crescent textile

advertisement

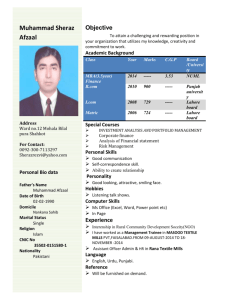

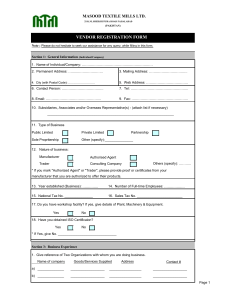

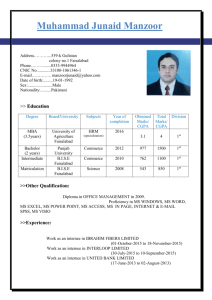

1 FINANCIAL STATEMENT ANALYSIS OF CRESCENT TEXTILE MILLS LIMITED 2 FINANCIAL STATEMENT ANALYSIS Presented To: Mr. Hamza Mukhtar Presented By: NAMRA IQBAL I-D # 2005-AG-4166 AYESHA ANEES I-D # 2005-AG-4190 3 OVERVIEW OF THE PRESENTATION 4 OVERVIEW OF THE PRESENTATION BREIF ANALYSIS OF THE ECONOMY INDUSTRY ANALYSIS OF THE TEXTILE INDUSTRY INTRODUCTION TO CRESCENT TEXTILE MILLS RATIO ANALYSIS DECISIONS WITH REFERENCE TO Lenders Investors Manager 5 Financial Statements Analysis We will done our analysis in three Steps: 1. Economic Analysis 2. Industry Analysis 3. Firm Analysis • Common size analysis • Vertical analysis • Horizontal analysis • Ratios Analysis • Peer Group Analysis 6 OVERVIEW OF THE ECONOMY OF PAKISTAN 7 ECONOMIC OVERVIEW OF PAKISTAN MONETORY POLICY FISCAL POLICY INFLATION UNEMPLOYMENT GROWTH AND INVESTMENT AGRICULTURE SECTOR MANUFACTURING MONEY AND CREDIT EXTERNAL DEBT AND LIABILITIES EDUCATION ENERGY 8 MONETORY POLICY IT IS A MEASURE USED BY THE SBP TO MANAGE AND CONTROL THE ECONOMIC AND FINANCIAL SECTOR OF THE COUNTRY. TOOLS USED BY THE SBP TO MANAGE AND CONTROL THE ECONOMY AND FINANCIAL SECTOR ARE INTEREST RATES SUPPLY OF MONEY CASH RESERVE REQUIREMENT BY DECREASING AND INCREASING THE INTEREST RATES AND MONEY SUPPLY THE SBP CAN MANAGE & CONTROL THE ECONOMY AND FINANCIAL SECTOR. 9 FISCAL POLICY IT IS A POLICY USED BY THE GOVERNMENT TO BOOST UP THE ECONOMY AS WELL AS TO MANAGE AND CONTROL THE OVERALL ECONOMY. TOOLS USED IN FISCAL POLICY BY THE GOVERNMENT ARE TAXES (DIRECT & INDIRECT) INTERNAL AND EXTERNAL BORROWINGS BY INCREASING AND DECREASING THE MARK-UP/INTEREST RATES AND BORROWING MONEY, A GOVERNMENT CAN MANAGE AND CONTROL THE ECONOMY. 10 INFLATION Inflation is the general rise in the prices of all the commodities. There are three major types of inflation. Consumer Price Index Whole Sale Price Index Sensitive Price Index The inflation rate as measured by the changes in Consumer Price Index (CPI) stood at 10.3 percent during the first ten months (July-April) of the current fiscal year, 2007-08, as against 7.9 percent in the comparable period of last year. The food inflation is estimated at 15.0 percent and non-food 6.8 percent, against 10.2 percent and 6.2 percent in the corresponding period of last 11 year. INFLATION The Wholesale Price Index (WPI) during July-April, 2007-08 have increased by 13.7 percent, as against 6.9 percent of last year. The Sensitive Price Indicator (SPI) has recorded an increase of 14.1 percent during July-April, 2007- 08, as against 11.1 percent of last year. The increase in inflation rate during the current year 2007-08 is attributable to the increase in food price inflation which has been due to increase in prices of wheat, edible oil, rice, pulses, milk, poultry, meat, fresh vegetables 12 UNEMPLOYMENT Unemployment is a central problem because when unemployment is high, resources are wasted and people's incomes are depressed; during such periods, economic distress also spills over to affect people's emotions and family lives. Unemployment rate in Pakistan is increased by 5.3% from previous year. Unemployment in rural areas is higher then the unemployment in urban areas due to industries. Mostly industries are established in urban areas. That’s why the unemployment rate in urban areas is low as compared to rural areas. 13 CAUSES OF UNEMPLOYMENT Agriculture sectors is not absorbing them due to adaptation of mechanical industries. Small scale industries are not working efficiently due to worse economic conditions. Poor Government policies are also increasing unemployment rate. 14 GROWTH AND INVESTMENT Pakistan’s economy has grown at an average rate of almost 6.6 percent per annum during the last five years. Real GDP grew by 5.8 percent in 2007-08 as against 6.8 percent last year and growth target of 7.2%. The economy has shown great resilience against internal and external shocks of extraordinary nature during the out going fiscal year. Agriculture sector showed dismal performance and grew by 1.5 percent as against 3.7 percent last year and target of 4.8 percent. Large-scale manufacturing registered a growth of 4.8 percent in 2007-08 against the target of 10.9% and last year’s achievement of 8.6%. Pakistan’s per capita real GDP has risen at a faster pace in real terms during the last six years (4.5% per annum on average in rupee terms) leading to a rise in average income of the people. 15 GROWTH AND INVESTMENT Total investment could not sustain its record level of 22.9 percent of GDP of the last fiscal year and declined to 21.6 percent of GDP in 2007-08. Overall Foreign Investment during the first ten months (July-April) of the current fiscal year has declined by 32.2 percent and stood at $ 3.6 billion as against $5.3 billion in the comparable period of last year. 16 AGRICULTURE SECTOR The agriculture growth this year is estimated at 3.1 percent as compared with 1.5 percent during the previous year. Cotton production at 11.7 million bales has decreased by 10.5 percent in comparison to 12.9 million bales of last year. Wheat production is estimated at 21.7 million tons as against 23.3 million tons last year, showing a decrease of 6.6 percent. Rice production has increased from 5.4 million tons in 200607 to 5.6 million tons in 2007-08, showing an increase of 2.3 percent. 17 AGRICULTURE SECTOR Agriculture credit disbursement of Rs 138.6 billion during July-March 2007-08 is higher by 24.6 percent, as compared to Rs 111.2 billion over last year. 18 MANUFACTURING Overall manufacturing posted a growth of 5.4 percent during the first nine months of the current fiscal year against the target of 10.9 percent and 8.1 percent of last year. Large-scale manufacturing, accounting for 70.0 percent of overall manufacturing registered a growth of 4.8 percent in the current fiscal year Heightened political tension, deteriorating law and order situation, growing power shortages, cumulative impact of monetary tightening and rising cost of doing business are responsible for poor showing of manufacturing in 2007-08. Taking a longer term view, the manufacturing growth exhibits a moderating trend. 19 MONEY AND CREDIT Overall developments in the money and credit sector during the fiscal year 2007-08 have been satisfactory. Net domestic assets have increased to Rs.656.7 billion as compared to increase of Rs.395.5 billion in the same period of last year Net foreign assets have recorded a contraction of Rs.289 billion against the increase of Rs.84.6 billion in the same period of last year. Government borrowing for budgetary support has recorded an increase of Rs.362 billion as compared to Rs.212 billion in the same period of last year. Credit to private sector amounted to Rs.369.8 billion during July-May 10,200708 as compared to Rs.263.4 billion in the same period last year. The Islamic Financial Industry has grown substantially and its assets has reached to a level of Rs.200 billion. 20 EXTERNAL DEBT & LIABILITIES External debt and liabilities (EDL) at the end of March FY08 were US$ 45.9 billion. The net addition of $ 5.4 billion represents a 13.3 percent increase over the stock at the end of FY07. EDL were 236.8 percent of foreign exchange earnings (FEE) but declined to 127.1 percent in the same period. The EDL were nearly 5.8 times foreign exchange reserves (FER) at the end of FY02 but have decline to 3.4 percent by end-March 2008. Interest payments on external debt were 7.8 percent of current account receipts but declined to 2.5 percent during the same period. Given the negative sentiment surrounding capital markets, Pakistan has not issued any new instruments in FY08. However, the country is still pursuing a comprehensive external borrowing strategy. 21 EDUCATION Education is essential for the maintenance and development of the quality of human life as well as for economic activities; therefore, the government has adopted this sector as one of the pillars for poverty reduction and benefit to masses. The government has decided to double the education budget (as percentage of GDP) as visualized in Fiscal Responsibility and Debt Limitation (FRDL) Act, 2005. This means an extra spending of 1.8 percent of GDP over and above the existing funding will be on hand during the next five years. The overall literacy rate (10 years & above) was 45 percent in 2001 which has increased to 55 percent in 2006-07, indicating a 10 percentage points increase over period of only six years. According to the Ministry of Education, there are currently 231,289 institutions in the country. The over all enrolment is recorded at 34.84 millions with teaching staff of 1.37 million. 22 ENERGY Crude Oil: 1. Production of crude oil per day has increased to 70,166 barrels during July-March 2007-08 from 66,485 barrels per day during the same period last year, showing an increase of 5.54 percent. 1. On average, the transport sector consumes 50.9 percent of the petroleum products, followed by power sector (32.8 percent), industry (11.0 percent), household (1.9 percent), other government (2.2 percent), and agriculture (1.2 percent) during last 10 years. 23 ENERGY Natural Gas 1. The average production of natural gas per day stood at 3,966 million cubic feet during the year. 1. On average, the power sector consumer 36.8 percent of gas, followed by fertilizer (20.7 percent), industrial sector (19.8 percent), household (17.4 percent), commercial sector (2.7 percent) and cement (1.1 percent) during last 10 years. Electricity 1. The total installed generation capacity has increased to 19,566 MW during July-March 2007-08 from 19,440 MW during the same period last year, showing a marginal increase (0.65 percent). 1. Total installed capacity of WAPDA stood at 11,654 MW during July-March 2007-08 of which, hydel accounts for 55.6 percent or 6,474 MW, thermal accounts for 44.4 percent or 5,180 MW. During first three quarters of current fiscal year 74,032 GWh electricity has been generated as against 71,033 GWH in the same period last year, showing an increase of 4.22 24 percent. TEXTILE INDUSTRY ANALYSIS 25 TEXTILE INDUSTRY OUT LOOK The textile industry is one of the most important sectors of Pakistan. It contributes significantly to the country’s GDP, exports as well as employment. It is, in fact, the backbone of the Pakistani economy. The textile industry of Pakistan has a total established spinning capacity of 1550 million kgs of yarn, weaving capacity of 4368 million square metres of fabric and finishing capacity of 4000 million square metres. The industry has a production capacity of 670 million units of garments, 400 million units of knitwear and 53 million kgs of towels. The industry has a total of 1221 units engaged in ginning and 442 units engaged in spinning. There are around 124 large units that undertake weaving and 425 small units. 26 TEXTILE INDUSTRY OUT LOOK The world demand for textiles is rising at around 2.5%, due to which there is a greater opportunity for rise in exports from Pakistan. 27 CONTRIBUTION TO EXPORTS According to recent figures: the Pakistan textile industry contributes more than 60% to the country’s total exports, which amounts to around 5.2 billion US dollars. The contribution of this industry to the total GDP is 8.5%. It provides employment to 38% of the work force in the country, which amounts to a figure of 15 million. However, the proportion of skilled labor is very less as compared to that of unskilled labor. The industry contributes around 46% to the total output produced in the country. In Asia, Pakistan is the 8th largest exporter of textile products. 28 SWOT ANALYSIS OF TEXTILE INDUSTRY 29 SWOT ANALYSIS OF TEXTILE INDUSTRY STRENGHTS: It is an Independent & Self-Reliant industry. Demand Driven Industry (more than 2000 units for textiles alone). Strong presence in local market as well As in international markets. Availability of Low Cost and Skilled Manpower provides competitive advantage to industry Availability of large varieties of cotton fiber and has a fast growing synthetic fiber industry. Pakistan has great advantage in Spinning Sector and has a presence in all process of operation and value chain. 30 SWOT ANALYSIS OF TEXTILE INDUSTRY Weaknesses: Obsolete technology machinery and equipment used for manufacturing. Availability of raw material and inconsistent raw material prices Unskilled labor for modern equipments Absence of research and development culture Lack of synergies between Govt. support institutions and practical market. Pakistan Textile Industry is highly Fragmented Industry. Industry is highly dependent on Cotton. Lower Productivity in various segments. Lack of Trade Membership, which restrict to tap other potential market. Lacking to generate Economies of Scale. Higher Indirect Taxes and Interest Rates. 31 SWOT ANALYSIS OF TEXTILE INDUSTRY Weakness: There is Declining in Mill Segment. Lack of Technological Development that affect the productivity and other activities in whole value chain. Infrastructure Bottlenecks and Efficiency such as, Transaction Time at Ports and transportation Time. Unfavorable labor Laws. Lack of standardization and quality control Non-sophisticated marketing sense. (branding & grading) Political instability in the country. Limited access to information (availability of finance, technological know how & Govt. regulations) Energy costs 32 SWOT ANALYSIS OF TEXTILE INDUSTRY Opportunities: Import substitution. Pakistan imports machinery worth approximately US $ 600 million annually for textiles only. Large, Potential Domestic and International Market. Product development and Diversification to cater global needs. Elimination of Quota Restriction leads to greater Market Development. Market is gradually shifting towards Branded Readymade Garment. Free trade agreements like SAFTA and Pakistan’s recent attempt to get included in ASEAN. Research and development and reverse engineering 33 SWOT ANALYSIS OF TEXTILE INDUSTRY Threats: Competition from countries like India & China, which have more advanced engineering technology base. Lagging in technology, hence producing substandard goods that hamper consumer perception about local engineering products. Non-organized manufacturing and vendor base and unhealthy competition. Uncertainty in inputs cost Continuous Quality Improvement is need of the hour as there are different demand patterns all over the world. Elimination of Quota system will lead to fluctuations in Export Demand Threat for Traditional Market for Power loom and Handloom Products and forcing them for product diversification. Geographical Disadvantages. International labor and Environmental Laws. To make balance between price and quality. 34 THE CRESCENT TEXTILE MILLS LIMITED 35 THE CRESCENT TEXTILE MILLS LIMITED HISTORICAL BACKGROUND: The CTM was formed in may 01, 1950 and , MR. HAJI MUHAMMAD SHAFI was appointed as the 1st chief executive who served the company in this position till he breathed his last in 1978. Under his leadership, the company managed to produce quality products as per specification of the buyers in international market and started exporting its products in 1956. The main architect of the Crestex business expansion its Chief Executive, Mr. Muhammad Anwar, who took over this position after the death of his father. He has led the company from the front. It was he who not only managed to win awards for the company on account of highest sales of yarn and cloth in 1987-88, 1993-94 and 1994-95 but also has the distinction of recognition as "The Businessman of the Year" from the Pakistan Federation of Chambers of Commerce and Industry. Crestex has also been awarded the “President of Pakistan Export Trophy” for three consecutive years in the mid nineties. 36 THE CRESCENT TEXTILE MILLS LIMITED Progressive approach and prudent management policies of Mr. Nasir Shafi, Deputy Chief Executive enabled the company to become the 1st composite textile company of Pakistan which received ISO 9002 certification on July 07, 1997. Company has also been certified by “Oeko-tex standard 100” on December 13, 2000. 37 THE CRESCENT TEXTILE MILLS LIMITED Current Scenario: o The Crescent Textile Mills Limited (The Company) is a public limited company incorporated in Pakistan Under the Companies Ordinance 1984. The registered office of the Company is located at 40-A, Off: Zafar Ali Road, Gulberg-V, Lahore. o Its shares are quoted on all the Stock Exchanges in Pakistan. The Company is engaged in business of textile manufacturing comprising of spinning, combing, weaving, dyeing, bleaching, printing, stitching, buying, selling and otherwise dealing in yarn, cloth and other goods and fabrics made from raw cotton and synthetic fiber(s). o The company also operates a cold storage and a power generation house. o In June 1995, the company also signed a joint venture agreement with Greenwood Mills Inc., USA and set up a composite denim garment manufacturing unit at Bahuman, District Hafizabad under the name and style of Crescent Greenwood Ltd, (now called Crescent Bahuman Limited), the first & largest of its kind in Asia. 38 THE CRESCENT TEXTILE MILLS LIMITED Current Scenario: o CTM has 119,728 spindles, 288 MJS (Murata Jet Spinning) drums, 1,568 spindles for Doubling & Twisting. o The spinning capacity in 20s count based on 3 shifts per day is 42 million kgs/yr. o The company has 168 Air jet Looms to convert its own yarn into customer specific cloth. o Fabric weaving capacity in 50 picks based on 3 shifts per day is 65 million sq. meters/yr. o The company has the capacity to process/finish nearly 4,000,000/month and 133,000 meters of cloth per day. o Crestex is capable of converting 17 Million Meters of fabric into madeups annually. 39 CERTIFICATES The CTM has been awarded by the following certificates: 1. 2. 3. 4. 5. ISO 9001 ISO 14001 OEKO-TEX 100 ORGANIC EXCHANGE OE; 100 GLOBAL ORGANIC TEXTILE STANDARD; GOTS 40 POLICIES CTM has adopted the following policies: Provide consistent quality products and services with on time delivery to achieve and enhance customer satisfaction level. Provide safe & conducive working environment to employees and encourage their involvement in the never ending effort to improve quality of our products and services. Minimize environmental impact through prevention of pollution, solid & liquid waste management and conversation of natural resources. Promoting awareness and importance of Quality & Environment among employees, community and suppliers. Ensure continual improvement and compliance with customer & relevant environmental legislation & regulations. 41 COMPANY PROFILE . Company Profile: Ticker: Exchanges: 2008 Sales: Major Industry: Sub Industry: Country: Employees: Authorized Capital Paid Up Capital The Crescent Textile Mills Limited CRTM KAR 8,725,500,000 Apparel & Textiles Miscellaneous Textiles PAKISTAN 5567 100000000 40669358 42 SWOT ANALYSIS Strength Weakness Opportunities Threats 43 SWOT ANALYSIS STRENGHTS: Vertical integration Best corporate report award 2007 IT provides requisite leverage to the company to boost its performance. Better quality ( ISO 9001,ISO 14001 etc). Availability of Low Cost and Skilled Manpower provides competitive advantage to the company. Strong and intellectual management. CTM has large and diversified segments that provide wide variety of products. 44 SWOT ANALYSIS WEAKNESSES: Availability of raw material and inconsistent raw material prices. Lack of Technological Development that affect the productivity and other activities in whole value chain Infrastructural Bottlenecks and Efficiency such as, Transaction Time at Ports and transportation Time. CTM is operating in a highly Fragmented Industry. 45 SWOT ANALYSIS OPPORTUNITIES: Abandoning of textile manufacturing operations in developed countries. Creating self sufficiency by generating power. Greater Investment and FOREIGN DIRECT INVESTMENT opportunities are available. Emerging Retail Industry and Malls provide huge opportunities for the Apparel, Handicraft ETC. 46 SWOT ANALYSIS Threats: High cotton prices due an expected crop shortfall for FY2009 Gas load shedding might increase energy cost Consistent increase in utilities cost Increase in minimum wage rates Lack of funds through export refinance finances from bank . Political instability Poor fiscal as well as monitory policies. WTO rules & regulations International labor and Environmental Laws. 47 FINANCIAL ANALYSIS OF C.T.M 48 FINANCIAL ANALYSIS OF C.T.M Three types of financial analysis Ratio Analysis Common size/ vertical Analysis Index / Horizontal Analysis 49 RATIO ANALYSIS Profitability Ratio Activity Ratio Liquidity Ratio Interest Coverage Ratio Leverages Ratio RATIO ANALYSIS 50 Common size/ vertical Analysis 51 Index / Horizontal Analysis 52 DECISIONS Lenders Investors Manager 53 LENDERS 54 INVESTORS 55 MANAGER 56 THANKS YOU ALOT 57