a Bonus: Savings Resources

advertisement

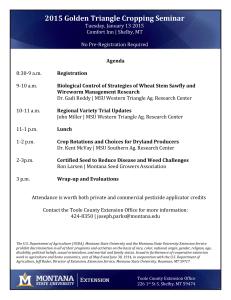

Creative Techniques for Finding Money to Save Plus a Bonus: Saving Resources 11 How would you you define savings? 22 One Montanan’s Definition •Amount left over after expenses… 33 Which is, most of the time, zero 44 Federal Reserve Board Definition • Savings is the process of setting aside a portion of current income for future use. 55 WIKIPEDIA Economics Definition • Saving is income not spent or deferred consumption. 66 Question: What year between 1962 & 2013 did Americans have the highest rate of saving? o o o o o 1962 1975 1983 1991 2000 77 Personal Savings Rate 1962-2013 •May 1975 •14.6% 8 8 2014 •As of January •3.9% 99 $aving Technique$ used by $uccesful $avers 10 10 Technique #1 Make savings automatic 11 Automatic deposits • Arrange for monthly automatic deposits from paychecks or checking to savings accounts for an emergency fund 12 Benefit!! • Don’t have to think about it every payday –Can adjust/change as needed 13 13 Save for Retirement • Arrange for automatic contributions to retirement plan: tax deferred (401k) (403b) (457) 14 Tax Deferred Plan Limits (401k, 403b, 457) • $17,500 – 2014 • Catch up if age 50 & older • $5,500 15 Benefit!! • Some plans offer loans for emergencies • Borrow if really, really, really needed 16 Penalty!! • Penalty if withdraw before age 59 ½ Less likely to make withdrawal 17 IRAs • $5,500 yearly • Catch-up amount if age 50 & older $1,000 18 Boost Saving by 1% More & have more at retirement Salary $25,000 $30,000 $35,000 $40,000 $45,000 $50,000 Age 25 $102,827 $123,393 $143,958 $164,523 $185,089 $205,654 Assuming 8% rate of return; Pay Increases 3% Age 35 $41,639 $49,967 $58,295 $66,623 $74,951 $83,279 19 Boost Saving by 1% More & have more at retirement Salary Age 40 $25,000 $25,675 $30,000 $30,810 $35,000 $35,945 $40,000 $41,080 $45,000 $46,215 Assuming 8% rate of return; Pay Increases 3% $50,000 $51,351 Age 50 $8,559 $10,271 $11,983 $13,695 $15,047 $17,118 20 Technique #2 • Once a loan is paid Pretend you are still making payments Place former payment in savings 21 Benefit!! • Already altered lifestyle so you can make loan payments A reallocation of payment to savings can be made without “sacrifice” 22 Technique #3 •Put 2014 state/federal tax refund into savings 23 Tax Refund • A tax refund is not a “bonus” it’s a refund of your money that can become savings 24 Benefit!! • It’s money you have already “adapted” to being without during the year 25 Technique #4 • Open an MSA • Montana Income tax “savings” $207 if taxable income above $16,700 $414 for married couple 26 Benefit!! • Saving tax money on medical expenses you have anyway 27 Question: What percent of Montanans have MSAs? o o o o o 1.4% 25.2% 53.6% 70.3% 92.5% 28 28 Percent of Montanans with MSAs • Only 1.4%% 29 29 Technique #5 • Utilize creativity for saving… Techniques used by Montanans 30 Piggy Bank Your Extra Coins •U. S. Treasury says Americans hold $15 billion in loose change 31 Sock it away •Eastern Montana mother •Filled-up old socks with loose change & hid in the closet 32 Hidden Savings in Checking Account • Central Montana woman wrote checks for next $1 or $5 up in checking account register • Monthly she deposited the “extra” in savings 33 Recipe Box • Western Montana Family who put money that they didn’t use for “eating out” in recipe box • Would go through weekly to show, “This is what we saved by not eating out….. 34 Nothing Week • Central Montana Family saves money that would have spent on activities that cost 35 Sugar Bowl • Woman on the high-line who squirreled away cash in sugar bowl at the top of the kitchen cabinet 36 Under the mattress • Grandpa in central Montana who hid money in envelope under his mattress 37 Save lunch money • Parents in northwest Montana packed lunches & totaled their savings 38 Coupon • Southeast Montana woman who saved money that would have spent without using coupon 39 Technique #6 • Kick habits that cost $$$$$$ 40 Money Saved if not spent on Everyday Items Item Snack/Candy/Soda Coffee, Latte, Etc Fast Food Meal Yearly Savings $360 $1,140 $1,320 41 Technique #7 • Accelerate debt repayment so have money to save 42 42 Which to accelerate? • Priority Pay off highest interest rate debt first to save on interest 43 PowerPay Web site (Utah State UniversityExtension) https://powerpay.org 44 44 Without Power Payments (Highest Interest First) Creditor Name # of payments Total Paid Int. Paid Chase Auto 31 $7970.04 $770.04 Mastercard 119 $23039.93 $11472.92 Security Bank 49 $3617.69 $267.69 Lowes 14 $1317.51 $67.51 Payoff Time Total Paid Total Interest 9 years 11 months May 2010 $35,945.17 45 $12,578.17 45 With Power Payments (Highest Interest First) Creditor Name # of payments Total Paid Int. Paid Chase Auto 31 $7970.04 $770.04 Mastercard 47 $16725.36 $5158.36 Security Bank 47 $3617.34 $267.34 Lowes 14 $1317.51 $67.51 Payoff Time Total Paid Total Interest 3 years 11 months May 2013 $29,630.25 46 $6,263.25 46 Bottom Line Benefits (Highest Interest First) • Time to Pay off Reduced by: – 6 years • Amount Saved in Interest: – $6,314.92 47 Bottom Line Benefits (Highest Interest First) • Amount Saved in Interest: – • • $6,314.92 No Power Pmt $12,578.17 Power Payment - 6,263.25 $6,314.92 48 Technique #8 •Kick the minimum payment habit on credit cards!!!!! 49 Credit Card Smarts Calculator 50 Orange Side--Side 1 • Paying Just 3% on Your Credit Card Debt Check the REAL cost 51 Blue Side: Side 2 • Pay MORE than 3% and Save a LOT 52 Matt & Julie—Side 1 •Credit Card Debt $10,000 53 53 Minimum Payment DANGER On $10,000 Loan • $300 • $9,421 in interest • 20 years to pay off 54 Increase payment amount--Side 2 PMT Years $400 13 years $600 8 years Interest $5,738 $3,226 Savings $3,226 $6,195 55 55 Another Example Debt: $25,000 10% APR $330.38 $531.18 $631.18 $731.18 Years 10 5 4 3.3 Interest $14,645 $6,871 $5,467 $4,548 56 Benefit of Power Payments • Once loans paid off the money not paid in interest is available for saving! 57 Technique #9: Establish Savings Goals & Track Progress Towards Them • Individually • As a couple • As a family 58 Goals: What are you saving for? • Things? • Experiences? • Regardless MSU Extension has a tool for you 59 Front Cover 60 Track’n Your Savings Goals Register • Funded by Montana Credit Unions for Community Development First Interstate BancSystem Foundation 61 What are you saving for? Savings Goals 62 Decide on Amount Needed: Figure 2 63 My Savings Goals: Figure 2 64 Recording a Savings Deposit Figure 4 65 Technique #10 • Moonlight for additional income for savings 66 66 Until Ron got me this job, I didn’t realize I was an important factor in his savings plan. 67 Moonlight Savings Yearly Age 25 - 65 Age 45-65 Amount $1,000 $120,800 $33,066 $2,000 $241,600 $66,132 $3,000 $362,400 $99,198 $4,000 $483,199 $132,264 Assuming 5% rate of return 68 Technique #11 • Trade down to a smaller home 69 69 Retire? Sure, Cheryl you can retire….if we live in a tent! Ha, Ha, Ha, Ha, Ha, Ha, 70 Savings from Smaller Home • Lower or no mortgage payment • Reduced maintenance costs • Lower utility bills • Lower property taxes • Lower insurance premiums 71 Technique #12 • Move to a less expensive location 72 72 Move within Montana 73 Montana Average Home Price City Bozeman Missoula Billings Anaconda Chinook Ekalaka Median Cost $227,300 $144,300 $138,400 $102,800 $96,800 $74,100 74 Move to another State 75 Question: Which state in the U.S. is the most affordable to live in? 1. 2. 3. 4. 5. Montana Texas Oklahoma Florida Minnesota 76 76 Most Affordable States 1. Oklahoma 2. Tennessee 3. Idaho & Kentucky http://money.msn.com/personal-finance/americas-cheapest-statesto-live-in 77 77 What are sources of advice about saving? oFriends/relatives oMedia (TV, newspaper, magazines) oInternet-Web oParents oFinancial Planner 78 Commitment Make a commitment to save by utilizing savings techniques that work for you, then take action!!!!!!! 79 Savings Resources • Organizations • Government Sources 80 USDA—Extension http://www.csrees.usda.gov/nea/economics/fs ll/publications/66_ways.pdf •66 ways to Save Money 81 Investing for Your Future www.extension.org/pages/10984/investingfor-your-future • eXtension: 11 lesson web/study at home course eXtension-Sponsored by Rutgers University 82 NEFE http://www.smartaboutmoney.org/Portals/0/ ResourceCenter/WealthCareKit-Insurance.pdf • Wealth Care Kit: A guide for financial wellness 83 The Money Mammals www.theMoneymammals.com • Teaching kids to share, save, and spend smart 84 Question • According to the (March 2013 Retirement Confidence Survey), what % of workers said they are very confident they’ll have enough for retirement? 85 85 What % of workers say they are very confident of having enough for retirement? 1.30% 2.20% 3.15% 4.13% 5. 5% 86 86 Confidence Survey 2013 •13% • lowest level since survey started in 1993 87 87 Ballpark E$timate www.choosetosave.org/ballpark • Easy-to-use, two-page worksheet –Helps you quickly identify approximately how much you need to save to fund a comfortable retirement 88 Department of Labor http://www.dol.gov/ebsa/pdf/savingsfitness.pdf • Savings Fitness: A Guide to Your Money and Your Financial Future 89 U. S. Securities & Exchange Commission www.sec.gov/investor/pubs/roadmap.htm • Get the Facts: The SEC’s Roadmap to Saving & Investing 90 American Savings Education Council www.choosetosave.org/calculators • Calculators on: Auto Bond Budget College Credit Card Employee Benefits Home InsuranceDisability InsuranceHealth Insurance-Life 91 American Savings Education Council www.choosetosave.org/calculators • Calculators on (cont’d): Mutual Fund Stock Paycheck Planning Savings Retiree-Health Retirement Roth IRA Taxes 92 America Saves www.americasavesweek.org • Designated week February 24 – March 1, 2014 93 Montana Saves www.montanasaves.org 94 America Saves: Savings Messages • Receive savings tips and reminders straight to your phone 95 www.360financialliteracy.org American Institute of Public Accountants: Offers information to help consumers make sound financial decisions at every stage of lives. 96 www.360financialliteracy.org • Life Stages Couples Parents and Children Home Owners In Crisis Retirees 97 97 www.360financialliteracy.org • Life Stages Small Business Owners Military and Reserves Employed College Students Tweens and Teens 98 98 Feed The Pig www.feedthepig.org American Institute of CPAs • Get Savings Tips E-mail Phone • Join a discussion • Beat your brain 99 99 www.feedthepig.org/tweens • 4, 5, 6th graders • The Great Piglet Challenge Interactive Adventure in Saving & Spending 100 100 Conclusion • Almost “overwhelming” amount of savings information organizational & governmental resources • Find the source that “works” for you 101 Understand yourself • What motivates you to save? 102 Question: What is your primary goal for saving at this point in time? o o o o o o Retirement Emergency fund College education Family vacation New Car New Home chat 103 103 Savings bottom line…… • Are you willing to delay gratification so you’ll have money to save? 104 In other words…… • Are you willing to make a change in your behavior to make saving a priority? 105 In Conclusion • Best wishes as you select the savings technique that works best for you & explore savings resources 106