Chapter 14 Firms in Competitive Markets

advertisement

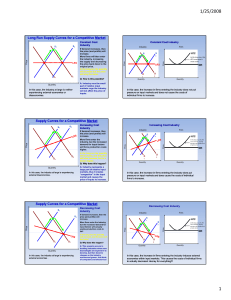

Firms in Competitive Markets 14 WHAT IS A COMPETITIVE MARKET? • In a perfectly competitive market • There are many buyers • There are many sellers • Firms can freely enter or exit the market, in the long run. • In the short run, the number of firms is assumed fixed (constant). • All sellers sell the same product. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 2 WHAT IS A COMPETITIVE MARKET? • As a result: • The actions of any single buyer or seller have a negligible impact on the market price. • That is, the market price is unaffected by the amount bought by a buyer or the amount sold by a seller • Therefore, every buyer and every seller takes the market price as given. • Everybody is a ‘price taker’ CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 3 Price takers • A firm in a perfectly competitive market cannot stay in business if its price is higher than what the other firms are charging • No firm would be able to raise the market price by reducing production and attempting to create a shortage. • Conversely, there is no danger that a firm would drive the market price down by producing too much. • Therefore, no firm would want to charge a price lower than what the others are charging. • In short, each firm takes the prevailing market price as a given—like the weather—and charges that price. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 4 Total Revenue of a Competitive Firm • Total revenue for a firm is the selling price times the quantity sold. TR = P Q • We saw this in Chapters 5 and 13 CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 5 Average Revenue of a Competitive Firm Total revenue Average Revenue = Quantity Price Quantity Quantity Price • Average revenue is the revenue per unit sold • P = AR. • This is simply because all units sold are sold at the same price. 6 Marginal Revenue of a Competitive Firm • Marginal Revenue is the increase (Δ) in total revenue when an additional unit is sold. MR = TR / Q CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 7 The Revenue of a Competitive Firm • In perfect competition, marginal revenue equals price: P = MR. • We saw earlier that P = AR • Therefore, for all firms in perfect competition, P = AR = MR CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 8 Table 1 Total, Average, and Marginal Revenue for a Competitive Firm Note: (a) P = AR = MR 9 (b) P does not fall as Q increases Demand curves for the firm and the market (industry) Jones and Peters, a firm Price Price P Market Demand, P = AR = MR Demand, P = AR 0 Quantity (firm) The market price is P. No matter what amount Jones and Peters produces, the market price will not change. Therefore, J&P will be able to sell any feasible output if it charges the price P. 0 Quantity (market) The market demand curve is negatively sloped, as usual. That is, the market price, which is the lowest prevailing price, is inversely related to the quantity 10 demanded. Supply • We have just seen the demand curves for a firm and for the entire industry • Next, we need to work out what the supply curves look like CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 11 Supply: short run and long run • The analysis of supply in perfect competition depends on whether it is the short run or the long run. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 12 Short run and long run: assumptions • The quantity of a resource used by a firm may be fixed in the short run but not in the long run. • Example: If a firm currently has three custom-made machines and if it takes six months to get new machines, then the firm is stuck with its three machines for the next six months. • All fixed costs are sunk costs in the short run but not in the long run • The number of firms in an industry is fixed in the short run but not in the long run CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 13 THE FIRM AND THE INDUSTRY IN THE SHORT RUN 14 Shut Down and Exit • Before a firm decides how much to supply, it must decide whether or not to stay in business • A shutdown refers to a short-run decision to stop production temporarily, perhaps because of poor market conditions. • Exit refers to a long-run decision to end production permanently. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 15 The Firm’s Short-Run Decision to Shut Down • A firm will shut down (temporarily) if its variable costs exceed its total revenue, no matter what quantity it produces • Its fixed costs do not matter! • This is because • Fixed costs are sunk costs in the short run • sunk costs are defined as costs that will have to be paid even if the firm shuts down. • Therefore, FC cannot affect a firm’s decision on whether to stay open or shut down CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 16 Sunk Costs • Sunk costs will have to be paid even when a firm is in a temporary shutdown. • Examples: • If the firm signs a long-term contract with its landlord, the rent will have to be paid even when the firm is temporarily shut down. • Some maintenance costs will have to be incurred even when the firm is shut down. • The firm may be under contract to provide customer service to past customers even after it shuts down. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 17 The Firm’s Short-Run Decision to Shut Down • • • • Total Revenue = $1000 per month Variable Cost = $800 per month Fixed Cost = $400 per month Profit = –$200 per month (a loss) • Q: Should this firm stay in business or should it shut down for the time being? • A: It should stay in business • If it shuts down, the fixed cost (say, rent owed to the landlord) will still have to be paid—because it is sunk!—and the loss will then be even higher, $400 per month. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 18 The Firm’s Short-Run Decision to Shut Down • • • • Total Revenue = $1000 per month Variable Cost = $1200 per month Fixed Cost = $400 per month Profit = –$600 per month (a loss) • Q: Should this firm stay in business or should it shut down for the time being? • A: It should shut down. • The lesson from this and the previous slide is that … CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 19 The Firm’s Short-Run Decision to Shut Down • A firm shuts down if total revenue is less than variable cost, no matter what quantity the firm produces. That is, • A firm shuts down if • TR < VC, no matter what Q is, or • TR/Q < VC/Q, no matter what Q is, or • P < AVC, no matter what Q is. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 20 A Firm’s Shut Down Decision $ The firm stays open because P > Minimum AVC AVC PH Minimum AVC Minimum AVC PL Quantity 0 The firm shuts down because P < Minimum AVC 21 Table 2 Profit Maximization: A Numerical Example Is it possible to figure out the profitmaximizing output from just the MR and MC numbers? Yes, it is where MR = MC. 22 Figure 1 Profit Maximization for a Competitive Firm Costs and Revenue The firm maximizes profit by producing the quantity at which marginal cost equals marginal revenue. MC MC2 We have seen before that, as firms are price takers in perfect competition, P = AR = MR. We have also seen that, profit maximization implies MR = MC. ATC P = MR1 = MR2 P = AR = MR AVC Therefore, P = AR = MR = MC is the fingerprint of perfect competition MC1 CHAPTER 14 0 Q1 QMAX Q2 Quantity 23 PROFIT MAXIMIZATION AND THE COMPETITIVE FIRM’S SUPPLY CURVE • Profit maximization occurs at the quantity where marginal revenue equals marginal cost. • This is a crucial principle in understanding the behavior of firms CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 24 PROFIT MAXIMIZATION AND THE COMPETITIVE FIRM’S SUPPLY CURVE • When MR > MC increase Q • When MR < MC decrease Q • When MR = MC Profit is maximized; stick with this Q. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 25 Recall: The Supply Curve Price Supply P2 P1 0 Q1 Q2 Quantity 26 Figure 2 Marginal Cost as the Competitive Firm’s Supply Curve Price P2 This section of the firm’s MC curve is also the firm’s supply curve. MC ATC P1 AVC 0 Q1 Q2 Quantity 27 Figure 3 The Competitive Firm’s Short Run Supply Curve Costs If P > ATC, the firm will continue to produce at a profit. Firm’s short-run supply curve MC ATC If P > AVC, firm will continue to produce in the short run. Firm shuts down if P < AVC AVC What can shift the supply curve to the right? 0 CHAPTER 14 FIRMS IN COMPETITIVE MARKETS Quantity 28 The Short Run: Market Supply with a Fixed Number of Firms • The market supply curve is the horizontal sum of the individual firms’ short run supply curves. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 29 Figure 6 Market Supply with a Fixed Number of Firms (a) Individual Firm Supply (b) Market Supply (# of firms fixed) Price Price MC Supply $2.00 $2.00 1.00 1.00 0 100 200 Quantity (firm) 0 100,000 200,000 Quantity (market) Q: What is the number of firms? 30 CHAPTER 14 FIRMS IN COMPETITIVE MARKETS Short-Run Equilibrium: back where we began! (a) Individual Firm Supply (b) Market Supply (# of firms fixed) Price Price MC Supply $2.00 $2.00 1.00 1.00 DemandL 0 100 200 Quantity (firm) CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 0 100,000 DemandH 200,000 Quantity (market) 31 Price = Minimum ATC; profit = zero; demand has no effect on price, and no effect on the quantity produced by a firm; demand does affect the quantity produced by the industry, and the number of firms in the industry THE LONG RUN 32 The Firm’s Long-Run Decision to Exit or Enter a Market • In the long run, the firm exits if it sees that its total revenue would be less than its total cost no matter what quantity (Q) it might produce • That is, a firm exits if • TR < TC, no matter what Q is. • TR/Q < TC/Q , no matter what Q is. • P < ATC , no matter what Q is. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 33 The Firm’s Long-Run Decision to Exit or Enter a Market • A new firm will enter the industry if it can expect to be profitable. • That is, a new firm will enter if • TR > TC for some value of Q • TR/Q > TC/Q for some value of Q • P > ATC for some value of Q CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 34 Entry and Exit of Firms in the Long-Run $ The number of firms will stabilize when P = Minimum ATC. This is the long run price! New firms will enter because P > Minimum ATC ATC PH Minimum ATC PL 0 Minimum ATC This is the efficient scale output. This is each firm’s long-run equilibrium output! Existing firms will exit because P < Minimum ATC Quantity 35 Figure 4 The Competitive Firm’s Long-Run Supply Curve Costs Firm’s long-run supply curve Firm enters if P > ATC MC = long-run S ATC Firm exits if P < ATC 0 CHAPTER 14 FIRMS IN COMPETITIVE MARKETS Quantity 36 THE SUPPLY CURVE IN A COMPETITIVE MARKET • A Firm’s Short-Run Supply Curve • The portion of its (short run) marginal cost curve that lies above the (short run) average variable cost curve. MC ATC AVC • A Firm’s Long-Run Supply Curve • The portion of its (long run) marginal cost curve that lies above the (long run) average total cost curve. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS ATC 37 Long-Run Equilibrium Price Price Market Demand ATC $1.50 P = Minimum ATC = $1.50 200 (efficient scale) Quantity (firm) This is it, as far as long-run equilibrium is concerned! How many firms are there in long-run equilibrium? What would happen if demand moves left (decreases)? What could cause prices to increase? 6,000 Quantity (industry) P = AR = MR = MC = ATC is the fingerprint of perfect competition in the long run. 38 A Firm’s Profit • Profit equals total revenue minus total costs. • • • • Profit = TR – TC Profit/Q = TR/Q – TC/Q Profit = (TR/Q – TC/Q) Q Profit = (P – ATC) Q CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 39 Figure 5 Profit as the Area between Price and Average Total Cost (a) A Firm with Profits Price MC ATC Profit P ATC P = AR = MR 0 Quantity Q (profit-maximizing quantity) 40 Figure 5 Profit as the Area between Price and Average Total Cost (b) A Firm with Losses Price MC ATC ATC P P = AR = MR Loss 0 Q CHAPTER 14 FIRMS IN COMPETITIVE MARKETS (loss-minimizing quantity) Quantity 41 The Long Run: Market Supply with Entry and Exit • Firms will enter or exit the market until profit is driven to zero. • Price equals the minimum of average total cost. • The long-run market supply curve is a horizontal line at this price. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 42 Figure 7 Market Supply with Entry and Exit (a) Firm’s Zero-Profit Condition (b) Market Supply (# of firms variable) Price Price MC ATC P = minimum ATC 0 Supply Quantity (firm) CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 0 Quantity (market) 43 Why Do Competitive Firms Stay in Business If They Make Zero Profit? • Profit = TR – TC • Total cost = explicit cost + implicit cost. • Profit = 0 implies TR = explicit cost + implicit cost • In the zero-profit equilibrium, the firm earns enough revenue to compensate the owners for the time and money they spend to keep the business going. • So, don’t feel sorry for the owners! 44 Recap: Economic and Accountants How an Economist Views a Firm How an Accountant Views a Firm Economic profit Accounting profit Revenue Implicit costs Revenue Total opportunity costs Explicit costs Explicit costs 45 Application • We will now work through what happens when the demand for a product increases. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 46 Short Run and Long Run Effects of a Shift in Demand: an application • An increase in demand raises price and quantity (for each firm and the industry) in the short run. • Firms earn positive profits • because price now exceeds average total cost. • • • • • New firms enter Market supply increases (shifts right) Price decreases; gradually returns to minimum ATC Profits decrease; gradually return to zero So, the long-run effect of an increase in demand is as follows: the price is unchanged, each firm’s output is unchanged, the number of firms increases, industry output increases. 47 Figure 8 An Increase in Demand in the Short Run and Long Run (a) Initial zero-profit long-run equilibrium Market Firm Price Price MC ATC Short-run supply, S1 A P1 Long-run supply P1 Demand, D1 0 q1 Quantity (firm) CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 0 Q1 Quantity (market) 48 Figure 8 An Increase in Demand in the Short Run and Long Run (b) Short-Run Response to an increase in demand Market Firm Price Price Profit MC ATC P2 B P2 S1 A P1 P1 D2 Long-run supply D1 0 q1 q2 Quantity (firm) CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 0 Q1 Q2 Quantity (market) 49 Figure 8 An Increase in Demand in the Short Run and Long Run (c) Long-Run Response to positive short-run profits: new firms enter, pushing the short-run market supply to the right. Market Firm Price Price MC ATC B P2 S1 S2 C A P1 Long-run supply P1 D2 D1 0 q1 Quantity (firm) 0 Q1 Q2 Q3 Quantity (market) An increase in demand leads to an increase in price in the short run. But this price increase will not last. New firms will enter and push the price back to P1, the minimum ATC. Each firm’s output will return to q1. The only long-run effect 50 of demand will be to increase the number of firms. Any Questions? CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 51 Summary • Because a competitive firm is a price taker, its revenue is proportional to the amount of output it produces. • The price of the good equals both the firm’s average revenue and its marginal revenue. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 52 Summary • To maximize profit, a firm chooses the quantity of output such that marginal revenue equals marginal cost. • This is also the quantity at which price equals marginal cost. • Therefore, the firm’s marginal cost curve is its supply curve. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 53 Summary • In the short run, when a firm cannot recover its fixed costs, the firm will choose to shut down temporarily if the price of the good is less than average variable cost. • In the long run, when the firm can recover both fixed and variable costs, it will choose to exit if the price is less than average total cost. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 54 Summary • In a market with free entry and exit, profits are driven to zero in the long run and all firms produce at the efficient scale. • Changes in demand have different effects over different time horizons. • In the long run, the number of firms adjusts to drive the market back to the zero-profit equilibrium. CHAPTER 14 FIRMS IN COMPETITIVE MARKETS 55