Chapter 7: Cash and Receivables

advertisement

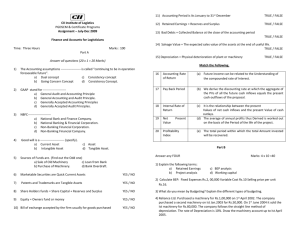

Exercise 1 E.10-8, On December 31, 2003, Alma Ata Inc, borrowed $ 3,000,000 at 12 % payable annually to finance the construction of a new building. In 2004, the company made the following expenditures related to this building, March 1, $ 360,000, June 1, $ 600,000, July 1, $ 1,500,000, December 1, $ 1,500,000. Additional information is provided as follows : Other debt outstanding : 10 year, 13 % bond, December 31, 1997, interest payable annually was $ 4,000,000 6 year, 10 % note, dated December 31, 2001, interest payable annually was $ 1,600,000 March 1, 2004, expenditure included land costs of $ 150,000 Interest revenue earned in 2004 $ 49,000 Instruction : a. Determine the amount of interest to be capitalized in 2004 in relation to the construction of the building b. Prepare the journal entry to record the capitalization of interest and the recognition of interest expense, if any, at December 31, 2004. Answer of Exercise 1 a. Computation of Weighted Average Accumulated Expenditures _ Expenditures _ Date Amount x Capitalization Period = W Average Acc Expenditures March 1 $ 360,000 x 10/12 =$ 300,000 June 1 $ 600,000 x 7/12 =$ 350,000 July 1 $ 1,500,000 x 6/12 =$ 750,000 Dec 1 $ 1,500,000 x 1/12 =$ 125,000 $ 3,960,000 $ 1,525,000 Answer of Exercise 1 W Avg Acc Expenditures x Interest Rate = Avoidable Interest $ 1,525,000 x 12 % = $ 183,000 Actual Interest $ 3,000,000 x 12 % = $ 360,000 $ 4,000,000 x 13 % = $ 520,000 $ 1,600,000 x 10 % = $ 160,000 $ 1,040,000 Avoidable interest lower than actual b. Building $ 183,000 Interest Expense $ 857,000 Cash $ 1,040,000 (360+520+160) Actual interest for year $ 1,040,000 Amount capitalized ($ 183,000) Interest expense debit $ 857,000 Exercise 2 E.10-13, Presented below is information related to Zonker Company. 1. On July 6 Zonker Company acquired the plant assets to Doonesbury Company, which had discontinued operations. The appraised value of the property is : Land Building Machinery and equipment Total $ 400,000 $ 1,200,000 $ 800,000 $ 2,400,000 Zonker Company gave 12,500 shares of its $ 100 par value common stock in exchange. The stock had a market value of $ 168 per share on the date of the purchase of the property. 2. Zonker Company expended the following amounts in cash between July 6 and December 15, the date when it first occupied the building Repairs to building $ 105,000 Construction of bases for machinery to be installed later $ 135,000 Driveways and parking lots $ 122,000 Remodeling of office space in building, including new partitions and walls $ 161,000 Special assessment by city on land $ 18,000 3. On December 20, the company paid cash for machinery $ 260,000 subject to a 2 % cash discount and freight on machinery of $ 10,500. Instructions : Prepares entries on the books of Zonker Company for these transactions Answer of Exercise 2 1. Land 350,000 Building 1,050,000 Machinery and Equipment 700,000 Common Stock (12,500 x $ 100) Paid-in Capital in Excess of Par 1,250,000 850,000 ($ 2,100,000 – $ 1,250,000 = $ 850,000) (The cost of the plant assets is $ 2,100,000, or 12,500 x $ 168,The cost is allocated in proportion to the appraised value: 1/6 to Land, 1/2 to Building, and 1/3 to Machinery and Equipment.) 2. Buildings ($ 105,000 plus $ 161,000) Machinery and Equipment Land Improvements Land Cash 3. Machinery and Equipment Cash 266,000 135,000 122,000 18,000 541,000 265,300 ($ 10,500 + $ 254,800, which is 98 % of $ 260,000.) 265,300 Exercise 3 P.10-8, Susquehanna Co, a wishes to exchange a machine used in its operations. Susquehanna has received the following offers from other companies in the industry. 1. Choctaw Company offered to exchange a similar machine plus $ 23,000 2. Powhatan Company offered to exchange a similar machine 3. Shawnee Company offered to exchange a similar machine, but wanted $ 8,000 in addition to Susquehanna’s machine. In addition, Susquehanna contacted Seminole Corporation, a dealer machines. To obtain a new machine, Susquehanna must pay $ 93,000 in addition to trading in its old machine Susquehanna Choctaw Powhatan Shawnee Seminole Machine cost $ 160,000 $ 120,000 $ 147,000 $ 160,000 $ 130,000 Acc depreciation 50,000 45,000 71,000 75,000 0 Fair value 92,000 69,000 92,000 100,000 185,000 Instructions : For each of the four independent situations, prepare the journal entries to record the exchange on the books of each company. Answer of Exercise 3 1. Susquehanna Corporation Cash Machinery (new) Accumulated Depreciation Loss on Exchange of Machinery Machinery (old) 23,000 69,000 50,000 18,000* 160,000 *Computation of loss: Book value $ 110,000 Fair value (92,000) Loss $ 18,000 Choctaw Company Machinery (new) Accumulated Depreciation Loss on Exchange of Machinery Cash Machinery (old) *Computation of loss: Book value $ 75,000 Fair value (69,000) Loss 6,000 92,000 45,000 6,000* 23,000 120,000 Answer of Exercise 3 2. Susquehanna Corporation Machinery (new) Accumulated Depreciation Loss on Exchange of machinery Machinery (old) 92,000 50,000 18,000 160,000 Powhatan Company Machinery (new) ($ 92,000 – $ 16,000) Accumulated Depreciation Machinery (old) *Computation of gain deferred : Fair value Book value Gain deferred 76,000* 71,000 147,000 $ 92,000 (76,000) $ 16,000 Answer of Exercise 3 3. Susquehanna Corporation Machinery (new) Accumulated Depreciation Loss on Exchange of machinery Machinery (old) Cash Shawnee Company Machinery (new) Accumulated Depreciation Cash Machinery (old) Gain on Exchange of Machinery 100,000 50,000 18,000 160,000 8,000 78,200* 75,000 8,000 160,000 1,200** *[$ 92,000 – ($ 15,000 – $ 1,200)] = $ 78,200 **Computation of Gain: _ $ 8,000 _ x ($ 100,000 – $ 85,000) = $ 1,200 $ 8,000 + $ 92,000 Answer of Exercise 3 4. Susquehanna Corporation Machinery (new) 185,000 Accumulated Depreciation 50,000 Loss on Exchange of machinery 18,000 Machinery (old) 160,000 Cash 93,000 Seminole Company Cash Used Machine Inventory Sales Cost of Goods Sold Inventory 93,000 92,000 185,000 130,000 130,000