*

*

*

How Economics

Affects

Business:

The Creation

and Distribution

of Wealth

Nickels

*

McGraw-Hill/Irwin

Understanding Business, 8e

McHugh

*

*

CHAPTER

**

2

McHugh

1-1

2-1

© 2008 The McGraw-Hill Companies, Inc., All Rights Reserved.

*

*

*

Learning goals

• Compare and contrast the economics of despair with

the economics of growth.

• Explain what capitalism is and how free markets work.

• Discuss the major differences between socialism and

communism.

• Explain the trend toward mixed economies.

• Discuss the economic system of the united states,

including the significance of key economic indicators

(GDP), productivity, and the business cycle.

• Define fiscal policy and monetary policy, and explain

how each affect the economy.

2-2

*

*

*

Economics: Create Wealth

• Study of how society chooses to

employ resources to produce

goods & services and distribute

them among competing

groups/individuals

• Micro v. Macro

• Resource Development

2-3

*

*

*

Four “What’s” of

an Economic System

$ What is produced?

$ What amount is produced?

$ What is the method of output

distribution?

$ What is the rate of economic growth?

Adapted from: Edwin Mansfield Economics (New York: W.W. Norton, 1976), p.8

2-4

*

*

*

Economic Theories

•

Thomas Malthus (Early 1800s)

• “Dismal Science”

• Too many people

•

Adam Smith (1776)

• Freedom is vital

• “Invisible Hand”

2-5

*

*

*

Circular Flow Model

2-6

*

*

*

Three Economic Systems

Mixed

Socialism

(Highly Controlled)

(Little Control)

Communism

Capitalism

2-7

*

*

*

Free-Market Capitalism

•

Private Property

•

Business Ownership/

Profits

•

Freedom of Competition

•

Freedom of Choice

2-8

*

*

*

Supply Curve

High

Price(P)

S

Low

Quantity(S)

High

2-9

*

*

*

Demand Curve

High

Price(P)

D

Low

Quantity(D)

High

2-10

*

*

*

Equilibrium Point

Surplus

High

Market Equilibrium

Price

S

Low

Shortage

Quantity

D

High

2-11

*

*

*

Free-Market Competition

Monopolistic

Oligopoly

Competition

One

Many

Perfect

Competition

Monopoly

Sellers

2-12

*

*

*

Perfect Competition

Sellers

Buyer

2-13

*

*

*

Monopolistic Competition:

Many Sellers With Perceived Differences

•

Fast Food

•

Colleges

2-14

*

*

*

Oligopoly: Few Sellers

•

Automobiles

•

Tobacco

2-15

*

*

*

Monopoly: One Seller

•

Utilities

• Microsoft?

2-16

*

*

*

Limits of Free-Markets

•

Inequality of Wealth- Causes

National & World Tension

•

Greed Compromises Ethics

•

Limitations Push Country

towards Socialism =

Government Regulation

2-17

*

*

*

Industrialized Nations’

Top Individual Tax Rate

U.S.

Japan

Germany

Italy

Spain

France

Austria

Denmark

0%

10%

20%

30%

40%

50%

60%

70%

Source: www.worldwide-tax.com, May 9, 2006

2-18

*

*

*

Socialism

•

Private & Public Ownership

•

Some Choices are Limited

• Creates Social Equality

• Reduces Individual Incentive

- Brain Drain

2-19

*

*

*

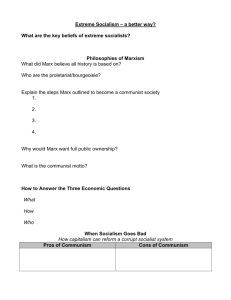

Communism

•

Public Ownership

•

•

Almost all major factors of

production

Central Planning/Controlled

Economy

• Shortages of food and other products

may develop

• Lack of motivation to work hard for

business people

2-20

*

*

*

Mixed Economies

•

Free-Market Economy = Capitalism

•

Command Economy

• Socialism

• Communism

•

Trend Results in Blend/Mix

• Capitalism > Socialism

• Socialism > Capitalism

2-21

*

*

*

Why is the U.S.

an Economic Success?

Major Reason

Percent*

Constitution

85

Free Elections

84

Free Enterprise System

81

Abundant Resources

78

Cultural Diversity

71

* Respondents could choose more than one.

Source: Investors Business Daily Survey

2-22

*

*

*

U.S. Economy

•

•

•

•

Key Economic Indicators

Productivity in the U.S.

Productivity in the Service Sector

Business Cycles

• Recession

• Depression

• Recovery

• Stabilization

• Fiscal Policy

• National Debt

• Economic Growth through Monetary Policy

2-23

*

*

*

Key Economic Indicators

•

Gross Domestic Product (GDP)

•

Unemployment Rate

•

Price Indexes

• Consumer Price Index (CPI)

• Producer Price Index (PPI)

2-24

*

*

*

U.S. Gross

Domestic Product

14,000

12,000

10,000

8,000

In Billions of U.S. $

6,000

4,000

2,000

0

1940

1950

Source: U.S. Dept. of Commerce, Bureau of Economic Analysis

1960

1970

1980

1990

2000

2002

2005

2-25

*

*

*

Share of World GDP(%)

1975

•G-8 Countries

•U.S. only

•China

•India

•Latin America

•Africa

55

22

5

3

7

3

2004

44

21

13

6

6

3

Source: www.dlc.org/ppi, July 6, 2005

2-26

*

*

*

U.S. Unemployment (%)

16

14

12

10

8

6

4

2

0

1940

1950

1960

1970

1980

1990

2000

2002

2005

Source: U.S. Bureau of Labor Statistics

Source: U.S. Bureau of Labor Statistics

2-27

*

*

*

What Makes Up The

Consumer Price Index?

Recreation Apparel

5%

6%

Medical Care/

Insurance

7%

Medical Care

6%

Other

5%

Housing & Util.

39%

Food &

Beverage

16%

Transportation

18%

Source: U.S. Bureau of Labor Statistics

2-28

*

*

*

Consumer Price Index

250

200

150

100

50

1982-84 = 100

0

1940

1950

1960

1970

1980

1990

2000

2002

Apr.

2006

Source: U.S. Dept. of Labor, Bureau of Labor Statistics

2-29

*

*

*

Percent Change in Labor

Productivity- U.S.

9

8

7

6

5

4

3

2

1

0

-1

1950

1960

1970

Source: U.S. Dept. of Commerce, Bureau of Labor Statistics

1980

1990

2000

2002

Q1 2006

2-30

*

*

*

Where Does the

Government Get Its Money?

4%

4%

9%

43%

Individual Income

Taxes

Social Security &

Payroll Taxes

Corporate Taxes

Excise Taxes

40%

Other

Source: Office of Management & Budget, 2002

2-31

*

*

*

Federal Spending

50%

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

1966

2006

Medicare &

Medicaid

Social

Security

Interest

Defense

Other

Source: Congressional Budget Office

2-32

*

*

*

Biggest Economic

Challenges

• Over the Next 3-5 years the U.S. can be

expected to face these challenges:

•

•

•

•

•

Pension & Health care costs

The Federal Deficit

High Energy and Commodity Costs

Balance of payments

Terrorism

Source: Investors Business Daily January 9, 2006

2-33

*

*

*

Healthcare Expenditure

Projections

(Percent of National GDP)

18.00%

17.50%

17.00%

16.50%

16.00%

15.50%

15.00%

14.50%

14.00%

2004

2006

2008

2010

2012

% of GDP

Source: FORTUNE May 3, 2004

2-34

*

*

*

Rising U.S. Trade Deficit

0

-100000

-200000

-300000

Deficit in

Millions

-400000

-500000

-600000

-700000

-800000

1980 1985 1990 1995 1999 2001 2003 2005

Source: US Dept of Commerce, Bureau of Economic Analysis

2-35

*

*

*

Where are the Homeland

Security Dollars Spent?

14

12

10

8

6

4

2

0

Border & Port

Security

Aviation Security

Immigration

Enforcement

BioDefense

Infrastructure

Protection

Source: Business Week June 14, 2004

2-36

*

*

*

What is the National Debt?

• The debt has reached $8.36

trillion+ (May 2006)

• If $1,000 bills were stacked:

• $1 Million = 4.29 Inches

• $1 Billion = 357.5 Feet

• $1 Trillion =

67 Miles

• The debt is equal to 560.1 miles in

$1,000 bills

• National Debt Clockhttp://www.brillig.com/debt_clock/

2-37