MA360 May 15 - Activating your university user account

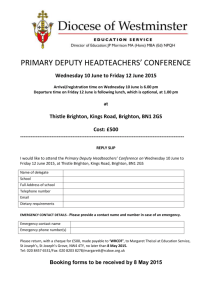

advertisement

s Brighton Business School Undergraduate Programmes BSc(Hons) Accounting & Finance BA(Hons) Accounting & Finance Level Six Examination May 2015 MA360: Management Control Systems ______________________ Instructions to candidates: Time allowed: 3 Hours Rubric: Answer FOUR questions in total Section A: You are required to answer any TWO questions from this section Section B: You are required to answer Question 5 which is COMPULSORY and one other question from this section All questions carry equal marks PLEASE USE A SEPARATE ANSWER BOOK FOR EACH SECTION. Nature of Examination: Unseen Questions/Seen Case Study Allowable Materials: None. You are not allowed to bring a copy of the case study into the examination room. A clean copy will be attached with the exam paper. Attachments: Present value tables Page 1 of 16 MA360: Management Control Systems (May/June 2015) Section A - You are required to answer any TWO questions from this section Question 1 Netting Centre (25 Marks: 45 minutes) P is a multinational professional services company. As P’s treasurer you have decided to investigate the possibility of introducing a multilateral netting system, to reduce the overall number of inter-office payments. You have forecast the following inter-company cash flows for the next month: Paying office UK (GBP) Europe (EUR) US (USD) Japan (JPY) Receiving office UK (GBP) ¥100,000,000 Europe (EUR) £2,000,000 US (USD) £1,500,000 $4000,000 Japan (JPY) €3000,000 Foreign exchange rates are: GBP 1 = €1.3849 $1.4663 ¥176.41 Additional information: P’s London-based treasury department will manage all settlements. Savings on foreign exchange transactions no longer required is 1%. Savings on any float (cash no longer tied up) is estimated at 3 days. (Assume 365 days in a year.) Interest costs are 2% per annum. Required: (a) Assuming transactions of a similar size and pattern occur for the next twelve months, what annual savings could be achieved from introducing a multilateral netting system? (17 marks) (b) Advise P’s directors of the advantages and disadvantages of offsetting balances using a multilateral netting system. A memorandum is not required. (8 marks) (Total 25 Marks) Page 2 of 16 MA360: Management Control Systems (May/June 2015) Question 2 Capital Budgeting (a) (25 Marks: 45 minutes) P plc has the potential to invest in a new project and intends to utilise a range of investment appraisal techniques, ensuring as far as possible that the financial implications of the project are understood by stakeholders. P evaluates projects using the company cost of capital rate of 9%. The following cash flows apply to the project: £m (46.00) 12.75 15.00 37.75 Initial Investment Year 1 Cash Flow Year 2 Cash Flow Year 3 Cash Flow Required: (i) Calculate the net present value (NPV), internal rate of return (IRR) and modified internal rate of return (MIRR) for the proposed project. Present value tables are attached. (11 marks) (ii) Discuss the advantages and limitations of MIRR in comparison with NPV and IRR. (6 marks) (b) P plc has £60m available to invest at time zero. You have been asked by the Finance Director to use capital rationing techniques as a basis for choosing a range of potential projects. Data is available about the following four projects: Initial cost PV of subsequent cash flows A £30m £52m B £20m £25m C £40m £56m D £10m £18m Required: Determine the optimum investment plan if £60m is available for investment and: (i) Projects are mutually exclusive; (ii) Projects are divisible; (iii) Projects are indivisible. Assume that any surplus funds cannot be invested elsewhere. (8 marks) (Total 25 Marks) Page 3 of 16 MA360: Management Control Systems (May/June 2015) Question 3 Divisional Performance Measurement (25 Marks: 45 minutes) The Apple Growing Division (AGD) is part of the Jam Manufacturing Company (JMC), a supplier of jams and fruit-pie fillings to the UK market. Data relating to the AGD and its financial performance for the year ended 30 April 2015 is set out below: Capital invested in the Apple Growing Division £13,000,000 Divisional cost of capital 10% Divisional Income Statement of AGD for the Year Ended 30th April, 2015. 1. 2. 3. 4. Sales to outside customers Transfers to other divisions Total sales revenue Less variable costs Variable short-run contribution margin Less controllable fixed costs Controllable contribution Less non-controllable avoidable costs Divisional contribution Less allocated corporate expenses Divisional net profit before tax 4,000,000 1,600,000 5,600,000 2,560,000 3,040,000 820,000 2,220,000 650,000 1,570,000 450,000 1,120,000 JMC operates a management incentive scheme, whereby the divisional manager earns an annual bonus if Residual Income (RI) is a positive figure. The RI calculation is based on divisional net profit before tax, and the manager’s bonus is 15% of any positive RI produced. AGD is an investment centre. The divisional manager (DM) is allowed to make individual capital investment (Capex) decisions up to £1 million in value. Any individual Capex projects greater than £1.0 million must be proposed and approved by JMC. Additional information relating to the year ended 30th April 2015: As indicated in the income statement above, AGD is required by JMC to sell (transfer) some of its apple production to other JMC divisions. AGD must set the transfer price at a level which allows AGD a 40% contribution margin on its transfer sales. If AGD did not have to supply the other divisions, it could sell all of this production on the outside market, where a CM% of 60% can be earned. Note that ‘contribution margin’ in this case refers to Level 1 contribution, i.e. Variable shortrun contribution. Also, variable costs per unit are the same for both external sales and internal transfers. The lower CM of 40% on internal transfers is due only to the lower internal transfer price. Question 3 continued… Page 4 of 16 MA360: Management Control Systems (May/June 2015) Question 3 Divisional Performance Measurement 37.5% of variable costs relate to the cost of fertiliser which AGD was required to buy from a factory owned by JMC. The price charged was 20% higher than the average price available on the open market during the past financial year. Included in controllable fixed costs is the depreciation charge for the year of £220,000. Capex purchased for £1.0 million or less totals £1,200,000, and is depreciated over ten years on the straight-line basis. All other depreciation relates to AGD projects costing more than £1.0 million. Allocated corporate expenses relate to the cost of services provided to AGD by the JMC corporate office. These services could have been obtained from outside companies for a total cost of £375,000 in 2014/2015. Required: (a) Based on the information provided above (but excluding the additional information), what will AGD’s Divisional Manager earn as a bonus for the year ended 30th April 2015? Provide calculations to support your answer. (3 marks) (b) In your opinion, is the current incentive scheme operated by JMC a fair one? If not, explain why not, and suggest an alternative, fairer Income Statement measure against which the Divisional Manager could be judged. You should also explain how your chosen measure might need to be adjusted in respect of any of the additional information provided to you. Calculations should be provided to show the effect of each relevant change. (12 marks) (c) One of JMC’s newly-acquired divisions (ND) uses Return on Investment (ROI) as a measure, both for incentive purposes and when making capital investment decisions. (Unlike AGD, the manager of ND is responsible for all Capex decisions). JMC claims that RI is a more appropriate measure when it comes to Capex decisions, as under certain circumstances ROI can lead to poor business outcomes. You are provided with the following information: Divisional cost of capital Company cost of capital Invested capital ROI in previous year (£14m) Question 3 continued… Page 5 of 16 MA360: Management Control Systems (May/June 2015) New Division (ND) 11% JMC 10% £100m 14% Question 3 Divisional Performance Measurement (c) The manager of ND has the opportunity of buying a new machine which will cost £10m and will provide a PBT of £1.2m this year. However, based on ROI considerations, the manager refuses to buy the new machine. (It should be mentioned that the manager will receive a bonus if the divisional ROI is higher than that achieved in the previous year. You may assume that the division will make the same ROI as last year on its prior year £100m investment). Required: (i) Explain, with calculations, why the manager (using ROI as a measure) has refused to buy the new machine. (5 marks) (ii) Explain too, with calculations, why the manager’s decision might be different if RI is used as a measure instead of ROI, and if a bonus is paid on any increase in RI over the previous year. (You may assume that the RI achieved this year on the prior-year capital investment of £100m, will be the same as that achieved last year). (5 marks) (Total 25 Marks) Page 6 of 16 MA360: Management Control Systems (May/June 2015) Question 4 Standard Costing (25 Marks: 45 minutes) You are the newly appointed management accountant at Woodworks Limited, which for many years has manufactured wooden benches for outdoor use. The company operates a standard absorption costing system with flexed budgeting, with inventories and cost of sales being valued at standard cost. Standards are based on the company’s annual budget. The recently retired CEO, John (“JT”) Tardy, has for many years pursued a cost leadership strategy. “Being the lowest cost producer in the industry allows us to compete aggressively on price,” he would regularly remind employees and fellow board members. It appeared that he was right, as the company produced regular if unexceptional profits during the time of his leadership. When JT retired towards the end of the 2013/2014 financial year, the board of directors appointed Robert Oak as his replacement. Oak believed that Woodworks had been pursuing the wrong strategy. According to him, the market for high quality wooden benches (for both outdoor and indoor use) was growing at an impressive rate. He believed that Woodworks should apply their expertise to producing such benches, as this would boost profits in both the short and longer term. Not all board members agreed with Oak. “JT has done a solid job for many years, in a highly competitive market” they pointed out. “Why should we risk that success by changing our strategy?” However, by a narrow margin the board voted to let Oak pursue his chosen strategy in 2014/2015. It was agreed, though, that the standard cost card used by JT in 2013/2014 would be used in 2014/2015 as well. “This will allow us to see how well Oak performs in comparison to JT,” Oak’s critics maintained. “We can compare his variances to JT’s, and that way we can establish whose strategy is best.” Preliminary results for the 2014/2015 year have just been released. They are set out on the next page, alongside the comparable figures achieved by JT in 2013/2014. Question 4 continued…. Page 7 of 16 MA360: Management Control Systems (May/June 2015) Question 4 Standard Costing Woodworks Ltd: Selected Financial and Market Information for the Years Ended April 2014 and April 2015 High Level Data: Budgeted Market Size Actual Market Size Budgeted Market Share % Actual Market Share % Budgeted Sales Units Actual Sales Units Selling Price per Unit (Actual) Selling Price per Unit (Budget) Capital Invested (Budget and Actual) Budgeted ROI% (Based on EBIT) Actual ROI% (Based on EBIT) Budgeted EBIT Actual EBIT Annual Variances: Sales price variance Sales volume variance Market share variance Market size variance Direct material price variance Direct material usage variance Direct labour rate variance Direct labour efficiency variance Variable manufacturing overhead spending variance Variable manufacturing overhead efficiency variance Fixed manufacturing overhead spending variance Fixed manufacturing overhead volume variance Fixed Sales and Marketing Expenses spending variance Fixed Administration Expenses spending variance 2013/2014 1,200,000 units 1,200,000 units 10% 10.83% 120,000 units 130,000 units £320 £330 £42,000,000 12% 12.2% £5,040,000 £5,124,000 2014/2015 1,000,000 units 1,100,000 units 10% ? 100,000 units 118,800 units £500 £330 £47,000,000 12% ? £5,640,000 ? £1,300,000 A £1,100,000 F £1,100,000 F £NIL ? ? ? ? £24,500 F £105,500 A £50,000 F £100,000 A £100,000 A £13,971,375 A £308,880 F £2,016,000 A £240,000 F £60,000 A £40,000 A £96,000 F £60,000 F £480,000 F £5,000 F £500,000 A £950,400 F £200,000 A £10,000 F £120,000 A Both fixed and variable manufacturing overheads are absorbed into production on the basis of direct labour hours. The company operates a JIT stock system, so that opening and closing stocks are negligible and can be ignored. Question 4 continued… Page 8 of 16 MA360: Management Control Systems (May/June 2015) Question 4 Standard Costing Standard Cost Card for a Woodworks Bench for the 2013/2014 and 2014/2015 Financial Years: £ Wood 25kg at £5.20 per kg 130.00 Direct labour 3 hours at £10 per hour 30.00 Variable manufacturing overheads 3 hours at £4 per hour 12.00 Fixed manufacturing overheads 3 hours at £16 per hour 48.00 Total standard manufacturing cost 220.00 Selected Actual Results: 2014/2015 Capital expenditure of £5 million related to the purchase of new woodworking machinery. The machinery is depreciated at 10% per annum on the straight line basis. The adverse Fixed Administration spending variance was largely due to the costs of additional staff training. ______________________________________________________________________________ Required: (a) Using the standard cost card provided to you as well as the actual results for the year, calculate the following variances for Woodworks Ltd for the 2014/2015 year: Sales Price Variance Sales Volume Variance Market Share Variance Market Size Variance (2 marks) (2 marks) (3 marks) (3 marks) (b) Do you think it was a good idea to use the previous year’s standard cost card as a means of evaluating John Oak’s performance? Discuss briefly, giving reasons for your answer. (6 marks) (c) Briefly discuss the extent to which Oak’s new strategy has been a success or failure. You should compare the 2014/2015 financial results to prior year performance, and focus on profitability, ROI% and market issues. (9 marks) (Total 25 Marks) Page 9 of 16 MA360: Management Control Systems (May/June 2015) Section B: You are required to answer Question 5 (COMPULSORY) and one other question from this section. Question 5 Case Study – Business Intelligence Services Company Background Business Intelligence Services (BIS) is a small British company which sells organisations the right to use certain business intelligence (BI) software. It also provides BI consultancy and training services. BIS consultants use licensed BI software programmes to develop customised, userfriendly reports and control systems for their clients, accessing data held on organisations’ own databases. Consulting fees, software license sales and annual software licence fees make up the company’s revenue streams. BIS was founded in 1988, and in early 2009 was sold to IT Solutions Ltd (ITS), a listed information technology company. At the time of BIS’ acquisition by ITS, Andrew Chapman (AC) was installed by the parent company as CEO of BIS. An accountant and experienced professional manager with many years of general business experience, AC was quick to implement his own policies, procedures and controls at BIC. Although AC did not have much experience in service industries, he was confident that his general management skills would be as applicable to BIS as they had been to the manufacturing and retailing organisations he had run in the past. In 2008 BIS’s annual turnover was in the region of £12 million. Having re-structured his management team, instituted a profit sharing and incentive scheme and put in place the appropriate (in his view) systems, procedures and controls, AC embarked on a growth strategy. This was based primarily on the growth of consulting and training revenues, particularly in longterm contracts, in recognition of the fact that margins on software licence sales and annual licence fees were likely to be reduced in the nearby future by BIS’s vendor. (The vendor was the company which had developed the BI software, and which allowed BIS to market the software on its behalf). A good service reputation had in the past led to BIS consultants being regarded as trusted advisors to their customers, leading to further orders for software (with license fees to follow), and additional services and training. The growth strategy was therefore dependent upon the ongoing recruitment of high quality BI consultants, and the retention of competent BI staff currently in the company’s employ. By the end of 2011 BIS had an annual turnover of just over £14 million, well below the target of £20 million set by AC. At this time BIS employed 66 staff (of which 44 were consultants), divided more or less equally between the head office in London and its only branch, situated in Brighton. The company had a flat management structure – one layer of management reported to AC (who was based in London), comprised of the Brighton branch manager, a national sales manager, two technical managers (consulting; one each in London and Brighton), and a financial manager. The Brighton technical manager was also responsible for customer and staff training, while AC looked after marketing in addition to his role as London branch manager and company CEO. Although BIS as a whole was successful, during AC’s time with the company the Brighton branch produced bottom-line profits which were almost 40% better than London’s. AC attributed this to the more competitive market in London, which squeezed margins, and which also made it more difficult to recruit and keep high-quality consultants. Consultant turnover in London was particularly high, with a high proportion of London consultants leaving BIS to join competitors or clients each year. This was not the case in Brighton, where consultant turnover was very low. Page 10 of 16 MA360: Management Control Systems (May/June 2015) Question 5 Case Study – Business Intelligence Services By early 2012 ITS had grown increasingly concerned about the staff retention issues in London, as well as the lower financial performance of the London head office in comparison to Brighton’s consistently good results. There were also concerns about AC’s leadership. A high performer in his previous roles, it appeared that he was struggling to get to grips with the BI industry. As a result an internal ITS business consultant had been sent to BIS, in an attempt to find a solution to the problems. The ITS consultant interviewed AC and a number of other BIS employees. Various quotes by these employees are provided below: CEO and Employee Quotes: “BIC’s mission is to be: ‘The Number 1 supplier of BI solutions in Britain.’ Our mission statement is displayed in reception, on screen savers and is drummed home at staff inductions, strategic reviews and briefings. We regard it as essential in communicating our mission to all stakeholders. ” – AC “Future success will depend on working with the management team to establish a clear vision of the future, communicating this to all staff, and putting the mechanisms in place to remind management of the agreed strategies to get us there. It is also important to have the right reward systems in place, and to make everyone aware of how they and their departments will benefit if we achieve our strategic objectives. As a management team we review our performance against strategic objectives on a quarterly basis, based on individual and team KPI’s (key performance indicators) which are linked to strategic objectives. Annual bonuses are also based on meeting KPI targets.” – AC “The ability to attract and retain the best people is what this business is all about.” – Sales Manager, Brighton. “The following is a list of the company values contained in the strategic plan: customer obsession; passion - for excellence, delivery, our products, and the company; individual respect (implying honesty, frankness, integrity); appropriate costs, systems and procedures; and innovation, which includes smart working and smart solution provision. These are communicated to all employees at the annual strategy briefing, and by me during the first hour of the induction for new employees. At this induction, I cover the history of the company, our strategies and values. The values were established top-down by me when I came into the company, but are reviewed annually and have changed over time – but not much.” - AC “Values are reinforced from time to time by me and by my managers in meetings and discussions, particularly when we are faced with challenges. Typical situations were when BIS had been overpaid by customers, delivery had not met our standards, etcetera. We would review our values and make appropriate decisions to reinforce the culture enshrined in our values. Decisions made on the basis of these values have become part of the company folklore, and are still told to new employees as an example of what we are all about” – AC AC, in response to the question: “What happens if a staff member or members do not behave in accordance with company values?” Answer: “Depending on the severity of the transgression, staff members are counselled or disciplined in line with the company’s disciplinary code.” “Yes, the senior management team shares pretty much the same values. I am fortunate in having a number of the management team who think similarly to me. Had this not been the case, I probably would have had to replace one or two so that there was greater similarity of thinking in the management team.” – AC (Note that the answers by AC in the box below relate to the London branch only. Different policies, procedures and outcomes may apply at Brighton). Page 11 of 16 MA360: Management Control Systems (May/June 2015) Question 5 Case Study – Business Intelligence Services AC, in response to the question: “In recruiting key personnel, do you look to recruit people who seem to share BIS’s core values?” Answer: “Yes, apart from qualifications, we look for stable employment records, good references of customer service and an ability to get on with colleagues in particular.” AC, when asked: “Do you find that staff retention is better among those who share the company’s core values?” Answer: “Yes we do, although there have been times when large companies were targeting our consultants with large packages in a desperate attempt to secure skills. This resulted in high turnover as we could not match these packages, despite the cultural fit of the staff members.” AC, in response to the question: “Do people who share the company’s core values generally perform better than those who don’t?” Answer: “Yes. They tend to have a longer term view and are more committed to both their careers and the customer, they tend to gossip less and deliver more.” AC, when asked: “Are there staff members who didn’t initially buy in to company values, but who have come to do so over time?” Answer: “This seldom happens and parting company sooner rather than later is essential. Such people tend to become frustrated and aggressive towards management, claiming that they are being micro-managed. They cause severe damage to the general harmony in the company. Younger staff do better in adapting but generally, if they do get into the company with very different values and attitudes it is hard to change them.” AC on the reasons for having “Personnel” as one of his seven key strategic performance areas: “Our employees are our greatest asset. This applies particularly to consulting staff who are mostly at the customer and if not regularly engaged with, coached, and directed by management, could become either delinquent, disillusioned or the “Stockholm Syndrome” could come into play. “This manifests itself in their taking greater care of the customers’ needs and wants, to the detriment of BIS. I personally make sure I meet with each of our consultants at least once a week, over a cup of coffee. We chat about their progress on the job, and any problems they are having. I like to remind them, too, that ‘Time is money.’ These guys sometimes get carried away, playing with their creative toys and forgetting that we’re in business to make a profit.” AC on the problem of recruiting and retaining good BI consultants: “It differs greatly between the coast [Brighton] and London. On the coast, staff look for a stable, learning environment, reasonable remuneration and regular recognition. Given that there is less competition for skills, staff tend to stay longer and leave only to pursue significant growth opportunities or overseas travel or work. In London the same criteria are required by staff but a much greater emphasis is placed on earning and earning potential in accepting a job. Many of the consultants left for more money in the boom times when skills were short.” Long-term London consultant on AC’s management style: “AC is a complete control freak. But he’s also a good, fair guy. I don’t let him faze me; as long as you do your job properly you’re okay. Some people can’t take his style, though, and most of them end up leaving.” AC (in 2012) on his perception of the BIC culture during the course of his tenure as CEO: “High integrity, emotionally intelligent, pride in consistent solid achievement, conservative. Maybe too conservative; this is probably why innovation wasn’t as high as it could have been.” Brighton branch manager VC (in 2012) on AC’s management style: “AC is a typical accountant. His analysis paralysis drives me crazy! I don’t particularly enjoy his management style, but he has changed the way we think about the business, particularly regarding where we want to be in the future. That is definitely a good thing.” Page 12 of 16 MA360: Management Control Systems (May/June 2015) Question 5 Case Study – Business Intelligence Services AC on the way in which performance is measured, and performance bonuses are awarded to London consultants: “I use certain KPI measures such as the number of billable hours per consultant, sales revenue earned per head, PBIT per head, and a productivity measure which compares employee productivity growth with annual CPI (i.e. inflationary) growth.” “This is a pretty challenging job. You have to transform complex business rules into comprehensible visualisations, using BI tools to design dashboards, cubes, static reports and so on. What is more, the client environments are complex, and everyone is different. Often the clients don’t quite know what they want, so most assignments involve a journey of discovery rather than a smooth progression towards a clear-cut destination.” (Brighton BI consultant with more than 10 years’ experience with BIS). “We have to use and report on the same key performance measures across the whole company, but quite frankly I don’t rely on them to manage my consultants’ performance. I also refuse to reward my people on Andrew’s KPIs. I get away with it because our financial performance is so good, but I don’t think Andrew likes my rebellious ways. To his credit, though, he sticks to the core company value of “respect for individuals” and lets me get on with it. It might be a different story, though, if our results start slipping” – VC, Brighton Branch Manager Differences in Operations between the Brighton and London Branches of BIS: (Personal notes made by ITS internal consultant) Brighton branch does things differently to London. According to branch manager VC, the Brighton branch was established by one of BIS’s founders back in 1988. According to VC: “He was an absolute gentleman; very polite and respectful to everyone, but also very professional and hardworking. The values that he established are still in place in Brighton today.” VC is an ex-consultant who was employed by the founder almost twenty years ago. She explained that similar values to those espoused by BIS were lived by the founder. All staff recruited were expected to be professional in their outlook and behaviour. This implied the delivery of excellent work and an adherence to the founder’s work ethic. The expectation that consultants would behave in a professional manner was based on trust rather than any attempts at formal supervision. According to VC, consultants who shared the founder’s values thrived at the company (and stayed), while those who did not “were out in no time.” London recruitment process: The recruitment and selection process at Brighton is very different from London. At London, AC has drawn up a BI Consultant Job Description, including a list of required attributes. He then personally interviews all short-listed consultants, using a structured interview process. (The short list is drawn up after candidates have been interviewed in the first instance by the Technical Manager - Consulting). Among other things, London applicants are tested for compliance with BIS’s core values. This is done by asking applicants how they have acted in the past in certain work-related situations. If candidates have not experienced these situations they are provided with hypothetical situations and asked to explain how they would react. AC admits, though, that in certain instances and particularly in times of high staff turnover, when demand for BI skills was high, people who might otherwise have been rejected were in fact employed. Such employees were very seldom, if ever, a success, despite going through the normal BIS induction process. Page 13 of 16 MA360: Management Control Systems (May/June 2015) Question 5 Case Study - Business Intelligence Services Brighton recruitment process: The London approach is quite different from the graduate recruitment scheme put in place at the Brighton branch in 2003 to recruit future BI consultants. (This was to facilitate the branch’s growth plans and to address the recognised looming shortage of BI skills). This scheme involves the recruitment of academically capable Honours graduates from the University of Brighton’s Information Systems programme. Similar interviewing techniques are employed in Brighton as in London, but short-listed candidates are also required to complete professionally-administered personality and other psychometric tests in an attempt to ensure a good fit between Brighton branch values and candidates’ values. Successful Brighton candidates are then provided with classroom training on relevant BI products, followed by on-the-job training in the company of an experienced BIS consultant who acts as a mentor to the new recruit. After being judged competent, the young graduates are given the title of Junior Consultant. They are then assigned to a practical assignment at a client company. However, in contrast to London where it is the norm for consultants to work alone (due mainly to efficiency issues or staff shortages), there are customarily at least three and never less than two consultants assigned to a client firm in Brighton. (This is intended to overcome the “Stockholm Syndrome” effect described to me by AC). Five years after the initial graduate intake in Brighton, all six initial appointees were still with the firm, and the retention of staff recruited via the programme remains excellent as at 2012. Over the years, graduates who have adapted and thrived at Brighton have been used to attract new recruits. They have been asked to refer friends or colleagues to BIS, especially those who they believe will fit in at the firm. (These friends or colleagues might be at rival firms, or about to graduate from the University of Brighton IT programme). Brighton consultants are also assessed in terms of their specific competencies and interests. They are then encouraged to develop their careers in these specific directions, and are provided with ongoing support and training to facilitate this. A career path allows promotion from Junior Consultant to Consultant, and then to Senior Consultant. As the company grows, or in cases of natural attrition, interested and competent Senior Consultants can move into management positions, as promotions are made from within the organisation whenever possible. VC maintains that Brighton consultants are selected as much on the basis of perceived ‘fit’ with the organisation as on technical skills. Staff turnover is very low, and VC maintains that they can afford to take their time when recruiting new candidates to ensure that they employ team players who will fit the culture. Levels of trust between management and staff are high, and Brighton branch is generally regarded by consultants as a “cool” place to work. Work Arrangements – Brighton: Brighton consultants have a good deal more freedom than their counterparts in London. For example, based on the exercise of their own judgement and of the needs and attitudes of their clients, consultants can choose their hours of work. Also, between consultancy assignments and at other appropriate times during assignments, consultants can choose to work from home if they believe that this will be more effective. Like London, Brighton has an open-plan, ‘hot-desk’ arrangement, so that consultants can work at the office between assignments. However, in Brighton this is left to their own discretion. (In London it is compulsory that consultants come in to the office between assignments). Page 14 of 16 MA360: Management Control Systems (May/June 2015) Question 5 Case Study – Business Intelligence Services Between assignments consultants are rewarded for good performance or for ‘going the extra mile’ with clients by being allowed to attend IT training programmes of their choice (all paid for by BIS). These programmes are often work-related or BI product-related, but can also be in an unrelated area of IT in which the consultant has a particular interest. All of this serves to increase consultant skills, but also makes them more marketable and, theoretically, more likely to leave BIS to pursue better opportunities. Strangely, however, turnover rates among Brighton consultants are very low. VC notes that, although the founder has long since retired, “war stories” dating back his time are still told in the Brighton branch to this day. These relate to things such as all- night work sessions to meet tough deadlines, and memorable parties held to celebrate successes. In Brighton it is compulsory for all staff to gather in the office on Friday afternoons, for a short informal meeting accompanied by drinks and snacks. The achievement of sales targets or the gaining of a new client is celebrated with champagne or pizzas, and regular staff barbecues (which include family members and partners of single staff) are held to celebrate successes. ______________________________________________________________________________ Required: 5 (a) With reference to the three generic strategies identified by Porter (1985), identify (using material from the case study to support your argument) the strategy being employed by BIS. How, in your opinion, does BIS intend to achieve its strategic objectives by the use of this strategy? (5 marks) 5 (b) Merchant and Van Der Stede (2007) have identified four different types of controls. Name and briefly explain these control types, and give one example from the case study of each type of control as employed by BIS. (4 marks) 5 (c) BIS could be described as a knowledge-intensive firm. Based on your understanding of the most appropriate form of control applicable to such firms, explain: (i) What type of control is being employed at the Brighton branch of BIS, and why this form of control is likely to be effective? (11 marks) (ii) What type of control is being employed in London, and why this is likely to be less effective than that employed at the Brighton branch of BIS? (5 marks) Note that in both (i) and (ii) above you should support your answers with examples from the case study, and by citing the relevant literature where applicable. (Total: 25 marks) Page 15 of 16 MA360: Management Control Systems (May/June 2015) Section B (continued) Question 6 Different types of management control systems exist, and each system has different knowledge and information goals. On the basis of this statement; (i) Define and explain the concept of control systems as a package (Malmi and Brown, 2008) (15 marks) (i) Compare and contrast management control systems based on the concept of control systems as a package (Malmi and Brown, 2008) with that of Merchant and Van der Stede's (2007) concept of management control systems. (10 marks) (Total: 25 marks) Question 7 In order to ensure the efficient and effective delivery of public services, the public sector (and other non-profit organisations) are coming under increasing pressure to adopt private sector management models. However, it is still the case that, to work more effectively, certain specific features are required in both private sector and public sector management control systems (MCS). (i) Describe the main features of public sector/ non-profit organisations’ MCS, and compare them to the main features of private sector MCS. (10 marks) (ii) How will the MCS features mentioned in (i) above, affect the design of a management control system for a public sector/non-profit organisation? (15 marks) (Total: 25 marks) Question 8 Due to increasing environmental complexity and variability, organisations need to adopt a process of continuous change with regard to their management control systems (MCS). However, despite this need for continuous MCS change, organisations face many obstacles to change. Using an institutional theory perspective, define the concept of ‘change’ and describe the process required to successfully change a management control system. (Total: 25 marks) Page 16 of 16 MA360: Management Control Systems (May/June 2015)