Document

advertisement

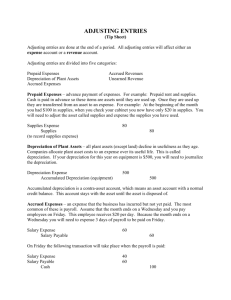

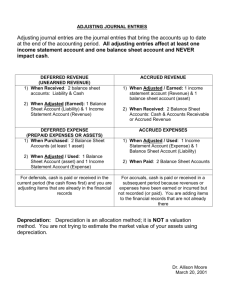

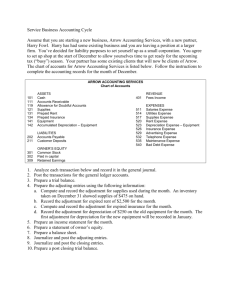

Welcome to AB113 Accounting For Non-Majors Unit 4 Professor David Levenstam Unit 4 Seminar AB113 Unit 4 1 Welcome to AB113 Accounting For Non-Majors Unit 4 Professor David Levenstam Unit 4 Seminar AB113 Unit 4 2 Reading, Help & Contact • • • • Reading: Survey of Accounting, Chapter 3 Author: Warren Tech Support 866-522-7747 (or free online) Contact info: – Email: DLevenstam@kaplan.edu – AIM: LFCCEconinstruct (sign up for AIM at http://www.aim.com) – Office Hours: Wednesdays 8-10 pm ET • When emailing, please include your full name & course number (AB113) AB113 Unit 4 3 This Week’s Assignments • Discussion (Don’t forget to post your initial response by Saturday! :-)) • Quiz (You can take only once.) • Homework Assignment: • Submit to Dropbox • We have an Excel template in Doc Sharing for each homework set • Templates show you wrong answers (*) :-) AB113 Unit 4 4 Quiz • Weeks 2-9. • 8 worth 20 each for a total of 160 (16% of your grade) • 10 multiple-choice questions • You can take it only once • You have 1 hour • You can see the results 7 days after a quiz closes AB113 Unit 4 5 Please Read the Announcements! :-) • Located on the Course Home page • Contain important administrative and accounting material • Please check the announcements and the syllabus first for administrative questions you might have AB113 Unit 4 6 Please Read My “Hi Students” Posts! :-) • Typically located early on the board • Occasionally come later too • Could say “Hi Class” or “Warning, Warning, Danger, Will Robinson!!” :-D • Please give my tired old eyes a break and LABEL your multi-part answers! :-) AB113 Unit 4 7 Jing Links and Scripts • To help you with the homework the course leads have created some voice presentations called Jings. You can find all the Jings in Doc Sharing by downloading the file named AC113-AB113 Jing Links.docx. • After downloading, click on the link for this week’s chapter to see and hear the presentation. • You can also download a script of each week’s presentation so that you can read the spoken words from the presentation later without reviewing the whole Jing presentation. For this week you can download AC113AB113 Jing Chapter 4 Script.docx. AB113 Unit 2 8 Accrual Basis Accounting AB113 Unit 4 9 What is GAAP? AB113 Unit 4 10 What Is GAAP? Inexpensive clothing store Oh wait, that’s GAP. :-) AB113 Unit 4 11 What Is GAAP? Generally Accepted Accounting Principles AB113 Unit 4 12 Why does GAAP require the use of accrual basis accounting rather than cash basis? AB113 Unit 4 13 Why does GAAP require the use of accrual basis accounting rather than cash basis? Adjustments at end of period to follow several interrelated core accounting principles (some mentioned in Chapter 1) included in GAAP: AB113 Unit 4 14 1. Periodicity To make accounting information meaningful and comparable, we divide it into regular periods: months, quarters or years. In Renaissance Italy, by contrast, where people invented double-entry bookkeeping, a merchant often accounted for each sailing journey not in regular periods, but at the end, when the vessel returned from its journey. Our authors refer to periodicity as the accounting period concept. AB113 Unit 4 15 2. Matching Principle Under the matching principle we match the benefits from the business (i.e. the revenues) to the period in which we earned them. We match the efforts of the business (i.e. expenses) to the benefits that the efforts earn. Where we can’t match an expense to a benefit we match the effort to the period in which we incurred it (such as when an oil company drills a dry hole). AB113 Unit 4 16 3. Revenue Recognition In order to match revenue to the period in which we earned it, we record (accrue) revenue when we earn it rather than when the customer pays for it. If a customer purchases goods (or services) from the business on credit, for instance, we record, or recognize, the revenue at the time of the purchase, even if the customer pays in the next period. AB113 Unit 4 17 Because the rest of AB113, and indeed most financial accounting in general, uses accrual based accounting, it’s critical that you understand the material in Chapter 3. AB113 Unit 4 18 What are five general categories of accounts requiring adjusting entries at the end of a period? AB113 Unit 4 19 What are five general categories of accounts requiring adjusting entries at the end of a period? 1. Prepaid Expenses (assets) 2. Unearned Revenues (liabilities) 3. Accrued Revenues (assets) 4. Accrued Expenses (liabilities) 5. Depreciation (an expense and a contra-asset account) AB113 Unit 4 20 What Are Prepaid Expenses? AB113 Unit 4 21 1. Prepaid Expenses Pay in advance for an expense that benefits more than one period, debit an asset called Prepaid (Something) Expense. Example: pay 2 years’ worth of rent up front (perhaps to get a lower rate), debit the whole amount to Prepaid Rent. End of Year 1 adjustment : remove first year’s portion of the rent from Prepaid Rent and put it in Rent Expense. AB113 Unit 4 22 1. Prepaid Expenses, continued End of year adjusting entry transfers the first year’s rent from Prepaid Rent to Rent Expense. (since we’ve gotten the benefit of first year’s rent). A prepaid expense is an asset (because it has future value, in this case, the use of the building in the future). AB113 Unit 4 23 What are Unearned Revenues? AB113 Unit 4 24 2. Unearned Revenues If you were accounting for the business that leased the building to the business in my example in number 1: Record the advance rent payment as a credit to Unearned Rent. End of the year adjustment : Transfer the first year’s portion from Unearned Rent to credit Rent (or Rent Revenue) AB113 Unit 4 25 2. Unearned Revenues, continued End of the year adjustment : Transfer the first year’s portion from Unearned Rent to credit Rent (or Rent Revenue) Unearned revenue is a liability (because it obligates us to something—in this case, to let the lessee use the building—in a future period). AB113 Unit 4 26 What Are Accrued Revenues? AB113 Unit 4 27 3. Accrued Revenues Perform services or ship goods without getting paid yet: accrue the earned but unpaid revenue Unpaid lawyer’s fee: lawyer must accrue revenue. Adjustment: Add amount to Accounts Receivable and Fee Revenue (or Fees Earned, or just Fees) AB113 Unit 4 28 3. Accrued Revenues, continued Unpaid lawyer’s fee: lawyer must accrue revenue Adjustment: Add amount to Accounts Receivable and Fee Revenue (or Fees Earned, or just Fees) Accrued revenue is an asset (because it has future value—customer will pay later) AB113 Unit 4 29 What Is An Accrued Expense? AB113 Unit 4 30 4. Accrued Expenses Receive goods or services without paying for them yet, accrue the incurred but unpaid expense. Example: End of year owe your employees for the work they’ve done since last pay day AB113 Unit 4 31 4. Accrued Expenses, continued Example: End of year owe your employees for the work they’ve done since the last pay day Accrue unpaid wages Adjustment: add amount to Wages Expense & Wages Payable AB113 Unit 4 32 4. Accrued Expenses, continued again :-) Accrue unpaid wages Adjustment: add amount to Wages Expense & Wages Payable Accrued expenses are liabilities (because they represent an obligation to pay in a future period) AB113 Unit 4 33 What Is Depreciation? AB113 Unit 4 34 5. Depreciation Depreciation is the systematic and rational allocation of a portion of the cost of an asset to each period the asset benefits. AB113 Unit 4 35 5. Depreciation 2 Example: A delivery truck may benefit the company for 5 years. We don’t expense the whole truck in Year 1. We expense part of the cost in each of the 5 years of the truck’s life. AB113 Unit 4 36 5. Depreciation 3 Depreciation follows both the periodicity and matching principles. (They’re the same reasons we set up prepaid expenses as assets instead of expensing prepaid assets all in the year of payment.) We use depreciation for long-term assets like buildings and equipment. AB113 Unit 4 37 5. Depreciation 4 LAND Since land has an unlimited or indefinite useful life, we don’t depreciate it, but keep the cost as an asset. Exception: Use land for extractive industry, (oil & gas, coal mining, etc.): land declines in usefulness, we expense over estimated useful life: Depletion AB113 Unit 4 38 5. Depreciation 5 Chapter 7 (Unit 8) deals with depreciation (and depletion) For now the authors calculate it for you Adjustment for depreciation: + Depreciation Expense (-Equity) + Accumulated Depreciation (-Asset) AB113 Unit 4 39 5. Depreciation 6 Accumulated Depreciation is a contraasset account. (Contra: opposite balance) Accumulated Depreciation is thus a negative asset account AB113 Unit 4 40 5. Depreciation 7 Depreciation is NOT an attempt to value the asset. We use depreciation merely to allocate the historical cost of the fixed asset to each of the years of income it helps produce AB113 Unit 4 41 E3-1 a. Owner invested $20,000 for capital stock. b. Paid $7,200 on May 1 for 1-year insurance policy. c. Purchased supplies on account, $1,200. d. Received fees of $32,500 during May. e. Paid expenses as follows: wages $8,000; rent $2,500; utilities $1,000; miscellaneous $850. f. Paid dividends to owner of $3,000. AB113 Unit 4 42 E3-1 (a) a. Owner invested $20,000 for capital stock. Which accounts? Which financial statements? AB113 Unit 4 43 E3-1 (a) a. Owner invested $20,000 for capital stock. Cash +$20,000 (Asset) Capital Stock + $20,000 (Equity) Balance Sheet Statement of Cash Flows (Financing) +$20,000 AB113 Unit 4 44 E3-1 (b) b. Paid $7,200 on May 1 for 1-year insurance policy. Which accounts? Which financial statements? AB113 Unit 4 45 E3-1 (b) b. Paid $7,200 on May 1 for 1-year insurance policy. Cash -$7,200 (Asset) Prepaid Insurance +$7,200 (Asset) Balance Sheet Statement of Cash Flows (Operating) -$7,200 AB113 Unit 4 46 E3-1 (c) c. Purchased supplies on account, $1,200. Which accounts? Which financial statements? AB113 Unit 4 47 E3-1 (c) c. Purchased supplies on account, $1,200. Supplies +$1,200 (Asset) Accounts Payable +$1,200 (Liability) Balance Sheet AB113 Unit 4 48 E3-1 (d) d. Received fees of $32,500 during May. Which accounts? Which financial statements? AB113 Unit 4 49 E3-1 (d) d. Received fees of $32,500 during May. Cash +$32,500 (Asset) Fees Earned +$32,500 (Revenue = +Equity) Balance Sheet Income Statement +$32,500 Statement of Cash Flows (Operating) +$32,500 AB113 Unit 4 50 E3-1 (e) e. Paid expenses as follows: wages $8,000; rent $2,500; utilities $1,000; miscellaneous $850. Which accounts? Which financial statements? AB113 Unit 4 51 E3-1 (e) e. Paid expenses as follows: wages $8,000; rent $2,500; utilities $1,000; miscellaneous $850. Cash -$12,350 (Asset) Wages Expense, Rent Expense, Utilities Expense, Miscellaneous Expense, total +$12,350 (Expenses = -Equity) Balance Sheet Income Statement -$12,350 Statement of Cash Flows (Operating) -$12,350 AB113 Unit 4 52 E3-1 (f) f. Paid dividends to owner of $3,000. Which accounts? Which financial statements? AB113 Unit 4 53 E3-1 (f) f. Paid dividends to owner of $3,000. Cash -$3,000 (Asset) Retained Earnings -$3,000 (Equity) Balance Sheet Statement of Cash Flows (Financing) -$3,000 AB113 Unit 4 54 E3-1 Balances What Balances Do We Have in Our Accounts? AB113 Unit 4 55 Assets = Prepaid Cash + Supplies + Insurance a. $20,000 b. (7,200) $7,200 Bal. 12,800 7,200 c. 12,800 d. 32,500 Bal. 45,300 e. + Accounts = Payable Stockholders' Equity Capital + Stock 32,950 f. (3,000) Bal. 29,950 + Earnings 1,200 20,000 $1,200 7,200 1,200 20,000 $32,500 1,200 7,200 1,200 20,000 (12,350) Bal. Retained $20,000 $1,200 Bal. Liabilities 32,500 (12,350) 1,200 7,200 1,200 20,000 20,150 (3,000) 1,200 7,200 1,200 20,000 17,150 56 E3-2 Make End-of-Month Adjustments For a1. Insurance Expired a2. Supplies Used AB113 Unit 4 57 E3-2 (a1) a1. Insurance Expired Which accounts? Which financial statements? AB113 Unit 4 58 E3-2 (a1) a1. Insurance Expired We paid $7,200 for 1 year. We used 1 month: $7,200/12 = $600 used. Prepaid Insurance -$600 (Asset) Insurance Expense +$600 (Expense = -Equity) Balance Sheet Income Statement -$600 AB113 Unit 4 59 E3-2 (a2) a2. Supplies Used Which accounts? Which financial statements? AB113 Unit 4 60 E3-2 (a2) a2. Supplies Used We started with $1,200. We finished with $650. $1,200 - $650 = $550 used. Supplies -$550 (Asset) Supplies Expense +$550 (Expense = -Equity) Balance Sheet Income Statement -$550 AB113 Unit 4 61 E3-2 Balances What Balances Do We Have in Our Accounts After Adjustments? AB113 Unit 4 62 Assets = Liabilities Prepaid Cash + Supplies + Insurance a. $20,000 b. (7,200) $7,200 Bal. 12,800 7,200 c. 12,800 d. 32,500 Bal. 45,300 e. 32,950 f. (3,000) Bal. 29,950 1,200 + Stock a2. $1,200 7,200 1,200 20,000 1,200 7,200 1,200 20,000 32,500 (12,350) 1,200 7,200 1,200 20,000 20,150 (3,000) 1,200 7,200 1,200 20,000 1,200 6,600 $650 17,150 (600) 1,200 20,000 (550) $29,950 + Earnings 20,000 (600) 29,950 Retained $32,500 a1. Bal. = Payable Capital (12,350) Bal. Bal. Accounts Stockholders' Equity $20,000 $1,200 Bal. + 16,550 (550) $6,600 $1,200 $20,000 $16,000 63 Questions? :-) AB113 Unit 4 64