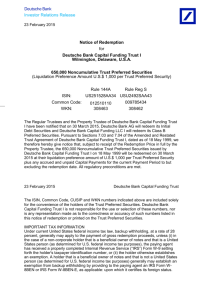

Deutsche Bank screenshow template

advertisement