Management Accounting Information for Activity and Process

advertisement

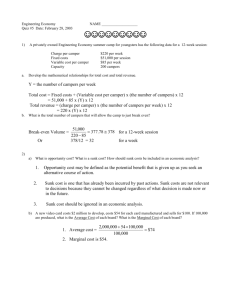

Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Chapter 6 Management Accounting Information for Activity and Process Decisions Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Chapter 6 Objectives: To be able to: 1. 2. 3. 4. 5. 6. 7. 8. explain why sunk costs are not relevant costs analyze make-or-buy decisions demonstrate the influence of qualitative factors in making decisions compare the different types of facilities layouts explain the theory of constraints demonstrate the value of just-in-time manufacturing systems describe the concept of the cost of quality calculate the cost savings resulting from reductions in inventories, reduction in production cycle time, production yield improvements, and reductions in rework and defect rates Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Sunk costs Relevant costs/revenues = Those factors that are affected by a decision Sunk costs = The costs of resources that already have been comitted and cannot be changed by any current action or decision; contrast with incremental costs. Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Sunk costs Bonner Company, exhibit 6-2 page 221 Sept 1, 2000 Buys a new drilling machine for $180,000. Pays $50,000 cash + bank loan financing the remaining $150,000. Monthly payment $5,200 for 36 months. Sept 27, 2000 A technologically better drilling machine becomes available. Price ? Scrap value old machine $50,000. Old machine taken as down payment. Monthly payments $6,000 for 35 months. Efficiency savings: Direct labor Maintenance Materials scrap $4,400 per month $ 800 per month $1,000 per month Managers must be able to identify the costs and revenues relevant for the evaluation of alternatives. Equally important, they must recognize that some costs and revenues are not relevant in such evaluations. Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Sunk costs Throwing Good Money after Bad How does this well known expression correspond with the sunk cost theory? Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Make-or-Buy Decisions Definition: A decision in which managers must decide whether their companies should manufacture some parts and components for their products in-house or subcontract whith another company to supply these parts and components. Outsourcing = The process of buying resources from an outside supplier instead of manufacturing them inhouse Avoidable costs = Those costs eliminated when a part, product, product line, or business segment is discontinued Exhibit 6-3, page 223 Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Make-or-Buy Decisions Qualitative Factors: • • • • Suppliers lowballing the price to get a foot in the door? Reliability of supplier (quality, delivery, capacity etc.)? Solution ”certified suppliers? Do you eliminate own capabilities for good? Are you handing over strategic knowledge to the vendor with the risc of the vendor becoming a competitor? Exercise Perform a general SWOT with the students in class establishing general Strengths, Weaknesses, Opportunities and Threats. Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Facility Layout Systems 1. 2. 3. Process layouts. A production design in which all similar equipment or functions are grouped together. Typically used when production takes place in smaller batches or unique products. Product layouts A production design in which equipment is organized to accommodate the production of a specific product. Typically used in high volume productions. Cellular manufacturing Refers to the organization of a plant into a number of cells so that within each cell all machines required to manufacture a group of similar products are arranged in close proximity to each other. Objective: Department of Accounting To streamline operations and thus increase the operating income of the system. Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Facility Layout Systems Theory of constrains: A management approach that maximizes the volume of production through a bottleneck process. A bottleneck is defined as any condition that impedes or constrains the efficient flow of a process. Measured by: Throughput contribution: The difference between revenues and direct materials for the quantity of products sold. Investment: The montetary value of the assets that the organization gives up to acquire an asset. Operating costs: Costs, other than direct materials costs, that are needed to produce a product or service. Comparison of TOC versus ABC Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Inventory Costs and Processing Time Building inventories create costs such as: • Moving, storing and handling • Damaged or obsolete products • Potential cost of reworking • Ties up financial resources • Increases cycle-time Definitions: Cycle time The time required to produce a product from start to finish. Processing time Time expended to complete a processing activity. Manufacturing cycle efficiency Ameasure used to assess the efficiency of a manufacturing process. Evaluates how much of the total cycle time was spend in inventory. Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Inventory Costs and Processing Time San Rafael Electric Corporation, Exhibit 6-6, 6-7, 6-8, 6-9, 6-10 Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Cost of Nonconformance and Quality Issues Definition: The cost incurred when the quality of products and services does not conform to quality standards. Major factors: - satisfying customer expectations regarding the attributes and performance of the product, such as functionality and features. - ensuring that the technical aspects of the products design and performance, such as whether it performs to the standard expected, conform to the manufacturers standards. ISO9000 Standards Exhibit 6-11 Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Cost of Nonconformance and Quality Issues Costs of quality control Definition: Those costs incurred on quality-related processes; include prevention, appraisal, internal failure and external failure. Prevention costs Those costs incurred to ensure that companies produce products according to quality standards. Appraisal costs Those costs related to inspecting products to ensure that they meet both internal and external customer requirements. Internal failure costs The costs incurred when the manufacturing process detects a defective component or product before it is shipped to an external customer. External failure costs Those costs incurred when customers discover a defect. Examples Department of Accounting Exhibit 6-13 Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Just-in-Time Manufacturing Definition: A production process method in which products are manufactured only as needed. Produce and deliver WHAT is requested, WHEN it is requested and ON TIME. Exercise Perform a general SWOT with the students in class establishing general Strengths, Weaknesses, Opportunities and Threats Important measures Benchmarking of manufacturing cycle effectiveness: • Defect rates • Cycle times • Percent of time that deliveries are on time • Order accuracy • Actual production as a percent of planned production • Actual machine time available compared with planned machine time available. Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Just-in-Time Manufacturing Tobor Toy Company - Selling an advanced, pricey mechanical toy robot with a 30% market share. Problems: Large drop in sales and market share. Investigations at customer level shows that a significant decrease in the quality of the product and general delays in getting it to the customer are the primary causes. Problems originate from: • A disorganized, sloppy production system in which piles of both work-in-process and raw materials inventories were scattered over the shop floor. • A lenghty and complex flow of production. • High inventory levels of work-in-process. • High rates of rework. • The use of outdated machinery. • Lack of commitment, focus and training among workers. Solutions: • • • Implementing a new production process - Just In Time. Establish intensive worker training Investing $300,000 in the above. Department of Accounting Management Accounting Chapter 6 - Management Accounting Information for Activity and Process Decisions Just-in-Time Manufacturing Tobor Toy Company - Selling an advanced, pricey mechanical toy robot with a 30% market share. Improvements: • Major rework rate reduced from 5.8% to 3.3% • Minor rework rate reduced from 13.6% to 7.0% • Average production time reduced from 16.4 days to 7.2 days • Investment in implementation ($300.000) with a payback time of approximately 5 months. Department of Accounting