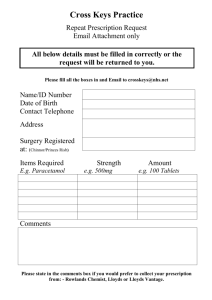

Prime Bank

advertisement

Liquidity Analysis, Trend Analysis and Comparison between 'LLOYDS TSB' and 'PRIME' Bank North South University Course Title: Financial Markets and Institutions (FIN433) Topic: Liquidity Analysis, Trend Analysis and Comparison between 'LLOYDS TSB' and 'PRIME' Bank Prepared for, Mr. Raisul Islam (RSM) Lecturer, School of Business, North South University, Dhaka. Prepared by, Makin Rishalat Jitu (073435030) (Section-1) Arif Hossain (0910639030) (Section-2) K.M. Rafiqul Haque (082122030) (Section-2) Nazia Haider (0920207030) (Section-2) Date of Submission: April 23, 2012 Letter of Transmittal April 23, 2012 Mr. Raisul Islam Lecturer, School of Business, North South University, Dhaka. Subject: Transmittal Message Sir, We would like you to have a look on our report of 'LLOYDS TSB' and 'PRIME' bank. We compared the Liquidity position for these two financial institutions. It will give you a detailed idea about the impact of Financial Crisis on both of these banks. We tried to interpret the information’s. We appreciate your thoughts for asking us to make this report and giving us the chance to implement our knowledge on this course. Yours Sincerely, Makin Rishalat Jitu Arif Hossain K.M. Rafiqul Haque Nazia Haider Acknowledgement We worked very hard to finish this report successfully. A lot of people helped us to complete this report on time. Firstly, thanks to The Honorable Faculty, Mr. Raisul Islam. It was the support of him which encouraged us to precede us with the report. He gave us a very helpful guideline and inspired us to do the work attentively. We are very much grateful to our Honorable Faculty for helping us to finish the project. Thank you. Preface Banking Industry is a crucial component of any economy. Financial system of any nation is heavily dependent on the performance of their respective banking sector. On a narrower standpoint, it can be said that the banking sector's performance is dependent on the banks performance that it is consisted of. Banking sector of a country is comprised of many banks and of many sorts as well. According to the website Investor Word, a bank is an organization, usually a corporation, chartered by a state or federal government, which does most or all of the following: receives demand deposits and time deposits, honors instruments drawn on them, and pays interest on them; discounts notes, makes loans, and invests in securities etc. Analyzing a commercial bank's performance is unlike evaluating other conventional companies. The composition of a commercial bank's financial statements is diverse and often much more critical than any other organization and thereby, demand extra care. We will try to identify the similarities between these two banks and their trends. Methodology Data Collection: This report is based on Secondary data. The main source of information was the banks annual report, selected reference books, local text books about bank management and websites. Quantitative Analysis: We have conducted quantitative analysis. Various types of ratios were used to evaluate the performance. Application Software: Microsoft Word, Microsoft Excel, Pages, Numbers, Open office. Executive Summary We have analyzed two companies. One of them is a financial institution named 'LLOYDS TSB' and the other one is a local financial institution named 'PRIME BANK'. We have analyzed these two banks different financial data’s to find out about their liquidity situation. Financial Data’s include: Net Profit After Tax Total Asset Total Debt Total Equity Cash and Marketable Securities Cash Flow from Operating Activities Current Ratio Solvency Ratio Liquid security Equity Multiplier Cash Position We analyzed these data’s for 5 years. It gave us ideas about the different situations of the banking industry. Introduction We have analyzed these two banks to find out the possibility of future liquidity crisis. Liquidity for a bank means its ability to meet its financial obligations as they come due. Bank has to face lots of challenges. One of the main challenges is for a bank to ensure its own liquidity under all reasonable conditions. The essential function of a bank is to provide services related to deposit. A bank has to be responsible to the society. Money is the key factor. But, a bank has to look at other things also. A bank must operate ethically. We have seen before what a company faces if it fails to do things ethically. Brief History of Selected Banks LLOYDS TSB Lloyds TSB Bank Plc is a retail bank in the United Kingdom. It was established in 1995 by Lloyds Bank and the TSB group. Lloyds TSB has an extensive network of branches and ATMs across England and Wales and offers 24-hour telephone and online banking services. Today it has 16 million personal customers and small business accounts. In Scotland, the bank operates as Lloyds TSB Scotland Plc. It's a public limited company. Lloyds TSB Bank will be rebranded as Lloyds Bank by the end of 2013. Lloyds TSB Bank has been criticized by its customers because of different reasons. Lloyds TSB received 9,952 complaints via the UK Financial Ombudsman Service in the last half of 2009. In December 2008 the British anti-poverty charity War on Want released a report documenting the extent to which Lloyds TSB and other UK commercial banks invest in, provide banking services for and make loans to arms companies. The Lloyds Banking Group, which encompasses Lloyds TSB, has been repeatedly criticized for its failure to protect jobs. By March 2010, it was revealed that 15,000 workers (1 in 5 of the total workforce) had been made redundant. PRIME BANK Prime bank was established in 1995. It is listed in Dhaka Stock Exchange (DSE) and Chittagong Stock Exchange (CSE). Prime Bank did IPO in the year of 1999. Prime Bank offers all kinds of Commercial Corporate and Personal Banking services covering all segments of society within the framework of Banking Company Act and rules and regulations laid down by central bank. Diversification of products and services include Corporate Banking, Retail Banking and Consumer Banking right from industry to agriculture, and real state to software. Prime Bank has already made significant progress within a very short period of its existence. The bank has been graded as a top class bank in the country through internationally accepted CAMELS rating. The bank has already occupied an enviable position among its competitors after achieving success in all areas of business operation. Extensive Financial Analysis Net Profit/Loss after Tax Analysis: Year 2006 2007 2008 2009 2010 Lloyds Bank 100% 114% 29% 102% -9% Prime Bank 100% 134% 119% 270% 348% 400% 350% 300% 250% 200% Lloyds Bank Prime Bank 150% 100% 50% 0% 2006 -50% 2007 2008 2009 2010 Interpretation: The Lloyds Bank net profit after tax shows a decreasing trend except in 2007. Their income was not increased as compared to the increase in expense. As a result the profit was less which totally reflects the retained earnings and in 2010 the company suffers heavy losses. From this it is evident that the financial crisis in the world market has had a significant impact. In case of Prime Bank the graph shows an increasing trend except in 2008. In 2008 the bank’s administrative and interest expense was high so the profit after tax decreases. After that the bank’s net profit after tax increases. This evidence shows that the financial crisis in the world didn't create impact in Dhaka. Total Asset Analysis: Company 2006 2007 2008 2009 2010 Lloyds Bank 100% 99% 128% 523% 556% Prime Bank 100% 131% 181% 205% 251% 600% 500% 400% Lloyds Bank 300% Prime Bank 200% 100% 0% 2006 2007 2008 2009 2010 Interpretation: Every year the Lloyds Bank total asset increases except 2007 as because the cash decreases. But after this year they are able to increases their total asset of the company which is seen in the 2010. The company asset was more than 500% compare to 2006 where as the Prime Bank total asset steadily increases every year. Total debt Analysis: Company 2006 2007 2008 2009 2010 Lloyds Bank 100% 99% 135% 274% 297% Prime Bank 100% 173% 219% 306% 388% 450% 400% 350% 300% 250% Lloyds Bank 200% Prime Bank 150% 100% 50% 0% 2006 2007 2008 2009 2010 Interpretation: From the curve it is seen that the Lloyds Bank total debt gradually increases except 2007 where as the Prime Bank more than 50% total debt was added every year. The main reason behind this cause was the current deposit and saving deposit was added every year. Total Equity Analysis: Year 2006 2007 2008 2009 2010 Lloyds Bank 100% 99% 122% 748% 789% Prime Bank 100% 1353% 1718% 3012% 4301% 5000% 4500% 4000% 3500% 3000% 2500% Lloyds Bank 2000% Prime Bank 1500% 1000% 500% 0% 2006 2007 2008 2009 2010 Interpretation: In 2007 the Lloyds bank total equity was less than the other year. The main reason the retained earnings was low because in that year the large portion of money was used in the administrative and interest expense which directly impact the total equity. After 2008 the bank total equity increases tremendously. In case of Prime Bank the total equity increases gradually because of the statutory reserve and the retained earnings increased. Cash and Marketable Securities Analysis: Company 2006 2007 2008 2009 2010 Lloyds Bank 100% 5% 99% 234% 31% Prime Bank 100% 132% 175% 249% 233% 300% 250% 200% Lloyds Bank 150% Prime Bank 100% 50% 0% 2006 2007 2008 2009 2010 Interpretation: The Lloyds Bank shows a decreasing trend except in 2009 which prove the liquidity crisis of the bank. In 2007 the cash was half compared to the 2006 but it was able to improve the liquidity of the bank but it again failed in 2010. In case of Prime Bank their liquidity was getting high as the cash was added every year which is a good sign for a company. Its cash slightly decreases in 2010 which will not create any severe problem. Net cash inflow from operating activities Analysis: Company 2006 2007 2008 2009 2010 Lloyds Bank 100% -99% -103% 3730% 1534% Prime Bank 100% 38% 94% 55% -208% 4000% 3000% 2000% Lloyds BG 1000% Prime Bank Ltd. 0% 2006 -1000% -2000% 2007 2008 2009 2010 Interpretation: The Net cash inflow from operating activities of Lloyds BG generally shows a decreasing trend during the horizontal analysis period (2006-2010) with an exception in 2009 where it shows an increase. In 2007 it decreased to -£134m and in 2008 it decreased to -£140m from £136m in 2006. This indicates a 119% decrease in net cash inflow from operating activities of Lloyds BG in 2007 and a 203% decrease in 2008 from that of 2006 figure. From this it is evident that the financial crisis in the world market has had a significant impact in the liquidity position of Lloyds Banking Group in 2007 and 2008. The Net cash inflow from operating activities of Prime Bank Limited also shows a general decreasing trend with an exception in 2008 where cash flow increased from Tk2849m in 2006 to Tk2666m. In 2007 and 2008, when the financial crisis had significant impact on the world market, Prime Bank Ltd. did not have a negative cash flow like that of Lloyds Bank Group in these two years. This shows that the effect of Global Financial Crisis on Prime Bank Limited was not significant. Current Ratio Analysis: Company 2006 2007 2008 2009 2010 Lloyds Bank 4.56 4.85 1.55 0.93 0.40 Prime Bank 1.07 1.02 1.04 0.99 1.13 6 5 4 Lloyds BG 3 Prime Bank Ltd. 2 1 0 2006 2007 2008 2009 2010 Interpretation: The Current Ratio for Lloyds Bank over the 5-year trend increased from 2006 to 2007, then declined alarmingly from 2007 to 2010. In 2009, the ratio went below 1 becoming 0.93 and in 2010 it further dropped to a worrying 0.4. A ratio under 1 suggests that the company would be unable to pay off its obligations if they came due at that point. This shows the impact the Global Financial Crisis had on the company. The company did not have a good financial health in 2009 and it further worsened in 2010 according to the current ratio. The current ratio of Prime Bank Ltd. decreased from 2006 to 2007, increased from 2007 to 2008, then declined in 2009, and again increased in 2010. This fluctuating trend shows little or no relationship between the Global Financial Crisis and Prime Bank’s liquidity position. Working Capital Requirement/Sales Ratio (WCR/S Ratio) Analysis: Company 2006 2007 2008 2009 2010 Lloyds Bank (0.08) 0.01 0.03 (0.12) (0.15) Prime Bank 9.697 6.585 6.719 7.263 7.497 0.050 (0.050) 2006 2007 2008 2009 2010 Lloyds BG (0.100) (0.150) (0.200) 12.000 10.000 8.000 6.000 Prime Bank Ltd. 4.000 2.000 2006 2007 2008 2009 2010 Interpretation: Horizontal analysis does not address the challenge of negative numbers. Since Lloyds BG has a negative WCR/S ratio in the base year, because of that we were unable to apply horizontal analysis. So, we have compared the respective WCR/S ratio trends of Lloyds BG and Prime Bank in analysis the impact of the Financial Crisis on the individual banks. Lloyds BG's WCR has demonstrated increased from 2006 to 2008 and then dropped from 2008 to 2010. The impact of Global Financial Crisis on Lloyds bank is clearly evident in 2007 and 2008. The larger the WCR/S ratio, the less financial flexibility and less liquidity the firm will have, because the operating cycle will require significant investment of funds. On the other hand, the WCR/S ratio of Prime Bank Ltd. decreased from 2006 to 2007, and then increased from 2007 to 2010. This indicates that the financial flexibility and liquidity position of Prime Bank deteriorated from 2007 to 2010. This shows that the financial crisis and its aftershocks may have had an impact on Prime Bank Ltd. from 2008-2010. Net Liquid Balance (NLB) Analysis: Company 2006 2007 2008 2009 2010 Lloyds Bank 100% -14% -298% 519% -36% Prime Bank 100% 131% 161% 125% 115% 600% 500% 400% 300% 200% Lloyds BG 100% Prime Bank Ltd. 0% -100% 2006 2007 2008 2009 2010 -200% -300% -400% Interpretation: The Net Liquid Balance of Lloyds BG shows a falling trend over the 5-year time horizon with an exception in 2009 which shows an increase in the figure. It fell significantly in 2008 from 2006 indicating financial inflexibility and insolvency. Definitely, from this trend analysis it is visible that the bank suffered from the severe global economic recession in 2008 which was caused by the Global Financial Crisis or the Credit Crunch. However, the 5-year trend of Prime Bank Limited shows the total opposite picture. There was no negative NLB during this 5-year period. The trend shows an increase in NLB from 2006 to 2008, then a decrease in the figure from 2008 to 2010. From this trend it can be concluded that Prime Bank Ltd. was not that much affected by the Financial Crisis. It may have some effect, but that is insignificant. Capacity ratio: Year 2006 2007 2008 2009 2010 Lloyds Bank Prime Bank 0.672 0.699 0.658 0.01 0.673 0.678 0.676 0.639 0.679 0.68 0.8 0.7 0.6 0.5 0.4 Lloyds Bank 0.3 Prime Bank 0.2 0.1 0 2006 2007 2008 2009 2010 Interpretation: The above analysis tells us that the ability of LLOYDS to take additional amount of loan & to service the existing loan is tending to decrease Over-time. Along with an exception in 2009, when the amount has been dramatically lower than other years. From the above chart we can see that, the ability of Prime Bank to take additional amount of loan & to service the existing loan is Increasing Over-time Cash Position: Year 2006 2007 2008 2009 2010 Lloyds Bank Prime Bank 0.00552 0.012 0.011 0.037 0.038 0.061 0.059 0.058 0.074 0.054 4.5 4 3.5 3 2.5 Lloyds Bank 2 Prime Bank 1.5 1 0.5 0 2006 2007 2008 2009 2010 Interpretation: As we know that Cash Position Indicator measures the portion of a company's assets held in cash or marketable securities. Although a high ratio may indicate some degree of safety from a creditor's viewpoint, excess amounts of cash may be viewed as inefficient. So, here, LLOYDS is maintaining a balance throughout last 5 years from 2006-2010; where, in 2007 & 2008, the ratio had been remarkably lower. So, here, Prime Bank is maintaining a balance throughout last 5 years from 2006-2010. Liquid security: Year 2006 2007 2008 2009 2010 Lloyds Bank Prime Bank 0.005 0.00455 0.0055 0.0024 0.0061 0.019 0.015 0.01 0.0019 0.0438 50 45 40 35 30 25 Lloyds Bank 20 Prime Bank 15 10 5 0 2006 2007 2008 2009 2010 Interpretation: Banks only maintain a small portion of their assets as cash available for immediate withdrawal; the rest is invested in illiquid assets like mortgages and loans. By requiring a lower proportion of total assets to be held as liquid cash the Federal Reserve increases the availability of loan able funds. This acts as an increase in the money supply. We can see, here, LLOYDS is maintaining a balance by lowering as well as increasing the amount. That is, it is trying to keep a balance in the money supply. In case of Prime Bank is tending to increase this portion, i.e., the bank is contributing in the acceleration of money supply. Equity Multiplier: Year 2006 2007 2008 2009 2010 Lloyds Bank 29.859 28.438 44.95 23.29 21.14 Prime Bank 15.77 15.09 16.49 10.62 9.11 3 2.5 2 Lloyds Bank 1.5 Prime Bank 1 0.5 0 2006 2007 2008 2009 2010 Interpretation: We can see here, in case of LLOYDS, 2008 had been the year with the largest debtdependency. But over-time, they have reduced this amount, that is their reliance on debt to finance their asset has reduce, which is a very good indication. In case of Prime Bank, the opposite scenario is happening. That is, overtime, the bank is decreasing its dependence on debt to finance its asset, which is a very good sign for the company. The Role of SPV By financing the firm in pieces, some on–balance sheet and some off –balance sheet, control rights to business decisions are separated from financing decisions. The SPV-sponsoring firm maintains control over business decisions, whereas the financing is done in SPVs, which are passive; they cannot make business decisions. Furthermore, the SPVs are not subject to bankruptcy costs because they cannot in practice go bankrupt, as a matter of design. Bankruptcy is a process of transferring control rights over corporate assets. Securitization reduces the amount of assets that are subject to this expensive and lengthy process. We argue that the existence. Of SPVs depends on implicit contractual arrangements that avoid accounting and regulatory impediments to reducing bankruptcy costs. We develop a model of off –balance sheet financing and test the implications of the model. An SPV, or a special purpose entity (SPE), is a legal entity created by a firm (known as the sponsor or originator) by transferring assets to the SPV, to carry out some specific purpose or circumscribed activity, or a series of such transactions. The legal form for an SPV may be a limited partnership, a limited liability company, a trust, or a corporation. Typically, o ff balance sheet SPVs has the following characteristics: They are thinly capitalized. They have no independent management or employees. Their administrative functions are performed by a trustee who follows pre-specified rules with regard to the receipt and distribution of cash; there are no other decisions. Assets held by the SPV are serviced via a servicing arrangement. They are structured so that, as a practical matter, they cannot become bankrupt. In short, SPVs are essentially robot firms that have no employees, make no substantive economic decisions, have no physical location, and cannot go bankrupt. Off –balance sheet financing arrangements can take the form of research and development limited partnerships, leasing transactions, or asset securitizations, to name the most prominent. And less visible are tax arbitragerelated transactions. In this paper we address the question of why SPVs exist. The key issue concerns why otherwise equivalent debt issued by the SPV is priced or valued differently than on–balance sheet debt by investors. The difference between on– and o ff –balance sheet debt turns on the question of what is meant by the phrase “truly satisfy the legal and accounting requirements to be off –balance sheet.” In this paper we argue that “off –balance sheet” is not a completely accurate description of what is going on. The difficulty lies in the distinction between formal contracts. Analysis of Overall findings The two Banks are from the two different countries. As a result their financial environment and the strategic planning were completely different. It has been found out through our 5year trend analysis that Lloyds BG has been affected significantly by the late-2000s financial crisis that is the Global Financial Crisis or the Credit Crunch. The Global Financial Crisis had a significant impact on Lloyds BG during the years 2007 and 2008 which we have found out from our 5-year trend analysis (2006-2010). It deteriorated the bank’s liquidity position making it insolvent. Its market value of equity fell significantly from 20062008. On the other hand, Prime Bank limited did not show any major signs of the financial crisis as Bangladesh was not affected by the crisis. That is because its economy is not so dependent on international capital and foreign investment, which has helped to lower the immediate impact of the crisis. The financial crisis has made Lloyds BG financial inflexible as its liquidity position deteriorated mostly in 2007 and2008.The bank had good amount of total assets, but not sufficient liquidity assets. The company is solvent but not liquid which has made huge impact on the bank. On the other hand Prime Bank’s total assets including cash were gradually increasing over the 5 year period of our analysis which is a good sign as it is adding more value to the bank. For any company cash is king, and if it is financial institution then cash plays a vital role for the company. Without cash companies can make defaults. Therefore Lloyds BG must overcome the liquidity crisis for the welfare of the bank. Limitations Due to lack of available information, it was not possible to compare ratios with Industry Average. Unfortunately, due to our hectic schedule and other projects and assignments that were due, we were not able to give more effort on this report. Although, it must be said that we tried to push our effort to the limit to make it more useful. As we are dealing with a local bank, some local ratios needed to be given, as the text books we follow only talk about American ratios. So, we had to use local books. Lack of access to Bank's internal Information. These two banks are from different countries. So, it was tough to compare between them. Conclusion It was a fun exercise. We got to know about so many things. These two banks were from different countries which created some obstacles in our analysis. We have implemented what we have learnt in our classes. Analyzing Lloyds TSB gave us a chance to know some new financial terms. References http://www.lloydstsb.com/ http://www.primebank.com.bd/ http://www.investopedia.com/ Annual Report of Prime Bank Annual Report of Lloyds TSB