IPEV-VII

advertisement

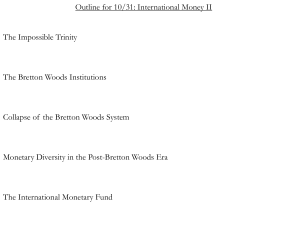

INTERNATIONAL POLITICAL ECONOMY I. Management to Governance ONE International Economic Regimes-norms, rules and, institutions intended to achieve common economic goals among the world’s peoples. They range from bilateral to complex multilateral, regional and, universal. Regimes are shaped by political factors such as the distribution of power, degree of shared goals and, interests, nature of leadership. International economic systems are clusters of regimes. Since WWII, three 1) Bretton Woods WWII-1971 2) Interdependence 1971-1989 3) Globalization 1989-present. ONE Bretton Woods For nearly two decades controlled conflict and helped participants to achieve common objectives. The regime was built upon three pillars: the International Monetary Fund (IMF); the International Bank for Reconstruction and Development (World Bank) and; the General Agreements on Tariffs and Trade (GATT) In the early years interaction was limited but growing. Nations were recovering. Protectionism was difficult to unwind. International investment was limited. ONE There were three political foundations: the concentration of power in a small number of states; the existence of a cluster of shared interests and; the presence of a dominant power willing and able to lead. Developed nations were the drivers. 2nd World were no challenge. 3rd world was inchoate. Japan was an outlier. Management was made easier by the great degree of consensus that existed. There was a shared belief in CAPITALISM and LIBERALISM, with a reliance upon market mechanisms. They agreed on the principle of INTERVENTION founded upon Keynesian/Welfare state approach. ONE Liberal international economic system. The beggar-thy-neighbor era of the interwar years provided and object lesson. But there was an acknowledgement that free markets could be unstable. There was a belief that a liberal international economy could assist in the achievement and maintenance of international peace as well as the expansion of economic prosperity and integration. The Cold War intensified the sense of community in the West. They agreed upon a stable system, reduction of impediments to the free flow of economic instruments and, a stable monetary system. US power and leadership was central. ONE Reasons for US leadership. Interdependence Changes in the nature of international interaction and shift in balance of power brought about the transition. Economic changes occurred. Growth and liberalization increased volume of interactions and penetration. National economies became more interdependent. Domestic conditions were increasingly challenging. Monetary affairs were particularly problematic. Reactions: New barriers arose in response to challenges, eg., NTBs, Managed trade, regionalism. ONE Secondly, new forms of management occurred. Economic summits and the Tokyo and Uruguay Rounds of trade negotiations occurred. Changes in power and leadership also altered the political management of the system. The developed countries were dominant but states outside of the group challenged particularly LDCs with NIEO The 2nd world sought limited participation with Gorbachev’s initiatives taking root. Power shifted within North. The European idea was maturing, Japan emerged. The US was weakening with b of p and b of t difficulties. Détente also diminished the perceived sense of urgency. Unsettled era. ONE Globalization 1990s emergence. Continued liberalization and improved technologies set it off. Politics also: 1) End of the cold war. No more 2nd World. Capitalism was global. Globalized world emerged. Wrenching change ensued. New challenges to national policy emerged, along with pressure to maintain them. Greater vulnerability and, thus, challenges to rules and institutions. New states emerged as powers, the so-called “emerging markets.” EU, Mercosur, ASEAN, WTO. TWO Governing the International Monetary System Central to the international economy. Framework for trade, investment, transactions and, payments, across international boundaries. Money. How nations have worked together to create and manage the international monetary system while maintaining sovereignty over national currencies. Three central functions: adequate liquidity, timely adjustment, and confidence in systemic stability. No central government. Requires agreed upon media of exchange. Gold and national currencies have been the principal answers. TWO 19th and early 20th c gold backed currencies. Later, the British pound sterling served as the reserve, transaction and, intervention currency. After WWII, the dollar became key. Monetary and fiscal policies have been developed for adjusting imbalances. For Bretton Woods, the system was fixed exchange rate. They floated among major participants, most notably, in Europe. Stability essential. TWO Bretton Woods: Origins July 1-15, 1944, economic ministers of 44 nations met in Bretton Woods, NH. A system reliant upon market forces was inadequate. What was required was a more publicly managed system. Similar to what necessitated the Keynesian New Deal approach but, with global political and economic stakes. To avoid economic nationalism free trade and international economic interaction were thought to be remedies. An Anglo-American bilateral plan was the basis. IMF and IBRD were the principal monetary institutions. TWO Rules: 1) Fixed exchange rate system. Floating rates of the 30s were unstable. Parity or par value required. Exchange rates against gold and allowed to float only 1% above or below par value 2) IMF would be keeper of rules. Weighted voting for decision-making 3) Dues would involve gold and national currencies. Countries could borrow against quota for the short term. National solutions were still required. The recovery period was expected to be five years. By 1947 it was clear that more time and effort would be required. TWO US LEADERSHIP The US assumed a lead role because of the combination of hardship and the emergence of a cold war between Eastern and Western blocs of nations. The $ began to play a hegemonic role as the hard currency of the Western World. $35/ounce of gold. Dollar shortages globally posed a liquidity problem though so the US needed to run balance of payments deficits. 1947-1958 the US encouraged an outflow of dollars. Bilateral and multilateral aid programs played a role: Truman Doctrine, Marshall Plan. Between 1948 and 1952 16 West European nations received $17 billion. Defense spending also. TWO The US provided liquidity and managed imbalances. It allowed for European and Asian protection, particularly on the part of West Germany and Japan. The result was recovery. MULTILATERAL MANAGEMENT UNDER US LEADERSHIP The system relied upon a mechanism that would, ultimately, undermine confidence in the system, US dollar outflows and deficits. By 1958 the US no longer sought deficits. Run on dollar in November 1960 when speculators converted dollars into gold. The IMF also began to emerge. Also the Bank of International Settlements or Basel Group emerged. Central bankers met to manage crises. TWO Group of 10 formed December 1961. p. 19 It created an exchange rate management mechanism for liquidity issues. In 1968 Special Drawing Rights (SDRs), artificial reserve units created by the IMF could settle accounts. Currency crises happened nonetheless in 1967 and 1968. BRETTON WOODS TO INTERDEPENDENCE Financial interdependence grew in the 60s with European and Asian recovery. Multinational banks were especially active vehicles in that process. A multiplicity of currencies emerged as hard currencies, facilitating that process. TWO Nixon Shock and Floating Rates The US policy could be summed up as “benign neglect.” By the summer of 1971 that was no longer a tenable approach. There were runs on US gold stocks and the supply was dwindling. August 15, 1971 suspended the convertibility of the dollar into gold and imposed a 10% surcharge on imports. December 15, the G-10 group came up with the Smithsonian Agreement that would devalue that dollar and allow for greater par value flexibility, raising the float from 1-2.25%. March 1973, fully floating international monetary system. TWO Petrodollar recycling The Oil Crisis of 1973-74 led to a sharp increase in oil prices. Oil exporting countries, needing an outlet for their surplus funds, began to funnel them back to the oil importing countries. Private banks were the vehicles. Monetary pressure precipitated a meeting of the heads of government o of the major powers in November 1975. They formed the G-6 group (US, UK, France, WG, Japan, Italy) formally, in January 1976. Floating exchange rate system was legitimated. Economic summits on page 28. TWO INTEDEPENDENCE 1971-1989 national governments wrestled with balance between multilateral cooperation and national autonomy. Financial Interdependence: Markets became integrated by accident and by design. Highly integrated world financial and capital markets meant that what happened in one region would effect all of the others, sometimes positively, often negatively. Liquidity of the dollar. $ maintained a central role despite pressures. Other vehicles would emerge. Still rates were allowed to float. Occasional intervention occurred. The G-7 Group was the principal manager, thus, multilateral. TWO $ Crisis of 1978 ensued, nonetheless. Tight monetary policy was the approach. The Fed became an important instrument of monetary policy. High interest rates tightened the money supply, reducing inflation and stabilizing the currency. The overall economy suffered though. Under Reagan there was a more unilateral approach that would focus on supply-side (p. 34). Reaganomics would undermine this approach. Stability and Crisis Management: There were difficulties coordinating normally but crisis management worked out reasonably well. Debt Crisis was a major source of consternation in the 1980s. IMF intervened with Paris Club (public) and London Club (private) efforts. TWO The debt crisis did compel the US to abandon unilateralism on occasion and take a multilateral approach. The US began to accumulate debt of its own that was largely left unchecked. Balance of payments and balance of trade difficulties occurred. September 22, 1985 Plaza Agreement among G-5 of G-7 allowed for coordinated market intervention. Finance Ministers would agree to regular market coordination meetings. Formalized in Tokyo May 1986. Louvre Agreement February 1987, more coordination. G-7 stronger than ever. European Monetary System (EMS). After 1972 “snake” emerged (4.5%). TWO December 1978 “zone of monetary stability” with a basket of currencies. Exchange Rate Mechanism (ERM). 1989 agreed to create European Central Bank (ECM) GLOBALIZATION Globalization of financial markets. US-Japan partnerships in the 90s for coordination. EU Single European Act (SEA) 1986. Maastricht 1992 provided for further integration. Euro would follow. January 1, 1999 first introduced. January 1, 2002, circulated. Former communist countries got into the mix. TWO The expansion of financial and capital flows put strains on the international monetary system. The pressure to maintain par values in a fixed exchange rate regime was a major burden. Flexibility was limited. Disequilibria that was short-term could remedied reasonably smoothly. Structural or long-term disequlibria could force devalue and revaluations of currency, considerably more intrusive upon national sovereignty. National economic management was increasingly at-risk. The US was an exception for awhile, in part because of the strength of the US economy and confidence in it, along with intervention to maintain the exchange rate. Dissatisfaction with the dollar and, confidence in it began to wane in the late 60s. TWO Adjustment: Improvement of fundamentals became a priority. The US under Clinton took steps to reduce deficit. The economy was resurgent, often, at the expense of western partners. Crisis Management: Peso 1994, Asian 1997-1998, Russian 1998, Argentine 1999-2002. 2007-2008 Subprime Mortgage Crisis Crisis Prevention: IMF, New Arrangement to Borrow (NAB) principal. Monetary Governance in the 21st Century: complicated by conflicts between globalization and national sovereignty. THREE INTERNATIONAL TRADE AND DOMESTIC POLITICS Trade policy is indivisible from domestic politics. The TPP deliberations are illustrative of that point. In the US, the Constitution provides a recipe for political conflict over trade policy just as it does for nearly everything else by giving Congress the power of the purse, including, levying tariffs and regulating foreign commerce. At the same time, the president is the chief foreign policy officer. Congress has to respond to constituent wishes as much, if not more, than to the imperatives of national interest. While Congress often links trade policy with domestic interests, the executive prioritizes the national interest more. THREE Presidents have tried to resolve this tension by asking Congress to delegate authority. Since 1934, Congress has often complied. Trade Act of 1974 formalized this as fast-track authority. Bretton Woods The creation of the international trade regime was motivated by the same imperatives underlying Bretton Woods in general. Protectionism and the subsequent disintegration of world trade during the interwar years contributed to prewar tensions. Secretary of State Cordell Hull was a major proponent of liberal trade theory and very influential. THREE The Havana Charter. It was to create the International Trade Organization (ITO) to accompany IMF. 1947 it was signed. Agreement was elusive. For Havana the LDCs demanded a greater role than they were accorded for the IMF It did not survive US domestic politics. Liberals and protectionists in the US opposed its ratification. In 1950 the Truman Administration decided not to submit the Havana Charter to Congress for ratification. General Agreements on Tariffs and Trade (GATT) It was agreed to in 1947 at the Havana Conference. THREE Open trade system, comparative advantage, most-favored-nation (MFN). Nondiscrimination. Reciprocity There were departures from the open standard. P. 75, principally, subsidies. Gaps included the absence of a definitive disputes settlement mechanism, enabling parties to block and delay actions. US Leadership. The US was able to lead because of steps taken to insulate trade from the domestic policy process. Fast-track was instrumental in this process. In the two decades following WWII the US helped Europe and Japan particularly. Regionalism in trade was a significant element in this. THREE The US also provided leadership in multilateral trade negotiations. US initiatives were responsible for the nine major rounds from Geneva 1947 to Doha 2001. The US accepted limited benefits. The benefits were asymmetrical. P. 78 Multilateral Trade Negotiations INTERDEPENDENCE Structural Change and Protectionism. By 1967 there were developments that undermined GATT system. Protectionist pressures were at the heart, along with interdependence. P. 79. THREE Both volume of trade and, trade as a percentage of GDP grew greatly as interdependence deepened. Convergence of national economies was also a factor. Early successes relied on comparative advantage. FACTOR ENDOWMENTS put the US and Western Europe at a disadvantage, to compound matters. Newly Industrialized Countries (NICs) emerged. Also disruptions had an adverse effect. The economic downturns of the 70s and 80s were instrumental. Stagflation typified the economics of the period. The early 80s put a brake on trade. Late 80s improvements marked a partial restoration. THREE Interdependence: Europe The EEC-EC-EU. Common external tariff and Common Agricultural Policy were features. Trade grew among the Europeans Interdependence: Japan Japan rose over the post-war decades quickly. Export expansion and import restrictions were central to Japanese government policy. Japan began to liberalize some in the 70s under pressure but, still, it accumulated large surpluses. Also there is/was a lot more private/public partnership than in the US and elsewhere in the industrialized West. Japan was accused of unfair practices Voluntary Restraint Agreements (VRAs) were made. THREE Interdependence: US US dominance eroded and support for openness diminished. Domestic support for openness suffered. Issue: Agriculture. Too sensitive to be easily subsumed under GATT Issue: New Protectionism. Non-Tariff barriers (NTBs), VERs, Trigger- Price Mechanism (TPM) anti-dumping. Tokyo Round (1973-1979) dealt with subsidies, procurement, trade management regimes. THREE GLOBALIZATION New Forms of Trade. 1) Services or Invisibles (white collar, tertiary). In 1998 65% US GDP, more than 50% GDP in other AICs. Difficult to regulate. Organizing regimes to cover services has been elusive. 2)Intellectual Property. Knockoffs, copyrights, piracy. Trade Related Investment Measures (TRIMs) detailed requirement regarding domestic sourcing (licensing) New Regionalism NAFTA (1992). Environmental groups became concerned. Mercosur. P. 101 THREE In the 1994 Summit of the Americas. Free Trade Area of the Americas. ASEAN 1992, APEC 1994. Bilateralism also. Uruguay Round NTBs were featured prominently. 1986 Punta del Este launched it. Began formally in 1987. Services, intellectual property. N-S. 1994 completed with the assistance of Fast-Track. January 1, 1995 new. Marrakesh Agreement established the World Trade Organization (WTO) THREE Marrakesh created the WTO and dealt with a lot of NTBs, including on subsidies, services, intellectual property, e-commerce. New Challenges. The flow of capital, people and ideas is much easier and less expensive, which is the good news for proponents of a free trade regime. Agriculture protection, antidumping legislation, dispute settlements are still vexing. Cartels are still unsettled. E-commerce. Environmental issues like Dolphin/Tuna cases continue. Climate change as well. Also NGOs want more opportunities to participate in IGO deliberations. THREE Power Relations Shift. The US has been resurgent, Japan has declined. The European idea has expanded its membership but not necessarily its power. Doha Doha Round commenced with the November 8-14, 2001 Summit. Doha Development Round reflected an effort to devote particular attention to the developing world. Agricultural trade liberalization and nonag market access (NAMA) have been among the emphases. Cancun September 2003 brought some progress that was built upon later. Pessimism exists regarding its ultimate denouement. FOUR MNCs and GLOBAL GOVERNANCE MNC “foreign direct investment” p. 128. Home/Host Not new. Foreign direct investment goes back to pre-Westphalian times. It was principally financial prior to the 19thc then, it went commercial, first in agriculture, later, in manufacturing. After WWII FDI changed dramatically. The balance-of-power was in favor of the MNC. In the 1970s a wave a nationalization ensued, primarily, in the developing world, during the period of interdependence. Numbers increased dramatically p. 129. FOUR During the period of globalization, the controversy was more philosophical, regarding MNCs as agents of globalization and, whether or not that was a good thing. Common Characteristics of MNCs. P. 131 list. They do not simply market abroad, they carry with them capital, tech, talent and marketing. Looking for a global market share. Joint ventures are objectives absent FDI, eg., licensing, patents, trademarks, strategic alliances. Division of labor is a concern. Home/Home, Home/Host, Host/Host relations are impacted. Jurisdictional problems arise. FOUR Trends in FDI p. 135 Fluctuations. The US is an ongoing focus. Banks and securities firms are a particular preoccupation. Explaining MNC Activity Growth. Is it MNCs directing government or, vice-versa? Horizontal or Vertical FDI? Where should the emphasis be? Consequences of MNC Activity. Proponents say that FDI is a mechanism for increasing productivity and stimulating growth. Critics believe the opposite. Possible Negative Effects. Neocolonialism, Dependency Theory. Home Government Controls. P. 153. National politics (Home and Host). FOUR REGIMES FOR FOREIGN DIRECT INVESTMENT International governance of FDI has been extremely limited and relatively informal. A big reason why that has been the case has been 1) the relative agreement in approaches shared by MNCs and the global economic governance. There exists a shared belief in the liberal economic order. Also, 2) the balance-of-power between the MNCs and the majority of host nations has been tilted in the direction of the former. 3) They are liberally distributed world-wide 4) The US is disinterested in governing it. National Governance: Home Regional: Regional organizations FOUR International Governance IMF, ITO, OECD, UN, bilateral and multilateral agreements. Conclusions All of these efforts focused on the promotion of MNCs during the Bretton Woods era. In the 70s, regulatory regimes emerged. In the 90s, the momentum was in the direction of anti-globalization. FIVE THE NORTH-SOUTH SYSTEM Separate from but, embedded in, Western system. Centered around grievances, particularly with regard to economic development. 1) Gap in incomes p. 189 is fundamental. Low growth rates for the South vis-à-vis the North is an ongoing concern. Dispute between the North and South over the proper philosophical approach to development as well. The Liberal approach has been the dominant one but, it is challenged by Marxist and Structuralist approaches. Liberalism. Positivist. Acceptance of the status quo. Capitalist principles provide the basis. FIVE For the liberal, the proper Southern approach to development is capitalist, p. 193. Ancillary effects can be deleterious, requires discipline. Marxists and Neo-marxist claim that the status quo perpetuates disadvantage. Structuralists focus on the systemic paradigm itself. DEPENDENCE Dependency theorists describe the N-S relationship as one of neo- colonialism where, the same bounds exist as in the colonial era but the mechanisms of domination are more subtle. In order for Southern development to occur that had to be a break. (see Development) FIVE G-77, NIEO Globalization. The WTO grew in importance because trade relations were seen as key. Still though the Washington Consensus predominated. P. 205 SIX Financial Flows to the South Bretton Woods-IBRD and bilateral assistance. Picked up during the Cold War. Fairly robust in 50s and 60s. Stagnated in the 70s. NIEO brought confrontation but little concessions. SAP became the principal recourse for developing nations. Privatization came with bank lending. Decline in the 80s followed by Debt Crisis. Debt crisis management came through emphasis on SAPs and Conditionality. Globalization. During this era increasingly there have been the appearance of Emerging Markets. SIX Many developing countries have improved their credit-worthiness. The were crises in the 90s for selected areas: Mexico, Indonesia, South Korea and Argentina, were among the subjects. In the 21st century there has been reform and increased assistance. Environmental resource management has also been helpful. Millennium Development Goals set in September 2000 raised awareness. P. 244. The overall impact of financial flows has been positive although there have been outliers in the Fourth World that have essential been triaged. SEVEN Trade and Development Strategies Bretton Woods: Isolation Import substitution, primary production Unity and Confrontion UNTAD (G-77) 1964. Interdependence: Southern Power NIEO 1974-1976. Subsequently, there were N-S Conferences for the purpose of improving balance-of-power in favor of the South. Export-Led Growth in the 80s and 90s. NICs emerged. Protectionist pressures grew. SEVEN Globalization: Joining the Trade Regime: Uruguay Round. The middle income nations of the 3rd World particularly felt as if there was something to gain by participation in the status quo. China and India were emergent. They wanted continued access to 1st World markets for industrial goods. BRICS rose. Brazil, Russia, India, China, which also included the transitional economies. They had benefitted from reform. Doha Round December 2001. BRICs were important. Also, regionalism was re-emergent. P. 284. N-S 21st Century. Ongoing efforts at gaining leverage for both blocs.