Econs Definitions - 12S7F-note

advertisement

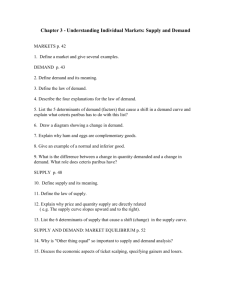

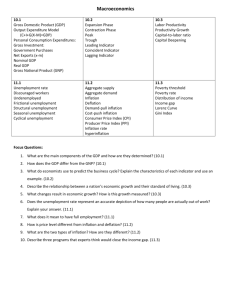

Microeconomics Chapters 4 – 6 1. Scarcity: The situation where the limited resources available are unable to satisfy the unlimited human wants. 2. Choice: Because resources are scarce, they have alternative uses. Therefore, individuals and societies must make choices among the alternative uses so as to maximise the use of resources to achieve the highest possible level of satisfaction. 3. Opportunity Cost: Opportunity costs measure the cost of making a choice, in terms of the next best alternative foregone 4. Law of Increasing Opportunity Cost: As more of a particular good is produced, larger and larger quantities of the alternative good must be sacrificed, ie. the opportunity cost of its production rises. 5. Production Possibility Curve The PPC shows all the different maximum Consumer Goods (units) attainable combination of goods and services that can be produced in an economy, when all U available resources are fully and efficiently used at a given state of technology A A: Full employment of resources I I: Inefficient combination as resources are not fully employed or used inefficiently Capital Goods (units) U: Unattainable 6. Economic Growth: Economic Growth is defined as the expansion or increase in an economy’s level of output of Gross Domestic Product (GDP) over time. 7. Demand: Demand refers to the different quantities of a product consumers are willing and able to buy at each possible price during a given period of time, ceteris paribus. 8. Derived vs Final Demand 9. Competitive vs Complementary Demand 10. Determinants of Demand: a. P: Change in Price of related goods b. T: Change in Tastes and references c. I: Change in Consumer Income d. D: Demographics e. E: Change in Consumers’ Expectations 11. Supply: Supply refers to the various quantities of a good a producer is willing and able to offer for sale at a given set of prices over a period of time in a given market, ceteris paribus. 12. Determinants of Supply: a. C: Change in Cost of production b. P: Change in Price of related goods c. P: Change in number of Producers d. S: Supply Shocks e. E: Change in sellers’ price Expectations 13. Market Equilibrium: The market equilibrium price and quantity is the price and quantity exchanged where the quantity demanded equals the quantity supplied, ceteris paribus. Sequence for description of Demand-Supply related graphs 1. Change in Factor 2. Change in Producer/Consumer’s willingness and ability 3. Shift in Demand/Supply Curve 4. Change in Price and Quantity 5. Equilibrium Price and Quantity 6. Change in Total Revenue/Expenditure Chapter 7 1. Elasticity: The degree of responsiveness of quantity demanded/supplied to changes in one of its related variables, ceteris paribus. 2. PED: Price Elasticity of Demand measures the degree of responsiveness of quantity demanded of a good to a change in its price, ceteris paribus. 3. Determinants of PED: a. S: Availability(number and closeness) of Substitutes b. N: Necessity c. I: Proportion of Income d. T: Time period 4. Total Revenue = Unit Price X Quantity Sold 5. PES: Price Elasticity of Supply measures the degree of responsiveness of quantity supplied of a commodity to a change in its own price, ceteris paribus. 6. Determinants of PES: a. S: Existence of Spare capacity b. N: Nature of production (factor mobility, production period) c. I: Ease of accumulating Inventory or stock d. T: Time period 7. Total Expenditure by consumers = Total revenue by producers 8. YED: Income elasticity of demand measures the degree of responsiveness of demand to a change in the income of consumers, ceteris paribus. 9. Determinants of YED: a. Nature of goods b. Level of income or affluence of consumers (According to Engel’s law, the same good might be considered an inferior, normal or luxury good depending on the income level of the consumer) 10. CED: Cross Elasticity of Demand measures the degree of responsiveness of demand for a product to a change in the price of another good, ceteris paribus. 11. Limitations of Elasticity Concepts: a. Ceteris Paribus Assumption b. Ignores cost-side of the profit equation c. Informational problem d. Ignores supply side of market Chapter 8 1. Consumer surplus (in the form of satisfaction): The difference between the price that buyers are willing and able to pay (ie max amount) for the good and the actual price paid. 2. Producer surplus (in the form of earnings): The difference between what a producer is willing and able to put up for sale (ie min amount received) for a good, and the actual price charged and amount he receives. 3. Specific Tax: A fixed amount of tax per unit of a good; results in parallel shift of supply curve. 4. Ad Valorem Tax: A percentage of the sale price of a commodity; results in a pivotal shift of the supply curve. 5. Tax Incidence: The division of a tax between consumers and producers 6. Subsidy: A per unit subsidy is a fixed amount of money given to the producers for each unit they sell. 7. Price Floor: A legally established minimum price above the market equilibrium price. 8. Price Ceiling: A legally established maximum price below the market equilibrium price. 9. Black market: Market where sellers ignore the government’s price restrictions and sell illegally at whatever price equates demand and supply. Macroeconomics Chapter 9 1. Full employment: Situation where everyone in the labour force is able to find a job. 2. Labour force: Those in the working population of legal working age and are willing and able to work or find employment. 3. Unemployment: Percentage of those in the labour force who are without work but are willing and able to take up employment. 4. Cyclical unemployment: demand deficient unemployment (recession/economic downturn) 5. Structural unemployment: mismatch of skills 6. Frictional unemployment: lack of perfect information concerning job availability (search unemployment) 7. Inflation: Sustained increase in the general price level in an economy a. Demand-pull inflation: inflation arising from excessive aggregate demand or total spending in the economy b. Cost-push inflation: inflation driven by soaring production or business costs 8. Inflation rate (%) = 𝑪𝑷𝑰 𝒇𝒐𝒓 𝒀𝒆𝒂𝒓 𝟐−𝑪𝑷𝑰 𝒇𝒐𝒓 𝒀𝒆𝒂𝒓 𝟏 𝑪𝑷𝑰 𝒇𝒐𝒓 𝒀𝒆𝒂𝒓 𝟏 𝑿 𝟏𝟎𝟎% 9. Balance of Payments: A set of official accounts kept by the government to record and track all international monetary transactions between the residents of the country and the rest of the world during a specified time period, usually one year. 10. Current account: trade flow (X - M) 11. Financial account: International investments Chapter 10: 1. GDP: Gross Domestic Product is the market value of all final goods and services produced within the geographical boundaries of an economy in a given period of time. 2. GNP: Gross National Product is the market value of all final goods and services newly produced anywhere in the world from resources belonging to residents or nationals of a country in a given period of time. 3. Factor Income from Abroad (FIFA) – Factor Income Paid Abroad (FIPA) = Net Factor Income from Abroad (NFIA) 4. GNP = GDP + NFI 5. Real: Real GNP/GDP is GNP/GDP measured at constant prices or base year prices. It is GNP/GDP with the effects of inflation being removed. 𝑵𝒐𝒎𝒊𝒄𝒂𝒍 𝑮𝑫𝑷 6. Real NI/GDP = 𝑮𝑫𝑷 𝑷𝒓𝒊𝒄𝒆 𝑫𝒆𝒇𝒍𝒂𝒕𝒐𝒓 X 100% 7. Growth in Real NI (% change) ≈ Nominal NI (% change) – Inflation rate (%) 𝑹𝒆𝒂𝒍 𝑮𝑫𝑷 8. Real GDP per capita = 𝒑𝒐𝒑𝒖𝒍𝒂𝒕𝒊𝒐𝒏 9. Purchasing Power Parity: PPP refers to the number of currency units required to purchase an amount of goods and services equivalent to what can be bought with one unit of currency of the base country. 10. Limitations of using NI to compare SOL of living over TIME and SPACE Material aspects Non-material aspects Over TIME Real NI per capita measured in domestic currency Changes in general price level Changes in population Changes in composition of NI Changes in distribution of NI Externalities Disamenities Over SPACE Real NI per capita measured in US$, at PPP Different currencies used Differences in population Differences in composition of NI Differences in distribution of NI Differences in the size of the nonmonetised sector Differences in the availability and reliability of data Externalities Disamenities Chapter 11 1. 2. 3. 4. Keynesian Model: AE = C + I + G + (X - M) Withdrawal = Savings + Taxes + Imports Injections = Investment + Government + Exports Consumption = autonomous + b(multiplier)Y ∆𝐶 5. Marginal Propensity to Consume: MPC = ∆𝑌 𝑝𝑟𝑜𝑓𝑖𝑡 6. Marginal Efficiency of Investment: MEI = 𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝑋 100% ∆𝑌 7. Multiplier: k = ∆𝐽 1 8. k = 1−𝑀𝑃𝐶 = 1 = 1−𝑏 1 = 𝑀𝑃𝑊 1 𝑤