estimate dependence of CPI on distance • Pd-Po f(Xd) • Key breakthroughs • New P data • New od pair data • Large implications for • Benefits to LDC consumers • (if applies in both directions) Supply to global economy from “remote” Divide into (social) (trade) cost and (intermediaries’) markup • Based on pass-through • Idea: markup over landed cost (C) and markup over transport (etc.) costs should be the same ? Po as proxy for C – meas. error ? Measuring market power vs slope of social MC ? Iterated oligopoly of intermediaries Pd1~Pd2>>Po d1 d2 ∂Pd/ ∂Po~.5 (with much variance) Even .75 in the US o od direction and price gaps • A city pair of ~400 miles (within sample) in Ethiopia • If it is an od pair, price gap averages ~.045 • If it is a pair picked at random, ~.02 • Also, pr(prod avail) falls to about .75 (from over .9 at 50) • Substantial, systematic price increases between o and d clearly associated with supply of internal transport, retail markets, and intermediaries (including bribes…) Price setting at o and d (slightly more general) Add rising MC in retail, transport • Landed or manufactured cost C • Cost to retailer at o: C+ro(q) • Costs to transport τ(q,Xd); markup on transport μ; rising MC • Cost to retailer at d: C+rd(q)+ τ(Xd)+ μ • Competitive Retail Eqm at o: C+ro(q)=D-1o(q) • Competitive Eqm at d: C+rd(q)+τ(Xd)+ μ=D-1d(q) Local retail market and errors in Po • Ps - Ps’=Cs - Cs’ +Ms - Ms’ +θs – θs’ • Costs, Margins, θ:Quality 1. Paper uses fixed commodity, but θs – θs’ still has outlet service quality 1. Only known service, inventory holding, worsens with distance from o 2. Local supply and demand (if ro(q) has slope) errors are in Po and add measurement error if it is interpreted as being C • Plausibly, this measurement error is same for all X • So might be bias to ρ, but possibly not to ρX • Similar problems with market power in local retail (anything that makes supply relation slope up) • Solutions: exchange rate as IV (also for domestic manufacturers?). Repeated observations (to d along different travel routes) Constant vs. Rising MC and measuring market power with cost shocks • This paper, like many, assumes constant MC and uses cost shocks to measure market power • Panzar and Rosse (1977) showed that flat LRMC is sufficient • Bresnahan (1982) showed that flat MC is necessary • For this paper, rising MC in either retaild or at intermediary must be assumed away • Economics: distinguishing slope of MC from slope of MR • Econometrics: use exogenous supply-side shifters to measure S (?) Rising MC and intermediaries (infrastructure) Potential solutions • Find elasticity-of-demand shifters • Most intermediaries invent “value of service pricing” • Use overseas estimates of demand elasticity by category • Paper also uses horizontal market structure • … might also investigate vertical market structure of intermediaries… Double Marginalization? • Iterated monopoly among …. • Manufacturer (importer) and intermediaries • Transport and retail and bribe-taking official • More and more bribe-taking officials as distance grows • Toll castles along the Rhein….. • Different markups over different costs Fin Price Differences in Markets with Negotiation • Typical Price Index Approach Ps - Ps’ • Where s is a seller (and s’ has different location, time …) • Data, index number formulae, quality adjustment …. • Bargaining markets: Psb • Where b is a buyer - Let b buy from s, b’ from s’ • One might calculate either Psb-Ps’ b or Psb-Ps’ b’ • Advantages of Psb-Ps’ b’ – close to market outcome • Advantages of Psb-Ps’ b – closer to pure seller effect