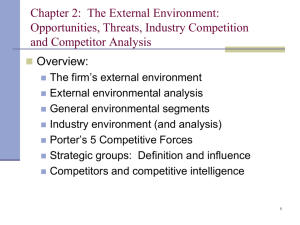

External Environment 2nd Lecture MSc Agricultural Economics and Management Introduction All companies face competition. For resources, customers, sales revenues, and profits. All companies face uncertain industry environments. Managers must position the organizations strategically in order to compete successfully. This is what we call business definition. Requires that managers understand the dynamics of their firms’ markets before formulating strategies. Introduction (cont.) Rapidly growing markets (emerging industries) tend to be less competitive and often attract new entrants. Usually provide sufficient room in competitive space for making some mistakes. Mature, concentrated markets provide firms with very little breathing room. Mistakes by one firm can significantly impact entire industry. One firm’s price reductions can set off industry-wide price war. Purpose of External Analysis To understand the external environment as it affects the enterprise 3 levels of analysis: General changes in business environment Changes within the industry Activities of competitors and other specifics Selecting analytical tools Vast range of tools available Usually use several tools but choice is important Choice depends on: Data available Nature of issues to be resolved Time and skills available External Environmental Analysis A continuous process which includes Scanning: Identifying early signals of environmental changes and trends Monitoring: Detecting meaning through ongoing observations of environmental changes and trends Forecasting: Developing projections of anticipated outcomes based on monitored changes and trends Assessing: Determining the timing and importance of environmental changes and trends for firms’ strategies and their management Steps in Environmental Analysis Assess the nature of the environment Audit environmental influences Identify key competitive forces Identify competitive position Identify key opportunities and threats Strategic Strategic position position External Environment General Environment Dimensions in the broader society that influence and industry and the firms within it Economic Sociocultural Global Technological Political/legal Demographic General Environment (cont’d) The Economic Segment Inflation rates Interest rates Trade deficits or surpluses Budget deficits or surpluses Personal savings rate Business savings rates Gross domestic product General Environment (cont’d) The Sociocultural Segment Women in the workplace Workforce diversity Attitudes about quality of worklife Concerns about environment Shifts in work and career preferences Shifts in product and service preferences General Environment (cont’d) The Global Segment New global markets Changing markets existing Important international events Critical cultural and institutional characteristics of global markets General Environment (cont’d) The Technological Segment Product innovations Applications of knowledge Focus of private and government-supported R&D expenditures New communication technologies General Environment (cont’d) The Political/Legal Segment Antitrust laws Taxation laws Deregulation philosophies Labor training laws Educational philosophies and policies General Environment The Demographic Segment Population Age size structure Geographic distribution Ethnic mix Income distribution Industry Environment Set of factors directly influencing a firm and its competitive actions and competitive responses Threat of new entrants Power of suppliers Power of buyers Threat of product substitutes Intensity of rivalry among competitors Porter’s Five Forces Model of Competition Threat of Threat Newof New Entrants Entrants Bargaining Power of Suppliers Rivalry Among Competing Firms in Industry Threat of Substitute Products Bargaining Power of Buyers Five Forces Model of Competition Identify current and potential competitors and determine which firms serve them Conduct competitive analysis Recognize that suppliers and buyers can become competitors Recognize that producers of potential substitutes may become competitors Threat of New Entrants Barriers to entry Economies of scale Product differentiation Capital requirements Switching costs Access to distribution channels Cost disadvantages independent of scale Government policy Expected retaliation Bargaining Power of Suppliers A supplier group is powerful when: it is dominated by a few large companies satisfactory substitute products are not available to industry firms industry firms are not a significant customer for the supplier group suppliers’ goods are critical to buyers’ marketplace success effectiveness of suppliers’ products has created high switching costs suppliers are a credible threat to integrate forward into the buyers’ industry Bargaining Power of Buyers Buyers (customers) are powerful when: they purchase a large portion of an industry’s total output the sales of the product being purchased account for a significant portion of the seller’s annual revenues they could easily switch to another product the industry’s products are undifferentiated or standardized, and buyers pose a credible threat if they were to integrate backward into the seller’s industry Threat of Substitute Products Product substitutes are strong threat when: customers face few switching costs substitute product’s price is lower substitute product’s quality and performance capabilities are equal to or greater than those of the competing product Intensity of Rivalry Intensity of rivalry is stronger when competitors: are numerous or equally balanced experience slow industry growth have high fixed costs or high storage costs lack differentiation or low switching costs experience high strategic stakes have high exit barriers High Exit Barriers Common exit barriers include: specialized assets (assets with values linked to a particular business or location) fixed costs of exit such as labor agreements strategic interrelationships (relationships of mutual dependence between one business and other parts of a company’s operation, such as shared facilities and access to financial markets) emotional barriers (career concerns, loyalty to employees, etc.) government and social restrictions Effects of Entry Barriers and Exit Barriers on Industry Profits Exit Barriers Low Low Entry Barriers High High Effects of Entry Barriers and Exit Barriers on Industry Profits Exit Barriers Low Low Entry Barriers High Low, Stable Returns High Effects of Entry Barriers and Exit Barriers on Industry Profits Exit Barriers Low Low Low, Stable Returns Entry Barriers High High, Stable Returns High Effects of Entry Barriers and Exit Barriers on Industry Profits Exit Barriers Low Low High Low, Stable Returns Low, Risky Returns Entry Barriers High High, Stable Returns Effects of Entry Barriers and Exit Barriers on Industry Profits Exit Barriers Low Low High Low, Stable Returns Low, Risky Returns High, Stable Returns High, Risky Returns Entry Barriers High Limitations of the Five Forces Model Attempt to minimize the impact of any of the forces that are acting to make the industry attractive. Make their industries more attractive by reducing the power of the five forces; or Shield or protect their companies from the power of the forces. Certain action may lead to allegations of collusion or other unfair practices (Microsoft vs. Justice Department). Limitations of the Five Forces Model (cont.) Model provides “snapshot” of industry at that time, but fails to show how industry is changing. Most managers assume that conditions will remain relatively stable. The life cycle model Development Users/ buyers Growth Maturity Few: Growing adopters: Growing selectivity Saturation of trial of of purchase trial of users early product/service Repeat purchase adopters reliance Entry of competitors Competitive conditions Shakeout Attempt to achieve trial May be many Fight to maintain share Decline Drop-off in usage Exit of some competitors Likely price cutting Difficulties in Selective Few for volume gaining/taking distribution competitors share Fight for share Shake-out of Undifferentiated Emphasis on weakest products/services competitors efficiency/low cost Industry Analysis (EFE) External Factor Evaluation Matrix Summarize & evaluate: Economic Demographic Governmental Social Environmental Technological Cultural Political Competitive Industry Analysis (EFE) Five-Step process: List key external factors (10-20) Opportunities & threats Assign weight to each (0 to 1.0) Sum of all weights = 1.0 Industry Analysis (EFE) Assign 1-4 rating to each factor • Firm’s current strategies response to the factor Multiply each factor’s weight by its rating • Produces a weighted score Sum the weighted scores for each Determines the total weighted score for the organization. Highest possible weighted score for the organization is 4.0; the lowest, 1.0. Average = 2.5 Key External Factors Weight Rating Weighted score Global markets untapped .15 1 .15 Increased demand .05 3 .15 Astronomical Internet growth .05 1 .05 Pinkerton leader in discount market .15 4 .60 More social pressure to quit smoking .10 3 .30 Legislation against the tobacco industry .10 2 .20 Production limits on tobacco .05 3 .15 Smokeless market SE region U.S. .05 2 .10 Bad media exposure from FDA .10 2 .20 Clinton Administration .20 1 .20 Opportunities Threats TOTAL 1.00 2.10 Industry Analysis (EFE) Total weighted score of 4.0 = Organization response is outstanding to threats & weaknesses Total weighted score of 1.0 = Firm’s strategies not capitalizing on opportunities or avoiding threats Industry Analysis (EFE) The firm in the previous example, has a total weighted score of 2.10 indicating that the firm is below average in its effort to pursue strategies that capitalize on external opportunities and avoid threats. Industry Analysis (EFE) Important Understanding of the factors used in the EFE Matrix is more important than the actual weights and ratings assigned. Competitor Analysis The follow-up to Industry Analysis is effective analysis of a firm’s Competitors Industry Environment Competitive Environment Competitor Environment All of the companies that the firm competes against. Strategic Groups Strategic group: a group of firms in an industry following the same or similar strategy along the same strategic dimensions The strategy followed by a strategic group differs from strategies being implemented by other companies in the industry Strategic Group Analysis Strategic Group Analysis is useful to: Identify firms with similar strategic characteristics Therefore identify the most direct competitors Identify mobility barriers Identify strategic opportunities (“strategic spaces”) Strategic threats and problems It is useful to consider the extent to which organisations differ in terms of characteristics such as: · · · · · · · · · · · · · · · · · Extent of product (or service) diversity Extent of geographic coverage Number of market segments served Distribution channels used Extent (number) of branding Marketing effort (e.g. advertising spread, size of salesforce) Extent of vertical integration Product or service quality Technological leadership (a leader or follower) R&D capability (extent of innovation in product or process) Cost position (e.g. extent of investment in cost reduction) Utilisation of capacity Pricing policy Level of gearing Ownership structure (separate company or relationship with parent) Relationship to influence groups (e.g. government, the City) Size of organisation Strategic Groups in the Personal Computer Industry Apple Product Quality High Dell Compaq Hewlett-Packard IBM Fragmented Players Low Gateway Packard Bell AST Research Tandy Exited from market, 1999 Low High Customization and Speed of Delivery Trends in Strategic Groups Strategic groups can shift over time as market changes Entire strategic groups can emerge or disappear over time Industry consolidation alters strategic groups Distinctiveness enhances firm’s sustainable competitive advantage Competitor Environment Competitor intelligence is the ethical gathering of needed information and data about competitors’ objectives, strategies, assumptions, and capabilities What drives the competitor as shown by its future objectives What the competitor is doing and can do as revealed by its current strategy What the competitor believes about itself and the industry, as shown by its assumptions What the the competitor may be able to do, as shown by its capabilities Competitor Analysis Future objectives Future Objectives: How do our goals compare with our competitors’ goals? Where will the emphasis be placed in the future? What is the attitude toward risk? Competitor Analysis Future objectives Current strategy Current Strategy: How are we currently competing? Does this strategy support changes in the competitive structure? Competitor Analysis Future objectives Current strategy Assumptions Assumptions: Do we assume the future will be volatile? Are we operating under a status quo? What assumptions do our competitors hold about the industry and themselves? Competitor Analysis Future objectives Current strategy Assumptions Capabilities Capabilities: What are our strengths and weaknesses? How do we rate compared to our competitors? Competitor Analysis Future objectives Response Response: Current strategy Assumptions Capabilities What will our competitors do in the future? Where do we hold an advantage over our competitors? How will this change our relationship with our competitors? Industry Analysis (CPM) Competitive Profile Matrix Identifies firm’s major competitors and their strengths & weaknesses in relation to a sample firm’s strategic position (CPM) Critical Success Factor Avon L’Oreal Procter & Gamble Weight Rating Score Rating Score Rating Score Advertising 0.20 Product Quality 0.10 Price Competition 0.10 Management 0.10 Financial Position 0.15 Customer Loyalty 0.10 Global Expansion 0.20 Market Share 0.05 Total 1.00 1 4 3 4 4 4 4 1 0.20 0.40 0.30 0.40 0.60 0.40 0.80 0.05 3.15 4 4 3 3 3 4 2 4 0.80 3 0.60 0.40 3 0.30 0.30 4 0.40 0.30 3 0.30 0.45 3 0.45 0.40 2 0.20 0.40 2 0.40 0.20 3 0.15 3.25 2.80

0

0

advertisement

Download

advertisement

Add this document to collection(s)

You can add this document to your study collection(s)

Sign in Available only to authorized usersAdd this document to saved

You can add this document to your saved list

Sign in Available only to authorized users