Texas Real Estate Law - PowerPoint - Ch 07

advertisement

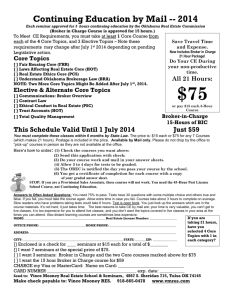

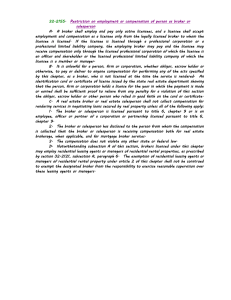

TEXAS REAL ESTATE LAW 11E Charles J. Jacobus Chapter 7 Real Estate Brokerage 2 Real Estate Brokerage • Real estate brokerage is an ever-changing, complicated subject. • Real estate brokerage has been regulated by law in Texas since 1939. • TRELA applies to all persons who engage in the real estate business. • It is now in the Texas Occupation Code. • Its intent is to avoid fraud on the public by requiring a license. • The licensee is not only responsible to the TREC, but also to the public. • The public has the right to believe that all licensees are competent, honest, trustworthy, and of good character. • A free copy of TRELA is available at www.trec.texas.gov. • As an assignment for this chapter, print the act and read it. • The act must be understood by all who are regulated by it. • Ignorance of the law is no excuse for violations of it. 3 www.trec.texas.gov 4 The Texas Real Estate Commission (TREC) • TRELA is administered through TREC, which is a body composed of nine commissioners appointed by the governor with the advice and consent of two-thirds of the senate present. • The governor appoints the chairperson. • Six members are brokers. • The other three members must be representatives of the general public. • Appointments are made without regard to the race, creed, sex, religion, or national origin of the appointee. • The commission creates, administers, and enforces all rules and regulations that govern real estate license holders • These rules and regulations are also available on the TREC website. 5 Licensing Requirements for Salesperson • Must have a sponsoring broker to receive an active license. • Must be a citizen of the United States or a lawfully admitted alien. • Be at least 18 years of age, • Be a legal resident of Texas. • Satisfy the commission as to his honesty, trustworthiness, integrity, and competency. • The commission conducts a criminal history check of each applicant. • Applicant must submit a legible set of fingerprints to the commission. • Must complete 4 semester hours in principles, 2 in the law of agency, 2 in law of contracts, 2 in contract forms and addendums, and 2 in real estate finance. 6 Broker Licensure • Not less than six years’ active experience in this state as a licensed real estate salesperson during the 84 months preceding application. • 60 semester hours of core real estate courses or related courses, which must include 18 semester hours of core real estate courses, two semester hours of which must be a course in real estate brokerage. • If the applicant has a degree form an accredited college or university, the “related course” requirement is automatically satisfied. • Competency is determined by an examination prepared by or contracted for by the commission. 7 Mandatory Continuing Education (MCE) • The commission requires at least 15 classroom hours of continuing education courses during the term of the current license. • At least six hours of that instruction must be devoted to legal topics as set out in the Act (legal update and ethics). • Core real estate courses can also be used for up to nine hours of credit. • The commission may not require examinations except for correspondence courses. • Course segments must be at least one hour long but cannot last more than ten hours a day. • A broker who sponsors a salesperson or supervises another license holder must also attend at least 6 classroom hours of broker responsibility courses approved by the commission. 8 Brokers and Salespersons • The Act requires licensure to perform certain functions applicable to real estate transactions. • It is specifically unlawful for a person to engage in brokerage without being licensed by TREC. • It is unlawful for any salesperson to act as an agent unless he is associated with a Texas real estate broker. • Any attempt to circumvent the act as a “consultant” or other similar sham will not be overlooked by the courts. • If a broker acts in two capacities (broker/executor of an estate), the broker is held to the duty of care of a broker . • The Act defines real estate broker and real estate salesperson as follows: 9 The Acts of Brokerage (2) “Real estate broker” is a person who, for another person and for a fee: (A) sells, exchanges, purchases, rents, or leases real estate; (B) offers to sell, exchange, purchase, rent, or lease real estate; (C) negotiates the listing, sale, exchange, purchase, rental, or leasing; (D) lists real estate for sale, rental, lease, exchange, or trade; (E) auctions, or offers or attempts or agrees to auction, real estate; (F) buys or sells or otherwise deals in options on real estate; (G) aids in locating for purchase, rent, or lease any real estate; (H) procures prospects effecting the sale, exchange, lease, or rental; (I) procures property effecting the sale, exchange, lease, or rental; (J) controls the acceptance or of rent on a single-family unit; or (K) provides a written opinion relating to the estimated price of real property if: (i) is not referred to as an appraisal; (ii) is provided in the ordinary course of the person’s business; & (iii) is related to the management, sale, or lease of real estate. (3) “Broker” also includes a person employed by or on behalf of the owner or owners of lots or other parcels of real estate. 10 Brokers and Salespersons • No real estate salespersons can accept compensation from any person other than the broker under whom they are licensed at the time or under whom they were licensed when they earned the right to compensation. • A person, as defined by the act, means an individual, a partnership, a limited liability company, a limited liability partnership, or a corporation. • A business entity must be licensed if the entity receives compensation on behalf of a license holder. • A business entity must also have an officer, partner, or manager to act for it who must be qualified as a real estate broker. • A business entity must maintain errors and omissions insurance with a minimum annual limit of $1,000,000 for each occurrence if the designated broker owns less than ten percent of the business entity. 11 Exemptions (a) an attorney at law licensed in this state; (b) an attorney in fact under a duly executed power of attorney; (c) a public official in the conduct of his official duties; (d) a person calling the sale of real estate by auction; (e) a person acting under a court order , will or written trust instrument; (f) a salesperson employed by an owner in the sale of structures and land on which said structures are situated, provided such structures are erected by the owner in the due course of his business; (g) an on-site manager of an apartment complex; (h) an owner or his employees in renting or leasing his own real estate; (i) transactions involving sale/lease/transfer of mineral or mining interests (j) transactions involving the sale, lease, or transfer of cemetery lots; (k) transactions involving the rent/lease/management of hotels or motels; (l) sale of property under a power of sale conferred by a deed of trust or other contract. 12 Property Managers • One of the confusing areas involves property management. • It appears that the person who is an on-site manager of an apartment complex is exempt from licensure regardless of the activity performed. • Any other type of management function, however, would probably include some items that were specified under the definition of broker. • If so, these managers would have to be licensed. • Property management is not considered to be a “brokerage” function as defined under Section 2 of the Real Estate License Act. • It is common practice, though, for property managers to attempt to lease or solicit prospective tenants to lease space . • TREC takes the position that if the property manager performs a brokerage function, he will be required to be licensed. 13 Attorneys at Law • A very controversial exemption has been the attorney exemption. • Section 1101.651 makes it unlawful for a seller to pay a commission to anyone who is not a real estate licensee and Section 1101.652(b)(11) makes it unlawful for a licensee to pay anyone who is not a licensee (including attorneys). • Nothing prevents a principal paying an attorney for acts of brokerage. • Attorneys have requested fees from seller, asking broker to cut their fee. • Attorneys may be a principal and request a commission. • There is no restriction against a licensee splitting a commission with a principal because the principal is not performing a brokerage function! • People requesting these commission splits should be advised: • (1) they will have to be provided with an IRS form 1099; • (2) it will have to be reported to the lender and • (3) it should be agreed to by the seller to prevent agency issues. 14 Penalties • A person acting as a real estate broker or salesperson without obtaining a license is guilty of a Class A misdemeanor. • Violations are punishable by a fine not to exceed $5,000. • Each day a violation continues or occurs may be considered a separate violation (that’s $5,000 per day!) • If the person received money he shall additionally be liable for not less than the amount received, and up to three times the sum received. • The Commission may order a licensee to pay a refund to a consumer. • TREC may appoint a disciplinary panel to determine whether or not a person’s license should be temporarily suspended if the licensee constitutes a threat to the public. 15 Inactive Status • An inactive salesperson is a currently licensed salesperson who is not sponsored by a currently licensed broker. • If, for any reason, a salesperson is no longer sponsored by a licensed broker, she is required to surrender her license to the commission. • This inactive status allows her to retain her license on inactive status until it expires or until she finds a new sponsoring broker. • The inactive licensee is effectively unlicensed and cannot act as an agent or receive commissions during the inactive period. • The legislature has also allowed a broker to elect inactive status. 16 Licensee’s Employment • A suit for a commission requires the agreement on which the action is brought to be in writing and signed by the party to be charged. • A listing agreement is considered to be specific enough when: 1. It is in writing and signed by the person paying the commission. 2. It promises a definite commission or refers to a written schedule. 3. It specifies the name of the broker to be paid. 4. It must identify with reasonable certainty the land to be conveyed. • If the employment agreement is for a buyer’s broker, the real estate doesn’t need to be identified. • Any employment agreement (other than a contract to perform property management services) should also contain a definite termination date. • Section 1101.652(b)(12) of the Real Estate License Act specifies that failure to specify a definite termination date in the employment contract provides grounds for license revocation or suspension. 17 Types of Listing Agreements Exclusive Right to Sell Property owner is prohibited from selling the property himself without paying the broker a commission. Exclusive Agency to Sell Owner reserves the right to sell the house himself and does not have to pay the commission to the broker. Open Agency Listing Allows the owner to give other open agency agreements to other brokers or the seller may sell the house himself. Net Listing Seller must net X dollars and any overage is commission. Broker may not take a net listing unless the principal requires one, appears to be familiar with market values, and the broker limits the amount of compensation. Multiple Listing Normally an exclusive right to sell taken by a broker who is a member of an association of brokers. 18 Actions for Commissions – Listing Brokers A broker’s right to a commission is conditioned on five factors: 1. Be a licensed broker or salesperson when services are commenced. 2. The agreement for the payment of the commission must be in writing. 3. Broker must advise the purchaser, in writing, that the purchaser should have the abstract covering the real estate examined by an attorney or obtain a policy of title insurance. 4. If the broker produces a ready, willing, and able buyer, he is entitled to his commission if the first three requirements are met and the contract submitted is substantially the same terms as those specified in the listing agreement. 5. When using listing agreements other than the exclusive right to sell, the broker must be the procuring cause of the sale. 19 Actions for Commissions – Buyer’s Brokers • Buyer’s brokers create a complicating issue involving procuring cause. • A prospect may spend a great deal of the listing broker’s time asking questions and getting information. • Before submitting an offer the prospect goes to a buyer’s broker to prepare a contract. • Who was the procuring cause? • Once a consumer has obtained a buyer’s broker’s advice the buyer’s broker may become the real procuring cause. • The buyer’s broker may not even need a written agreement to obtain the commission. 20 Consummation of Sale? • Closing of the sale, by itself, is not the determinative factor as to whether or not the broker is entitled to a commission. • If the seller backs out, he clearly has breached the terms of the listing agreement, and the commission must be paid. • If the sale has not been consummated through no fault of the broker, the broker is still entitled to his commission. • Even if the commission is contingent upon consummation of the sale. • Broker may be due a commission even if the purchaser backs out of the agreement and the seller chooses not to sue. • A residential broker may not file a lien on to secure a commission. • There is a statutory right for commercial brokers and appraisers to put liens on property. 21 Special Problem Areas – Securities • There has been a lot of emphasis on investment real estate in recently. • Real estate has tax benefits that many other investments do not share. • The investments generally take the form of syndication interests or ownership of rental housing such as resort condominiums. • In these cases, the broker may be selling real estate interests, from which the owner expects a profit through the efforts of a third party. • This is considered to be a security rather than a parcel of real estate. • If the interest sold is deemed a security, the broker may find he cannot maintain an action for a commission unless he has a securities license. • After all, a stockbroker cannot maintain an action for a commission on a real estate sale unless he is licensed. 22 Truth-in-Lending • The Federal Reserve Board has passed Regulation Z, to implement enforcement of the federal Truth-in-Lending Act (T-i-L). • T-i-L, simply explained, requires the lending institution to make a full disclosure of all costs of a loan to a consumer. • Although the first impression of the T-i-L Act makes very good sense, it does provide a pitfall for an unwary broker. • In at least one case, a broker who personally financed five real property sales was found to be “in the business of making loans.” • The broker, never realizing he should make a full disclosure , was found in violation of the T-i-L and was subjected to its penalties. 23 Employees Versus Independent Contractors Broker s like salespeople to be independent contractors because: • smaller amount of paperwork ; • fewer records to maintain; • no office hours are required to be kept; • sales personnel work on a commission basis only; • no Social Security taxes paid by the firm; • no unemployment taxes to be paid by the firm; • tends to promote more professionalism; • no limit to his potential income; and • fewer controls on the individual’s time. A real estate agent is treated as an independent contractor if: (1) such individual is a licensed real estate agent; (2) substantially all the remuneration is directly related to sales; and (3) the services are performed pursuant to a written contract creating the independent contractor status. 24 Brokers Versus Lawyers • Both represent clients and often represent the same client. • Conflicts in this type of situation are inevitable. • You will find brokers who attempt to give legal advice. • You will find lawyers who attempt to practice real estate brokerage. • Keep in mind that attorneys licensed in Texas are Exempt from TRELA. • The broker’s ability to “fill in the blanks” of an earnest money contract is specifically approved using TREC promulgated contract forms. • The relationship should be complementary. • Neither profession should downgrade the other. • It will take the efforts of both to keep these conflicts at a minimum. 25 Antitrust Laws Price Discrimination Charging different prices to different groups to inhibit competition. Exclusive Dealing Arrangements Agreeing with competitors not to compete. Aggressive Acquisition Large firms buying up small firms to limit competition. Price Fixing Agreeing with competitors to fix, set, or limit prices or terms. Boycotting Agreeing with competitors not to do business with a person or entity. Tying Claims Tying the purchase of one product or service to another 26 Deceptive Trade Practices—Consumer Protection Act (DTPA) • Under DTPA, anybody who receives “goods” or “services” can sue the provider of those goods or services if the consumer has been deceived or if the producer of those goods or services has engaged in false, misleading, or deceptive acts or practices. • A Texas Supreme Court case defined a deceptive trade practice as one “which has the capacity to deceive an average, ordinary person, even though that person may have been ignorant, unthinking, or credulous.” • It is important to note that the Act is liberally construed in favor of the consumer. 27 DTPA Waivers A consumer may waive the right to sue under the DTPA provided that: (1) the waiver is in writing and is signed by the consumer; (2) the consumer is not in a significantly disparate bargaining position; (3) the consumer is represented by legal counsel in seeking or acquiring the goods or services. The waiver is not effective if the consumer’s lawyer is directly or indirectly identified, suggested, or selected by the defendant. To be effective, the waiver must be: (1) conspicuous and in boldface type at least 10 points in size; and (2) identified by the heading “Waiver of Consumer Rights,” or words of similar meaning and in substantially the following form: “I waive my rights under the Deceptive Trade Practices–Consumer Protection Act, Section 17.41 et seq., Business & Commerce Code, a law that gives consumers special rights and protections. After consultation with an attorney of my selection, I voluntarily consent to this waiver.” 28 DTPA Causes of Action – The Laundry List 1. Representing that goods are original or new, if they are deteriorated, reconditioned, reclaimed, used, or secondhand. 2. Representing goods or services are of a particular standard, quality, or grade or that goods are of a particular style if they are of another. 3. Making false or misleading statements of fact concerning the reasons for, existence of, or amount of price reductions. 4. Representing that an agreement confers or involves rights, remedies, or obligations that it does not have. 5. Knowingly making false or misleading statements of fact concerning the need for parts, replacement, or repair service. 6. Misrepresenting the authority of a salesperson, representative, or agent to negotiate the final terms of the consumer transaction. 7. Representing that work or services have been performed or parts replaced when the work or services were not performed or parts replaced. 8. Failing to disclose information concerning goods or services that was known at the time of the transaction if such failure to disclose such information was intended to induce the consumer into a transaction into which the consumer would not have entered had the information been disclosed. 29 DTPA Breach of Warranties • The criteria for the breach appear to be circumstances existing where the knowledge of the seller, in conjunction with the buyer’s relative ignorance, operates to make the slightest divergence from mere praise into representations of fact. • This is really nothing more than taking unfair advantage of a “consumer” who is “credulous, ignorant, and unthinking”. • While the services of a real estate broker have not yet been held to have an implied warranty, it may be on the horizon. • Texas courts have held that there are implied warranties for homebuilders and for repairs of residential structures. • Implied warranties for developers have been specifically rejected by the Texas Supreme Court 30 DTPA Unconscionable Acts • Defined as “taking advantage of a consumer’s lack of knowledge to a grossly unfair degree, thus, requires a showing of intent, knowledge or conscious indifference” at the time the misrepresentation was made. • It is very important that all brokers deal with consumers in a very, very careful manner. • A real estate broker makes representations in the normal course of business. • It is clear now that making such representations can be very, very hazardous if they are not true since there is such a disparity between a professional real estate agent’s knowledge of the business and that of a “consumer” purchaser or seller. • Old-fashioned references to “mere puffing” are no longer applicable in Texas. What may be mere puffing to a broker could be understood as absolute fact by an ignorant, unthinking purchaser or seller. 31 DTPA Remedies 1. Economic damages 2. Treble economic damages if the conduct was committed knowingly 3. Mental anguish if the conduct was committed knowingly 4. Treble mental anguish if the conduct was committed intentionally 5. An order enjoining such acts or failure to act. 6. Orders to restore 7. Any other relief that the court deems proper 32 DTPA Defenses: Statutory §17.505. Notice: Inspection (a) As a prerequisite to filing a suit seeking damages a consumer shall give written notice to the person at least 60 days before filing the suit advising the person in reasonable detail of the consumer’s specific complaint and the amount of actual damages and expenses, including attorneys’ fees, if any, reasonably incurred by the consumer in asserting the claim against the defendant. During the 60-day period a written request to inspect, in a reasonable manner and at a reasonable time and place, the goods that are the subject of the consumer’s action or claim may be presented to the consumer. §17.5051. Mediation (a) A party may, not later than the 90th day after the date of service of a pleading in which relief under this subchapter is sought, file a motion to compel mediation of the dispute. 33 DTPA Defenses: Statutory §17.5052. Offers Of Settlement (a) A person who receives notice may tender an offer of settlement within 60 days of the notice. (b) If a mediation is not conducted, a person may tender an offer of settlement for 90 days after that date. (c) If a mediation is conducted, a person may tender an offer of settlement for 20 days after the mediation ends. (g) If the court finds that the amount tendered in the settlement offer for damages under is the same as, substantially the same as, or more than the damages found by the trier of fact, the consumer may not recover as damages any amount in excess of the lesser of: (1) the amount of damages tendered in the settlement offer; or (2) the amount of damages found by the trier of fact. 34 DTPA Defenses: Statutory §17.506. Damages: Defenses (a) It is a defense to the award of any damages if the defendant proves that he gave reasonable and timely written notice to the plaintiff of the defendant’s reliance on: (1) written information obtained from official government records if the information was false or inaccurate and the defendant did not know of the falsity or inaccuracy; (2) written information obtained from another source if the information was false or inaccurate and the defendant did not know and could not reasonably have known of the falsity or inaccuracy of the information; (c) In a suit where the above defense is used, suit may be asserted against the third party supplying the written information without regard to privity where the third party knew or should have reason ably foreseen that the information would be provided to a consumer. 35 DTPA Defenses: Statutory §17.555. Indemnity The statute provides that the defendant may seek contribution or indemnity from one who, under statutory law or at common law, may have liability for the damaging event of the consumer complaint. This allows the defendant to cross-file against the seller, property inspector, or other person who may be determined to have the ultimate liability for the misrepresentation. Note that the statute also provides for reimbursement for reasonable attorney’s fees and court costs. 36 DTPA – New Exemptions • Provides for exemptions for causes of action under the DTPA. • One prohibits a claim for damages based on the rendering of a professional service, the essence of which is the providing of advice, judgment, opinion, or similar professional skill. • The exemption does not apply, however, • (1) to an express misrepresentation of a material fact; • (2) to an unconscionable action or course of action, the failure to disclose information and violation of §17.46(b)(23); or • (3) to breach of an express warranty that cannot be characterized as advice, judgment, or opinion. • This section also provides for an exemption if the contract relates to a transaction involving total consideration of more than $100,000 if the consumer is represented by legal counsel and the contract does not involve the consumer’s residence. 37 DTPA Defenses: Case Law • It is a defense if, in fact, the broker never made the representation. • It also may be a defense if the broker did not know of any defect. • There may also be a successful defense plead if the court can be convinced that the plaintiff relied on somebody else’s representation other than the real estate broker. • One case has also held that if there was a defect disclosed to the buyer and the buyer bought the property anyway, aware of the defect, that he may not later turn around and sue the broker for failing to disclose. 38 DTPA Defenses: Contractual • In TREC forms a broker can recover attorney’s fees from the other party. • TAR has published a seller disclosure form and may provide a successful defense by saying that all representations concerning the condition of the property were made by the seller, not the broker. • “As is” might not be a defense to the DTPA . • The Texas Supreme Court has clearly held, though, that “as is” is a proper defense under certain circumstances. • One court has held that Section 7.D. creates an “as is” defense. • All actions brought under the act must be commenced within two years after the date on which the deceptive act or practice occurred or within two years after the consumer discovered or should have discovered the false, misleading, or deceptive act or practice. 39 Questions for Discussion 1. List the requirements to obtain a salesperson’s and broker’s license in the state of Texas. 2. Define the five types of listings discussed in your text. 3. A broker’s commission is conditioned on what five factors? 4. Explain the three primary violations of antitrust laws. 5. The Deceptive Trade Practices–Consumer Protection Act (DTPA) prohibits a claim for damages based on the rendering of a professional service, the essence of which is the providing of advice, judgment, opinion, or similar professional skill. When does this exception not apply? 40