Gas, Energy, etc

advertisement

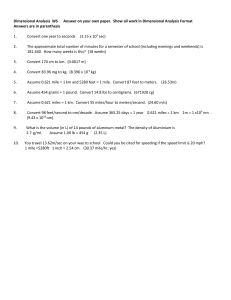

Gas, Energy, etc Peter Berck 2003 Cost of Cars • Private cost is mostly capital cost – Starts at 51c/mile for a recent Taurus – Declines with age – IRS estimate of 37c/mile (all ages) – Marginal costs about 13c/mile Taxes External Costs How to Regulate • Full marginal cost pricing – Hard to do, since must measure • Emissions • Dangerous driving • Place of driving • • • • • Gas tax (possibly by vehicle type) Reg. Fees Tolls (including for use of inner city) Emissions standards Refund/disposal fee systems for toxics: oil, batteries, tires • Subsidize alternative means of transport Tolls • Proost and van Dender (1999) Brussels in the year 2005. – Cordon pricing results in about 50% of the welfare gain of full marginal cost pricing. • Geoghegan – Substantial gains from higher tolls on bay bridge, both congestion and pollution— pollution lowest at medium speeds. Less Cars or Miles • Increased costs result – Less miles per car – Less cars – How much less? Demand for Gas • Two Choice variables – Miles driven • Vacation choice (short run) • Bus/train v. car for commute (short run) • Location of job or house (long run) – Car fleet • About 10 years to adjust • Scrappage important • Many characteristics, including mpg, size, horsepower, safety, pollution Rebound Effect • Demand Elasticity: – gasoline use (G), – vehicle miles traveled (VMT) – miles per gallon (MPG). • G=VMT/MPG. – VMT is a function of c, the price per mile of travel, which in turn – depends on the price p of fuel and the fuel economy, that is, – c = p / MPG. • • • • ln G = ln ( VMT( ln c ) ) - ln MPG ( p ), Elasticity formula. EG.p = EVMT.c ( 1 - EMPG.p ) - EMPG. Note that increasing MPG has indirect effect of making driving cheaper. First Thoughts • Elasticity from derived demand – IRS estimate is about 37 cents per mile for full cost of driving – 1/25 gallon per mile at $2/gallon = 8 cents – A 1% increase in gasoline price is a – .08/37 = .0022= 0.2% increase in cost of driving – Worse if one puts in time cost • E.g. 25 miles/hr at $10 per hour; 40 cents per mile! • Will take massive increase in price of gas to discourage gas consumption. Another way • $cost of fuel price increase – – – – – 12,000 miles per year 1/25 gallons / mile 480 gallons of gas per year 50 cent increase gallon (25%) = $240 additional expense • Or lower gas mileage – 1/12.5 gallons per mile; 960 gallons; coincidentally $960 more – At 7% for 10 years: $7214 or about 1/7 the cost of a hummer. Espey Meta Study Short run elasticity • Short run keeps vehicle fleet constant – Regressions are quantity on current price, income, car fleet characteristics and size, etc. – Might include some lag structure Long Run Espey Long run • Long run allows car fleet to adjust – Appropriate price must be present value of expected gasoline prices. – Expected price changed much less than instantaneous price, so long run price elasticity would be woefully underestimated. Real Gasoline Prices gasoline prices 250 cents per gallon 200 150 real leaded real unleaded 100 50 0 1940 1950 1960 1970 1980 year 1990 2000 2010 $1,132.06 $1,146.62 $1,145.23 $1,145.96 $1,153.37 $1,131.05 Prices • • • • • • • $1,132.06 $1,146.62 $1,145.23 $1,145.96 $1,153.37 $1,131.05 843 is 2002 value • Present value at 7% of previous 10 years of gas prices 1975-1984; 1976-1985; etc • Notice that pv price declines steeply post 80-89. also that pv price is at top is 1.36 times price at bottom—nothing like the 26c to 2.15c per gallon nominal that I remember. Espey meta results • Regresses (long run) elasticity on characteristics of study – Inclusion of mpg, car type, leads to less elastic estimate – Using only quarterly lags (1 qtr?) leads to less elastic – 70% of response occurs within time frame of static models (nonsense.) – Inclusion of countries other than US lead to greater elasticity (not surprising: $1 per gallon v. $4 gallon) – More long run elastic if estimated from more recent data. Wheaton • Estimate, for countries by year: – Mpg – Autos per cap – Miles/ auto • As a function of gas prices and income. • Use the three equations to get income and demand elasticity of gas. Wheaton More detail • Could track fleet: – New purchase decision • Exog: gas price, income distribution, topography, regulation, price of new auto(maybe) • Predetermined: existing auto • Endog: mpg, horsepower, longevity, number of autos, etc – Scrap decision • Same variables as above, but expect that income of lower quartile more important for scrapping – Also makes sense to track potential drivers. Stoker Schmalensee • Income elasticity of demand – Key to forecast demand growth – Done partially non-parametrically • Adding drivers to equation costs effect of income on total gallons in half. – Inc elast for inc over 12K is .2 – Driver elast is .6 – Implies that gallons will go up more slowly since number of drivers isn’t expanding quickly anymore. (not true for Calif or rest of Price elasticity – RTECS doesn’t really have prices, just an average cost of gasoline by region. Hence estimate of price elasticity are spurious Environment and Cars • Lit reviewed leads to strong link between gas price and mpg, however reducing fuel requires sustained high price. Doubling prices probably leads to 40% fuel savings. – Political suicide. – CAFÉ also saves fuel. No political will. – Tradeable mileage certificates would also do the job—need certifs to buy Hummer, get certifs if bought Prius. – Only way to get CO2 down is to get fuel down. Nox and Sox • Regulation directly makes cars cleaner (converters, in tune engines, etc.) • Regulation adds to cost of car and decelerates scrapping, hence makes fleet dirtier on average from older cars. – Effect depends on how long cars are held when new car price goes up – Effect depends on how well pollution control equipment stands up on older cars. – Again, suicide to ban older cars, but ok to buy them up and scrap them. Reality Check • Vehicle License Fee doomed Davis • VLF on a $10K car was approx $200/year or $2800 present value (forever at 7%) Welfare • IF V(gas price), welfare loss from taxing gas is standard. Makes no difference that response is to buy more efficient car. • If U(regulation) then welfare is much harder. Consumers don’t face a set of prices that would get them to elect the cars that regulators (and CAFÉ) chose for them. Kling • Emissions are effluent standards in gms/mile. No trade or averaging. – Some vehichles beat standard so on he whole emissions are better than standard • Can trading do better? Costs • To sell in CA, manufacturers must tell CARB what parts are used for pollution reduction. • Wang prices these parts to get cost of pollution reduction and that is the estimate of cost used by Kling – Could use ex ante engineering estimates, but these were too low. Or expert opinion. – Wang’s numbers are ex post Regression • Cost is regressed upon MPG and emissions profile. Least Cost • The cost functions are for each manufacturer and type of car (little, medium, big). Find min cost of current level of emissions • Minimize cost, holding types of car sold constant. • Allow car size to vary, hold consumer surplus constant. Greene has logit based measures of CS depending on car attributes. Savings • On order of 10% for full trading. Can One Emit Less? • Fullerton and West, 2002 – Tax cars for gas depending on type of car – Get very close to taxing NOx SOx etc. – Depends upon emission per mile being a function of car type and maybe age. – Amazing opportunity for fraud. • Parry and Small (2001), welfare-maximizing gasoline taxes. – From a simple general-equilibrium model externalities also vary by mileage, whereas global warming varies by fuel use. – United States optimum is $1.01 per gallon, acutual is 37¢/gallon – United Kingdom is $1.34, less than half its current value. – optimum vehicle miles traveled (VMT) tax, 14¢/mile. – VMTs generate most of the external costs of driving, not fuel use. Scrappage programs • Such scrappage programs have been examined by • Alberini et al. (1995, 1996), who found that the vehicles scrapped tend to be older and in worse • condition than other vehicles in that same age class. Although emissions from these vehicles are • high, their remaining useful life on the road is low. The cost-effectiveness of such policies ranges • from $3,500 to $6,500 per ton of HC removed, which makes them attractive in some contexts • and not others. Dill (2001) provides a summary of the studies on old-car scrap programs.