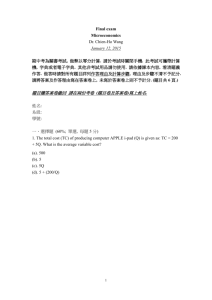

Structure - Eurekawow

advertisement