analiza piata lactatelor_e

advertisement

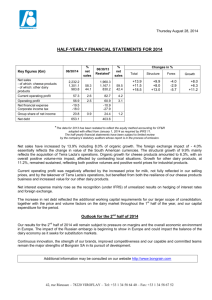

Milk producers have lost 47% of their turnover between 2008-2013 13 May 2015 Author: Manageranticriza.ro DAIRY PRODUCTION SECTORIN ROMANIA – GENERAL MATTERS + POSITIVE MATTERS - NEGATIVE MATTERS Turnover increase by 7.9% in 2013 vs. Turnover decrease by 47% between 1 1 2012 2008 - 2013 Turnover per company increase by 11.4% decrease in the number of 2 2 8.2% in 2013 vs. 2012 companies between 2008 - 2013 Decrease in days sales outstanding for Decrease in earning companies’ the companies between EUR 20 - 50M weight in the total number of 3 3 from 73 days (2004) to 50 days (2013) companies sector-wide, from 46.1% (2004) to 34.4% (2013) 25.5% increase in the number of Leverage ratio increase from 68.4% 4 employees for the companies between 4 (2008) to 78.9% (2013) EUR 0 and 100K in 2013 vs. 2008 Improved net profit margin for Extension of days sales outstanding 5 companies between EUR 20 - 50M 5 from 60 days (2008) to 65 days from -24.7% (2004) to -0.4% (2013) (2013) Decrease in the loss-making 8.9% increase in the absolute loss companies’ weight in total number of value of loss-making companies in 6 companies, for the segment between 6 2013 vs. 2012 EUR 20 - 50M, from 1.3% (2008) to 0.4% (2013) Optimisation of days inventory Increase in the days sales of inventory outstanding for companies between from 32 days (2004) to 37 days 7 7 EUR50 and 100M, from 28 days (2013) (2004) to 20 days (2013) Over the period from 2008 to 2013, the dairy farming and processing companies reported 47% decline in activity, at an annual average pace of ~12%, as a consequence of external competition and the decrease in the number of domestic producers due to the low value of subsidies per head of cattle and high VAT rate as compared with other EU countries. The information provided reflects data reported by companies in the following business segments: operation of dairies and cheese making, manufacture of ice cream. A major cause of the decline in the Romanian Milk Production and Processing Market is the price of milk as raw material. Thus, when competing with the external players who receive higher subsidies from the State, the local producers are forced to deliver milk at lower prices than in 2012, while both the fuel and electricity costs and the production, transport, milk analysis, pasteurising, packaging and warehousing charges are higher. The Romanian Dairy market features a lack of cooperation between producers and processors, many processors choosing to terminate the agreements concluded with tens of Romanian farms to bring milk from Hungary and Poland, at a smaller price per litre. The Romanian internal production capacity remains thus unexploited, the milk market issues also influencing the livestock sector, triggering a decrease in the number of milk cow breeders. No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 THE ROMANIAN DAIRY PRODUCTION SECTOR – 2008-2013 EVOLUTION 2008 2012 2013 2013 vs. 2012 Number of companies 791 687 685 Turnover (EUR) 1,838,033,535 902,347,951 973,906,667 Turnover per company (EUR) 2,323,683 1,313,461 1,421,762 Net profit (EUR) -26,806,155 -9,250,818 -21,469,331 Number of earning companies 365 258 237 Number of earning companies/ total 46.1% 37.6% 34.6% number of companies Earning companies’ profit (EUR) 75,033,729 28,619,947 19,763,294 Earning companies’ profit / number 205,572 110,930 83,389 of earning companies (EUR) Number of loss-making companies 426 429 448 Number of loss-making 53.9% 62.4% 65.4% companies/Total number of companies Loss-making companies’ loss 101,839,884 37,870,765 41,232,624 (EUR) Loss-making companies’ loss / no. 239,061 88,277 92,037 of loss-making companies (EUR) Number of employees 27,868 14,216 14,145 Turnover /Number of employees 65,955 63,474 68,852 (EUR) Days sales outstanding (days) 60 66 65 Net profit margin (%) -1.5% -1.0% -2.2% Leverage ratio (%) 68.6% 76.2% 78.9% Indicators 2013 vs. 2008 significantly by the reduced consumption (considering the reduction of the purchasing power among the population) as well as by the problems faced by the local processors in creating a competitive advantage in terms of price. The development of Dairy and Cheese Production and Processing industry in Romania depends on factors relating to the evolution of consumption power among the population, the legal measures aimed at reducing the grey market, the capacity of local players to adjust to the European standards regarding the quality of products and consumer protection, unemployment rate – as a driving factor of decreased demand, the investments made by the international players operating on the local market, the change in consumers’ behaviour (choice of a healthy lifestyle and increased preference for the acquisition of products directly from local producers), the development of livestock sector towards obtaining powerful breeds to increase milk production. Companies’ development also depends on how a series of factors, such as: quality and diversity of product portfolio, making cash flow available for brand building, creation of an organised distribution chain and strengthening the relationships with the distributors, are reflected in the strategy of their own organisations. An analysis performed among all Romanian companies that declared to carry out business in the Milk Production and Processing sector showed that the total sector turnover decreased from 2008 to 2013 at an annual average pace of about 12%, at the end of said period being 47% below the level recorded at the beginning thereof, influencing the vertical integration (to raw material suppliers or local distributors), the capacity to manufacture dairy products in large quantities so as to achieve cost savings, the increased efficiency and quality of production processes, the adjustment thereof to market demands, the acquisition of packaging, labelling, storing and transportation equipment. The Dairy market is a market having a high degree of concentration, being dominated by some large players (1.5% of the total number of companies), including the companies between EUR 20-500 M, that in 2013 contributed with 59% to the sector’s turnover, providing jobs for 28% of total active employees in this sector. The companies having a turnover between EUR 0-500 K is the most fragmented segment of the Dairy Production market. These companies dominate the sector as number in 2013 representing 52.1% of the total number of companies, obtaining 3.6% of the total turnover of the sector, holding 13.4% of the manpower on this market. Fig. 1 - Structure of the turnover obtained in the Dairy production sector – by company size groups - 2013 Source: calculation made by www.manageranticriza based on the data provided by the National Trade Register Office The companies having a turnover between EUR 0-500 K reached in 2013 an average leverage ratio (112.2%) much higher than the one of the sector (78.9%), indicative of problems related to attracting funds for supporting and optimising the business. Besides that there are also the debt collection problems, evident in the days sales outstanding, i.e. 176 days, much higher than the sector average between 2008-2013 (64 days). The large companies had no major problems in keeping the debts under control, taking advantage of their power on the market. Thus the companies having a turnover between EUR 100-500 M had the best days sales outstanding, between 2008-2013 the average being 21 days, higher than the sector-wide value (64 days). Fig. 2 – Days sales outstanding 2008-2013 Source: calculation made by www.manageranticriza based on the data provided by the National Trade Register Office Considered globally, the profit margin on the Dairy Market features big differences between the company size groups. Thus, the lowest net profit margin was recorded in 2013 by the companies between EUR 0 - 100 K (-84.6%),while the maximum value was reached by the companies with a turnover ranging between EUR 10 and 20M (+5.1%). The evolution of profit margin is given below: Fig. 3 – Net profit margin 2008 - 2013 Source: calculation made by www.manageranticriza based on the data provided by the National Trade Register Office The economic environment pressures in the last years, after the economic downturn, have been also evident in the evolution of the Dairy Market where the number of companies active in this field decreased by 13.4% in 2013 compared to 2008. Also the percentage of loss-making companies in the total number of active companies increased from 53.9% (2008) to 65.4% (2013) - a percentage higher than the one at the level of economy - 59.5%), due to the reduction of the purchasing power and the lack of protection measures for the local producers and distributors against the global competitor players present on the local market. The effect of these factors can be also seen in the dynamics of the number of employees that decreased by approximately 49.2% between 2008-2013 and in the decrease in the turnover/ company by 38.8% in 2013 vs 2008. Also, the number of companies under insolvency proceedings in the Dairy sector showed a persistence of the recession period influences, increasing over the 2008-2013 period from 1 to 59, the weight of insolvent companies in total companies in this sector reaching its peak in 2013 (8.6%). In this sector, a large number of insolvencies were due to factors such as: decrease in the number of own brands launched by retailers at a low price – a level that cannot be supported by the local farmers without any major reduction of profit, the difficult access to funding/bank loans, the high level of fees and taxes, the absence of working capital, the decreased consuming power among population. The Dairy Production market is assessed to have a very high risk, namely 9.5 (on a scale from 1 to 10), which reveals a vulnerable economic sector when examining the volatility of key economic performance indicators. This risk level is also due to the significant pressures the milk processors are exposed to and which come from the suppliers’ power of negotiation, as even the large processors are influenced by the impact of an increase in the price of milk. The competitors present on this market entail an average level of threat as the efforts and costs related to a change of supplier are not high for buyers; some players may enhance competition by strengthening their brands. Industrial dairy production requires special equipment; therefore, a possible business reorientation would create significant barriers to exit from this market. Also, the barriers to entry are high for the processors because of the sanitary regulations regarding the products, the high investment expenses, the high level of production, the need to have in place a very thorough organisation of the supply and distribution chains due to product perishability. Some retailers may have exclusivity for the dairy products of specific producers, increasing the clients’ power and reducing the competition level to some extent. At the same time, the consumers’ negotiation power is also influenced by the fact that dairy products are an important part in the diet of most consumers and the traders are strongly motivated to include them in their stocks. In 2013 the aggregate turnover of the top 10 players in the Dairy Production sector increased by 7.7% compared to 2012 and by15.2% compared to 2008, showing the evolution of the local processors Albalact and Covalact, which between 2008-2013 had increases by 84.6% and 50%, respectively. The market leader in 2013, according to the turnover criterion, was the company Danone, accounting for 19% of the turnover of the top 10 players. The company’s turnover dropped by 4.2% compared to 2012, with a days sales outstanding number of 25 days, much better than the average value across the companies that declared to carry out business in the Dairy Production industry (65 days) and better days sales of inventory (16 days) than the sector-wide average (37 days). The net profit margin for the main 10 companies on the market ranged in 2013 between-8.5% (Dorna Lactate) and11.9% (Simultan), while the average value for the top 10 companies was 1.0%. The most intense activity in Dairy industry was recorded in 2013 by the companies based in Cluj, Bucharest and Alba, being among the top companies in 2013 having in view the turnover criterion (Fig. 4). Fig. 4 – The turnover achieved in the Dairy Production sector – by county Source: calculation made by www.manageranticriza based on the data provided by the National Trade Register Office Another effect of the crisis is also evident in the evolution over this period of the number of earning companies. Thus only approximately 34.6% of total companies operating in the Dairy Production sector had profit in 2013 (below the level of total economy - 40.5% of the total number of active companies), decreasing as compared to their weight in 2008 (46.1%). The net profit margin calculated globally for the whole area of business reached its peak in 2010 (2.2%), in 2013 being -2.2%, below that of 2012 (-1%) and 2008 (-1.5%). As to the companies acting in the Dairy Production sector and having reported losses, the aggregate value of loss increased in absolute value by 8.9% in 2013 as compared to the previous year, but it was 59.5% lower than the absolute value reached in 2008. The following figure shows how the net loss is formed on the Dairy Market: Fig. 5 – Net Loss 2013 Groups of company (turnover criterion) Source: calculation made by www.manageranticriza based on the data provided by the National Trade Register Office In 2013, the highest ranking counties in terms of the net profit margin reached by the companies (Fig. 6) were Dolj (14.6%), Caras-Severin (14.4%) and Calarasi (11.9%). Fig. 6 – Net profit margin -Dairy Production sector by county Source: calculation made by www.manageranticriza based on the data provided by the National Trade Register Office The problems related to the recovery of receivables Dairy Production sector were more significant in 2013 in the companies based in the counties Satu Mare (276 days), and Arad (262 days), the values recorded for days sales outstanding being above the sector-wide aggregate value of the indicator (65 days). This reveals the need to optimise the debt collection process, by developing proactive tools of receipt monitoring and customer selection created within the companies. The leverage ratio across the sector increased from 68.6% in 2012, to 78.9% in 2013, being influenced by the progress of weight of short term debts in total debts, which increased from 67% in 2012 to75.5% in 2013. The key success factors of a company operating in the Dairy Production sector include: building a strategic alliance with major distributors which do not have any production unit – in order to consolidate the image in the market and increase regional coverage, an aggressive management of costs, an increased degree of automation for higher efficiency of operations, diversity of customer portfolio by taking part in auctions organised by end consumers (schools, kindergartens, retirement homes) and implementation of an adequate system of performance indicators, having in view the employees’ behaviour and market situation. The information provided in this material is selected from an extensive set of detailed market studies and analyses on the evolution of this sector – prepared by the management consulting and market analysis platform ManagerAnticriza (www.manageranticriza.ro). We have taken all due diligence to ensure collection and processing of data as correctly as possible but the authors undertake no liability whatsoever for any potential negative consequences or losses caused by accessing this summarising analysis and taking some management decisions in reliance on it.