NATCP e-help Presentation

advertisement

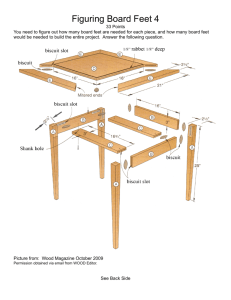

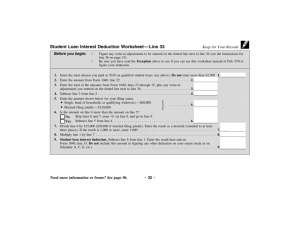

e-help for the National Association of Computerized Tax Professionals 1 Supported Products Modernized e-File (MeF) - Forms 1120, 990 1065, 7004, 2290, 720 and 8849 - Testing e-services EFTPS Electronic Federal Tax Payment System FIRE Filing Information Returns Electronically ITIN Acceptance Agent Application - Registration - PTIN - TIN Interactive - e-file Application - EAR - TIN Matching - DA - TDS (IVES) - reporting 990-N Postcard Mod e-File -1040 MeF Quick Alerts e-mail only CCR Centralized Contractor Registration e-file - 1040/1041 - 94x - Testing Currently Supported Coming Soon 2 2009 e-help Desk Hours of Operation Standard Hours: Weekdays: 6:30am – 6:00pm Central Time Weekends: closed Extended Hours: Weekdays: 6:30am – 10:00pm Central Time - MLK Day: open - President’s Day: open Saturdays: 7:30am – 4:00pm Central Time 866-255-0654 3 2009 e-help Desk Hours of Operation Form 1065,1120 & 990 Extensions: 9/12 Saturday 9/14 Monday 9/15 Tuesday 0730 - 1600 Central 0630 - 2200 Central 0630 - 2300 Central Form 1040 Extensions: 10/13 and 10/14 0630 - 2200 Central 10/15 0630 - 2300 Central 866-255-0654 4 NACTP Suggestions for Improving the IRS e-file Program Issue: Can assistors be trained before PATS/ATS begins? Update: Training will take place in August and September of this year. However, not all training can be completed before PATS/ATS begins. 5 “Express Service” for Software Developers Issue: Desire for Direct Communications with the e-help Desk Update: Implementation of a Silent Prompt from November 03, 2009 through January 31, 2010 for Software Developers Only E-mail response times will improve through more efficient routing of e-mails. Long-term Strategy: Investigate chat capability - This is still a couple of years away as security concerns still need to be addressed. 6 Contact Information Toll-free 866-255-0654 7 QuickAlerts • QuickAlerts, transitioned smoothly on June 1, 2009 from an external source to an IRS hosting platform. To date, no problems have surfaced regarding the change either in customer service or in the subscription process. The removal of the EFIN or ETIN requirement has made the subscription process much simpler. • Aside from the earlier notification of the QuickAlerts transition to the current subscribers, we also have a team of individuals that are helping Tax Forum customers to subscribe in each of the six cities. 8 Wage & Investment Submission Processing E-Submissions Branch 9 New Forms, Schedules and Worksheets for Tax Year 2009/ Processing Year 2010 • • • • • • • • • • • • Form 1098-C - Contributions of Motor Vehicle, Boats and Airplanes Form 8925 - Report of Employer - Owned Life Insurance Contract Forms 8931 - Agricultural Chemicals Security Credit Form 8932 - Credit for Employer Differential Wage Payments; and Form 8933 - Carbon Dioxide Sequestration Credit Form 8936 - Qualified Plug-In Electric Drive Motor Vehicle Credit Schedule L – Standard Deduction Schedule M – Making Work Pay and Government Retiree Credits Worksheet 1 – Figuring the Percentage of Tax-Free Income Worksheet 2 – Figuring the Allowable Deduction for Schedule C or C-EZ Expenses Worksheet 3 – Figuring the Allowable Deduction for Form 2106 or 2106-EZ Expenses Worksheet 4 – Figuring Net Self Employment Income for Schedule SE 10 Changes to Form 8453 Transmittal Document • The check box for Worksheets 1 through 4 from Publication 517, Social Security and Other Information for members of the Clergy and Religious Workers, is being deleted. • A check box for Appendix A, Statement by Taxpayer Using the Procedures in Rev. Proc. 2009-20 to Determine a Theft Loss Deduction Related to a Fraudulent Investment Arrangement, is being added. 11 Changes for Earned Income Tax Credit (EITC) • For TY2009 and TY2010 a taxpayer can have up to three qualifying children to receive the maximum earned income credit. • All error reject codes related to Sch. EIC have been revised to include the third child and all qualifying information. • Qualifying Child Definition Modified – ERC 0541 created. 12 First-Time Homebuyer Credit • For Tax Year 2009, Form 5405 will include a “Change of Main Home” and “Repayment of Credit” section. • New legislation expands the refundable credit for new home purchases by a first-time homebuyer to 10% of the purchase price up to a maximum of $8,000 opposed to $7,500 for tax year 2008. • The $8,000 credit applies to primary residence purchases that closed on or after January 1, 2009 through November 30, 2009. • Additional error reject codes (ERC’s) are being created for the revised Form 5405. • There will be revisions to Form 1040 to include repayment amounts. • FAQ’s are available on IRS.gov – Click on the “First-Time Homebuyer Credit” link that’s located on the home page. 13