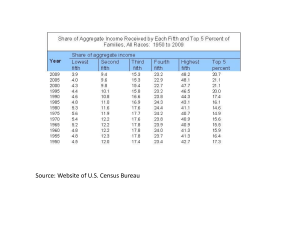

DATA ON THE DISTRIBUTION OF WAGES

advertisement

OECD AND TAX POLICY Martin Jareš Tax Policy and Statistics Division OECD Centre for Tax Policy and Administration martin.jares@oecd.org Overview • 1. Work of the OECD in the tax area – Introduction – Double taxation – Transfer pricing – Harmful tax practices – Tax administration – Consumption taxes • 2. Tax statistics and tax policy analysis – Revenue Statistics – Taxing Wages – Tax Database – Tax policy studies – Current work 2 1. WORK OF THE OECD IN THE TAX AREA 3 Introduction • The core work of the OECD in the tax policy area lies in setting standards. • The standards are not binding, the OECD does not have any legislative power to enforce them. • However, they are generally highly regarded and also many non-OECD countries follow recommendations formulated by the OECD. • There is no voting, the aim is to find a unanimous support. 4 Double taxation • In the case of international transactions, both countries might want to tax the profit • Double taxation would be harmful for international business and investment • Countries conclude bilateral double-taxation treaties • Model Tax Convention on Income and on Capital – A model for bilateral double-taxation treaty – It sets general principles and allocation of taxing rights of the two contracting countries – Used by all OECD countries and some non-OECD countries as a basis for negotiation with other countries – Regularly updated – The full version has more than 2,000 pages 5 Transfer pricing • One of the ways to shift profits among subsidiaries of a multinational group • Multinational groups manipulate intra-group prices, – Increase prices of export to high-tax countries – Decrease prices of exports to low-tax countries • Tax legislation says that the intra-group prices must be set at the same level as prices of third-party transactions – It is called “arm’s length principle” • Easier in the case of tangibles, complicated in the case of intangibles 6 Transfer pricing (2) • Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations. – Provide guidance on the application of the arm's length principle (valuation of cross-border transactions between associated enterprises) – Used by all OECD countries as a basis for their legislation – The full version has almost 400 pages 7 Harmful tax practices • In the last decades, countries have been decreasing corporate income tax rates in order to attract more investment. • This is called tax competition. • There are instances of tax competition which is regarded as harmful. – For example, a country might introduce tax incentives only for new, foreign-owned companies. • Harmful Tax Competition report in 1998 and progress reports. – Model Agreement on Exchange of Information on Tax Matters 8 Investment incentives • Investment incentives in the Czech Republic – Direct subsidies – Tax expenditures (tax holiday up to 10 years) • Is it a harmful tax practice? • Is it good for the Czech Republic? 9 Tax administration • Sharing best practices and experiences • Main areas of concern are – Voluntary compliance (taxpayers pay voluntarily their taxes) – Taxpayer services (e-services) • Two work streams: – Taxpayers with global interests (multinational companies, high net worth individuals), – Small and medium enterprises. • Tax Administration: Comparative Information – A good source of information on tax administration 10 Consumption taxes • Traditionally, OECD worked only in the are of direct taxation – Direct taxes = taxes on income – Indirect taxes = consumption taxes • Importance of indirect taxation is rising • Indirect taxes could cause double-taxation if countries do not follow similar principles – One of the reasons for harmonisation of VAT and excises in the EU • The OECD started to work also in this area • International VAT/GST Guidelines 11 2. TAX STATISTICS AND TAX POLICY ANALYSIS 12 Overview • Work on tax policy analyis and tax statistics is carried on by – Working Party No. 2 on tax policy analyis and tax statistics – Joint Meeting of Tax and Environment Experts • Regular statistical products – – – – – Revenue Statistics Taxing Wages Tax Database Environmental Tax Database Data available at http://stats.oecd.org • Economic analysis – Tax policy studies and Working papers 13 Revenue Statistics • The Interpretative Guide defines what is tax – In the OECD classification the term “taxes” is confined to compulsory unrequited payments to general government • Data on tax revenues of all member states from 1965 • Data on accrual basis – Tax revenue is recorded at the time that the tax liability was created • Breakdown by type of tax and level of government 14 Revenue Statistics – classification of taxes • 1000 Taxes on income, profits and capital gains – 1100 Taxes on income, profits and capital gains of individuals – 1200 Corporate taxes on income, profits and capital gains • • • • 2000 Social security contributions 3000 Taxes on payroll and workforce 4000 Taxes on property 5000 Taxes on goods and services – 5100 Taxes on production, sale, transfer, leasing and delivery of goods and rendering of services • 5110 General taxes (5111 Value added taxes) • 5120 Taxes on specific goods and services (5121 Excises) – 5200 Taxes on use of goods, or on permission to use goods or perform activities • 5210 Recurrent taxes (5211, 5212 Paid in respect of motor vehicles) 15 Revenue Statistics – levels of government • Attribution of tax revenues to levels of government • In general, a tax is attributed to the government unit that – exercises the authority to impose the tax (either as a principal or through the delegated authority of the principal), – has final discretion to set and vary the rate of the tax, and – also final discretion over the use of the tax proceeds. • Link: http://www.oecd.org/tax/tax-policy/revenuestatistics.htm. 16 Revenue Statistics & Czech Republic • Total tax burden in the Czech Republic has been slightly above the average of the OECD countries. OECD - Average Czech Republic 38 37 36 35 34 33 32 31 30 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 17 Revenue Statistics & Czech Republic (2) • Czech Republic has higher share of social security contributions and lower share of personal income tax and property taxes. Taxes on goods and services Property taxes Taxes on corporate income Taxes on personal income Social security + payroll taxes 40 35 30 25 20 15 10 5 0 OECD 2013 Czech Republic 2013 18 Taxing Wages • Provides comparative information of tax burden on labour income of OECD countries. • Shows information on – income tax paid by workers – social security contributions levied on employees and their employers – family benefits paid as cash transfers. 19 Taxing Wages (2) • Average and marginal effective tax rates are calculated – Average effective tax rate = total tax divided by total income – Marginal effective tax rate = tax from additional income divided by the additional income • Not based on actual data but on a model • Results are presented for different household types which differ by – income level (in percentage of average wage) – household composition (one- and two-earner families, different number of children) • Link: http://www.oecd.org/ctp/tax-policy/taxingwages.htm. 20 Taxing Wages & Czech Republic • Average tax wedge (vertical axis) for different levels of income (horizontal axis) and different family types – Tax wedge = income tax, employer and employee social security contributions, pay roll tax minus social benefit as a percentage of gross labour costs (gross wage + employer SSC) 21 Taxing Wages & Czech Republic (2) • Tax burden on labour income in the Czech Republic is comparable with the OECD average – The lines are close to each other • Even with a single tax rate of personal income tax, the Czech tax system is as progressive as tax systems of OECD countries on average – The lines increase similarly • The Czech Republic has lower tax burden of low-income families with children compared to the OECD average but higher in other case – Red lines are below blue lines in the right-hand graphs 22 Tax Database • Comparative information on a range of tax statistics on – personal income taxes, – social security contributions – non-tax compulsory payments, – corporate and capital income taxes – taxes on consumption. – (data from Revenue Statistics and Taxing Wages also included here.) 23 Tax Database – Personal taxes • Personal income taxes • Social security contributions paid by – employees – employers – self-employed • Non-tax compulsory payments – compulsory payments made to organisations outside the government sector or because they are not unrequited 24 Tax Database – Corporate taxes • • • • Basic (non-targeted) rates Surcharges Small business tax rates Corporate income taxes relating to sub-central governments 25 Tax Database – Indirect taxes • Value added tax – Rates – Registration threshholds • Excise duties on – Beer – Wine – Alcoholic beverages – Mineral oils – Tobacco • Link: http://www.oecd.org/ctp/tax-policy/taxdatabase.htm 26 Economic analysis • Tax Policy Studies • Since 1999, 22 studies published • Link: http://www.oecd-ilibrary.org/taxation/oecd-taxpolicy-studies_19900538 • Taxation Working Papers • Since 2011, 22 papers published • Link: http://www.oecd-ilibrary.org/fr/taxation/oecdtaxation-working-papers_22235558 27 Tax Policy Reform and Economic Growth • Regression analysis of data on GDP growth, the structure of tax revenue and other variables • Main findings: different types of taxes have different effects on economic growth – Corporate income taxes the most harmful – Personal income taxes – Consumption taxes – Recurrent taxes on immovable property the least harmful 28 The Distributional Effects of Consumption Taxes • Actual household microdata used • Households ranked by their income (or expenditure) and split into ten deciles • Each expenditure item was assigned its VAT rate • VAT paid can be calculated for each decile • It allows to calculated how much each deciles gains from reduced rates • One of the outcomes: highest income deciles benefit most from reduced VAT rates 29 The Distributional Effects of Consumption Taxes (2) Average tax expenditure (in CZK) per household from reduced rates on museums and ZOOs : income deciles, Czech Republic 80 70 60 50 40 30 20 10 0 1 2 3 4 5 6 7 8 9 10 30 Thank you for your attention. 31