Federal Reserve Presentation

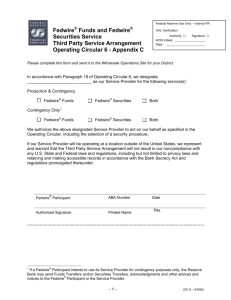

advertisement

Fedwire® Securities Service Modernization Bank Depository User Group Annual Meeting September 24, 2013 Agenda 1. Present an overview of customer-suggested postmodernization enhancements. 2. Solicit BDUG feedback on key themes being explored for post-modernization enhancements. 3. Next steps. 2 Background • The Federal Reserve Banks’ Wholesale Product Office (WPO) has embarked on an effort to modernize Fedwire® Securities Service software. • Modernization in and of itself is not the goal. Rather, the WPO seeks to create a service that is more nimble and flexible in responding to stakeholder needs. • We plan for a “like-for-like” cutover to the modernized software in late 2015. • We are beginning the process of evaluating and prioritizing enhancements suggested by customers and policy stakeholders that could be implemented once the cutover is complete. • To date, we have interviewed several external customers and multiple internal stakeholders. 3 Important Note Meetings like these are an important means by which we solicit stakeholder feedback on the services we provide. However, we cannot and do not guarantee that any features or functionality discussed today will be developed or implemented. The Financial Services logo, the Fedwire logo, “Fedwire,” and “Wired to Deliver” are registered service marks of the Federal Reserve Banks. A complete list of marks owned by the Federal Reserve Banks is available at FRBservices.org. 4 Background - Key Fedwire Securities Features • Transfer of Securities – Delivery Versus Payment (DVP) – Securities transactions involve a simultaneous exchange of valuables. – Secondary market activity accounts for most transfers. – Settlement. • Account Maintenance – Includes securities account maintenance. • Fiscal Agent Responsibilities – Securities issuance support. – Payment of principal and interest and securities redemption. 5 Background - Fedwire Securities Service Functionality 1. Customer Directory 2. Securities Directory 7. 8. – CUSIP ® Information – Factor File Processing – Fail Tracking – Interim Accounting – Repo Tracking 3. Custody – Par Holdings – Repo Balances – Merger Support Principal & Interest Payments Automated Claim Adjustment Process 9. Customer Statements 4. Transfer & Settlement 5. Conversion (Strip & Reconstitution) 6. Collateral Processing – Pend Withdrawals – Remit/Suspend Maturity Proceeds “CUSIP” is a registered trademark of the American Bankers Association. 6 Background - Key Volume and Value Statistics 2012 Fedwire Securities Origination Volume and Value 1 1 2 Average Daily Transfer Volume 73,000 Average Transfer Value $15.6 million Average Daily Transfer Value $1.1 trillion Total Annual Dollar Value $284 trillion Total Annual Volume 2 18.2 million Source: PACS Database. 99.97% of Securities volume was originated online (electronically). The remainder was originated offline (via telephone). 7 Background - Customer Statistics Fedwire Securities Service Customers (2012) • Approximately 6,100 participating accounts. • The top 25 customers account for 96 percent of the total transfer volume and 94 percent of the total transfer value originated. • The top 2 customers account for 67 percent of the total transfer volume and 72 percent of the total transfer value originated. 8 Summary of progress • Over past year, interviewed broad range of customers and internal stakeholders regarding potential post modernization service enhancements and new functionalities. • Reviewed feedback and identified broad, high level themes and work streams to further develop concepts – Operational Efficiency and Customer Self-Service – Communicating and Messaging – Operating Hours – Collateral Management – Credit and Liquidity • Vetting high level themes with stakeholders 9 Today’s Focus • Operational Efficiency and Customer Self-Service – Data Availability & Accessibility – Account Services – Securities Call/Redemption Process • Message Format & Communication Standards – Transaction Tracking – Counterparty and Securities Mapping 10 Post Modernization Enhancements Feedback Data Availability & Accessibility • Discuss limitations or gaps, if any, in the availability and accessibility of Fedwire Securities data. • Describe enhancements, if any, to the availability and accessibility of Fedwire Securities data that would better address your institutions’ needs. Be prepared to discuss how potential changes would be utilized by your organization. 11 Post Modernization Enhancements Feedback Account Services • Discuss limitations or gaps, if any, in the existing Fedwire Securities account services. • Describe enhancements, if any, to the existing account structure and services that would better address your institutions’ needs. Be prepared to discuss how potential changes in the account structure would be utilized by your organization. 12 Post Modernization Enhancements Feedback Securities Call/Redemption Process • As it relates to securities call or redemption services, what information is currently not provided by the Bank’s processing methodologies that would better address your institutions’ needs? • Describe enhancements, if any, to the call or redemption service work flow that would better address your institutions’ needs. 13 Post Modernization Enhancements Feedback Message Format & Communication Standards • From the perspective of transfer messaging at a high level, describe your institutions’ current process from trade to settlement, focusing on how other message formats are translated or mapped to the Fedwire securities transfer message. • Discuss limitations or gaps, if any, in the current transfer messaging process. • From your organizations’ perspective, what are the potential benefits and challenges, if any, of Fedwire Securities maintaining a proprietary message format. 14 Next Steps • Prioritize stakeholder feedback regarding potential postmodernization enhancements. • Develop preliminary high level post modernization roadmap by end of 2013. • Complete deeper dive into roadmap enhancements with stakeholders. 15 Contact Information Cathy Zeigler – Assistant Vice President Wholesale Operations Site Federal Reserve Bank of Kansas City (816) 881-2168 catherine.zeigler@kc.frb.org 16