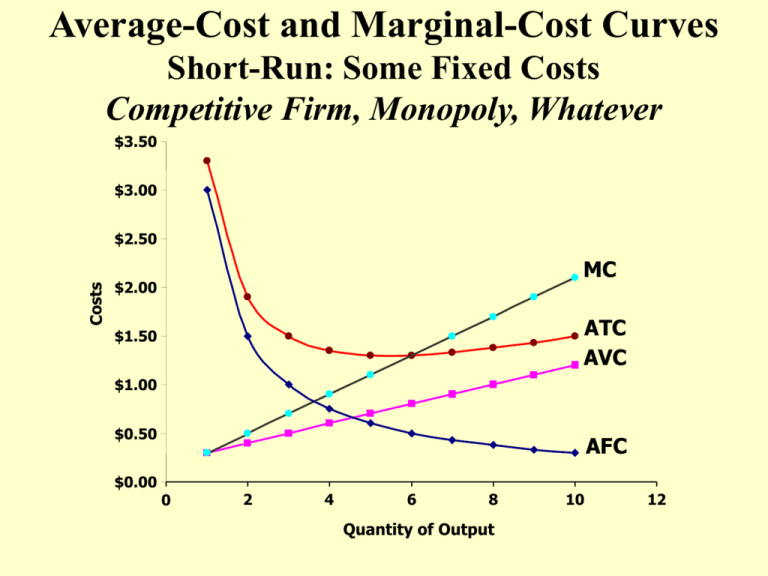

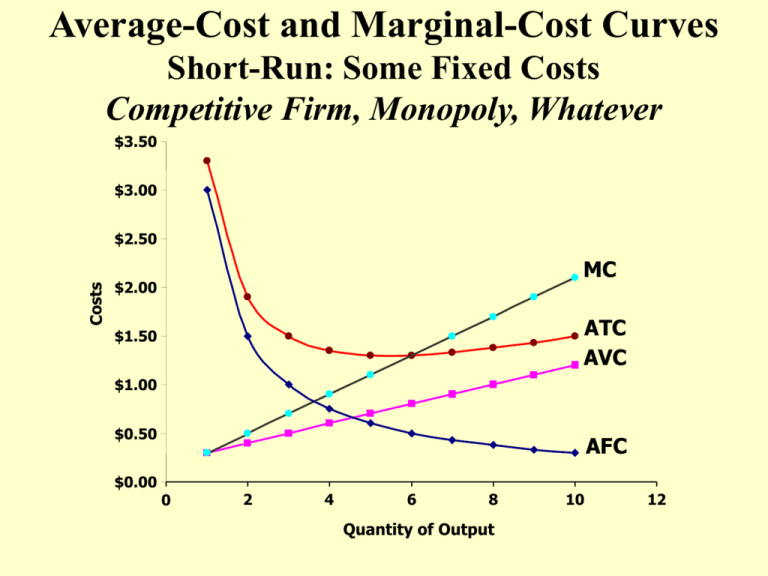

Average-Cost and Marginal-Cost Curves

Short-Run: Some Fixed Costs

Competitive Firm, Monopoly, Whatever

$3.50

$3.00

Costs

$2.50

MC

$2.00

ATC

AVC

$1.50

$1.00

$0.50

$0.00

AFC

0

2

4

6

8

Quantity of Output

10

12

Competitive Industry

Supply and Demand

Price

Supply

$3.00

Equilibrium

2.50

2.00

1.50

1.00

Demand

0.50

0

1 2 3 4 5 6 7 8 9 10 11 12

Quantity

The Competitive Firm’s Short-Run Supply Curve:

(The Competitive Firm is a Price-Taker)

Produce where MC = MR = Price > AVC

Costs

Firm’s short-run

supply curve.

If P > ATC,

keep producing

at a profit.

If P > AVC,

keep producing

in the short run.

MC

ATC

AVC

If P < AVC,

shut down.

0

Quantity

The Short Run: Market Supply with a

Fixed Number of Firms...

(a) Individual Firm Supply

Price

(b) Market Supply

Price

Supply

MC

$2.00

$2.00

1.00

1.00

0

100

200

Quantity

(firm)

0

100,000 200,000 Quantity

(market)

Industry Supply: Some Examples

1. 50 firms, each with TC(x) = 2x + .01 x2

•

•

Each firm’s supply

Industry supply

2. 50 firms with TC(x) = 2x + .01 x2

and 50 firms with TC(x) = 3x + .005 x2

•

•

Each firm’s supply

Industry supply

3. 50 firms with TC(x) = 100 + 2x + .01 x2, x > 0 ;

but TC(0) = 0, i.e., avoidable fixed cost

•

•

Each firm’s supply

Industry supply

Competitive Firm’s Supply Curve

Long Run: No Fixed Costs

Costs

MC = Long-run S

Firm enters

if P > ATC

ATC

Firm exits

if P < ATC

0

Quantity

The Long Run: Market Supply with

Entry and Exit...

(a) Firm’s Zero-Profit Condition

Price

(b) Market Supply

Price

MC

ATC

P=

minimum

Supply

ATC

0

Quantity

(firm)

0

Quantity

(market)

Response to Increase in Demand

Short - Run , Medium - Run, Long - Run

Initial equilibrium: existing firms operating at

efficient scale and earning zero profit

• Short – run: fixed number of existing firms

– Price rises each firm expands output along its MC

curve MC = Price > AC PROFITS

• Intermediate – run: additional firms enter

– Industry supply shifts outward Price declines

Reduced profits

• Long – run: additional firms continue to enter,

industry supply continues to shift increase, and price

continues to drop

Return to zero profit equilibrium

The Long Run: Competitive Market Supply

Is long – run supply truly horizontal (flat)?

Are long – run profits truly zero?

• All firms are not created equal … some are

endowed with lower costs

– More and less fertile land Rents

– Better and worse management Quasi – rents

As less and less efficient firms enter, industry supply

curve slopes upward

• Industry expansion higher input prices

higher costs for all firms

As industry expands, each firm’s minimum cost

increases industry supply curve slopes upward

Monopolistic Competition: Many Firms

with Differentiated Products

Short-Run: Firm Makes a Profit

Price

Price

Average

total cost

MC

ATC

Demand

Profit

MR

0

Profitmaximizing quantity

Quantity

Price

A Monopolistic Competitor

in the Long Run…P > MC

… but Zero Profit

MC

ATC

P=ATC

MR

0

Profit-maximizing

quantity

Demand

Quantity

Consumer Surplus and Producer Surplus:

Benefits they get from trading in the market

Price

A

D

Equilibrium

price

Supply

Consumer

surplus

E

Producer

surplus

B

Demand

C

0

Equilibrium

quantity

Quantity

Price And Consumer Surplus...

Copyright © 2001 by Harcourt, Inc. All rights reserved

Consumers benefit from price < what they’re

willing to pay, whether they face competitive firm

or monopolist

Price

A

P1

P2

Initial

consumer

surplus

B

D

Additional

consumer

surplus to

initial

consumers

0

Consumer

surplus to “new”

consumers

C

E

F

Demand

Q1

Q2

Quantity

How Price Affects Producer Surplus...

Price

Supply

Additional producer

surplus to initial

producers

P2 D

P1 B

Initial

Producer

surplus

E

F

C

Producer surplus

to new producers

A

0

Q1

Q2

Quantity

Static Efficiency of Competitive Market

Equilibrium

Price

Supply

Value

to

buyers

Cost

to

sellers

Cost

to

sellers

0

Value

to

buyers

Demand

Equilibrium

quantity

Value to buyers is greater

than cost to sellers.

Value to buyers is less

than cost to sellers.

Quantity

Insights About Market Outcomes

Free markets allocate the supply of goods to the

buyers who value them most highly.

With money-left-over utility function,

MUx/px = 1 or MUx= px same for all buyers

Free markets allocate the demand for goods to

the sellers who produce them at least cost

MCx= px same for all sellers = px = MUx

Free markets produce the quantity of goods that

maximizes the sum of consumer and producer

surplus.

But promise of monopoly profits drives innovation

The Tax Wedge and Deadweight Loss

Price

Consumer Surplus

Supply

Price Paid

Tax

Tax

Revenue

Price Rec’d

Producer Surplus

Demand

0

Quantity