Economic Functions of Financial Markets

advertisement

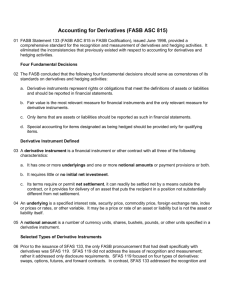

Financial Markets, Institutions & Derivative Instruments ECO 473 – Money & Banking – Dr. D. Foster Match savers and investors ◦ Savers want to wealth ◦ Investors want to create wealth Spread/share risk. Successful strategy - diversification ◦ Savers seek out mutual funds ◦ Savers seek out financial intermediaries ◦ Investors seek OPM Financial Markets - Why & Who ◦ ◦ ◦ ◦ ◦ Why - Intermediation Who . . . banks credit unions S&Ls thrifts savings banks pension funds Insurance companies mutual funds mortgage brokers investment bankers finance companies Financial Markets - New & Used New - Primary Markets ◦ stocks (IPO), bonds, mortgages, other. Used - Secondary Markets ◦ exchange of ownership. Where: NYSE, NASDAQ, OTC . . . Financial Markets - Short & Long Short - Money Markets ◦ A financial instrument that matures w/in one year. ◦ Used to facilitate liquidity demands. Need funds soon. Have excess cash. 3 mo. & 6 mo. T-Bills Commercial paper Bank CDs Fed’l funds Repurchase agreements Bankers’ acceptances Euro$ funds Money Market Instruments Outstanding, 2000-2012 Financial Markets - Short & Long Long - Capital Markets ◦ Maturities of more than one year. ◦ Used for capital purchases (investment). ◦ Less liquid & more risk than MM. Corporate stock Corporate bonds U.S. Treasury bonds Other U.S. & Munis Mortgages Comm./Con. loans Financial Institutions Mutual Funds Sell diversification to individual savers. Government regulations limit risks. 8,000 mutual funds in the United States. Hedge Funds Raise money from wealthy people/institutions Largely unregulated ◦ Use leverage which magnifies gains/losses. ◦ Trade in derivative instruments. Brokers and Dealers A broker buys and sells securities for others ◦ May be “full service” or “discount.” A dealer buys and sells for itself, making a market in these securities. Investment Banks Underwrites and advises companies on mergers and acquisitions. Investment banks buy and sell securities and derivatives. 1930s Regs/diversification option? 2008 - collapse of the MBS market. Bear Stearns - couldn’t roll over debt. Lehman Brothers - $639 bill. in assets. Merrill Lynch - sold to BoA Goldman Sachs & Morgan Stanleyconverted to commercial banks. Derivative Financial Instruments Forward contracts Future contracts Options Swaps Derivatives in . . . Interest rates Currency Stock Commodities Weather “Purpose” of a Derivative Hedging/Insuring against adverse changes … You have $10 million in U.S. Treasuries, nominal yield is 5% and maturity date is 3 years from now. But, you only want to hold them for one more year. Risk – If interest rates rise, the price will fall. Hedge – execute a forward contract, promising to sell bonds in 2009 at a price yielding 5.1%. “Purpose” of a Derivative Hedging/Insuring against adverse changes … You need to buy €5 million in 6 months, the current exchange rate is $1.33/ €. But, you think the dollar will depreciate by then. Risk – If the dollar falls, it costs more to buy €. Hedge – go “long” and agree to buy €, through a futures contract, at $1.36 each. Forward vs. Future Contract Forward: ◦ Variable in content. ◦ Settled at maturity date. ◦ Matching participants. Future: ◦ ◦ ◦ ◦ Standardized amounts and terms. Ongoing settlement cash flows. Active, liquid market. Default can’t hurt other party. “Purpose” of a Derivative Hedging/Insuring against adverse changes … You need to buy €5 million in 6 months, the current exchange rate is $1.33/ €. But, you think the dollar will depreciate by then. Risk – If the dollar falls, it costs more to buy €. Alternative Hedge – buy a call option to purchase Euros at $1.40 each; exercise only if the rate moves higher than that. “Purpose” of a Derivative Hedging/Insuring against adverse changes … You pay a variable return on $25 million worth of outstanding bonds. Risk – If interest rates rise, so do your costs. Hedge – execute an interest rate swap, to gain a fixed payment schedule, and reducing your exposure to interest rate changes. Derivatives as speculative Bank agrees to buy bonds in one year at a price that earns 5% . . . thinking rates will fall. Buy/sell currency futures if you expect rates to move contrary to market. Buy options to leverage your investment. Actions raise market liquidity for non-speculators!! Case: Barings Bank - 1762 to 1995 1992 – Nick Leeson becomes a trading manager at Baring Securities in Singapore. Charged with executing client option orders and arbitraging price differences between SIMEX and Osaka exchanges. Took “speculative positions” in futures linked to Nikkei 225 and Japanese gov’t. bonds. Hid losses in an unused error account: $400 m. – 1994 and $1.4 b. – 1995 Fled Singapore; arrested in Germany. The Credit Swap Derivative Hedging against adverse changes.. You own $25 million worth of outstanding bonds. Risk – If the firm goes bankrupt . . . Hedge – buy a credit default swap, and make a fixed payment (insurance). If firm goes bust, the seller owes you for the bond (difference). The Credit Swap Derivative First one in 1995 (J.P. Morgan) • By 2008, $45 trillion in value. • As speculation – buy & sell to manage risk. • You don’t need to own bond! • Done OTC. • Party-to-party transaction. • Settlement/liquidity issues. • Build a virtual bond portfolio. • Insider trading issue . . . Financial Markets, Institutions & Derivative Instruments ECO 473 – Money & Banking – Dr. D. Foster