Financial Market and Instruments - College of Business Administration

advertisement

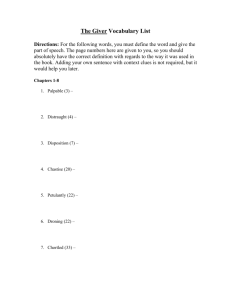

Financial and Real Estate Markets • • • • Money Markets Capital Markets Mortgage Markets Financial Derivative Markets BUS322 – Chapters 9, 10, 11, 12 & 25 1 The Money Markets • Money Markets – Money market securities are usually sold in large denominations – They have low default risk – They mature in one year or less from their issue date • Purpose •Investors in Money Market: Provides a place for warehousing surplus funds for short periods of time •Borrowers from money market provide low-cost source of temporary funds BUS322 – Chapters 9, 10, 11, 12 & 25 2 Interest Rates of Money Market Instruments BUS322 – Chapters 9, 10, 11, 12 & 25 3 Participants in Money Markets • U.S. Treasury Department • Federal Reserve System • Commercial Banks • Businesses • Investment and Securities Firms • Individuals (mostly through money market mutual funds) BUS322 – Chapters 9, 10, 11, 12 & 25 4 Money Market Instruments • Treasury Bills • Federal Funds • Repurchase Agreements • Negotiable Certificates of Deposit • Commercial Paper • Banker’s Acceptance • Eurodollars BUS322 – Chapters 9, 10, 11, 12 & 25 5 Treasury Bills 1. Short-term borrowings of the federal government (US Treasury Department) 2. Usually sold at discount BUS322 – Chapters 9, 10, 11, 12 & 25 6 Discounting Example • You pay $9850 for a 91-day T-bill. It is worth $10,000 at maturity. What is its annualized yield? F P 365 iyt P n BUS322 – Chapters 9, 10, 11, 12 & 25 7 Federal Funds • Short-term funds transferred (loaned or borrowed) between financial institutions, usually for a period of one day • Having excess reserve -> loan (sell) federal funds • Fed can influence the rate by setting target BUS322 – Chapters 9, 10, 11, 12 & 25 8 Federal Funds Figure 8.2: Federal Funds and Treasury Bill Interest Rates, January 1990–January 2002 BUS322 – Chapters 9, 10, 11, 12 & 25 9 Negotiable Certificates of Deposit • A bank-issued security that documents a deposit and specifies the interest rate and the maturity date • Denominations range from $100,000 to $10 million BUS322 – Chapters 9, 10, 11, 12 & 25 10 Negotiable Certificates of Deposit Comparing Interest on CDs and T-bills Figure 8.3: Interest Rates on Negotiable Certificates of Deposit and on Treasury Bills, January 1990–January 2002 BUS322 – Chapters 9, 10, 11, 12 & 25 11 Commercial Paper • Unsecured promissory notes, issued by corporations, that mature in no more than 270 days • Banks also issue commercial paper, but have reserve requirement on bank-issued commercial paper BUS322 – Chapters 9, 10, 11, 12 & 25 12 Commercial Paper Comparing Interest on Commercial Paper to Bank Prime Rate Figure 8.4: Return on Commercial Paper and the Prime Rate, January 1990–January 2002 BUS322 – Chapters 9, 10, 11, 12 & 25 13 Banker’s Acceptances • An order to pay a specified amount to the bearer on a given date if specified conditions have been met, usually delivery of promised goods • Used in international trade • Have secondary markets BUS322 – Chapters 9, 10, 11, 12 & 25 14 Repo (Repurchase agreement) • Buyer purchase securities with an agreement that the seller will repurchase them in short period of time, anywhere from 1 to 15 days from the original date of purchase. • Implicitly the buyer is a lender, seller is borrower • Buyer is compensated with the interest • This contract has secondary market BUS322 – Chapters 9, 10, 11, 12 & 25 15 Eurodollars • Dollar denominated deposits held in foreign banks • Used as alternative to fed fund for banks around the world – London interbank bid rate (LIBID) • The rate paid by banks buying funds – London interbank offer rate (LIBOR) • The rate offered for sale of the funds BUS322 – Chapters 9, 10, 11, 12 & 25 16 Figure 8-6: Interest Rates on Money Market Securities, 1990–2002 BUS322 – Chapters 9, 10, 11, 12 & 25 17 Money Market Mutual Funds • Open-end investment funds that invest only in short-term securities • No fee for purchasing or redeeming shares • Minimum initial investment of $500 to $20,000 • Check-writing privileges – No fee for writing checks – No minimum check amount • Earn 0.5% to 1% higher return than interest earned on money in the bank • Low risk of default, low rate of risk • Popular to small investors BUS322 – Chapters 9, 10, 11, 12 & 25 18 Money Market Fund Assets Figure 8.8: Average Distribution of Money Market Fund Assets, 2001 BUS322 – Chapters 9, 10, 11, 12 & 25 19 Capital Markets • Original maturity is greater than one year • Best known capital market securities: – Stocks and bonds • Primary issuers of securities: – Federal and local governments – Corporations • Largest purchasers of securities: – You and me BUS322 – Chapters 9, 10, 11, 12 & 25 20 Capital Market Trading 1. Primary market for initial sale (IPO) 2. Secondary market – Over-the-counter – Organized exchanges (i.e., NYSE) BUS322 – Chapters 9, 10, 11, 12 & 25 21 Want to be listed on the NYSE? • You will need at least: 1. 2000 stockholders, each owning at least 100 shares 2. A minimum of 1.1 million shares traded publicly 3. Pretax earnings of $2.5 million at the time of listing 4. $2 million in pretax earning in each of the two prior years 5. A total of $100 million in market value of publicly traded shares BUS322 – Chapters 9, 10, 11, 12 & 25 22 Treasury Bonds •No default risk •Very low interest rates BUS322 – Chapters 9, 10, 11, 12 & 25 23 Compare 20-Year Treasury Bonds to 90-Day Treasury Bills Figure 9-4: Interest Rates on Treasury Bills and Treasury Bonds, 1973–2002 (January of each year) BUS322 – Chapters 9, 10, 11, 12 & 25 24 Municipal Bonds 1. Issued by local, county, and state governments 2. Used to finance public interest projects 3. Tax-free municipal interest rate = taxable interest rate (1 marginal tax rate) 4. Two types – General obligation bonds – Revenue bonds 5. NOT default-free BUS322 – Chapters 9, 10, 11, 12 & 25 25 Comparing Revenue and General Obligation Bonds Figure 9-5: Issuance of Revenue and General Obligation Bonds, 1984–2000 (End of year) BUS322 – Chapters 9, 10, 11, 12 & 25 26 Corporate Bonds • Face value of $1,000 • Pay interest semi-annually • Can be redeemed anytime the issuer wishes • Degree of risk varies with each bond • Interest rate varies with level of risk BUS322 – Chapters 9, 10, 11, 12 & 25 27 Characteristics of Corporate Bonds • Registered Bonds • Restrictive Covenants • Call Provisions – – – – Higher yield Sinking fund Interest of the stockholders Alternative opportunities • Conversion and Convertible Bonds BUS322 – Chapters 9, 10, 11, 12 & 25 28 Convertible Bonds • The bond that can be converted into certain shares of common stocks at the discretion of the bondholder. – Conversion ratio BUS322 – Chapters 9, 10, 11, 12 & 25 29 Types of Corporate Bonds • Secured Bonds – Mortgage bonds – Equipment trust certificates • Unsecured Bonds – Debentures – Subordinated debentures – Variable-rate bonds • Junk Bonds BUS322 – Chapters 9, 10, 11, 12 & 25 30 Stock 1. Represents ownership in a firm 2. Earn a return in two ways – Price of the stock rises over time – Dividends are paid to the stockholder 3. Stockholders have claim on all assets 4. Right to vote for directors and on certain issues 5. Two types – Common stock • • Right to vote Receive dividends – Preferred stock • • Receive a fixed dividend Do not usually vote BUS322 – Chapters 9, 10, 11, 12 & 25 31 Stock Prices BUS322 – Chapters 9, 10, 11, 12 & 25 32 30 Stocks in the Dow Jones Industrial Average BUS322 – Chapters 9, 10, 11, 12 & 25 33 Stocks • ADR – American Depository Receipts – A US bank buys the shares of a foreign company and places them in its vault. The bank then issue receipts against these shares, and these receipts can be traded domestically, usually on the NASDAQ. • In US dollars • No need to meet disclosure rules required by SEC BUS322 – Chapters 9, 10, 11, 12 & 25 34 Mortgage Market • Definition – Mortgage is a long-term loan secured by real estate by developer and family – Commercial mortgage and residential mortgage – A mortgage is amortized • The borrower pays it off over time in some combination of principal and interest payment that result in full payment of the debt by maturity BUS322 – Chapters 9, 10, 11, 12 & 25 35 Types of Mortgage loans – Insured mortgage: Guaranteed by Federal Housing Administration or Veterans Administration, applicants need meet certain qualifications • Serve in the military • Low incomer – Conventional mortgage: insured by private mortgage insurance (PMI): loan-to-value exceeding 80% – Fixed or adjustable rate mortgages (ARM) – Innovative mortgage contracts, e.g., • Graduated-payment mortgage • Second mortgage BUS322 – Chapters 9, 10, 11, 12 & 25 36 Mortgage Market • Primary Mortgage Market (see page 302) – Constituted by commercial banks, S&Ls, commercial banks, life insurance companies, and mortgage pools – Sell loans after they lend money – Diversify their risk in the secondary market • Secondary Mortgage Market – buy mortgage from the primary market – Bundle mortgages and offer securitized mortgage-backed assets BUS322 – Chapters 9, 10, 11, 12 & 25 37 Mortgage Market • Major participants in the secondary market – Fannie Mae (Federal National Mortgage Association) – Ginnie Mae (Government National Mortgage Association) – Freddie Mac (Federal Home Loan Mortgage Corp) • Securitization of Mortgages – Mortgages are too small to be wholesale instruments – Sell mortgage backed security • Mortgage pool • Mortgage pass-through – is a kind of special debt BUS322 – Chapters 9, 10, 11, 12 & 25 38 Types of securitized mortgage/Debt • Mortgage Pool • Mortgage pass through: a security created when one or more holders of mortgages from a collection of mortgages and sell shares in a pool • Mortgage-backed security (MBS): make mortgage a security, similar ideas: asset-backed security (ABS) • Collateralized mortgage obligations (CMO) • Collateralized bond obligations (CBO) • Collateralized debt obligations (CDO) • The largest market dealer for securitized asset is Bear Sterns BUS322 – Chapters 9, 10, 11, 12 & 25 39 Derivative Market • See definitions in chapter 23 • Option – Call – put • Futures and forward – Long – short • Swap – Financial contracts that obligate each party to the contract to exchange a set of payments it owns for another set of payments owned by another party BUS322 – Chapters 9, 10, 11, 12 & 25 40