Church Plan Workshop VIII - Church Benefits Association

advertisement

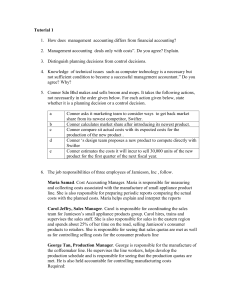

Final 403(b) Regulations Danny Miller Erica Summers © 2007 Conner & Winters, LLP 1627 I Street NW, Suite 900 Washington, D.C. 20006 202-887-5711 CONNER & WINTERS Introduction • Final Regulations issued July 26, 2007. • Generally effective beginning January 1, 2009. • Special effective dates apply to certain provisions; some of these special effective dates key off of the date the Final Regulations were issued. 2 CONNER & WINTERS 2 Definitions • Church – Church as defined in Code section 3121(w)(3)(A); – Qualified church controlled organization defined in Code section 3121(w)(3)(B) (“QCCOs”). • Church-Related Organization – Church; – Convention or association of churches; – Organization described in Code section 414(e)(3)(A) (i.e. church pension board). Note: Neither definition includes non-QCCOs. 3 CONNER & WINTERS 3 Definitions • Section 403(b) Plan – The “plan of the employer under which the section 403(b) contracts for its employees are maintained.” • Section 403(b) Contract – Underlying funding mechanism, i.e., – 403(b)(1) annuity contract; – 403(b)(7) custodial account; – 403(b)(9) retirement income account. Note: In multiple vendor situation, IRS contemplates a single 403(b) “plan” that wraps around all separate 403(b) “contracts.” 4 CONNER & WINTERS 4 Plan Document • All 403(b) contracts must be maintained pursuant to a written plan document that satisfies the requirements of 403(b) in form and operation. • No need for single document. • Can incorporate other documents by reference. 5 CONNER & WINTERS 5 Plan Document • Plan must contain all material conditions – e.g., – Eligibility; – Contributions limitations; – Vesting; – Time and form of benefits; – Distribution restrictions; – Minimum distribution requirements (401(a)(9) rules); – Eligible rollover requirements. 6 CONNER & WINTERS 6 Plan Administration • The employer is responsible for coordinating plan administration for purposes of compliance. • Plan document can allocate compliance and other administrative responsibilities (to a TPA or one of several multiple vendors). • Administrative and compliance responsibilities cannot be delegated to participants. • No participant “self-certification” is permitted. Query: How are responsibilities allocated in multiple vendor situation? • It is not clear what employer needs to do with respect to “orphan” plans. 7 CONNER & WINTERS 7 Contributions Elective deferrals – • Includes pre-tax salary reduction and designated Roth after-tax contributions. Note: Salary reduction agreement must clearly specify whether contributions are pre-tax or Roth. • Must be made pursuant to salary reduction agreement that meets requirements of 401(k). • Subject to anti-conditioning rule (cannot condition receipt of another benefit on making elective deferrals to the 403(b) plan). 8 CONNER & WINTERS 8 Contributions Elective Deferrals – Limitations • Subject to Code section 402(g) limits. • Special 402(g)(7) catch-up provision – – Available to employees with 15 years of service with “qualified organization” (church service within same denomination can be aggregated). – Limit is least of following: • • • $3,000, or $15,000 reduced by prior special 402(g) catch-up amounts, or Excess of $5,000 times years of service over prior elective deferrals. 9 CONNER & WINTERS 9 Contributions • Ordering of elective deferrals (for purposes of the elective deferral limit): – First, regular 402(g) limits. – Next special 402(g)(7) 15-years of service catch-up. – Finally, age 50 catch-up contributions. 10 CONNER & WINTERS 10 Contributions Contributions for former employees • Employer can make contributions through 5th year following year of termination. (Can actually contribute for up to 6 years.) • Nonelective employer contributions only; no salary reduction or employee after-tax contributions. • Amount of permitted post-employment contributions calculated on a monthly basis. (No contributions after death.) • Cannot discriminate in favor of HCEs (applies only to plans subject to nondiscrimination and coverage rules, including plans sponsored by non-QCCOs). 11 CONNER & WINTERS 11 Vesting • 403(b) plans can include vesting schedule. • Non-vested amounts must be accounted for separately. • Non-vested amounts are treated as part of a 403(c) annuity contract (or a 402(b) trust) until such amounts vest. • No need to set up a separate 403(c) annuity or 402(b) trust to hold non-vested amounts (nor even a 403(c) or 402(b) account or “bucket”). 12 CONNER & WINTERS 12 Excess Contributions • All contributions subject to 415(c) contribution limits; salary reduction contributions also subject to 402(g) limits. • Amounts in excess of limits will fail to be a 403(b) contract and must be either a 403(c) contract or a 402(b) trust. • Separate accounting required (again, separate accounting and not a separate account). • Vested excess contributions are taxable in year in which they were contributed. • Non-vested excess contributions are taxable in the year in which they vest. 13 CONNER & WINTERS 13 Crediting Contributions • Contributions must be transmitted to funding vehicle “within a period that is not longer than is reasonable for the proper administration of the plan.” • Crediting within 15 business days of month following deferral is considered reasonable. Note: This rule is different from DOL requirements on crediting contributions. Query: What is “reasonable” for proper administration of plan in case of employer contributions? 14 CONNER & WINTERS 14 Nondiscrimination and Coverage General Rules • No more reasonable, good faith standard for compliance with nondiscrimination and coverage requirements. • Notice 89-23 safe harbors no longer applicable. Note: Nondiscrimination and coverage requirements do not apply to churches and QCCOs; but they do apply to non-QCCOs. 15 CONNER & WINTERS 15 Nondiscrimination and Coverage Employer Contributions and After-Tax Contributions • Must comply with nondiscrimination and coverage requirements applicable to qualified plans – – 401(a)(4); – 410(b); – 401(a)(17); – 401(m). 16 CONNER & WINTERS 16 Nondiscrimination and Coverage Salary Reduction Contributions – Universal availability requirement • Certain categories of employees can permissibly be excluded: – Employees eligible under another 401(k) or 403(b) plan; – Nonresident aliens; – Students; and – Employees normally working < 20 hours/week. Safe harbor: In first year, employer must reasonably expect employee to work fewer than 1,000 hours, and in all following years, employee must have actually worked fewer than 1,000 hours in preceding year. 17 CONNER & WINTERS 17 Nondiscrimination and Coverage Salary reduction contributions – Universal availability • Additional exclusions under Notice 89-23 no longer apply: – Religious order members who have taken vow of poverty (but Preamble to Final Regulations clarifies that such individuals are not employees and thus not subject to universal availability rule); – Employees covered by collective bargaining; – Visiting professors. Note: A special effective date applies to this provision. A plan containing any of these exclusions on July 26, 2007 generally has until the first day of the taxable year beginning after December 31, 2009. 18 CONNER & WINTERS 18 Nondiscrimination and Coverage Salary reduction contributions – Universal availability • Meaningful notice requirement. • Employees must have continuing “effective opportunity” to make salary reduction contributions. • Whether there is effective opportunity depends on facts and circumstances. 19 CONNER & WINTERS 19 Distributions Salary Reduction Contributions • Can distribute only upon severance from employment, death, disability, attainment of age 59½, hardship. • Definition of “severance from employment” – employee ceases to be employed by eligible employer maintaining the plan. Examples: – Employee transfers from 501(c)(3) organization to forprofit subsidiary. – Chaplain working for entity that is ineligible to maintain 403(b) plan ceases to perform services as minister, even though he/she continues to work for same entity. 20 CONNER & WINTERS 20 Distributions Employer Contributions • Distributable events: – Severance from employment; – Attainment of specified age or number of years of service; – Prior occurrence of specified event. Note: Financial need, including need to purchase retirement home is permissible event. • Distributable events must be specified in plan document. Note: This distribution restriction does not apply to annuity contracts issued before January 1, 2009. 21 CONNER & WINTERS 21 Distributions Rollover Contributions and After-Tax Contributions • No distribution restrictions apply. 22 CONNER & WINTERS 22 Contract Exchanges • Contract exchanges must meet following requirements: – Plan must specifically provide for exchange. – Distribution restrictions on receiving contract must be no less stringent than original contract. – Employer must have information-sharing agreement (“ISA”) with issuer of receiving contract. • Special effective date: – Rules apply to exchanges after September 24, 2007. – Don’t need to have ISA until January 1, 2009. – But if no ISA on January 1, 2009, the exchange is taxable event. (Not clear whether taxable in 2009 or at time of prior exchange.) 23 CONNER & WINTERS 23 Plan-to-Plan Transfers Plan-to-plan transfers must meet following requirements: • Receiving plan must impose distribution restrictions no less stringent than those imposed under transferring plan. • Participant whose assets are being transferred must be employee or former employee of employer maintaining receiving plan. • If transfer is of only portion of participant’s interest, the different types of funds are transferred on pro rata basis. Note: Transfers allowed only between 403(b) plans. 24 CONNER & WINTERS 24 Plan Termination 403(b) plans can be terminated if: • All of participants’ accumulated benefits distributed as soon as administratively practicable after termination; and • Employer does not make contributions to another 403(b) contract during the 12 months before or after termination. Note: Limited exception if fewer than 2% of employees eligible under 403(b) plan are eligible under alternative 403(b) plan. 25 CONNER & WINTERS 25 Failure to Comply • Failures relating to individual contract – affects the 403(b) contract and all other 403(b) contracts purchased for individual by same employer. Examples: Violations of distribution restrictions; loans in excess of statutory limits; contributions in excess of 402(g) limits. • Operational failures – affects all contracts issued by the employer to all employees with respect to whom operational failure has occurred. Examples: Failure to follow plan’s eligibility requirements. 26 CONNER & WINTERS 26 Failure to Comply • Plan-wide failures – affects all contracts issued under plan; all contributions and earnings under plan become taxable. Examples: Failure to comply with nondiscrimination rules; employer eligibility failures; failure to have contracts issued pursuant to a plan that meets the regulatory requirements for a written plan document. 27 CONNER & WINTERS 27 Special Church Plan Rules Requirements for retirement income accounts: • Plan document must specifically state that it is intended to be church retirement income account. • Investment performance must be based on gains and losses on the plan’s assets. • Can invest in mutual funds without becoming 403(b)(7) custodial account. Note: Any asset that is owned or used by a participant or beneficiary is treated as distribution (e.g., artwork; antique furniture or luxury cars). 28 CONNER & WINTERS 28 Special Church Plan Rules • Exclusive benefit rule. Note: No loans or other extensions of credit to employer. • Chaplains and self-employed ministers can participate. • Includible compensation for self-employed ministers is earned income (computed without regard to Code section 911 exclusion for foreign service income). • Years of service within the denomination are aggregated. • Can pay annuity benefits if: – Amount of distribution must have actuarial present value equal to participant’s accumulated benefit; and – Plan sponsor must guarantee benefits. 29 CONNER & WINTERS 29 Special Church Plan Rules • 403(b)(9) plan can commingle with other amounts devoted exclusively to church purposes; but must separately account for 403(b)(9) assets. • If 403(b)(9) plan assets are held in trust, they can be commingled in collective investment trust (Revenue Ruling 81-100 trust). • Trust holding 403(b)(9) assets is tax-exempt (but a trust is not required). 30 CONNER & WINTERS 30 Special Church Plan Rules Defined benefit 403(b)(9) plans are permitted – • Must have been in existence on September 3, 1982; and • Must apply both 415(c) contribution limits and 415(b) benefit accrual limits. 31 CONNER & WINTERS 31 Special Church Plan Rules • Designated Roth contributions can be made on behalf of foreign missionaries and self-employed ministers. • Special effective date for plans maintained by churches or church-related organizations for which the authority to amend is held by a church conventions: First plan year after 12/31/2009. Note: This has limited application. 32 CONNER & WINTERS 32 Controlled Group Rules • Basic Rule – Common control if 80% directors/trustees of one organization are directly or indirectly controlled by, or are representatives of, other organization. Note: These rules do not apply to churches and QCCOS; they do apply to non-QCCOs. Query – Does Notice 89-23 still apply to churches and QCCOs? • Permissive Aggregation – organizations can choose to be aggregated if: – They maintain a single plan; and – They regularly coordinate their day-to-day exempt activities. 33 CONNER & WINTERS 33 Controlled Group Rules • Permissive Disaggregation – Church plans receiving contributions from more than one entity, at least one of which is a non-QCCO, may disaggregate churches from the non-QCCOs – but, as the Final Regulations are written, only if they participate in a multiple employer church plan. Effective date for controlled group rules: Plan years beginning after December 31, 2008. 34 CONNER & WINTERS 34