AEPC - Supply Chain Management & Logistics Executive Education

advertisement

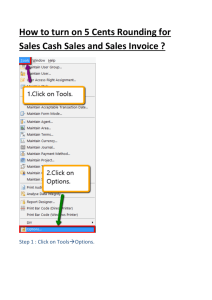

Supply Chain Financing Dr. Dale S. Rogers Nevada Logistics Institute Reno, NV 13 August 2015 A.T. Kearney 82/7478 1 Overview Strategic Supply Chain Financing •Supply chain financing defined •Fund the Growth •Working capital Tactics •Supply chain finance – reverse factoring •E-Payables •Cash Conversion Cycle •Options 2 2 Supply Chain Flows Product Flow Financial Flow Information Flow 3 Supply Chain Finance is: 1. Using the supply chain to fund the organization, and 2. Using the supplier organizations to fund the supply chain 4 Supply Chain Financing Fund the Growth! 5 5 Fund the Growth Firms are looking to an efficient and effective supply chain to fund the growth of the company. Companies cannot only be dependent on revenues and financial management to grow profit. 6 6 Sources of Operating Capital: An Example Pricing Functional Savings Supply Chain Savings SKU Rationalization Mix Management 7 Reasons for Increases In Cash Holdings Inventories have fallen R&D expenditures have increased. Cash flow risk for firms has increased Capital expenditures have fallen Source: THOMAS W. BATES, KATHLEEN M. KAHLE, and REN´E M. STULZ (2009). Why Do U.S. Firms Hold So Much More Cash than They Used To? Journal of Finance 8 Supply Chain Finance (Reverse Factoring) Uses Manufacturer’s credit rating Pays in 90 days Bank 3PL sells accounts receivable to bank and receives payment in less than 30 days Transportation Provider (Carrier) Pays in 30 days Manufacturer 3PL Customer Pays Immediately 9 Timeline Bank pays the 3PL 3PL pays the Transportation Carrier 0 days 30 days Manufacturer pays the Bank 60 days 90 days 10 Supply Chain Finance Uses Manufacturer credit rating Agrees to SCF Arrangement Aggregator Supplier can choose to receive payment as early as 2 days after the invoice has been approved. Supplier Submits invoice to Aggregator Manufacturer Bundle of Manufacturer receivables as DTC notes Bank 1 Bank 2 Bank 3 Or wait 90 days 11 Timeline Aggregato r sends money to bank(s) Delivery of Product product received Invoice sent to Manufactur er day 0 Aggregato Aggregato r sends money to r sells Invoice supplier approved notes to bank(s) day 8 day x day 10 Manufactur er sends money to Aggregator day 90 12 Dynamic Discounting Offering of early payment discounts on approved invoices awaiting payment. Buyers have option of choosing an APR Supplier invoices discounted based on a sliding scale derived from the number of days supplier is paid early. Types: •Early Payments •Extended Discount Term •Dynamic Payment Terms (ASAP) 13 HOW DOES IT FIT WITH OTHER EARLY PAY PROGRAMS? THEY COMPLEMENT EACH OTHER PERFECTLY SPEND LEVELS Buyer p ush = SCF $50M+ Buyer extends DPO Accounts Payable Value = C2FO everything in between = P-Cards less than $1M Supplier p ull Buyer generates profit SCF Cards C2FO Supplier Size Larger Smaller 14 TOGETHER THEY HELP ADDRESS ALL PARTS OF THE SUPPLY CHAIN AND MAJORITY OF VALUE OPPORTUNITY IS IN MIDSECTION OF SPEND Typical spend distribution of Fortune 500 company Spend Value APR Capital Cost SPEND $M APR $X0 70% $35 60% $30 50% $25 40% $20 30% $15 20% $10 10% $5 $0 0% Largest Supplier 250 SCF 500 750 1,000 1,250 C2FO 1,500 1,750 2,000 Smalles t Supplie Cards r Source: Bavelos Group, 2015 15 Payments Purchase Requisition Purchase Order • • • • • Check ACH VCA Wire Transfer FedWire 16 E-Payables P-Card EPayables Virtual Card Ghost Card 17 E-Payables – P-Cards Buying Firm Chief Purchasing Officer Supplier Firm Retail Commercial Tie Cards Co-Branding Fraud Security Rebates Bank Card Issuer Processor MasterCard Visa Bank 18 SCF vs. E-Payables SCF brings CPO and CFO together. The tension used to be on CPO focusing on price and CFO on working cap. SCF for core suppliers, large volume of money, frequent transactions. P-card (or virtual card) more for lots of SME suppliers. 19 Cash Requirements – Monthly Payments vs. Weekly Payments Monthly Invoice Payments Average Cash Required Weekly Invoice Payments Average Cash Required 20 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 Cash Conversion Cycle Apple 100 80 60 40 20 Apple 0 -20 -40 -60 21 Cash Conversion Cycle CCC = DSO + DIO – DPO Days Sales Outstanding (DSO): the number of days needed to collect on sales. Days Inventory Outstanding (DIO): how many days it takes to sell the inventory. Days Payable Outstanding (DPO): the company's payment of its own bills. 22 Selected CAPS Firms 2014 CCC Company Name TRANSCANADA CORP STATOIL ASA CHEVRON CORP PROCTER & GAMBLE CO XCEL ENERGY INC NORTHROP GRUMMAN CORP GENERAL MOTORS CO UNITED STATES STEEL CORP CELANESE CORP LOCKHEED MARTIN CORP HONEYWELL INTERNATIONAL INC INTEL CORP RAYTHEON CO GENERAL DYNAMICS CORP TEXAS INSTRUMENTS INC TEVA PHARMACEUTICALS 2014 CCC -44.99 -24.90 1.22 12.11 24.46 31.38 35.30 52.18 57.77 59.29 59.35 78.10 82.70 133.71 139.27 154.43 23 Further Explanation http://financing.supply 24 Funder Solutions 25 End Of Presentation Extra slides follow 26 Sources of Data Income Statement: •Revenue •Cost of Goods Sold (COGS) Balance Sheet: •(Average) Accounts Receivable •(Average) Accounts Payable •(Average) Inventory The number of days in the period (year = 365 days, quarter = 90) 27 Days Sales Outstanding (Average) Accounts Receivable/ Revenue per day Choices: •Accounts Receivable •AAR = (beginning AR + ending AR) / 2 •Time average of AR 28 Days Inventory Outstanding (Average) Inventory / COGS per day Choices: •Inventory •Average Inv. = (beginning Inv. + ending Inv.) / 2 •Time average of Inventory •De-inflate COGS? 29 Days Payable Outstanding (Average) Accounts Payable / COGS per day Choices: •Accounts Payable •AAP = (beginning AP + ending AP) / 2 •Time average of AP •De-inflate COGS? 30