I. An Overview of Budgeting

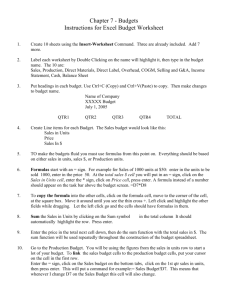

advertisement

Chapter 10 Budgetary Planning and Control Presentation Outline I. II. An Overview of Budgeting The Master Budget and Selected Budget Formats I. An Overview of Budgeting A. The Stages of Budgeting B. Developing the Budget A. The Stages of Budgeting 1. Planning 2. Control 1. Planning The budget process forces managers to consider carefully their goals and objectives and to specify means of achieving them. 2. Control Budgets provide a means of evaluating performance. Potential causes of significant deviations from budgets include: Budget was poorly conceived. Conditions have changed since the budget was prepared. Managers have done a particularly good or poor job. B. Developing the Budget 1. The Budget Committee 2. The Budget Time Period 3. Zero Base Budgeting 1. The Budget Committee Various budgets are approved by a budget committee that is composed of senior managers such as the president, CFO, VP of operations, and the controller. Budgets may be developed with either a top-down or bottom-up approach. 2. The Budget Time Period Budgets may cover a variety of time periods including a month, quarter, year, or even longer. Generally, longer budget periods provide less detail. 3. Zero Base Budgeting Budgets are often adjusted up or down on the basis of a previous period adjusted for current conditions. Zero base budgeting requires that all budget amounts be currently justified even if they were supported in prior budgets. Due to the cost of the process, this zero base budgeting is often not used in business. II. The Master Budget and Budget Formats A. A Formal Summary of Company Plans B. Selected Budget Formats The master budget coordinates the organization’s activities. A. A Formal Summary of Company Plans It sets specific targets for sales, production, selling and admin., and capital acquisitions. It culminates a budgeted income statement, balance sheet, and cash receipt and disbursement summary. III. Selected Budget Formats A. B. C. D. E. F. Sales Budget Production Budget Direct Materials Budget Direct Labor Budget Overhead Budget Cash Receipts and Disbursements Budget A. Sales Budget Projected sales x Selling price per unit = Budgeted sales revenue B. Production Budget Budgeted sales in units + Desired ending inventory of finished goods = Total needs - Beginning inventory of finished goods = Units to be produced C. Direct Materials Budget Units to be produced x Cost of parts per unit = Cost of parts needed for production + Desired ending inventory of parts = Total needed - Beginning inventory of parts = Cost of purchases D. Direct Labor Budget Direct labor hours per unit x Labor rate per hour = Direct labor cost per unit x Units to be produced = Total direct labor cost E. Overhead Budget Units to be produced x Variable costs per unit = Total variable overhead + Budgeted fixed overhead = Total budgeted overhead - Noncash expenses = Cash disbursements for overhead F. Cash Receipts and Disbursements Budget Cash receipts - Cash disbursements = Excess (deficiency) of cash available over disbursements + Beginning cash balance = Ending cash balance IV. Static v. Flexible Budget A. Static Budget B. Static Budget Illustration C. Flexible Budget D. Flexible Budget Illustration A. Static Budget Why are we so off from budget? A budget designed for only one level of activity. Differences from the budget can be misleading when an organization actually operates at a different level of activity. B. Static Budget Illustration Standard cost per unit Actual 8,000 Units produced and sold Variable Overhead Costs: Maintenance $ Indirect materials Utilities Fixed Overhead Costs: Depreciation Supervision Insurance Total fixed overhead Total overhead costs 0.60 1.40 1.00 $ 4,500 12,000 9,500 26,000 40,000 49,000 10,000 99,000 $ 125,000 Original Budget 10,000 $ Variance 2,000 U 6,000 14,000 10,000 30,000 $ 1,500 2,000 500 4,000 40,000 50,000 10,000 100,000 $ 130,000 $ 1,000 F 1,000 F 5,000 F $ F F F F C. Flexible Budget A budget designed to cover a range of activity. Can be used to compare actual costs incurred to budgeted costs around that level of activity. D. Flexible Budget Illustration Standard cost per unit Units produced and sold Variable Overhead Costs: Maintenance $ Indirect materials Utilities $ Fixed Overhead Costs: Depreciation Supervision Insurance Total fixed overhead Total overhead costs Units 10,000 5,000 0.60 1.40 1.00 3.00 $ 3,000 7,000 5,000 15,000 40,000 50,000 10,000 100,000 $ 115,000 $ 6,000 14,000 10,000 30,000 40,000 50,000 10,000 100,000 $ 130,000 15,000 $ 9,000 21,000 15,000 45,000 40,000 50,000 10,000 100,000 $ 145,000 Summary Planning and control stages of budget Budget committees, time periods, zero based budgeting Formal plan culminating in projected financial statements Budget formats Static and flexible budgets