the presentation

advertisement

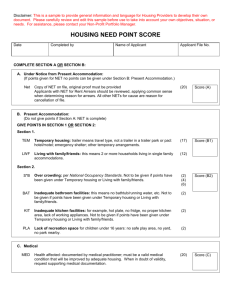

WELCOME How to mitigate the impact of Universal Credit on rent collection The webinar will begin at 10am Organised by: Sponsored by: Opening remarks from the Chair Emma Maier, Editor, Inside Housing Organised by: Sponsored by: Sue Ramsden, Policy Leader (Welfare Reform), National Housing Federation Organised by: Sponsored by: Universal Credit Sue Ramsden Policy Leader March 2015 Federation’s work Timetable Nov 2014 UC extends to families in Warrington and Wirral (new claims). End of 2014 UC live in all JCPs in NW and Hammersmith, Bath, Rugby, Harrogate, Inverness and Shotton. Jan 2015 UC extends to families in all existing live sites. Tranche 1 – 26th Jan – Some areas in NW and Hammersmith, Bath, Rugby, Harrogate, Inverness and Shotton. Tranche 2 – 2nd March – remaining areas in NW. Feb 2015 – March 2016 National roll out to all JCPs – new claims from single people without children. Tranche 1 (Feb – Apr 2015) 150 JCPs Tranche 2 (May – Jul 2015) 160 JCPs Tranche 3 (Sept – Nov 2015) 180 JCPs Tranche 4 (Dec 2015 – Mar 2016) 110 JCPs May 2016 – Dec 2017 National roll out to all new claims and claimants with change of circumstances Jan 2018 – Dec 2019 Managed transfer of legacy benefit claims including housing benefit, JSA and IS Universal Credit Single payment Conditions and sanctions Monthly payment Culture change Supporting work Direct to tenant Online Assessment period Housing element For social sector tenants the housing element will be: Liable rent and eligible service charges Minus Any underoccupation deduction Minus any Housing Cost Contribution (HCC) from nondependants Alternative payment arrangements: process Need for APA/ budgeting support identified in the Job Centre And/or landlord fills out APA form and send to: Freepost Plus RTEU-LESU-EXTJ Universal Credit Post Handling Site B Wolverhampton WV99 1AJ Same form can be used to apply for third party deductions. • Use escalation process where needed • Understand role of service centre and JCP work coaches • Use information from data sharing • What support is available locally? • What information does tenant have to verify claim? Third party deductions Priority list • Applied for on APA form • Rent arrears 10-20% of standard allowance • No more than 3 deductions in total • No more than 40% deducted in total Rent arrears 10% Rent arrears 10% Data sharing – name, address and date of claim from 16th Feb Preparing for UC Knowing your tenants • What do you need to know? Now and at different stages of roll out? • Can you record/retrieve information needed from your management system? • Sharing data – how, when and with whom? Working with Staff • Who needs training and in what? • Does your organisation have the right skills (digital inclusion, financial inclusion, debt management)? • How do you make better use of staff resources? • Do you need to review staff structures? Do teams work together? Can people access the right information and share information? Preparing for UC (2) Communications • What is your message? • Are your communications consistent internally and with JCP, LA etc? General v targeted messaging? • Automated v driven by staff? Rent collection • How can you make sure that UC claim covers correct amount of rent/eligible service charge? • How easy is it for tenants to pay rent? How will tenants and systems cope with monthly payments in a weekly rent regime? • Do you need to adapt your IT or finance system? • Do you need to review your arrears procedure? Preparing for UC (3) Building relationships with stakeholders • • • • Who are your stakeholders? How do you build good relationships? Do you have means to share information and learning? What about support to get people into work? Resources Learning from North West • Video: Housing association experiences • Reports: Universal Credit One Year In, Early learning from the North West pathfinders • Tips: Preparing for Universal Credit DWP (Universal Credit and rented housing) • Landlord support pack • Frequently asked questions • Service charge guidance • Rent arrears form Contact Sue Ramsden National Housing Federation 020 7067 1080 Sue.ramsden@housing.org.uk Further information: www.housing.org.uk/welfare Sign up to our newsletter Join us on LinkedIn Vivian Davies, Director of Rent and Collection, Family Mosaic Organised by: Sponsored by: 25,000 Homes London £240m Income Demonstration Project HB Direct Southwark 500 Tenants 1,500 Southwark June 2012 To December 2013 Key Learnings • Staff skills • Transactions Costs • Resource? – Technology/Data • Preparation – Direct payment • Did not know our customers we can Staff Skills Negotiating Skills Customer Focus Training we can Transaction Costs we can Technology Expected Payments Texts – in advance as well as chasing Focus on pace, low level interventions Big Issue / Experian Rental Exchange Rent paid = positive rating Risk profiling we can Preparation & Risk Management Preparation Re-engage with our customer HB Direct in line with DWP UC rollout timetable Timetable to 2019 so 4 years Graham Darby, Head of Customer Service North East, Home Group Organised by: Sponsored by: Universal Credit – Mitigating the Impact Graham Darby, Head of Customer Service North East Introduction Home Group, a social enterprise and a charity with a turnover of over £325m, is one of the UK’s largest providers of high quality housing and supported housing services and products. Home Group's role is to provide general needs housing, supported housing services, and home ownership options targeted towards helping some of society’s most vulnerable people take control of their own lives: Home Group houses over 120,000 people a year, managing 55,000 homes in over 200 local authority areas in England, Scotland and Wales. Each year this includes working with almost 30,000 vulnerable people through 500+ supported housing, justice and health services Income Protection: Our Key Themes Protect our Customers and Clients and we Protect Our Income Predict Prevent Manage Recover Predict • A theme that provides focus for the business on our ability to predict financial vulnerability and therefore target support and intervention: • • Predict Prevent Manage Recover Profiling of customer segmentation to incorporate better targeting of: • Direct Debit campaigns • Identification of customers already in financial distress • Early warning indicators of customers in danger of increased rent arrears • Identification and prediction of where we’re likely to see increased former and current tenant arrears. Changes to allocations processes: • I&E assessments • Align size criteria with under-occupancy charge criteria Prevent • A theme that provides the ability to intervene at the earliest possible stage to avoid arrears and ensure we offer best ways to pay on time: • • • • • • Collections Academy – core behavioural change programme Paperless DD Customer Service Partner roles – income maximisation Manage Payments Step Change debt advice partnership Campaign to target colleagues and customers understanding Predict Prevent Manage Recover Manage • A theme that provides the ability to ensure our arrears process is ready for UC • • • Arrears process streamlining • Remove wasteful or repetitive processes Prioritisation modelling of arrears activity (80:20) • Reduce case stagnation • Increase accountability Call to Collect • Outbound dials – automation • Customer call back through immediate response • Text • Increased call volume to CSC • Reduces FTE demand vs traditional model Predict Prevent Manage Recover Recover Predict Prevent • Provides the ability to claw back and recover Manage Recover debts if the customer moves on: • Improved former tenant arrears processes – 2015 • Switchback/Clawback processes – now “Rent Arrears” processes Key Points • Fail to prepare, prepare to fail! • • • • • • • • • • • Collections Academy Customer, Client and Colleague Campaign Roll Out Support Pack for colleagues Income Maximisation roles Partnership with StepChange Debt Charity Managing Your Money Packs including Budgeting & Bank Account Information Paperless Any day Direct Debit Customer and Client Profiling Call to Collect – outbound dialler and texts to reminder of payment due Review of existing arrears process and reporting Commercially caring approach QUESTIONS & ANSWERS Organised by: Sponsored by: Closing remarks from the Chair Emma Maier, Editor, Inside Housing Organised by: Sponsored by: THANK YOU The webinar is now closed A recording of the webinar and slides will be available to download from the IH website shortly Organised by: Sponsored by: