Shareholders' equity

advertisement

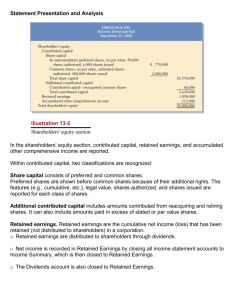

Accounting Lecture no 8 Prepared by: Jan Hájek CORPORATE CAPITAL Shareholders’ equity (owner’s equity) The shareholders’ equity section of a corporation’s balance sheet consists of: Contributed capital ○ Share capital ○ Additional contributed capital Retained earnings SHAREHOLDERS’ EQUITY SECTION Shareholders’ equity Contributed capital Common shares, 100,000 no par value shares authorized, 50,000 issued $800,000 Retained earnings Total shareholders’ equity 130,000 $930,000 SHAREHOLDER RIGHTS To raise capital, the corporation sells shares If only one class of shares-common shares Ownership rights specified in articles of incorporation or by-laws Voting…owners SHARE TERMINOLOGY shares – maximum amount of shares a corporation is allowed to sell as authorized by corporate charter Issued shares – number of shares sold Authorized SHARE ISSUE CONSIDERATION How many shares should be authorized for sale? How should the shares be issued? At what price should the shares be issued? What value should be assigned to the shares? STOCK MARKET PRICE Shares of publicly held companies are traded on organized exchanges at dollar prices per share established by the interaction between buyers and sellers STATED AND PAR SHARE VALUES Stated value – assigned value to no-par value shares Par value – assigned legal capital value Must retain legal capital. Stated and par values have not relationship to market value NO PAR SHARE VALUES No assigned legal capital value Legal capital equals issue price (proceeds) Must retain legal capital. No-par value has not relationship to market value once issued. RELATIONSHIP OF PAR, NO PAR AND STATED VALUE SHARES TO LEGAL CAPITAL Shares Legal Capital per Share Par value No par value Par value Entire proceeds Stated value Stated value ISSUING NO PAR VALUE COMMON SHARES FOR CASH Shares are most commonly issued for cash. When no par value common shares are issued, the entire proceeds from the issue becomes legal capital. Account Titles and Explanation Cash Common Shares To record issue of 1,000 shares. Debit 1,000 Credit 1,000 ISSUING STATED VALUE COMMON SHARES FOR CASH When common shares have a stated value, the stated value is credited to Common Shares. When the selling price exceeds the stated value, the excess is credited to Contributed Capital in Excess of Stated Value. Account Titles and Explanation Cash Common Shares Contributed Capital in Excess of Stated Value To record issue of 1,000 shares. Debit Credit 5,000 1,000 4,000 SHAREHOLDERS’ EQUITY CONTRIBUTED CAPITAL IN EXCESS OF STATED VALUE Shareholders’ equity Contributed capital Common shares, 10,000 shares of $1 stated value authorized, 2,000 shares issued Contributed capital in excess of stated value Total contributed capital Retained earnings Total shareholders’ equity $ 2,000 4,000 6,000 27,000 $33,000 ISSUING COMMON SHARES FOR SERVICES OR NON-CASH ASSETS Shares may be issued for services, such as compensation to lawyers, or for non-cash assets, such as land. When common shares are issued for services or non-cash assets, cost is either the fair market value of the consideration given up or the consideration received, whichever is more clearly determinable. REACQUIRED SHARES Reacquired shares are a corporation’s own shares that have been issued, fully paid for, and then reacquired by the corporation. Reacquired shares are generally retired and cancelled. In certain restricted circumstances, these shares are not retired, but are held as treasury shares for later reissue. REACQUISITION OF SHARES Why would a company choose to reacquire its shares? Reduce quantity/raise share price Increase EPS If authorized share limit reached, may need additional shares for use in bonus or compensation plans or acquisitions PREFERRED SHARES Preferred shares have priority over common shares with regards to: 1. Dividends and 2. Assets in the event of liquidation Preferred shareholders usually do not have voting rights Preferred shares are shown first in the share capital section of shareholders' equity PREFERRED SHARE PREFERENCES Liquidation preference Cumulative (dividends in arrears) Convertible (book value) Redeemable/callable (company option) Retractable (shareholder option) DIVIDEND PREFERENCES CUMULATIVE DIVIDEND A cumulative dividend requires that preferred shareholders be paid both current and prior year dividends before common shareholders receive any dividends. Preferred dividends not declared in a given period are called dividends in arrears. Dividends in arrears are not considered a liability, but the amount of the dividends in arrears should be disclosed in the notes to the financial statements. CONVERTIBLE PREFERRED SHARES Convertible preferred shares allow the exchange of preferred shares into common shares at a specified ratio. This kind of share is purchased by investors who want the greater security of a preferred share, but who also desire the added option of conversion. In recording the conversion, the book value of the preferred shares is used. The conversion of preferred shares does not result in either gain or loss to the corporation. The market value of the shares is not considered. REDEEMABLE PREFERRED Redeemable (callable) preferred shares grant the issuing corporation the right to purchase the shares from shareholders at specified future dates and prices. This call feature allows some flexibility to a corporation by enabling it to eliminate this type of equity when it is advantageous to do so. While convertible shares are for the benefit of the shareholder, redeemable shares are for the benefit of the corporation. RETRACTABLE PREFERRED Retractable preferred shares are similar to redeemable preferred shares except that the shareholder can redeem shares at their option instead of the corporation’s. Retractable preferred shares and debt have many similarities. Both offer a rate of return to the investor, and with the redemption of the shares they both offer a repayment of the principal investment. Retractable preferred shares are presented in the liability section of the balance sheet rather than in the equity section because it has more of the features of debt than equity. STATEMENT PRESENTATION OF SHAREHOLDERS’ EQUITY In the shareholders’ equity section of the balance sheet, contributed capital and retained earnings are reported and the specific sources of contributed capital are identified. Within contributed capital, two classifications are recognized: 1. Share capital 2. Additional contributed capital SHAREHOLDERS’ EQUITY PRESENTATION ZABOSCHUK INC. Partial Balance Sheet Shareholders’ equity Contributed capital Share capital $ 770,000 $9 preferred shares, no-par value, cumulative, 10,000 shares authorized, 6,000 shares issued 2,000,000 Common shares, $5 stated value, unlimited shares authorized, 400,000 shares issued 2,770,000 Total share capital Additional contributed capital Contributed capital in excess of stated value - common shares 860,000 3,630,000 Total contributed capital 1,058,000 Retained earnings $4,688,000 Total shareholders’ equity BOOK VALUE VS. MARKET VALUE Book value per share seldom equals market value. Book value is based on historical costs; market value reflects the subjective judgement of thousands of shareholders and prospective investors about the company’s potential for future earnings and dividends. Market value per share may exceed book value per share, but that fact does not necessarily mean that the shares are overpriced. DIVIDENDS A dividend is a distribution by a corporation to its shareholders on a pro rata (equal) basis. Dividends may be in the form of Cash Shares (normally common shares) CASH DIVIDENDS A cash dividend is a pro rata distribution of cash to shareholders. For a cash dividend to occur, a corporation must have: 1. retained earnings, 2. adequate cash, and 3. declared dividends ENTRIES FOR CASH DIVIDENDS Three dates are important in connection with dividends: Declaration date Record date Payment date ALLOCATING CASH DIVIDENDS BETWEEN PREFERRED AND COMMON SHARES Cash dividends must first be paid to preferred shareholders before any common shareholders are paid. When preferred shares are cumulative, any dividends in arrears must be paid to preferred shareholders before allocating any dividends to common shareholders. When preferred shares are non-cumulative, only the current year’s dividend must be paid to preferred shareholders before paying any dividends to common shareholders. STOCK DIVIDENDS A stock dividend is a pro rata distribution of the corporation’s own shares to its shareholders. A stock dividend results in a decrease in retained earnings and an increase in share capital since a portion of retained earnings is transferred to legal capital. In most cases, the fair market value is assigned to the dividend shares. Total shareholders’ equity and the legal capital per share remain the same. STOCK DIVIDEND EFFECTS Before dividend Shareholders’ equity Common shares Retained earnings Total shareholders’ equity Issued shares Book value per share $500,000 300,000 $800,000 50,000 $ 16.00 After dividend $575,000 225,000 $800,000 55,000 $ 14.55 Stock dividends change the composition of shareholders’ equity because a portion of retained earnings is transferred to contributed capital. However, total shareholders’ equity remains the same. The number of shares increases and this means that the book value per share decreases. PURPOSES AND BENEFITS OF STOCK DIVIDENDS For company To satisfy shareholders' dividend expectations without spending cash To increase marketability of its shares by increasing number of shares and decreasing market price per share To reinvest and restrict a portion of shareholders' equity PURPOSES AND BENEFITS OF STOCK DIVIDENDS For shareholder More shares with which to earn additional dividend income More shares for future profitable resale, as share price climbs again STOCK SPLITS A stock split involves the issue of additional shares to shareholders according to their percentage of ownership. In a stock split, the number of shares is increased in the same proportion that legal capital per share is decreased. A stock split has no effect on total share (contributed) capital, retained earnings, or shareholders’ equity. It is not necessary to formally journalize a stock split. STOCK SPLIT EFFECTS A stock split does not affect total share capital, retained earnings, or shareholders’ equity. However, the number of shares increases and book value per share decreases. Before Stock Split Shareholders’ equity Common shares Retained earnings Total shareholders’ equity Issued shares Book value per share $500,000 300,000 $800,000 50,000 $ 16.00 After Stock Split $500,000 300,000 $800,000 100,000 $ 8.00 EFFECTS OF STOCK SPLITS, STOCK DIVIDENDS, AND CASH DIVIDENDS Stock Split Total assets Total liabilities Total shareholders’ equity Total share capital Total retained earnings Legal capital per share Book value per share Number of shares % of shareholder ownership NE = No effect NE NE NE NE NE NE = Increase Stock Dividend NE NE NE NE NE Cash Dividend NE NE NE NE NE = Decrease RETAINED EARNINGS Retained earnings is the cumulative net earnings (less losses) that is retained in the business (i.e., not distributed to shareholders) Retained earnings, opening balance + Net earnings (or - net loss) - Dividends = Retained earnings, ending balance DEFICIT Shareholders’ equity Share capital Common shares Retained earnings (deficit) Total shareholders’ equity $800,000 (50,000) $750,000 A debit balance in retained earnings is identified as a DEFICIT and is reported as a deduction in the shareholders’ equity section RETAINED EARNINGS RESTRICTIONS In some cases there may be retained earnings restrictions that make a portion of the balance currently unavailable for dividends Restrictions result from one or more of the following causes Legal Contractual Voluntary PRIOR PERIOD ADJUSTMENTS A prior period adjustment results from 1. the correction of a material error in reporting net income in previously issued financial statements, or 2. changing an accounting principle. PRIOR PERIOD ADJUSTMENTS A correction of an error occurs after the books are closed, and relates to a prior accounting period. A change in an accounting principle occurs when the principle used in the current year is different from the one used in the preceding year. PRIOR PERIOD ADJUSTMENTS The cumulative effect of the correction or change (net of income tax) should be made directly to Retained Earnings; reported in the current year’s retained earnings statement as an adjustment of the beginning balance of Retained Earnings; disclosed in a footnote to the financial statements; corrected and restated in all prior period financial statements presented; and the corrected amount or new principle should be used in reporting the results of operations of the current year. DEBITS AND CREDITS TO RETAINED EARNINGS Retained Earnings Debits (Decreases) 1. Correction of a prior period error that overstated income 2. Cumulative effect of a change in accounting principle that decreased income 3. Net loss 4. Cash dividends 5. Stock dividends Credits (Increases) 1. Correction of a prior period error that understated income 2. Cumulative effect of a change in accounting principle that increased income 3. Net income Many corporations prepare a statement of retained earnings to explain the changes in retained earnings during the year. Some companies combine this statement of retained earnings with their income statement. CORPORATION INCOME STATEMENTS • The income statement for a corporation includes essentially the same sections as in a proprietorship or a partnership. • The major difference is a section for income tax expense. • For tax purposes, corporations are considered to be a separate legal entity. INCOME STATEMENT WITH INCOME TAX LEADS INC. Income Statement For the Year Ended December 31, 2003 Sales $800,000 Cost of goods sold 600,000 Gross profit 200,000 Operating expenses 50,000 Income from operations 150,000 Other revenues and gains 10,000 4,000 Other expenses and losses 156,000 Income before income tax 46,800 Income tax expense $109,200 Net Income INTRAPERIOD TAX ALLOCATION • Intraperiod tax allocation refers to the procedure of associating income taxes within the income statement to the specific item that directly affects the income taxes for the period. • In contrast, interperiod tax allocation allocates income taxes between two or more periods. • Under intraperiod tax allocation, the income tax expense or tax saving is shown for income before income tax. • Each non-typical item discussed next is also shown net of tax. ADDITIONAL SECTIONS OF AN INCOME STATEMENT Additional sections should be added to the income statement to report material items not typical of regular operations. These non-typical times include: 1. discontinued operations 2. extraordinary items Each item should be carefully explained in notes to the financial statements, and the income statement should report the income tax expense or savings applicable to each item. DISCONTINUED OPERATIONS Discontinued operations refers to the disposal of a significant segment of a business, such as the elimination of an entire activity or of a major class of customers. Income statement reports both income (loss) from continuing operations and income (loss) from discontinued operations. Income (loss) from discontinued operations consists of 1) income (loss) from operations and 2) gain (loss) on disposal of the segment. Both components are reported net of applicable income tax in a section entitled Discontinued Operations, which follows Income from Continuing Operations. STATEMENT PRESENTATION OF DISCONTINUED OPERATIONS HWA ENERGY INC. Income before income tax Income tax expense Income from continuing operations Discontinued operations Loss from operations of chemical division, net of $60,000 income tax saving Loss from disposal of chemical division, net of $30,000 income tax saving Total tax savings Net income $800,000 240,000 560,000 140,000 70,000 210,000 $350,000 Note that the caption “Income from continuing operations” is used and that a section “Discontinued operations” is added. Within the new section, both the operating loss and the loss on disposal are reported net of applicable income tax. EXTRAORDINARY ITEMS Extraordinary items are events and transactions that meet three conditions: Infrequent Non-typical Not subject to management decision Extraordinary items are reported net of income tax in a separate section of the income statement immediately following discontinued operations. EXAMPLES OF EXTRAORDINARY AND ORDINARY ITEMS Extraordinary Items Ordinary Items 1. Effects of major casualties (acts of God) if rare in the area 2. Expropriation (takeover) of property by a government 3. Effects of a newly enacted law or regulation, such as a condemnation action 1. Effects of major casualties (acts of God) if frequent in the area 2. Write down of inventories or write off of receivables 3. Losses attributable to labour disputes 4. Gains or losses from sale of capital assets STATEMENT PRESENTATION OF EXTRAORDINARY ITEMS HWA ENERGY INC. Income Statement (partial) For the Year Ended December 31, 2003 Income before income tax Income tax expense Income from continuing operations Discontinued operations Loss from operations of chemical division, net of $60,000 income tax saving Loss from disposal of chemical division, net of $30,000 income tax saving Income before extraordinary item $800,000 240,000 560,000 $140,000 Extraordinary item Expropriation of property, net of $21,000 income tax saving Net income 70,000 210,000 350,000 49,000 $301,000 ADDITIONAL EARNINGS PER SHARE DISCLOSURES HWA ENERGY, INC. Net income Earnings per share Income from continuing operations Loss from discontinued operations Income before extraordinary item Extraordinary loss Net income $301,000 $5.60 (2.10) 3.50 (.49) $3.01 When the income statement contains any non-typical item, EPS should be disclosed for each component.