HON 200C Honors Macroeconomics

HON 200C Honors Macroeconomics

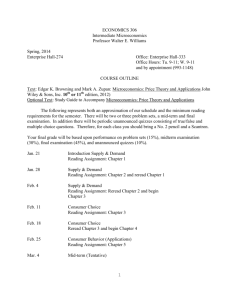

Spring 2011

MW 10 – 11:15 am

CBC – C146

Instructor

Bernard Malamud Office: BEH 508 Phone: 895 – 3294 FAX: 895 – 1354 email: berrnard.malamud@unlv.edu

website: faculty.unlv.edu/bmalamud

Office Hours: MW 11:30 – 12:30; 2:30 – 3:30 pm … and by appointment

General Nature of the Course

Course Objectives: An introduction to the study of the determination of the level of national income, employment and prices and the basic causes of fluctuations in these levels.

This course will help you guide economic policy if you are ever elected to Congress or to the presidency, intelligently advise those who are, and, as an informed citizen, evaluate and anticipate what these officials are up to. The course gives you the tools and the confidence to grapple with a highly complex system, the macroeconomy, to understand how it works and how its performance can be affected by policy. The course also familiarizes you with the private and public, national and global, monetary and real, characteristics of today’s economic world. We will relate the theories that we study to economic events and policy discussions as they unfold throughout the semester.

We will also apply these principles to understanding and explaining an important episode in US economic history: the financial crisis of 2007 – 2008 and the ongoing Great Recession.

Upon completion of this course you will know i) measures of macroeconomic performance; ii) determinants of macro-equilibrium in the short-run and in the long-run; iii) how the economy responds to demand-side and supply-side shocks; iv) the ways monetary and fiscal policies affect the economy; and v) determinants of long-term economic growth and development.

Course Design: This is primarily a lecture course with a considerable amount of student participation. We will cover the principles of macroeconomics using the well-written, comprehensive textbook by Charles I. Jones.

Text and Supplemental Readings

Text:

Charles I. Jones, Macroeconomics : Economic Crisis Update . Norton: New York.

Supplements:

The Economic Report of the President, 2011

The Economist

Understanding the Great Recession

Joseph Stiglitz, Freefall .

John Cassidy, How Markets Fail .

Raghuram G. Rajan , Fault Lines.

Nouriel Roubini and Stephen Mihm, Crisis Economics .

Understanding Financial Fragility

Simon Johnson and James Kwak, 13 Bankers.

Gillian Tett,

Fool’s Gold.

David Wessel, In Fed We Trust.

Michael Lewis, The Big Short: Inside the Doomsday Machine .

Andrew Ross Sorkin, Too Big to Fail .

Examinations and Grading

Three 100-point classroom exams and a 150-point comprehensive final exam will be given this semester. These will be mostly essay exams, though some multiple choice questions may be thrown into the mix. In addition, you will submit ten 5- or 10-point homework problems.

Grading:

February 16 Classroom examination, Chapters 2,7,8

March 28 Classroom examination, Chapters 9,10,11,12

100 points

100 points

April 27

May 9

Classroom examination, Chapters 3,4,5,6

10 Homework problems

Comprehensive Final examination, Chapters 1 – 15

100 points

75 points

150 points

Maximum score 525 points

Heads Up: One question on the final exam will ask you to explain the recent financial crisis and the ongoing Great Recession drawing on Chapters 13 and 14 of the Jones text and at least one of the supplementary readings for “Understanding the Great Recession,” i.e., Stiglitz, Cassidy,

Rajan, and/or Roubini and Mihm.

Approximate grade distribution:

Average Score out of 525 points

90 percent

80 percent

70 percent

60 percent

Final Grade

Borderline A-

Borderline B-

Borderline C-

Borderline D-

Attendance and class participation will very much affect your final grade.

Makeup Policy

Makeup exams may be arranged at mutual convenience if you have a compelling reason to miss a scheduled classroom exam. A makeup exam must be taken before the missed exam is returned to the class. There will be no makeup quizzes or final exam. However, a student missing a class because of observance of a religious holiday and students who represent UNLV at any official extracurricular activity shall also have the opportunity to make up assignments. Such students must provide official written notification no less than one week prior to the missed class(es).

Class Conduct

Your instructor and classmates deserve courtesy. If you must arrive late or leave early, do so quietly. Inform me beforehand if you must leave a class early. Smoking and eating in class are prohibited. Texting, talking to your neighbors, and reading newspapers and magazines in class is rude, disruptive, and unacceptable. While this probably need not be said, anyone found engaging in any act of academic dishonesty will be punished in accordance with UNLV policies.

Other Information

The Disability Resource Center (DRC) coordinates all academic accommodations for students with documented disabilities. The DRC is the official office to review and house disability documentation for students, and to provide them with an official Academic Accommodation

Plan to present to the faculty if an accommodation is warranted. Faculty should not provide students accommodations without being in receipt of this plan.

UNLV complies with the provisions set forth in Section 504 of the Rehabilitation Act of 1973 and the Americans with Disabilities Act of 1990, offering reasonable accommodations to qualified students with documented disabilities. If you have a documented disability that may require accommodations, you will need to contact the DRC for the coordination of services. The

DRC is located in the Student Services Complex (SSC), Room 137, and the contact numbers are:

VOICE (702) 895-0866, TTY (702) 895-0652, FAX (702) 895-0651. For additional information, please visit: <http://studentlife.unlv.edu/disability/>.

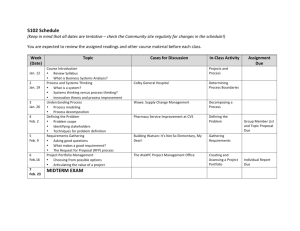

Dates

Jan 19

Jan 24

Jan 26,31

Feb 2,7

Feb 9,14

Feb 16

Feb 21

Feb 23

Feb 28

Mar 2

Mar 7,9

Mar 14-18

Mar 21,23

Mar 28

Mar 30

Apr 4,6

Course Schedule

Topic, End-of-chapter homework problem(s), points

(Think thru ALL exercises, particularly “Worked

Exercises” which will be discussed as time permits)

Course Organization

Course Overview: The Macroeconomy Today

Microeconomics in One Lesson

Measuring Macro-Performance

GDP; Price Level; Real GDP

Chapter 2 Problem 4 due Feb 2, 5 points

The Labor Market: Unemployment; Labor Demand and Supply

Chapter 7 Problem 2 due Feb 9, 5 points

Inflation: MV=PY; π =g m

– g y

; Interest & Wages – Nominal & Real

Classroom examination, Chapters 2,7,8

Presidents’ Day Recess

The Short-Run

A Phillips Curve; Okun’s Law

Chapter 9 Problem 4 due Feb 28, 10 points

IS : Goods Market Equilibrium (Y = C + I + G + EX – IM)

Life Cycle Consumption/Permanent Income/Spending Multiplier

Chapter 10 Problems 7 and 8 due Mar 7, 10 points

MP : Monetary Equilibrium; Monetary Policy; Open Market Ops

Chapter 11 Problems 3 and 10 due Mar 21, 10 points

Spring Break

Stabilization Policy: Shocks; Aggregate Supply/Aggregate Demand

Classroom examination, Chapters 9,10,11,12

Global Financial Crisis and The Great Recession

Financial Fragility

Chapter 13 Problem 4 due Apr 4, 5 points

The Crisis: Risk Premium; Deflation; Taylor Rule – IS/MP; AS/AD

Chapter 14 Problem 1 due Apr 11, 10 points

Chapter 8

Chapter 9

Chapter 10

Chapter 11

Chapter 12

Chapter 13

Chapter 14

Reading in Text

Chapter 1

Chapter 2

Chapter 7

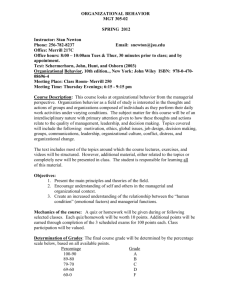

Dates

Apr 11

Apr 13

Apr 18,20

Apr 25

Apr 27

May 2

May 4

May 9

Course Schedule (continued)

Topic, End-of-chapter homework problem(s), points

(Think thru ALL exercises, particularly “Worked

Exercises” which will be discussed as time permits)

The Long-Run: Economic Growth

Economic Growth: Some Facts

Chapter 3 Problem 8 due Apr 11, 5 points

Production Function: Empirics; Total Factor Productivity

Chapter 4 Problems 5 and 6 due Apr 18, 10 points

Solow Growth Model: Output, Investment, Steady State

Chapter 5 Problem 4 due Apr 25, 5 points

Growth and Ideas: Romer; Solow-Romer; Growth Acctg

Classroom examination, Chapters 3,4,5,6

Note: Chapter 13 and 14 material will appear on Final

Government and the Macroeconomy

Note: Chapter 15 material will appear on Final

Catch-up and review

Comprehensive Final Examination, 10:10 – 12:10 pm

Heads Up: One question on the final exam will ask you to explain the recent financial crisis and the ongoing Great Recession drawing on Chapters 13 and 14 of the Jones text and at least one of the supplementary readings for “Understanding the Great Recession,” i.e., Stiglitz, Cassidy, Rajan, and/or Roubini and Mihm.

You can take extra time on the final as long as no other class is waiting to use the room. But you must end before 12:45.

Reading in Text

Chapter 3

Chapter 4

Chapter 5

Chapter 6

Chapter 15