progress on strategic goals

advertisement

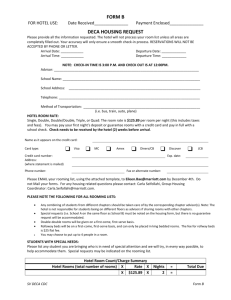

ANALYST BRIEFING WEDNESDAY 3 DECEMBER 2008 GLOBAL TOURISM TRENDS • Growth in global tourism for the first eight months of 2008 averaged a 3,7% compared to the same period last year. Annual growth in arrivals globally is projected to be 3% compared to 3.9% in2007. • The Middle East, Africa and Asia Pacific experienced higher growth rates at 5.2%, 5.9% and 5.7% respectively • Mature markets, notably Europe and Americas falling behind at 2.3 % and 2.1% respectively. • Asia and the Pacific’s growth of 5.7% was well behind its 2007 level, with Oceania and North-East Asia suffering the brunt of the downturn in demand. • Source: UNWTO / World Travel & Tourism Council (WTTC) GLOBAL TOURISM TRENDS CONT’D • The slow down in tourism growth is attributed to the uncertainty over that global economic outlook driven mainly by the : • current global financial crisis • Rising food prices • Currency fluctuations • Climate change fears • Continued economic expansion in emerging markets such as China, India and Brazil should assist in mitigating impact of the slowdown GLOBAL ECONOMIC SLOWDOWN IMPLICATIONS • Traffic to closer destinations, including domestic travel, is expected to be favored as compared to long-haul travel. • The decline in average length of stay as well as on expenditure is projected to be more pronounced than in the overall volume. • Price is becoming a key issue and destinations offering value for money and with favorable exchange rates will have an advantage. • Companies will concentrate on containment of cost in order to keep their competitive edge thereby cutting back on business travel. • Source: UNWTO / World Travel & Tourism Council (WTTC) ARRIVAL TRENDS INTO ZIMBABWE ● Foreign arrivals into the country decreased by 58% compared to growth trend experienced in the previous period. ● Foreign arrivals into African Sun hotels marginally declined by 15%, resulting in a decrease in room nights of 6%. ● The country continued to experience negative publicity and travel warnings due to the political impasse existing in the country. The credit crunch also had an impact on travel which resulted in decline in arrivals into Zimbabwe. ARRIVAL TRENDS INTO AFRICAN SUN HOTELS ZIMBABWE COUNTRY % INCREASE COUNTRY % % DECREASE INCREASE COUNTRY India 202% Czech Republic 28% South America 94% Russia 111% France 21% Australia 24% Taiwan 100% Malawi 18% Germany 19% Japan 80% USA 13% United kingdom 14% Italy 59% Canada 9% Namibia 8% ARRIVAL TRENDS INTO SOUTH AFRICA ● The total arrivals growth slowed in the first eight months of the year from 11.9 percent in January to 6.3 percent in August. ● 75 percent of the visitors who came to South Africa in the first eight months were from African land and air markets. ● Contribution to group turnover from South Africa Operations increased to 27% compared to 15% in the prior year. This increase was due to increases in ADR of The Grace from USD $ 104 in 2007 to USD $ 142 in the current year. ARRIVAL TRENDS INTO NIGERIA ● Foreign arrivals into the Nigeria for 2008 expected to grow by 6% compared to the year 2007. ● Nigeria’s economy benefited from high oil prices experienced in the first half of 2008 and the resultant economic growth has translated directly into increased hotel rates and occupancies. ● ASL assumed management of Obudu Mountain Resort, a leading leisure facility in Cross River State in May 2008, with a mandate to restore the resort to its full operational potential based on the hospitality expertise and management given ASL ARRIVAL TRENDS INTO GHANA ● Foreign arrivals into Ghana are expected to grow to 1,125,720 for the year 2008 from 1 062 000 in 2007. This is a 6% growth. ● Since the take over of Holiday Inn Accra by ASL in August 2008, the unit has seen an average growth of 3% per month in occupancy. ● The hotel achieved REVPAR of US$124, 11% ahead of its competitive set STRATEGIC GOALS 1. To grow rooms in Africa under African Sun management from the current 2,500 to 8,500 by 2012 2. To become an employer of choice by providing competitive remuneration, an enabling and winning environment driven by personal learning and development 3. To achieve a market capitalization of USD1billion 4. To establish brand leadership where we dominate other brands and become the benchmark for other players 5. To seek a dual listing on a major bourse by 2012 PROGRESS ON STRATEGIC GOALS: CAPACITY GROWTH REGIONAL LOCAL • Amber Beitbridge – 200 rooms • 8500 rooms targeted by 2012 Since July 2008 the following hotels have been added to the Group’s portfolio: – Amber Tinapa – 243 rooms – Holiday Inn Accra Airport168 rooms – Utanga Lodge – 90 rooms – Nike Resort Enugu – 245 Rooms PIPELINE PROJECTS- ZIMBABWE VS REST OF AFRICA 14,000 12,000 10,000 9,540 8,000 10,269 10,269 ROA Zimbabwe 6,000 4,000 3,260 1,090 2,000 3,003 1,871 3,103 3,403 1,911 2008 2009 2010 2011 2012 PIPELINE PROJECTS Projected openings for 2012: • Regional contributions will be as follows: • West Africa 35% • East Africa 7% • Southern Africa 33% (excluding Zimbabwe) • Zimbabwe 25% PROGRESS ON STRATEGIC GOALS: HR AND HTA UPDATE • Role and Brand Profiling • HTA Regional Growth Support Programme – HTA will constitute an integral part of pre-opening teams to ensure that gap between new unit and the African Sun Way of doing things is closed • Development of Hospitality Training Academy Nigeria in 2009 • HTA on Existing Projects – HTA to focus on Service Revitalization Programmes group wide through strategic alliances with industry leaders in training such as Cornell University, Swiss Hotel School etc. Attention will be paid to: • Service Culture • Quality Control • How May I Serve You 2 • People and Brand Measurement PROGRESS ON STRATEGIC GOALS: BRAND LEADERSHIP • Introduction of own Mid Range Brand – Amber to both local and regional market: 1. Amber Beitbridge 2. Amber Tinapa (Nigeria) • Expansion of Intercontinental Hotel Group (IHG) properties 1. Holiday Inn Accra Airport – performed 11% ahead of its peers in its competitive set in the first few months of opening PROGRESS ON STRATEGIC GOALS: MARKET CAPITALIZATION • Research conducted by Renaissance Capital Research has valued ASL at US$0.54 per share (Market Capitalization of US$389 million compared to the current US$114 million) assuming a confirmed rooms of 3500 including the existing rooms. • According to this research, and taking into account the target of 8500 rooms, ASL value grows to US$762 million FINANCIAL PERFORMANCE ZIMBABWE THE ZIMBABWEAN STORY 450,000 400,000 350,000 300,000 250,000 285,818 268,077 200,000 Local roomnights 344,156 150,000 215,211 248,970 245,505 186,174 188,292 210,937 57,000 57,000 63,000 53,000 2005 2006 2007 2008 155,697 100,000 50,000 111,000 88,000 1998 103,454 1999 32,000 30,000 22,000 17,000 19,000 2000 2001 2002 2003 2004 Foreign roomnights TREND IN OCCUPANCIES AND MIX 12 MONTHS TO 30 SEPTEMBER 2008 12 MONTHS TO 31 SEPTEMBER 2007 Average Occupancy 41% 39% Foreign Mix (% of total rooms sold) 27% 34% Contribution of foreign revenue to total revenue 93% 51% Average Daily Rate USD 23 USD40 Revenue Per available room night USD 9 USD16 YIELD COMPARISON • • • • • Price controls in the financial year had ASL Zimbabwe reporting an ADR of US$23 and a Revpar of US$9 From 12 October 2008, Zimbabwe hotel prices are denominated in US$ , this has resulted in the ADR coming up to US$77. Looking forward- ASL Zimbabwe's ADR target is USD 80 with a REVPAR of US$40. Improvements are in line with South African benchmarks which are US$ 116 ADR and US$85 Revpar. Ideally our prices should be ahead of South African prices as our cost structures are now 32% above South African costs. SHIFT IN COST OF DOING BUSINESS • The cost of doing business in Zimbabwe has shifted in real terms . Inherent features of the Zimbabwe business environment entail: • • • • Price escalations in US dollar terms for food and basic commodities Dynamic changes to modes of trading and payment systems Spiraling rates of exchange and currency depreciation An upturn in the demand for imported brands and the emergence of middlemen • Local commodity prices becoming increasingly less competitive than those obtained in the region PROCUREMENT ANALYSIS: Price Trends For Strategic Commodities 100.00 90.00 80.00 Flour 50 kg 70.00 Rice 50kg Cooking Oil 25lt Sugar 50kg 60.00 Eggs 10tray 2 Ply Tissues 48 rolls 50.00 1 Ply Tissues 48 rolls Mealie meal 50kg 40.00 Beef 10kg Chickens 10kg 30.00 Bacon 10kg Ham 10kg Shampoo/body cream tube 30mlx 100 20.00 10.00 Jun-07 Feb-08 Current PROCUREMENT ANALYSIS: Price Trends For Strategic Commodities • The Graph illustrates the rate at which prices are escalating in US dollar terms for strategic commodities. • Actual cost of doing business has shifted upwards by 87% in Zimbabwe. • An overall comparison of major expense line items indicated that landed South African prices are at least 32% lower than Zimbabwean prices. MITIGATING TACTICS • ASL initiatives to counteract threats •In order for African Sun to obtain leverage against the challenges posed by the shift in the business model, the Group will undertake the following initiatives: Item Strategy 1. Embark on improved supply chain management through strategic alliances and backward integration 2. Adopt hybrid procurement model for imports and local purchases premised on price competitiveness, supply consistency and quality standards 3. Close monitoring and surveillance of price competitiveness through commodity and pricing intelligence at hotel units REST OF AFRICA SUMMARY PERFORMANCE Country REVPAR ADR OCCUPANCY USD USD USD ZIMBABWE 9 23 41% CURRENT SOUTH AFRICA 63 106 59% CURRENT NIGERIA 12 120 60% CURRENT GHANA 124 193 64% CURRENT BENCHMARKS 98 140 70% FUTURE •South Africa Contributed 27% to total revenues up from 15% in prior year •The impact of other regional operations will be felt in the coming year. GROUP PERFORMANCE PERFORMANCE METRICS INCOME STATEMENT 2008 US$ REVENUE OPERATING COSTS 2007 US$ 26,318,780 21,614,000 (12,187,706) (13,525,000) % change 21.77 (9.89) PROFIT BEFORE TAXATION 14,066,544 7,956,000 76.80 NET PROFIT 10,645,165 7,953,000 33.85 OCCUPANCY 41% 40% 1% EBDITA Margin 54% 37% 45% •Increase in revenues of 21% is as a result of increase in room nights contributed as follows: The Lakes: 151 rooms, Obudu and Holiday Inn Accra management fees. •The group employed various cost containment measures and strategies which ensured that operating costs decreased by 9% compared to the prior period. This significantly increased profit before tax and net profit. PERFORMANCE METRICS BALANCE SHEET ASSETS 2008 US$ 2007 US$ % change Non current assets Current assets 32,600,596 6,377,563 27,641,526 4,261,234 17.94 49.66 Total assets 38,978,159 31,902,760 22.18 Equity Liabilities 33,243,677 5,734,483 22,451,679 9,451,081 48.07 (39.32) Equity and liabilities 38,978,160 31,902,760 22.18 •During the year non current assets were revalued by an independent valuer. This affected the revaluation reserve hence an increase of 48%. •Current assets increased significantly because of cash reserves of US $ 2 million (2007: US$ 1 million) OUTLOOK • Funding – Negotiations underway to raise hard currency capital primarily to fund the various hotel projects in the pipeline and refurbish Zimbabwe properties OUTLOOK • Growth – Group continues to intensify expansion drive into Africa with a target to increase for current 2500 to 8500 by 2012 – Group’s expansion strategy has witnessed the following additions to the portfolio: • The Grace In Rosebank, 2004 • The Lakes Hotel & Conference Centre, April 2008 • Obudu Mountain Resort, Nigeria, May 2008 • Holiday Inn Accra Airport, August 2008 OUTLOOK CONT’D • • Management of the following in Nigeria commenced on 1 December 2008: • Nike Resort, Enugu, Nigeria – 215 Rooms • Hotel Tinapa, Calabar, Nigeria – 243 Rooms • Utanga Lodge, Cross River State, Nigeria – 90 Rooms Additional 2009 Pipeline Projects approaching completion include: • Holiday Inn, Kano, Nigeria – 200 Rooms • Holiday Inn Arusha, Tanzania – 198 Rooms • Mongomo Hotel, Bata, Equatorial Guinea – 74 Rooms • Hotel 3 Augusto, Malabo, Equatorial Guinea – 45 Rooms UPCOMING OPENINGS Holiday Inn Gaborone, Botswana Holiday Inn Arusha, Tanzania Chundu River Lodge, Livingstone, Zambia Amber Beitbridge Holiday Inn Rustenburg, South Africa OUTLOOK CONT’D • Dividend Declaration – Board of Directors declared a final dividend of Z$229.72c per share – Dividend will be payable to shareholders in Zimbabwe Dollars on 11 February 2009 – Shareholders will be able to elect to receive a dividend wholly in cash or take a scrip dividend in the form of ordinary shares – All shareholders who fail to return their form of election by the set deadline will receive their dividend in scrip