Conservator Handbook - Morgan County, Alabama

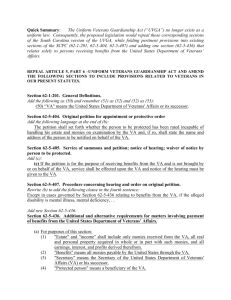

advertisement

PROBATE COURT OF MORGAN COUNTY

POST OFFICE BOX 848

DECATUR, ALABAMA 35602

256-351-4675

To:

Attorney of Record

Attached is the Handbook for Conservators. Provided also is a CERTIFICATE which shall be

used to confirm that the Conservator has reviewed the handbook information with their attorney.

At your convenience, and prior to the appointment of Conservator, please give this handbook to

your client and review it with him/her. Please file with the Court the executed CERTIFICATE to verify

that the review has been done.

Please note that the filling of the certificate with the Court is a pre-requisite to the issuance of

Letters of Conservatorship. If you have any questions, please do not hesitate to contact us.

Thank you for your assistance with this matter.

Greg Cain, Judge of Probate

IN THE PROBATE COURT OF MORGAN COUNTY, ALABAMA

IN RE: THE ESTATE OF

_______________________________,

Alleged Incapacitated

CERTIFICATE

I,

Conservator of

do

hereby attest and certify under penalty of perjury under the laws of the State of Alabama, to the Probate

Court of Morgan County, that I have personally read and am familiar with the foregoing Conservator’s

Handbook and all its attachments and have discussed the provisions of said Handbook with my attorney

and I understand all of the provisions contained herein.

Signed this ___________ day of ___________________, 20_____.

____________________________________

Conservator

I, the undersigned, Notary Public, hereby certify that ___________________________________ whose

name is signed to the foregoing instrument, and who is known to me, acknowledged before me on this

day that, being informed of the contents of the instrument, he / she executed the same voluntarily on the

day of the same bears date.

Given under my hand and Official seal this ________ day of ______________, 2______.

Notary Public

Commission expiration date

(SEAL)

Instructions: The petitioner is required to review the Conservator Handbook with his/her attorney prior

to the issuance of Letters of Conservatorship so that the Conservator may have a basic understanding of

the duties and responsibilities of becoming a Conservator. This certificate, properly executed, must be

filed with the Court before the Court will issue Letters of Conservatorship.

2

Revised 1/1/14

Table of Contents

INTRODUCTION ................................................................................................................................................................ 4

GENERAL INFORMATION ........................................................................................................................................... 5

LETTERS OF CONSERVATORSHIP .................................................................................................................................. 5

PROTECTED PERSON ............................................................................................................................................................... 5

CONSERVATOR RESPONSIBILITIES ................................................................................................................... 6

ASSETS ................................................................................................................................................................................................ 6

INVENTORY....................................................................................................................................................................................... 8

BOND ..................................................................................................................................................................................................... 9

THE BUDGET ..................................................................................................................................................................... 9

MONIES AND INVESTMENTS ............................................................................................................................................ 10

BANK ACCOUNTS....................................................................................................................................................................... 10

EXPENDITURE AND SALES ................................................................................................................................................ 11

SPENDING MONEY (ALLOWANCE) FOR PROTECTED PERSON............................................................... 13

TAX RETURNS: ............................................................................................................................................................................. 13

RECORDS ...........................................................................................................................................................................13

CANCELED CHECKS ............................................................................................................................................................... 14

RECORD MAINTENANCE DATE ....................................................................................................................................... 14

PARTIAL SETTLEMENTS AND ACCOUNTINGS ..................................................................................................... 14

AVOID THESE SERIOUS MISTAKES........................................................................................................................................... 15

CLOSING THE CONSERVATORSHIP: ................................................................................................................16

CONTACT WITH THE COURT AND ATTORNEY: .........................................................................................17

MODIFICATION OR TERMINATION....................................................................................................................18

REMOVAL OR RESIGNATION OF THE CONSERVATOR ........................................................................18

APPENDIX A......................................................................................................................................................................20

APPENDIX B (EXAMPLE INVENTORY) ..............................................................................................................21

APPENDIX C......................................................................................................................................................................25

EXAMPLE OF RECEIPTS ............................................................................................................................................................ 27

EXAMPLE OF DISBURSEMENTS ......................................................................................................................................... 28

APPENDIX D .....................................................................................................................................................................29

APPENDIX E......................................................................................................................................................................30

APPENDIX F ......................................................................................................................................................................31

APPENDIX G .....................................................................................................................................................................32

APPENDIX H .....................................................................................................................................................................33

3

Revised 1/1/14

INTRODUCTION

You have been appointed Conservator of the estate of someone who is unable

to handle his or her personal financial affairs. The position of Conservator is one of

great trust and responsibility. The Court and the Protected Person are trusting you

to follow the law and to act in the Protected Person’s best interest. Your

responsibilities will require a large time commitment from you.

The Morgan County Probate Court has prepared this handbook to assist you in

performing your duties as Conservator. The needs and circumstances of each person

whom a Conservator serves are unique but the Handbook provides you with general

information on the Conservator’s duties and responsibilities. Most of the information

is based on state law and Court rules. When an issue is not addressed by these

sources, we have tried to establish good policy within the spirit of the law. The duties

and responsibilities included in this handbook may not include all of the duties and

responsibilities required by our Court. It is important to check with your attorney if

you have any questions before taking action.

If you need legal advice or assistance in fulfilling your duties, you should

consult with an attorney who is familiar with Conservatorship procedures. The

personnel of this Court are not permitted to provide legal advice or assist in

completing documents for filing with the Court.

A Conservator is one who preserves, protects and manages the assets of

someone else. That person whose assets you are preserving is called the Protected

Person or Ward. To be a Conservator is a great responsibility. It is most important

that you understand the legal requirements that are placed upon you as a Court

appointed Conservator. The value and importance of retaining an attorney to help

you as you proceed through the Conservatorship cannot be overemphasized.

An important topic of this book is the powers you have as Conservator and the

liability you have to the Protected Person’s estate. Realize even if you have legal

authority, there may be practical problems you encounter in exercising that

authority. Before making decisions, discuss your plans with the Protected Person,

your lawyer and family members, if appropriate. A few minutes of discussion may

prevent hours of dispute and unnecessary legal costs later.

The procedures outlined in this handbook are subject to change without notice.

This handbook references certain sections of the Protective Proceeding Statutes of

Alabama. Statutes are laws that have been enacted by the Alabama State

Legislature. However, statutes are subject to change by the Legislature. If you have

any concerns about the meaning or state of the law, consult with an attorney familiar

with Conservatorship law. The statutes referenced in this handbook, are those in

effect as of March 25, 2013

4

Revised 1/1/14

GENERAL INFORMATION

Being a Court-appointed Conservator is an important and honorable position.

Always be aware of the fact that a Conservatorship is a legal relationship that

involves the Protected Person, the Morgan County Probate Court, and the Courtappointed Conservator.

The appointment of a Conservator marks a profound change in the legal and

social status of the Protected Person.

A Conservator of the estate makes decisions for the management of the estate,

financial affairs, income and property of the Protected Person. These decisions may

include the payment or dispute of bills and the investment of any excess assets.

Alabama law differentiates between a Conservator and a Guardian. A

Guardian makes decisions involving the personal needs of the Protected Person. The

practical responsibilities of a Guardian may include deciding where the Protected

Person will live, how meals and daily care will be provided, how transportation will be

arranged and how health care decisions will be made.

In some cases, both a Guardian and Conservator are needed for both the

Protected Person’s person and estate. The Court does not require these roles to be

filled by the same person. One person can serve as Guardian and another person

can serve as Conservator of the estate. In cases where there are separate

Conservators and Guardians a lot of communication is required to ensure the best

interest of the Protected Person is maintained. Due to overlapping duties it is often

easier if one person serves as both Guardian and Conservator.

LETTERS OF CONSERVATORSHIP

The Conservator will be issued Letters of Conservatorship to show that the

Conservator is authorized to act as the Conservator.

Additional copies of the Letters of Conservatorship can be obtained from the

Probate Court as needed. The Conservator should carry a copy of the Letters of

Conservatorship at all times. Most banks, credit unions, investment firms, and

mortgage companies will want to see a copy of the Letters of Conservatorship before

you can act on behalf of the Protected Person.

PROTECTED PERSON

The person for whom a Conservator is acting is referred to as the “Ward.” More

recently, the term “Protected Person” has come into use throughout the United

States.

The Protected Person is the person for whom a Guardian and/or Conservator is

5

Revised 1/1/14

appointed. The appointment of a Conservator or other protective order is made if the

Court determines that the person is unable to manage property and business affairs

effectively for a variety of different reasons including being a minor.

CONSERVATOR RESPONSIBILITIES

The Court has jurisdiction over all Conservators. The Court has delegated

certain powers and duties to the Conservator. The Conservator is responsible to the

Court and must obey all orders of the Court. The Court may remove a Conservator

who fails to obey any order of the Court.

The Conservator of the person has many duties and responsibilities. The

Conservator is responsible for knowing what these requirements are and must be

prepared to fulfill them from the very beginning of the Conservatorship.

A Conservator by law, “shall observe the standards in dealing with the estate of

the protected person that would be observed by a prudent person dealing with the

property of another, and if the Conservator has special skills or is appointed

Conservator on the basis of representations of special skills or expertise, the

Conservator is under a duty to use those skills.” See section 26-2A-145 of the Code

of Alabama (1975) as amended.

As Conservator, you will manage and use the Protected Person’s property for

his or her benefit. You must:

(1)

Determine the Protected Person’s Assets and take control of the

property and make sure that it is adequately protected against loss;

(2)

Establish (in consultation with the guardian of the person and/or

your ward) a budget;

(3)

Pay the ward’s debts as they become due;

(4)

Invest the property in investments suitable to your ward’s

circumstances; and

(5)

Annually report to the Court about the assets, receipts and

disbursements of the estate.

ASSETS

The primary job of the Conservator is to protect and conserve the assets of the

Protected Person. The first job of the Conservator is to identify what the Protected

Person owns and arrange for transfer of title into the conservatorship estate’s name.

The Protected Person’s property may include cash, uncashed checks, bank accounts,

stocks, bonds, notes receivable, partnership interests, life insurance policies, real

estate, furniture, jewelry, automobiles and the right to receive payments from the

government, insurance companies, employers and trusts.

The Conservator should also decide whether other people hold property that

belongs to the Protected Person. For example, the Protected Person may have loaned

to others furniture, artwork or other items, and it is necessary for the Conservator to

decide whether such items should be reclaimed. The Conservator may want to take

6

Revised 1/1/14

photographs of all the Protected Person’s valuable personal and household effects for

insurance purposes.

Family members or friends of the Protected Person may have had existing

informal arrangements about use or possession of certain real or personal property

among them. These agreements or arrangements may be interrupted by the formality

of a conservatorship. Exercise both diplomacy and diligence in attempting to

determine whether particular properties are rightly included in the Conservatorship

Estate. It may be helpful to use a letter to request return of property or clarification

regarding legal ownership.

Once the Conservator has identified personal property assets belonging to the

Protected Person, the Conservator has a responsibility to place all personal property

assets in safekeeping.

Property that is co-owned with another person (such as a joint bank account)

or co-controlled by another person acting under a power of attorney creates special

problems. If the only other owner is the Protected Person’s spouse, The Conservator

(with the help of an attorney) should determine whether the funds are community

property. Joint tenancy accounts also have an effect on the estate plan of the

Protected Person, and the Conservator must take the Protected Person’s estate plan

into account when investing or selling assets and paying the Protected Person’s bills.

The Conservator will need to determine the Protected Person’s intent for using

joint tenancy accounts and whether the other joint tenant contributed any part of the

account. Before dividing or closing a joint tenancy account, the Conservator should

consult with an attorney familiar with Conservatorships.

The Conservator should get the title to the Protected Person’s automobile and

make sure that no unauthorized person drives it. No one should drive the automobile

unless it is adequately insured. If the Conservator decides to store the automobile in

a garage, remember to keep the registration current.

Automobiles, real estate and household effects, should be insured. Real

property should be insured against fire, theft and other hazards (for its replacement

value), as well as liability to third parties (including workers’ compensation claims of

household help). The Conservator may insure the property of the Protected Person

without prior Court approval.

The Conservator should also consider canceling charge accounts and credit

cards issued in the Protected Person’s name to make sure that no one can make

unauthorized purchases. It is also recommended that you give notice to the credit

agencies to place a freeze on opening up new credit accounts. (See Appendix H)

7

Revised 1/1/14

INVENTORY

After identifying all of the Protected Person’s assets the next task of the

Conservator is to determine the size and the make up of the Protected Person’s assets

that will be protected and preserved. This is done by completing and filing a written

inventory with the Court within 90 days of appointment. Failure to file the

inventory within 90 days can result in the removal of the Conservator.

The inventory is a mechanism for listing all assets of the estate. Estate assets

may be of two kinds: real property and personal property. Real property means land

and improvements thereon. Personal property means all other things such as cash,

either on hand or in a bank; stocks and bonds; certificates of deposit; automobiles;

trailers; boats; furniture; silverware; antiques; jewelry, etc. In addition to listing all of

the assets, you must provide an approximate value for each asset. This inventory

should be amended or updated if any additional real or personal property comes into

your possession or knowledge.

Stock should be valued as of date of the Conservator’s appointment at the

closing value for the stock on whatever stock exchange the stock is traded Savings

bonds should be valued at their face value. The date of issuance should also be

listed. Life insurance policies should be valued at both their face value and any cash

value. Most policies, which have a cash value, contain a chart as part of the policy.

This chart can be used to determine the cash value for the policy.

Vehicles should be valued using the average of the retail (high) and wholesale

(low) value for the vehicle for the month the conservator is appointed. These values

can be obtained from vehicle valuation guides such as the National Auto Dealers

Association (NADA) guide or website at www.nada.com or Kelly Blue Book or website

at www.kbb.com.

The Conservator may estimate the value of furniture, but a qualified appraiser

must appraise antiques.

The Inventory shall contain the legal description and parcel number of all real

estate included in the inventory. Real estate may be valued at the value on the

county property tax records. The guardian can obtain this information from the

revenue commissioner’s office if a copy of the tax bill cannot be located

(www.morgancountyrevenue.com). Real estate is not required to be appraised or

bonded unless the Protected Person’s real estate is to be sold.

Attached hereto as Appendix A is a sample list of assets to look for in preparing

your inventory. Attached hereto as Appendix B is an inventory form that can be used

once you have been appointed the Conservator and which you will file with the Court

as stated above.

8

Revised 1/1/14

BOND

Before you can ever act as a Conservator, you must file a bond with the Court.

The Bond amount is determined by the value of the assets in the Estate of the

Protected Person. Upon filing of the initial Inventory of Assets the bond must be one

and one-half (1½) times the amount of the personal property in the Estate of the

Protected Person.

A bond is protection for the Protected Person from losses you may have caused

by your conduct as Conservator. The bond premium must be paid when the bond is

executed, and in most cases there will be a premium due each year thereafter until

the Estate is closed. Failure to pay the bond premium when due, is grounds for the

Court to remove the Conservator from his/her responsibilities.

After the Conservatorship is opened it is possible that new or additional items

or funds belonging to the Estate may be found, or the security upon which the

present bond is based, is discovered to be insufficient. In that event, The

Conservator must notify the Court immediately and thereafter increase the amount of

bond required to reflect that the amount is one and one-half (1½) the new or

enhanced value of the Estate of the Protected Person.

Should the Conservator make any unauthorized disbursements, dispose of

assets inappropriately, or otherwise fail to administer the Conservatorship estate in

accordance with legal requirements, the bond is a type of surety whereby the Court

tries to insure that the Protected Person will not lose his assets. This does not mean

that the conduct of the Conservator will be overlooked. The bonding company will

reimburse the estate of the Protected Person. The bonding company may pursue the

Conservator to obtain repayment of all monies the company had to expend because of

the misconduct. In addition, the company will also seek attorney’s fees from the

Conservator.

It will cost money to obtain the bond and the amount will vary depending on

the size of the bond. The assets of the Conservatorship estate may be used to pay for

this bond. Once the bond is filed with the Court and approved, you will be sent

“Letters of Conservatorship.” Once you have Letters of Conservatorship from the

Court, you are then entitled to act as a Conservator for the Protected Person.

THE BUDGET

One of the duties of a Conservator is to establish a budget for the Protected

Person. The budget should be prepared with the assistance of the Guardian and the

Protected Person if possible. The budget should project income from all sources

including income from investments and employment and income from the

government, insurance companies, (former) employers and trusts. Some income,

such as Social Security payments and Veteran’s benefits, may be recurring.

The budget should also project housing, food, clothing, personal care, in-home

assistance, medical care, transportation, insurance, utilities, taxes, entertainment

Revised 1/1/14

9

and estate administrative fees (including attorney’s fees). Many expenses such as

those for housing, utilities, water, sewer, garbage, etc., will also be recurring.

Other items to be considered in creation of the initial budget include the

upcoming health and care needs and expenses and possible sources of funds for

such expenses including the use of principal and income derived from investment

accounts and possible funds received from the sale of a residence, vehicle, or other

assets.

In establishing a budget, you should remember your sole responsibility is to

the Protected Person. You should not deprive The Protected Person of a reasonable

item merely to allow his or her heirs to inherit more property. Your responsibility is to

the Protected Person, not to the heirs.

MONIES AND INVESTMENTS

A Conservator must manage the Protected Person’s estate prudently and

should avoid risky investments. The safety of the investment is more important than

receiving a high rate of return. A Conservator may never invest the Protected Person’s

money, also known as “estate Funds” in individual stocks, mutual funds or other

volatile securities. It is absolutely prohibited for the Conservator to invest the

Protected Person’s money in any security that is not federally insured and backed.

The Conservator is required by law to keep all of the estate funds in federally

insured securities, which are defined as treasury bills, certificates of deposit, or

savings and checking accounts, which are insured by the FDIC or NCUA. This

means that even if the Conservator thinks an investment might be a good idea, they

are not permitted to invest the Protected Person’s money unless the security is

federally insured so as to protect the principal. If there are any questions as to

whether or not an investment opportunity meets this guideline, make certain to

check with an attorney that is familiar with Conservatorships to see if the investment

is permissible.

If the Court later decides that you invested unwisely, you may have to repay

any loss.

If a Protected Person already has investments in individual stocks, mutual

funds or other securities prior to becoming incapacitated, those funds may be

allowed to remain invested in those accounts. Seek advise from your attorney

concerning these type accounts.

BANK ACCOUNTS

The Conservator must open and maintain a separate bank account for the

estate funds. A Conservator may never co-mingle the Protected Person’s assets

with his/her own money or that of any other person. For this reason, The

Conservator may not use his/her own bank account for depositing the Protected

Person’s money.

10

Revised 1/1/14

Conservators should put the Protected Person’s money in separate checking

accounts, savings accounts, or CD’s. If the Conservator wishes to put the Protected

Person’s money into any other type of account, the Conservator should contact an

attorney the is familiar with Conservatorships and/or receive permission of the Court

before doing so. All bank accounts that are opened for the Protected Person must

meet the same legal standards as investments so that the principal is always secure.

This means that the accounts opened must be with banks or credit unions that have

FDIC or NCUA insured checking and savings accounts.

Property belonging to the Protected Person (i.e., bank accounts, investment

accounts, automobiles, homes, etc.) may need to be retitled or registered in the name

of the conservatorship, but never in the Conservator’s name only. As an example, the

bank account or deed may read as John Doe, Conservator for Jane Smith. It is also the

Conservator’s responsibility to provide the Protected Person’s Social Security number

to any bank or investment firm so that any earned interest will be properly reported

to the Internal Revenue Service.

No accounts opened by the Conservator should have a POD (pay on death)

or beneficiary other than “The Estate Of” the Protected Person without Court

permission.

EXPENDITURE AND SALES

In general, Conservators must expend the estate funds only for the benefit of

the Protected Person. Conservators may not generally expend the Protected Person’s

money to benefit other family members without prior Court approval. See Alabama

section 26-2A-152 Code of Alabama (1975), as amended, for the full powers of a

Conservator in administration of the protected person’s estate.

A Conservator is responsible for applying the protected person’s income and

principal as needed for his or her support, care and health; as well as habilitation,

education or therapeutic needs. When making these financial distributions, the

Conservator must adhere to the following important considerations:

Exercise authority only to the extent necessary because of the

Protected Person’s limitations.

Whenever feasible, encourage the protected person to participate in

decision making, to act on his or her own behalf, and to develop or

regain the capacity to manage the estate and his or her financial

affairs.

Consider the express desires and personal values of the protected

person when making decisions on his or her behalf.

Act in the Protected Person’s best interest and exercise reasonable

care, diligence and prudence.

A Conservator may expend or distribute income or principal of the estate

without Court authorization or confirmation for the health, support, education, or

11

Revised 1/1/14

maintenance of the protected person and dependents in accordance with the

following principles: (see section 26-2A-153 Code of Alabama (1975), as amended):

The Conservator shall consider recommendations relating to the

appropriate standard of support, education, and benefit for the

protected person or dependents made by a parent or guardian, if any.

The Conservator shall expend or distribute sums reasonably necessary

for the health, support, education, or maintenance of the protected

person and dependents with due regard to

The size of the estate, the probable duration of the

Conservatorship, and the likelihood that the protected person,

at some future time, may be fully able to be wholly selfsufficient and able to manage business affairs and the estate;

The accustomed standard of living of the protected person and

dependents; and

Other funds or sources used for the support of the protected

person.

If there are any questions about spending the Protected Person’s money, check

with an attorney familiar with conservatorships before making the expenditure.

A Conservator cannot dispose of any real property, including land in another

state, for cash or on credit, at public or private sale, and manage, develop, improve,

partition, or change the character of real estate property; Subdivide, develop, or

dedicate land or easements to public use; make or obtain the vacation of plats and

adjust boundaries without prior Court approval.

The Conservator may not require prior Court approval to sell personal and

household effects. There may, however, be notice requirements that need to be met.

If the Conservator wishes to sell any estate asset, make certain to confer with an

attorney familiar with conservatorships and have him/her file the appropriate

petition seeking the Court’s permission before selling the estate asset to make sure

you will not be held personally responsible for any loss that results from the

improper sale of personal property.

If a Conservator decides to dispose of the property, do not just distribute it

among family members, even if they will inherit the property after the death of the

Protected Person. The Court looks upon the disposal by gift or sale of any real or

personal property belonging to the Protected Person to the Conservator, to anyone

associated to or related to the Conservator, with great scrutiny. Therefore, exercise

great caution and diligence when disposing of any asset of the Protected Person.

If the conservatorship is for a minor, additional rules apply. The minor child’s

parents still have their normal obligation to provide for the support of their child.

Therefore, conservatorship assets are not available to meet the normal needs of

the minor child unless the parents prove that that they cannot for good reason

afford these needs. The Court may require the parents to submit a summary of their

income and expenses (i.e., federal and state tax returns) to verify that the parents

cannot afford to meet the support needs of their minor child. If the parents have the

12

Revised 1/1/14

ability to care for the child, the conservatorship funds are to be invested and held for

the minor until he or she turns nineteen years of age.

Court approval is required before a Conservator reimburses him or herself from

the Conservatorship estate expenses, unless the Court has previously authorized the

expenses.

SPENDING MONEY (ALLOWANCE) FOR PROTECTED PERSON

Sometimes a Protected Person retains the right to manage and spend small

amounts of money on things of their own choosing such as cigarettes or incidentals.

This action requires prior Court approval. In such event the Conservator will need to

establish a system for the Protected Person to have access to and to be able to spend

such funds. One option might be a prepaid debit card. Another option might be to

deliver the Protected Person a certain sum of money on a regular basis such as

weekly or bi-monthly.

TAX RETURNS:

The Conservator is responsible for preparing and filing any required state and

federal tax returns on the Protected Person throughout the period of the

Conservatorship. The Conservator should gather and keep all records pertaining to

the Protected Person’s income, deductions and taxes, in order that such returns, if

required, can be promptly and accurately filed.

RECORDS

A Conservator must keep detailed records of all financial activity on behalf of

the Protected Person. This means keeping a detailed record of all income received by

the Protected Person and a record of all disbursements paid out on behalf of the

Protected Person during the Conservatorship. The Conservator must also obtain and

keep all bank statements and evidence of canceled checks for any checking accounts

opened for the Protected Person; a copy of all statements from any savings accounts

or statements concerning any CD’s that were opened on behalf of the Protected

Person. The Conservator must keep copies of all receipts showing disbursements of

the Protected Person’s money. The Court generally does not approve cash or

debit card expenditures by conservators that do not show how the money was

spent.

The Conservator is also required to keep records of all non-cash assets such as

personal tangible property (furniture, jewelry, silverware, etc.); all real property; all

insurance policies in effect on the Protected Person’s life; any burial policy owned by

the Protected Person; and any other property owned by the Protected Person that is

not in the form of cash. The Conservator must take action to preserve these

properties.

13

Revised 1/1/14

CANCELED CHECKS

The Conservator must open and maintain a checking account for the Protected

Person with a bank that will return to you the original canceled checks each month

or provide statements with “thumbnail” images of canceled checks. When it is time

to do a partial settlement and accounting as explained below, the Court requires you

to produce original canceled checks, bank copies thereof showing both the front and

the back of each canceled check, or bank copies of thumbnail images.

RECORD MAINTENANCE DATE

It is essential to begin the Conservatorship with a record keeping system in

place. If you follow the record keeping tips in this handbook, it will be easier for you

and your lawyer to prepare reports required by the Court. The importance of

keeping complete records can’t be overstated. Conservators often regret not

setting up and adequate record-keeping system from the beginning, because trying to

piece together the information later from memory and old bank statements is difficult

and time consuming, and it may be expensive as well. The Court has the authority to

make you pay for this added expense out of your own pocket. Attached hereto as

Appendix C are examples of the type of record keeping system you are encouraged to

use.

PARTIAL SETTLEMENTS AND ACCOUNTINGS

All Conservators are required each year to file with the Court a complete

accounting of their activities to prove to the Court’s satisfaction that they have

properly handled the Protected Person’s estate assets, unless otherwise ordered. It is

at this time, that all of the records that have been kept, must be made available by

the Conservator for review by the Court. An accounting summary (See Appendix C)

should be filed with all accountings.

The accounting must include a comprehensive accounting of all receipts by the

estate; all disbursements by the estate; and all balances on hand at the time of the

accounting, investment transactions, disposition and acquisition of assets, gains or

losses on sale of assets and changes in value of assets. Every accounting should

include the original bank statements and the original canceled checks or thumbnail

copies of the front sides of canceled checks to support the accounting. Every

accounting should include all receipts for the expenditures that have made from the

conservatorship’s funds. This is the reason why record maintenance is so important

and why it is imperative to keep good records from the very beginning of the

Conservatorship.

Every item of income and every expenditure must be described in your records and in

the accounting, showing the following about each transaction, in addition to its date

and its amount:

■ To whom a disbursement was paid, or from whom income was received

14

Revised 1/1/14

■ The time period covered by the payment (example: “Rent for May 2002”)

■ The purpose of the expenditure (example: “Clothing for the Protected Person”)

The first accounting commences with the total estate figure shown on the

inventory, appraisal and record of value. The first account and report must also be

accompanied by original bank statements showing the account balance of each of the

Protected Person’s bank accounts immediately before the date you were appointed

conservator. (That is, the date of the court’s order appointing you, not the date that

your Letters of Conservatorship were issued.) If your account and report shows a

balance for any bank account different than the balance shown in the bank’s

statement for that account, you must explain the differences in your accounting or in

your report.

Each subsequent accounting commences with the total property of estate

figure from the prior accounting.

As a part of the annual accounting the Conservator may be required by the

Court to produce a copy of the latest credit report of the protected person to ensure

the Court that no funds have been borrowed under the Protected Person’s name by

the Conservator.

The Court may disallow any expenditure, which cannot be verified by a

cancelled check or other receipt, and the Conservator may personally be required to

repay these funds to the conservatorship. If the Conservator fails to repay the funds,

the Conservator may be removed and his/her bond forfeited.

The Court may remove the Conservator if an accounting is not filed on time. If

the Conservator fails to file an accounting on time a Court date will be set to

determine if the Conservator should be removed. If the Conservator fails to appear

before the Court, the Conservator is subject to removal and his/her bond forfeited.

If the Protected Person is receiving VA benefits, The VA is always a party in

interest to any partial or final settlements. The failure to have the VA approve partial

settlements could result in the VA removing the benefits of the Protected Person.

Also, the VA has its own accounting system that should not be confused with the

Probate Court. These accounting are separate and distinct. Approval by one doesn’t

necessarily mean approval by the other.

AVOID THESE SERIOUS MISTAKES

Never mix your own investments and money with the Protected Person’s.

Even though it may seem convenient at the time to deposit a check made out to the

Protected Person into your own bank account, it could get you into trouble. The

Protected Person’s assets should be kept in accounts in your name as conservator of

the estate, using the Protected Person’s social security number.

15

Revised 1/1/14

Do not manage the conservatorship estate so that you or your family or

friends profit from it. For example, if you were to sell the Protected Person’s car to

your son for less than what it was worth without getting a judge’s approval, you

would be violating your duty as conservator of the estate. Similarly, you may not give

your friends the Protected Person’s furniture or other possessions, nor may you move

into the Protected Person’s home without paying fair rent.

Never borrow money from the estate. You must not use estate funds or the

estate’s credit to get loans or credit for yourself, even if you will inherit the estate

when the Protected Person dies.

Do not give yourself or anyone else a gift from estate funds without

getting a judge’s approval first.

CLOSING THE CONSERVATORSHIP:

A Conservatorship of the estate of a minor child ends on the minor’s nineteenth

(19th) birthday. However, the Conservator of the estate of a minor is required to file a

final accounting. This final accounting must show that the remaining assets of the

conservatorship have been turned over to the former minor.

A conservatorship of the person or estate of an incompetent adult can be

terminated for four reasons.

(1)

The conservatorship is terminated if the Protected Person dies.

(2)

The conservatorship is terminated if the adult Protected Person is

determined by the Court to be competent.

(3)

The conservatorship may be terminated, as to the Conservator, if the

Conservator resigns, dies, or is removed by the Court.

(4)

The conservatorship of the estate may be terminated if all of the

Protected Person’s assets have been properly spent.

In all of these cases, the Conservator of the estate must file a final accounting.

If a protected person dies, the conservator may NOT make any further

distributions from the conservatorship. The Conservator may not pay the Protected

Person’s funeral expenses if they have not been pre-paid. The Conservator must

notify the Court of the Protected Person’s death as soon as possible. Within 90 days

of the death of the Protected Person, the Conservator must file a final report and/or

accounting with the Court. The Conservator of the estate is required to file a final

accounting and deliver any remaining assets to the person appointed by the Court as

the Executor, Administrator or Personal Representative of the Protected Person’s

probate estate.

At such time as the Conservatorship is due to be ended, you must take

responsibility for filing a petition with the Court to conclude the

Conservatorship. If the Conservatorship estate runs out of funds, the Conservator

still must move to close the estate. Please note, the Conservator is responsible for

closing the estate even if there are no funds to pay legal counsel and costs of Court.

16

Revised 1/1/14

This means that the Conservator may have to expend personal funds to pay for the

closing of the estate.

If there are funds left in the Conservatorship estate, those funds may be used

to pay legal counsel and costs of Court for the closing of the Conservatorship.

NOTE: The Conservator is liable to the Court and the Protected Person or the

Protected Person’s Estate until a final settlement has been filed with the Court.

If a final settlement is not filed with the Court in a timely manner, the Court

may order the Bonding Company to close the Conservatorship and the cost of

which may be charged back to the Conservator.

CONTACT WITH THE COURT AND ATTORNEY:

It is important that the Conservator maintain contact with an attorney familiar

with Conservatorships to ask questions concerning the performance of duties during

the Conservatorship. This is especially true when preparing to file partial settlements

with the Court, expending funds from the Conservatorship, or selling any assets of

the Conservatorship. Make certain that you notify your attorney of any change of

address or phone number throughout the time of your Conservatorship.

An attorney for the Conservator may be paid out of the estate of the protected

person, as long as attorney’s fees are reasonable and the work is necessary and

beneficial to the conservatorship. However, before a Conservator may use

Conservatorship funds to pay the attorney for services provided, the Court must

approve attorney’s fees. An attorney familiar with the proceedings should be willing

and able to seek Court approval for his or her fees on the Conservator’s behalf.

Throughout the Handbook there have been suggestions about when a

Conservator may find it helpful to seek the advice of an attorney, or have an attorney

assist the Conservator with Court matters, including:

Producing, filing and presenting a Court-required report;

Recovering property belonging to the Protected Person;

Seeking Court authority for payment of fees to the Conservator,

Conservator’s attorney or other professionals who perform services for the

benefit of the conservatorship;

Seeking Court authority to gift, sell, lease, mortgage, or grant an easement,

license or similar interest in any of the real property of the Protected Person;

Seeking Court authority to gift, sell, donate or dispose of personal property

of the Protected Person;

Seeking Court authority to make any major changes in the form of the

protected person’s assets;

Seeking Court authority to compromise a claim against or debt of the

conservatorship estate;

Seeking Court authority to perform other actions that are not listed or

described in the original order appointing the Conservator;

17

Revised 1/1/14

MODIFICATION OR TERMINATION

Because of reporting requirements of the conservator and the law’s interest in

maximizing the autonomy of incapacitated persons, no conservatorship is

“permanent” or intended to remain in the same form indefinitely. However, most

conservatorships are perpetual as long as the Protected Person remains legally

incapacitated, the Conservator performs its statutory and Court-ordered

responsibilities, and reporting requirements are fulfilled.

Nonetheless, Conservatorships are frequently modified or terminated, based

upon the changed needs of the incapacitated person or formerly incapacitated

person. A Court order is required to modify or terminate a conservatorship. Any

person, including the protected person, may petition the Court to modify or terminate

a conservatorship, or to replace a Conservator. The Court may order the modification

or termination of a conservatorship for good cause only.

Conservatorships may be modified because:

The protected person has gained capacity to adequately manage some or

more (but not all) of his or her personal and/or financial affairs;

The protected person has gained capacity sufficient to execute an appropriate

less restrictive alternative, but still requires the support and assistance that a

guardian provides;

Other good cause, as determined by the Court.

REMOVAL OR RESIGNATION OF THE CONSERVATOR

Conservators are subject to the ongoing supervision of the Court in the county

in which the conservatorship was created. One purpose of the requirement that

Conservators regularly report to the Court is to ensure that the conservatorship

continues to meet the needs of and maximize the autonomy of the Protected Person.

If the Conservator fails to file reports as required the Conservator is removed, the

Conservator remains legally liable for actions unlawfully taken on behalf of the

Protected Person.

The Court may remove a Conservator for a number of reasons that include:

illness, incapacity or inability to perform duties; wasting or mismanaging the estate;

unreasonably withholding distributions or making distributions in a negligent or

reckless manner; abusing powers or failing to discharge duties; failure to file

accountings or comply with Court orders; failure to file sufficient bond after being

ordered to do so; not acting in the best interest of the protected person or of the

estate

A Conservator may wish to resign even though the conservatorship continues

in effect. A Conservator must petition the Court for permission to resign and have a

successor Conservator appointed by the Court. A Conservator who receives the

Court’s permission to resign or who is removed by the Court must provide all records

18

Revised 1/1/14

and property of the conservatorship to the Court and/or the successor Conservator,

as ordered by the Court and file an accounting within 30 days of the Court Order

terminating the appointment.

Upon the termination of any conservatorship for any reason, the Conservator

must file a final report and/or account with the information and petition the Court

for approval of the report. The Conservator is liable for all actions taken until a final

accounting has been filed, the Court officially approves the final accounting, and the

Court discharges the Conservator.

It is important that the Court be able to find you at any time during the

Conservatorship. If you change your address, you are required to notify the

Probate Court by sending a written notice of the change of address to the

Probate Court of Morgan County at P. O. Box 848, Decatur, AL 35602. In your

notice, you must give the name of your Protected Person and their address.

This will allow the Court to make certain that its records correctly show your

change of address.

Thank you for your review of this document.

Greg Cain, Judge of Probate

19

Revised 1/1/14

APPENDIX A

Assets to Look for in Preparing Inventory

Cash on hand and belonging to the Ward’s estate

Uncashed checks and refunds

Deposit(s) in bank(s), savings and loan association(s), brokerage house(s), credit union(s),etc.;

(XYZ Bank, Checking Account No. 12-345-67)

(ABC Credit Union, Certificate of Deposit $777-7777)

Stocks

Bonds

Promissory notes

Partnership interest

Other business interests

Life insurance policies - payable to Estate

Group life insurance payable to Estate

Furniture

Antiques

Artwork

Jewelry

Chinaware

Silverware

Valuable collections (paintings, oriental rugs, coins, stamps, books, manuscripts, etc.)

Vehicles (automobiles, trucks, vans, etc.) Include description, VIN and current tag number

Safe Deposit Box - location and property description (list items having special value)

Real estate - location and property description (metes and bounds or by map book and page

reference)

Liabilities to Look For

Notes payable to banks

Notes payable to others

Real estate mortgages payable

Accounts payable

Unpaid income taxes: federal, state

Unpaid property taxes

Other liabilities

20

Revised 1/1/14

APPENDIX B (Example Inventory)

As Conservator, Alabama Law requires you to file an inventory listing all assets which belong to the

Protected Person. If you have any questions, please contact your attorney. The inventory should

contain, Cash Assets, Personal Property, Real Property and Income

INVENTORY OF ESTATE

PROBATE COURT OF MORGAN COUNTY

In the Matter of the Conservatorship of:

PART A CASH ASSETS

Item No.

)

(Add pages as necessary)

Description

Value

1. Cash found at 121 View Place, Decatur, Alabama,

Protected Person’s residence

$250.00

2

$7392.38

Balance in checking account No. 12345, Decatur, AL 35601

3. Balance in savings account No. 14654, Redstone Federal Credit

Union, Decatur, AL 35601

$37,747.04

4. Certificate of Deposit No. 1765432, Hometown Federal Bank,

900 Washington Blvd., Huntsville, AL 90083, in the name of

Joe Smith and Jane Smith (deceased) as joint tenants

$10,000.00

5. Uncashed check from Pension Fund, dated 3/1/90, payable to

Protected Person

$554.47

6. Uncashed check from Social Security dated 3/1/90, payable to

Protected Person

$498.00

7. Uncashed dividend check from Safeguard Investment Mutual

Fund, dated 3/2/90, payable to Protected Person

TOTAL CASH ASSETS:

21

$352.70

$56,794.59

Revised 1/1/14

PART B PERSONAL PROPERTY

(Add pages as necessary)

Description

Appraised Value

Household furniture and furnishings at 121 View Place,

Decatur, AL

$___________

1425 shares Safeguard Investment Mutual Fund

$___________

One $50 U.S. Savings Bond, Series E, issued May 3, 1950

$___________

Seven $100 U.S. Savings Bonds, Series EE, issued May 2, 1955

$___________

1994 Oldsmobile Cutlass Supreme, 2-door model, California

vehicle license No. 822HUD

$___________

Diamond wedding ring (2 carat)

$___________

U.S. President Coin Collection

$___________

Antique Coffee Table

$___________

TOTAL PERSONAL PROPERTY ASSETS:

$_____________

PART C REAL PROPERTY

Item No.

(Add pages as necessary)

Description

Appraised value

1.

Residence. 1111 Gold Rush Lane, Decatur, AL. More

particularly described as follows:

Lot 36, Heavenly Subdivision to Decatur, Alabama as shown

by Map book 1, page 1 & 2, in the Office of the Judge of

Probate of Morgan County, Alabama, situated, lying and

being in the City of Decatur, County of Morgan, State of

Alabama.

$_________

2.

Lake home. 2222 Co. Road 333, Cullman, AL. More

particularly described as follows:

A tract of land containing 1.76 acres, more or less,

situated in the NW1/4 of the SW1/4 of Section 13,

T6S., R5W., Union Hill, Cullman County, Alabama being

more particularly described as follows:

$

TOTAL VALUE OF REAL PROPERTY

$___________

PART D

INCOME

SOURCE

AMOUNT

FREQUENCY

TOTAL ANNUAL INCOME

Guardian/Conservator

CERT IFICAT ION

I the undersigned Conservator do hereby state under oath or affirmation

that the information provided in the foregoing inventory is true and correct to

the best of my knowledge, information and belief.

Signed this ___________ day of ___________________, 20_____.

____________________________________

Conservator

I,

the

undersigned,

Notary

Public,

hereby

certify

that___________________________________ whose name is signed to the

foregoing instrument, and who is known to me, acknowledged before me on

this day that, being informed of the contents of the instrument, he / she

executed the same voluntarily on the day of the same bears date.

Given under my hand and Official seal this ________ day of ______________,

2______.

___________________________________

Notary Public

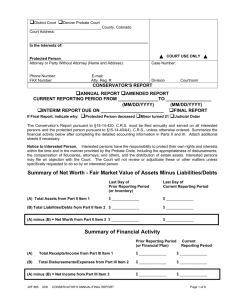

Appendix C

ACCOUNTING SUMMARY

MONEY ON HAND AT START OF

ACCOUNTING PERIOD . . . . . . . . . . . . . . . . . . . . . . $

MONEY RECEIVED DURING

ACCOUNTING PERIOD . . . . . . . . . . . . . . . . . . . . . . $

TOTAL . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

MONEY DISBURSED DURING

ACCOUNTING PERIOD . . . . . . . . . . . . . . . . . . . . . . $

BALANCE OF MONEY ON HAND AT END OF

ACCOUNTING PERIOD . . . . . . . . . . . . . . . . . . . . . $

TOTAL VALUE OF REAL PROPERTY ON HAND

AT END OF ACCOUNTING PERIOD………………. $

TOTOAL VALUE OF NON-CASH ASSETS ON

HAND AT END OF ACCOUNTING PERIOD……… $

ASSETS ON HAND TO REFLECT ABOVE BALANCE: CD’S, STOCKS, BONDS,

BANK ACCOUNTS

TYPE

FINANCIAL INSTITIUTION

AMOUNT

STATE OF ALABAMA

MORGAN COUNTY PROBATE COURT

I,

,

solemnly

swear

that

the

foregoing accounting of the estate of

exh

ibits a full, true and just statement of each and every asset of said estate with which

I should be charged, and to the expenditures to which I am entitled, to the best of

my knowledge and belief, so help me God.

Signed this ___________ day of ___________________, 20_____.

____________________________________

Conservator

I,

the

undersigned,

Notary

Public,

hereby

certify

that___________________________________ whose name is signed to the

foregoing instrument, and who is known to me, acknowledged before me on

this day that, being informed of the contents of the instrument, he executed

the same voluntarily on the day of the same bears date.

Given under my hand and Official seal this ________ day of ______________,

2______.

Notary Public

Commission expiration date

(SEAL)

EXAMPLE OF RECEIPTS

SCHEDULE A—RECEIPTS

AMOUNTS

DATE OF RECEIPT

Rental Income—121 View Place, Decatur, AL

8/1/12 through

3/1/13

Miscellaneous

8 months at $800.00 each

$6400.00

Receipts

8/20/11

Social Security

Administration,

Medicare Part B refund.

5/10/12

State of Alabama,

2000 state income tax

refund.

6/28/12

American Health,

insurance reimbursement for

prescription.

TOTAL MISC.

SOCIAL SECURITY BENEFITS

4/1/12—6/1/12,

3 mos. at $757.00 each

7/1/12—12/1/12, 6 mos. at $772.00 each

1/1/13—3/2/13,

3 mos. at $788.00 each

TOTAL SOCIAL SECURITY

$ 13.21

$ 97.00

$ 44.12

$ 154.33

$ 2,271.00

$ 4,632.00

$ 2,363.00

$ 9,266.00

EXAMPLE OF DISBURSEMENTS

Add as many pages as needed. Each disbursement should be individually listed

including a reason for the disbursement.

Date

2012

Payee and Purpose

Amount

3/9

Medicare Ambulance:

Transport from rehab to nursing home.

$ 60.00

3/15

Tax Preparers, Inc.:

Preparation of Protected Person’s

1999 income tax returns.

Downey Savings Bank:

February and March payments on loan secured by

first trust deed on Newport Beach real

property, and late fee for February payment.

3/20

3/29

$ 300.00

2,450.00

John Doe (conservator):

Reimbursement for payment of first year’s

bond premium.

Best Care Convalescent Hospital:

Care of Protected Person, to 3/25.

3,987.40

4/2

Downey Savings Bank:

April loan payment, Newport Beach home.

1,200.00

4/11

Jared Roberts, Esq. (conservator’s attorney),

reimbursement of costs advanced

4/12

AT&T,

4/20

Protected Person’s telephone for March, 2012

Comfort-Fit fashions

4/1

4/30

Clothing for Protected Person

Internal Medicine Group

Medical Care for Protected Person

5/16

Dr. I.C. Better

Ophthalmologist’s Exam for Protected Person

5/20

Kroger

2 week supply of groceries for the Protected

Person

TOTAL DISPURSEMENTS

235.00

$239.50

$50.34

$131.15

$260.00

$200.00

$150.00

$9263.39

APPENDIX D

SAMPLE LETTER CANCELING CREDIT CARD OR CHARGE ACCOUNT

[Insert your address]

[Insert the date]

[Insert the Bank/Company name]

[Insert the Bank/Company address]

Re:

Conservatorship of [Insert Protected Person’s name], a protected person

Account No. [Insert number]

Dear Sir/Madam:

I have been appointed Conservator for the above-named account holder. Enclosed is a certified

copy of the Letters of Conservatorship issued by the Probate Court of Morgan County.

I am requesting that you immediately cancel the account so no further charges may be made.

Thank you for your assistance in this matter.

Sincerely,

[Insert your name],

Conservator

APPENDIX E

SAMPLE LETTER TO BANK

[Insert your address]

[Insert the date]

Operations Officer

[Insert Bank name]

{Insert Bank address]

Re:

Conservatorship of [Insert Protected Person’s name], a protected person

Dear Sir/Madam:

I have been appointed Conservator for the above-referenced person. Enclosed is a certified

copy of my Letters of Conservatorship.

Please review your records to determine whether the above-referenced person has any accounts

or safe deposit boxes at any of the branches of your institution. If so, please inform me of the

account numbers, the balance in each account, the interest rate paid on each account, and the

branch where each account and safe deposit box is located.

This is also to inform you that I hereby revoke any power of attorney or other signature

authorization with respect to any of these accounts.

When I receive this information from you, I will let you know whether I wish to execute a new

signature card reflecting my appointment as Conservators or open another Conservatorship

account. It is my understanding that all accounts in FDIC institutions may be withdrawn prior

to maturity and no penalty for early withdrawal may be imposed if a Court declares a person is

no longer capable of managing his or her own financial affairs, and the account was issued

before the date of such determination and not extended or renewed after that date. If these

regulations do not apply to your institution, please let me know.

Thank you for your prompt assistance in this matter.

Sincerely,

[Insert your name],

Conservator

APPENDIX F

SAMPLE LETTER TO SOCIAL SECURITY / VETERANS ADMINISTRATION

[Insert your address]

[Insert the date]

[Social Security Administration or VA]

[Insert address]

Re:

Conservatorship of [Insert Protected Person’s name], a protected person

Social Security No. [Insert Protected Person’s number] or

Veteran’s VA Reference No. [Insert Protected Person’s number]

Dear Sir/Madam:

I have been appointed Conservators for the above-referenced person. Enclosed is a certified

copy of my Letters of Conservatorship. I am requesting that future checks be made payable to

me as Conservator for the above-referenced person.

Thank you for your prompt assistance in this matter.

Sincerely,

[Insert your name],

Conservator

APPENDIX G

SAMPLE LETTER TO INTERNAL REVENUE SERVICE AND ALABAMA

DEPARTMENT OF REVENUE

[Insert your address]

[Insert the date]

Internal Revenue Service or Alabama Department of Revenue

[Insert address]

Re:

[Insert Protected Person’s name]

Social Security No. [Insert Protected Person’s number]

Morgan County Conservatorship Case No. [Insert number]

Dear Conservatorship Coordinator:

I have been appointed Conservator of the Estate of the above-referenced person. A certified

copy of my Letters of Conservatorship is enclosed.

Please send all future correspondence concerning the above-referenced person to me at the

following address:

[Insert your mailing address]

Also, please send me a copy of the last two income tax returns that were filed by the abovereferenced person or any form necessary to obtain those returns.

Thank you for your help in these matters.

Sincerely,

[Insert your name],

Conservator

[The letter to IRS should be accompanied by its completed Form 56, Notice Concerning

Fiduciary Relationship. You may order the I.R.S. form by calling 1-800-829-3676]

APPENDIX H

January 17, 2014

Equifax Credit Reporting Agency

P. O. Box 740241

Atlanta, Georgia 30374

RE:

, an incapacitated person

SSN: XXX-XX-XXXX

Most recent address:

P. O. Box

Decatur, Alabama 35602

Dear Sir or Madam:

I am the Conservator for

, an incapacitated person.

In that role, I have the responsibility of collecting income, securing assets and paying

bills on behalf of disabled veterans, senior citizens, minors, and other disabled

individuals. An incapacitated person loses his or her ability to contract. It has come to

my attention that some incapacitated individuals are obtaining credit or receiving credit

cards, contrary to Alabama law.

It is my understanding that you can add a notation on the consumer statement of

their credit reports, which would notify a potential creditor that the individual is unable to

contract. Please add an appropriate notation to the above individual’s report

notifying potential creditors that the individual is incapacitated and cannot contract,

and that they should contact me before extending credit. Also enclosed is a copy of

my Letters of Conservatorship from the Probate Court.

Your assistance will be appreciated. Should you have any questions or comments

regarding my request, please contact me at [Insert your contact information here].

Respectfully yours,

[Insert Your Name]

Conservator

Enclosure