Financial markets

advertisement

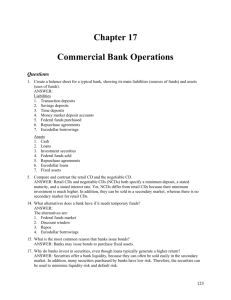

Raising Institutional Finance (To familiarize learner with the Major financial Institutions which provide short term or long term financial resources and other technical support to establish a business.) UNIT 1 Indian Financial System-Introduction Financial System- Meaning & its components, Financial Institutions, Financial Markets, Financial Instruments, Financial Services Types of Markets- Money Markets, Capital Markets, Foreign Exchange Markets Financial Intermediations Types of Financial Institutions & the regulators Financial System An institutional framework existing in a country to enable financial transactions Three main parts ◦ Financial assets (loans, deposits, bonds, equities, etc.) ◦ Financial institutions (banks, mutual funds, insurance companies, etc.) ◦ Financial markets (money market, capital market, forex market, etc.) Regulation is another aspect of the financial system (RBI, SEBI, IRDA) Financial assets/instruments Enable channelizing funds from surplus units to deficit units There are instruments for savers such as deposits, equities, mutual fund units, etc. There are instruments for borrowers such as loans, overdrafts, etc. Like businesses, governments too raise funds through issuing of bonds, Treasury bills, etc. Instruments like PPF, KVP, etc. are available to savers who wish to lend money to the government Financial Institutions Includes institutions and mechanisms which ◦ Affect generation of savings by the community ◦ Mobilisation of savings ◦ Effective distribution of savings Institutions are banks, insurance companies, mutual funds- promote/mobilize savings Individual investors, industrial and trading companiesborrowers Financial Markets Segments & Functions of Financial Markets Figure Flow of Funds Through the Financial System Sachin srivastava 7 Financial Markets Importance of Financial Markets Financial markets are critical for producing an efficient allocation of capital, which contributes to higher production and efficiency for the overall economy, as well as economic security for the citizenry as a whole Financial markets also improve the lot of individual participants by providing investment returns to lendersavers and profit and/or use opportunities to borrowerspenders Sachin srivastava 8 How We Study Financial Markets Features 1. Case studies 2. Applications and Numerical Examples 3. Special Interest Boxes 4. Following the Financial News boxes 5. Reading the Economics Times/Financial Times Etc Sachin srivastava 9 Reading the Financial Page Stock Prices Daily Stock Transactions Points A day’s Transactions Prices Dividend yield The price-earning ratio… Sachin srivastava 10 Exploring the Web Web Exercise The World Wide Web is an enormous resource for present and historical information Reading the electronic pages Reading the online FT.com/Economics times Company websites and online financial publications Sachin srivastava 11 Exploring the Web: Exercises http://www.indiainfoline.com/ http://www.forecasts.org/data/index.htm http://http://in.finance.yahoo.com/ Easy-to-use company level and industry-level information Pick any company and look up the closing stock price for that company one week ago, and for yesterday. Sachin srivastava 12 Exploring the Web Sachin srivastava 13 Exploring the Web Sachin srivastava 14 Exploring the Web Sachin srivastava 15 Financial Markets Money Market- for short-term funds (less than a year) ◦ Organized (Banks) ◦ Unorganised (money lenders, chit funds, etc.) Capital Market- for long-term funds ◦ Primary Issues Market ◦ Stock Market ◦ Bond Market Foreign Exchange Market Organized Money Market Call money market Bill Market ◦ Treasury bills ◦ Commercial bills Bank loans (short-term) Organized money market comprises RBI, banks (commercial and co-operative) Purpose of the money market • Banks borrow in the money market to: – Fill the gaps or temporary mismatch of funds – To meet the CRR and SLR mandatory requirements as stipulated by the central bank – To meet sudden demand for funds arising out of large outflows (like advance tax payments) • Call money market serves the role of equilibrating the short-term liquidity position of the banks Call money market (1) • • • Is an integral part of the Indian money market where day-to-day surplus funds (mostly of banks) are traded. The loans are of short-term duration (1 to 14 days). Money lent for one day is called ‘call money’; if it exceeds 1 day but is less than 15 days it is called ‘notice money’. Money lent for more than 15 days is ‘term money’ The borrowing is exclusively limited to banks, who are temporarily short of funds. Call money market (2) Call loans are generally made on a clean basis- i.e. no collateral is required The main function of the call money market is to redistribute the pool of day-to-day surplus funds of banks among other banks in temporary deficit of funds The call market helps banks economies, their cash and yet improve their liquidity It is a highly competitive and sensitive market It acts as a good indicator of the liquidity position Call Money Market Participants • • • Those who can both borrow and lend in the market – RBI ,banks and primary dealers Once upon a time, selected financial institutions viz., IDBI, UTI, Mutual funds were allowed in the call money market only on the lender’s side These were phased out and call money market is now a pure inter-bank market (since August 2005) Bill Market Treasury Bill market- Also called the T-Bill market ◦ These bills are short-term liabilities (91-day, 182-day, 364-day) of the Government of India ◦ It is an IOU (I owe you) of the government, a promise to pay the stated amount after expiry of the stated period from the date of issue ◦ They are issued at discount to the face value and at the end of maturity the face value is paid ◦ The rate of discount and the corresponding issue price are determined at each auction ◦ RBI auctions 91-day T-Bills on a weekly basis, 182-day T-Bills and 364-day T-Bills on a fortnightly basis on behalf of the central government Money Market Instruments (1) Money market instruments are those which have maturity period of less than one year. The most active part of the money market is the market for overnight call and term money between banks and institutions and repo transactions Call money/repo are very short-term money market products Money Market Instruments(2) Certificates of Deposit Commercial Paper Inter-bank participation certificates Inter-bank term money Treasury Bills Bill rediscounting Call/notice/term money Market Repo Certificates of Deposit CDs are short-term borrowings and are freely transferable by endorsement and delivery. Introduced in 1989 Maturity of not less than 7 days and maximum up to a year. FIs are allowed to issue CDs for a period between 1 year and up to 3 years Subject to payment of stamp duty under the Indian Stamp Act, 1899 Issued to individuals, corporations, trusts, funds and associations They are issued at a discount rate freely determined by the market/investors Commercial Papers Short-term borrowings by corporate, financial institutions, primary dealers from the money market Can be issued in the physical form (Promissory Note) or demat form Introduced in 1990 When issued in physical form are negotiable by endorsement and delivery and hence, highly flexible Issued subject to minimum of Rs. 5 lacs and in the multiple of Rs. 5 lacs after that Maturity is 7 days to 1 year Unsecured and backed by credit rating of the issuing company Issued at discount to the face value Market Repos Repo (repurchase agreement) instruments enable collateralized short-term borrowing through the selling of debt instruments A security is sold with an agreement to repurchase it at a pre-determined date and rate Reverse repo is a mirror image of repo and reflects the acquisition of a security with a simultaneous commitment to resell Average daily turnover of repo transactions (other than the Reserve Bank) increased from Rs.11,311 crore during April 2001 to Rs. 1,00,000 crore (Approx)in June 2010 Indigenous bankers Individual bankers like Shroffs, Seths, Sahukars, Mahajans, etc. combine trading and other business with money lending. Vary in size from petty lenders to substantial shroffs Act as money changers and finance internal trade through hundis (internal bills of exchange) Indigenous banking is usually family owned business employing own working capital At one point it was estimated that IBs met about 90% of the financial requirements of rural India RBI and indigenous bankers (1) Methods employed by the indigenous bankers are traditional with vernacular system of accounting. RBI suggested that bankers give up their trading and commission business and switch over to the western system of accounting. It also suggested that these bankers should develop the deposit side of their business Some of them should play the role of discount houses (buy and sell bills of exchange) RBI and indigenous bankers (2) IB should have their accounts audited by certified chartered accountants Submit their accounts to RBI periodically As against these obligations the RBI promised to provide them with privileges offered to commercial banks including ◦ Being entitled to borrow from and rediscount bills with RBI The IBs declined to accept the restrictions as well as compensation from the RBI Therefore, the IBs remain out of RBI’s purview The Indian Capital Market (1) • • • Market for long-term capital. Demand comes from the industrial, service sector and government Supply comes from individuals, corporates, banks, financial institutions, etc. Can be classified into: – Gilt-edged market – Industrial securities market (new issues and stock market) Industrial Securities Market Refers to the market for shares and debentures of old and new companies New Issues Market- also known as the primary marketrefers to raising of new capital in the form of shares and debentures Stock Market- also known as the secondary market. Deals with securities already issued by companies The equity or stock market is the market where stock, representing ownership in a company, are traded. Buyers of common stock are owners of the firm Common stock has no finite life or maturity date Advantage of common stock is potential high income since return is not fixed or limited Disadvantage is that debt payments must be made before equity payments can be made The stock exchange is the main ‘secondary’ market for shares in corporations. 33 Sac hin sriv asta va Primary Markets Definition: initial sale of securities from the issuing corporation to the investors Participants: investment bankers Commercial Banks ◦ underwrite securities Securities Houses ◦ distributor ◦ market makers ◦ brokers Primary Markets Primary market can be illustrated as Seasoned New Issues Sale of New Securities & Using Investment Bankers IPOs Who form Syndicates to sell the securities Primary Markets Functions of Investment Bankers Investment Banker: firm specializing in the sale of new securities to the public, typically by underwriting the issue ◦ Specialists in advice, design, and sales ◦ Intermediaries between issuer and investor Advising issuer on terms, key features and timing of offering, etc, i.e. to design a security structure ◦ advisor Buying securities from issuer ◦ Underwriting, Risk of selling to investors assumed from issuer Distributing issue to public ◦ Distributor, Coordinates marketing by helping issuer register securities, issue prospectus, and sell securities Secondary Markets Definition: where already issued/existing financial assets are traded. ◦ Auction markets involve bidding in a specific physical location, where brokers represent investors for a fee and others trade for their own account ◦ Negotiated markets consist of decentralized dealer network Functions ◦ Providing security values and required returns ◦ Providing liquidity Organization of Secondary Markets Intermediaries (1) Brokers agents – do not hold securities on their own account Dealers/Market-makers principals - do trade and hold securities on their own account, required to quote two-way prices for selected securities computerization Organization of Secondary Markets Intermediaries (2) Brokers A broker acts on behalf of an investor who wishes to execute orders. Broker functions: ◦ Receives, transmits and executes orders ◦ Brings together buyers and sellers ◦ Negotiates prices In return, the broker receives a commission. Organization of Secondary Markets Intermediaries (3) Dealers as market makers The dealer holds in inventory the financial asset traded. To execute orders for own account in order to provide liquidity. To make a market by standing ready to buy and sell securities at specifies price. Dealer functions: ◦ Takes a position (long or short) in the asset ◦ Provides opportunity to trade immediately ◦ Offers price information Dealer profit is the bid-ask spread. Organization of Secondary Markets Short Sales - Long the position –first you buy, then you sell because you believe the price is likely to rise. Short the position – first you sell, then you buy, you think the price of a security will decline. Have to borrow a stock from a third part Sell it Replace it later, hopefully when the price has declined The Foreign Exchange Market The foreign exchange market is where international currencies trade and exchange rates are set. Although most people know little about this market, it has a daily volume around $1 trillion! FII- An investor or investment fund that is from or registered in a country outside of the one in which it is currently investing. Institutional investors include hedge funds, insurance companies, pension funds and mutual funds. FDI-An investment abroad, usually where the company being invested in is controlled by the foreign corporation. An example of FDI is an American company taking a majority stake in a company in China 42 Sac hin sriv asta va Foreign Exchange Market Figure 1.3 Exchange Rate of the U.S. Dollar Sachin srivastava 43 Foreign Exchange Market Foreign exchange trading refers to trading of one country’s money for that of another country. The need for such trade arises because of: ◦ Tourism ◦ The buying and selling of goods internationally ◦ Investment across international boundaries. Foreign Exchange Market Foreign exchange market refers to large commercial banks in financial centers such as New York, London and Tokyo, Hongkong, Shanghai, Mumbai trading foreigncurrency denominated deposits with each other. Spot market: where currencies are traded for current delivery Financial Institutions Function of Financial Intermediaries (1) • Engage in process of indirect finance e.g. transfer of funds from savers to investors, • More important source of finance than securities markets The transformation role involves: providing maturity intermediation, reducing risk, reducing costs of contracting and information processing, and providing a payment mechanism • Needed because of transactions costs and asymmetric information 46 Sac hin sriv asta va Financial Institutions Function of Financial Intermediaries (2) Transactions Costs 1. FIs make profits by reducing transactions costs (e.g. provide with liquidity services and risk sharing) 2. Reduce transactions costs by developing expertise and taking advantage of economies of scale 47 Sac hin sriv asta va Financial Intermediaries in India Unorganized sector Organized Sector Money Lenders Capital Market Intermediaries Traders and Landlords Money Market Intermediaries Development Banks IRBI Insurance co. NBFC Gov. (PF,NSC Etc) Agl Financing Institutions Indigenous Bankers UTI Exim Bank Gov. (T Bills) RBI Commercial Banks Co-op Banks Post Offices The India Banking Scenario - A Comparison Only one Indian Bank in the top 100 Banks in the world India's best and brightest, the SBI, is roughly one-tenth the size of the world's biggest bank - Citigroup Six Chinese banks feature among the top 25 Asian banks while India has only two representatives - SBI and ICICI Bank. Similarly, SBI's consolidated pre-tax profit is $1.9 billion against Citigroup's $29 billion, Bank of America's $25 billion and HSBC's $21 billion The one area where Indian banks are able to compete with their global peers is their return on assets (RoA). Among big Indian banks, ICICI Bank, PNB, Canara Bank and HDFC Bank have a return on assets of over 1 per cent return, while SBI's return on assets is 0.89 per cent. Among Indian banks, HDFC Bank has the highest return on assets -- 1.71 per cent. This is lower than that of Citigroup (1.97 per cent) but much better than the RoA of HSBC (1.40 per cent). Our banks are small but efficient. However, if the economy has to grow at over 8 per cent, they must build the scale. India Inc has already announced over Rs 650,000 crore (Rs 6,500 billion) of investment plans. Without the scale, local banks can't possibly support this growth story Regulatory Mechanism RESERVE BANK OF INDIA The central bank of the country is the Reserve Bank of India (RBI). It was established in April 1935 with a share capital of Rs. 5 crores on the basis of the recommendations of the Hilton Young Commission. The share capital was divided into shares of Rs. 100 each fully paid which was entirely owned by private shareholders in the begining. The Government held shares of nominal value of Rs. 2,20,000. The Reserve Bank of India Act, 1934 was commenced on April 1, 1935. The Act, 1934 (II of 1934) provides the statutory basis of the functioning of the Bank. The Bank was constituted for the need of following: To regulate the issue of banknotes To maintain reserves with a view to securing monetary stability and To operate the credit and currency system of the country to its advantage. RBI’s Major Functions Supervisory & Regulatory Promotional & Developmental Refinance Activities RBI’s Major Functions SUPERVISORY & REGULATORY ISSUANCE OF CURRENCY NOTES CREDIT CONTROL EXCHANGE CONTROL TRANSFER OF FUNDS RBI’s Major Functions PROMOTIONAL & DEVELOPMENTAL Banker to Government Banker to Bankers Finance Agriculture Industry Exports Training RBI’s Major Functions REFINANCE ACTIVITIES LENDER OF LAST RESORT REFINANCE OPERATIONS Regulatory Mechanism Need For The Regulation Of Stock Market : A stock market is the hallmark of any capitalist economy. Growth of the industry requires long-term funds, and it is the saving of the people, which comes to the stock market for use as a long-term capital. Thus development of industry- and thereby of the economy necessitates the development of the stock market. And any desirable growth calls for regulations in the right direction. Monitoring Stock Market : There are three main regulatory bodies for monitoring stock market: 1. Reserve bank of India 2. Ministry of Company Affairs 3. Securities and exchange Board of India (SEBI) (SEBI is the main regulator of security market) In late 80’s , the government set up a body called Securities and Exchange Board of India for regulating the stock market. SEBI was established as statuary body on April 12, 1992 in accordance with the provision of the SEBI Act 1992. However, SEBI has received more power from the government recently and its regulating the entire capital market operation now. ) Objectives Of SEBI : The SEBI came into being to promote orderly and healthy development of the securities markets and to provide adequate investor protection. Headquartered in Mumbai, SEBI’s function is to ensure a conductive environment for growth in capital market. The Three objectives of SEBI as per SEBI Act 1992 are : Protect the interest of the investors in securities. Promote the development of the securities market Regulation of securities markets The SEBI has been entrusted with both the regulatory and developmental functions. The objectives of SEBI are as follows: a. Investor protection, so that there is a steady flow of savings into the Capital Market. b. Ensuring the fair practices by the issuers of securities, namely , companies so that they can raise resources at least cost. c. Promotion of efficient services by brokers, merchant bankers and other intermediaries so that they become competitive and professional. Function Of SEBI : The main Function of SEBI is to achieve all Objectives. SEBI has power to issue Direction for the protection of interest of investor. Matter related to issue and transfer of securities and non payment of dividend. Can take various actions like debarring, cancellation of registration etc. Role of SEBI : It is an independently constituted board with regulatory power over stock exchange, all intermediaries of securities market, matter relating to IPO, mutual fund etc. Although SEBI is an autonomous body, there is government control in the sense of having nominees from the ministry on its board. The regulatory powers given to SEBI are also subjected to government directives and overrule. The power to prosecute and fine defaulters is also denied. HOW SEBI REGULATES NEW ISSUE SEBI has been given wide powers for protecting the interest of investors in the securities market as well as for orderly development and regulation of securities market by such measures it thinks appropriates under provisions of the SEBI Act 1992. To regulate primary issue market, SEBI has come up with detailed guidelines known as SEBI ( Disclosure and investor protection) guideline 2000. These guide lines are issued U/s 11 of SEBI Act 1992. ^These guidelines are detailed guidelines in every aspect of pre-public issue and post- public issues of securities. HOW SEBI REGULATES INTERMEDIARIES All Intermediaries associated with the securities market have to be registered with SEBI. It has made separate regulations for regulating these entities. These intermediaries have to stick to code of conduct as specified in these regulations and support by the requirements of the regulations. If the intermediaries fail to stick the regulatory requirements, SEBI initiates disciplinary action against the violators as per SEBI Act and relevant regulation, SEBI may suspend their registration, impose monetary penalty, warning in case of small default. Generally, SEBI warns intermediaries for minor violation and takes severe action like suspension of registration, monetary penalty, or even registration cancellation in case of serious violation. SEBI can also launch prosecution in serious violation.