WAB Full Report - Student Managed Fund

Westinghouse Air Brake Technologies Corp.

Covered by Brian H. Laureano

“On track to outperform”

Key Financials/Ratios

Recommendation: BUY

Closing Stock Price (11/09/12): $80.06

Market Cap: $3.83 billon

Debt/Equity Ratio: .38

Quick Ratio: 1.32

Dividend/ Yield: 0.05/0.25%

Price/Book: 3.1

Company Summary:

Proposed Purchase Price: $90.48

ROE: 17.50

ROA: 8.59

ROIC: 12.32

Beta: 1.38

P/E: 16.67

FCF/ Share: 4.36

Wabtec (WAB) is one of the world’s largest providers of value-added, technology-based products and services for the global rail industry. Their products are found on virtually all U.S. locomotives, freight cars and passenger transit vehicles, as well as in more than 100 countries throughout the world. Their products enhance safety, improve productivity and reduce maintenance costs for customers, and many of their core products and services are essential in the safe and efficient operation of freight rail and passenger transit vehicles. Wabtec is a global company with operations in 20 countries. In the first nine months of 2012, about 50% of the Company’s revenues came from customers outside the U.S.

Effective November 18, 2011, Wabtec acquired Fulmer Company. Effective November 3, 2011,

Wabtec acquired Bearward Engineering, a manufacturer of cooling systems and related equipment for power generation and other industrial markets. On June 29, 2011, it acquired an aftermarket transit parts business from GE Transportation. On February 25, 2011, the Company acquired Brush

Traction Group, a provider of locomotive overhauls, services and aftermarket components. In July

2012, it acquired Tec Tran Corp. and its affiliates. In October 2012, it acquired LH Group.

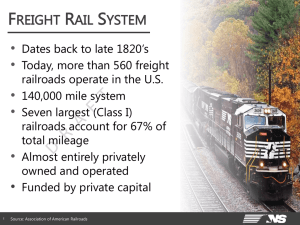

Segments:

Freight Segment- primarily manufactures and services components for new and existing freight cars and locomotives, builds new switcher locomotives, rebuilds freight locomotives, supplies railway electronics, positive train control equipment, signal design and engineering services, friction products, and provides related heat exchange and cooling systems. Customers include large publicly traded railroads, leasing companies, manufacturers of original equipment such as locomotives and freight cars, and utilities.

Transit Segment- primarily manufactures and services components for new and existing passenger transit vehicles, typically subway cars and buses, builds new commuter locomotives, friction products, and refurbishes subway cars. Customers include public transit authorities and

1

municipalities, leasing companies, and manufacturers of subway cars and buses around the world.

1 Year Stock Price

Source: Google Finance

Positives

Positive Train Control: Wabtec is the industry supplier of Positive Train Control (PTC). PTC is a safety requirement for Class I Railroads (which carry passengers or toxic materials) mandated by The

Rail Safety Improvement Act of 2008. Class 1 railroads account for 90% of the industry’s revenues.

As of now, this part must installed by December 31 st , 2015. PTC costs about 20-40k to install and should provide Wabtec with both short-term and long-term revenues (servicing of PTC can be seen as an annuity factor). Having said that, Wabtec expects PTC revenue to exceed $200 million in 2012 compared to approximately $125 million in 2011 (with contracts in both the U.S. and Brazil). It is estimated that in 2012 that UNP will spend $335 million, NSC will spend $250 million, and BNSF will spend $300 million on PTC. These are opportunities for Wabtec to capitalize on their product offerings.

Product Offering: Wabtec is a global company with about 50% of revenues coming from outside the United States. They are expanding in Europe, Asia Pacific, and South America. They have built their product offering with a stable mix of original equipment market (OEM) and after-market parts.

More than 50% of revenues come from the after-market products and services which have higher margins and are less cyclical. It is important that Wabtec is expanding their after-market products because it creates a defensive mechanism for revenues due to the less cyclical nature of those products.

Operations: Having looked into Wabtec’s portfolio, it is evident that they have leading design and engineering capabilities with 1250 patents worldwide. In addition, there is a barrier to entry due to their extensive experience with industry regulation requirements which are governed by AAR and

FRA. Recently, Wabtec has been improving margins with the implementation of the “Wabtec

Performance System”. The performance system includes 600 kaizen activities (as of 2011) coupled with lean manufacturing processes and has led to increased margins by more than 2% in the past five years.

Expansion: Wabtec continuously seeks value-added acquisitions to expand their market penetration.

In my opinion, this creates the potential for Wabtec to grow profitability, expand geographically, and

2

diversify risks from the North American railroad industry. Wabtec has market presence in Brazil where there is a high demand to move commodities (leading to an increased demand in freight parts for Wabtec). Wabtec has low debt and a safe amount of cash. With some of their cash, they bought back about $6 million worth of stock during the third quarter of 2012.

Risks

General Risks: Wabtec is affected by general macroeconomic conditions both in the U.S. and internationally. According to the Association of American Railroads, carloadings decreased 2.7% and revenue ton-miles decreased 1.7% through mid-October 2012 (compared to the previous year).

Reduction in freight traffic is due to decreased demand in coal (around 45% of freight revenue in

2011) which may reduce the demand for replacement parts. In addition, Wabtec operates in a highly competitive industry. Their top 5 customers accounted for 17% of total sales which creates a dependency risk. These customers include GE, Eversholt, CSX, CAT, and UNP. Wabtec faces collective bargaining risks due to the fact that 25% of employees are unionized. Wabtec is also subject to a variety of environmental laws and regulations.

Government Spending: Most government entities at all levels continue to face budget issues, which could have a negative effect on demand for the company’s products and service (due to passenger railways’ reliance on the government). However, $10.5 billion was supplied in June 2012 as the U.S. federal government passed a two-year transportation funding bill called MAP-21 which was a positive.

PTC Mandate Risks: In terms of their growth in PTC, mandate risks are present as the “highway bill” committee proposed extending the PTC deadline to December 31, 2020. This means that companies would be able to hold off on capital investments in PTC technology.

International Risks: Wabtec is a global company so international risk resides in currency exchange rate fluctuations, trade restrictions, intellectual property rights, and instability (political, economic, and social).

Acquisition Risks: Despite their recent acquisitions, there is a risk that value may not be added. This could be due to difficulties in achieving operational synergies, management differences, assumptions of unknown liabilities, and changes in business or economic factors affecting the acquisition.

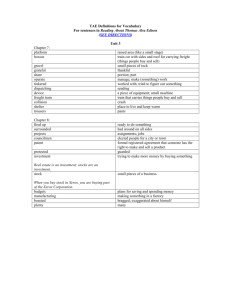

Sales Mix

3

Business Analysis

Wabtec strives to be the leading low-cost producer while maintaining quality, technology, and consumer responsiveness. They currently hold about a 50% market share in North America for their braking-related equipment and hold leading positions with most other products. In addition, they sell certain products in industrial markets such as mining, off-highway, and energy through their heat exchangers and friction materials.

Wabtec’s core strategies include expanding globally into adjacent markets, increasing after-market sales, developing new products and technologies, and seeking value-added acquisitions. Thus far, they have been able to expand their international presence at a rate of 20% over the last five years

(reaching $916 million in 2011 or 47% of total revenues). Sales in the after-market hit a record in

2011 of $1.1 billion (57% of revenues) and continue to grow. In terms of innovation, they have been expanding technology in Positive Train Control and Electronically Controlled Pneumatic Braking

(which made up 35% of total sales in 2011). Wabtec continues to lock in contracts for PTC implementation in both the U.S and Brazil.

Wabtec has also improved their productivity through the implementation of the “Wabtec

Performance System”. In addition, they have made acquisitions and acquired four businesses with about $180 million in revenues. With their new $600 million credit facility (in 2011), they can continue to seek value-added acquisitions in the near future.

Industry Analysis

To quote the Association of American Railroads, “Whenever Americans grow something, eat something, mine something, make something, turn on a light, or get dressed, it’s likely that railroads were involved somewhere along the line”. In North America, railroads carry about 43% of intercity freight (measured by ton-miles). Consequently, this industry is extremely sensitive to the well-being of the economy. Coal is the largest source of revenue (about 45%) for the railroad industry as it is used to generate about half of all U.S electricity.

With relatively low natural gas prices and stringent environmental regulations, Class I railroads have originated nearly 650,000 fewer carloads of coal in 2011 than it did in 2008.

However, rising diesel gas prices have made the trucking industry less attractive (rising from about an average of $2 per gallon in 2009 to $3.90 on a national scale) and the railroad industry more

4

attractive; especially in the intermodal space. It would cost shippers almost $70 billion more per year if all freight moved by rail were shifted to truck. This is because on average, railroads are four times more fuel efficient than trucks. In 2011, railroads moved a ton of freight an average of 469 miles per gallon on fuel.

In 2011, revenue ton-miles increased 3.2% while carloadings increased 2.2%. In addition, the demand for locomotives and freight cars is increasing compared to the past 10 years. According to the Department of Transportation, the demand for rail freight transportation will increase approximately 88% by 2035. Intermodal transportation has been the railroads’ fastest growing market segment in the past 10 years (growing 5.4% in 2011). This partly has to do with the fact that railroads are fuel efficient, reduce greenhouse gases, and pollution (while bypassing highway congestion). In terms of costs, the average U.S. freight rail rates fell 45% from 1981 to 2011. This means that the average business today can ship twice as much as it could for the same price it paid

30 years ago. As companies search for more efficient means of transportation (while decreasing carbon footprint), I believe that railroads will be strategically positioned. When the demand for railroads (both freight and passenger) increases, so does the potential revenue for Wabtec’s integral value-added parts.

In the passenger market, government funding is extremely important as they provide money to the local transit authorities to purchase new equipment and infrastructure. According to the

American Public Transport Association, ridership has increased in the U.S. about 2% in

2011. Most countries’ railways outside the U.S. are focused on passenger railways as opposed to freight. However, that trend is changing as capital is being invested in freight.

According to UNIFE, the global market for railway products and services is more than $100 billion, growing at 2-2.5% annually through 2016.

The largest markets (making up 80% of the total market) are Europe, Asia-Pacific, and North

America. Important factors that influence the rail transportation industry include general economic conditions, traffic, and government spending on public transportation.

As the economy recovers, manufacturing production will pick up and consumers will begin to spend more, driving demand for industry transportation services. Furthermore, rising fuel costs will cause rail transportation to be comparatively cost-efficient for businesses that require bulk freight.

Valuation

The valuation below is a five year prediction of the stock price of Wabtec. By investigating EPS, growth rate, earnings yield, and relative P/E ratio of the stock, a range of predictions were created by growing out the EPS (minus the cash).

Target Price Methodology:

To value this security, cash per share was subtracted from the current stock price which equaled to

$74.03. After, I divided $2.51 by $74.03 and arrived at an earnings yield of 4.741%. An EPS growth rate was then assigned over five years. Once the future earnings yield was determined, it was then

5

multiplied by the current share price to arrive at an EPS. This EPS was then multiplied by a given

P/E ratio to get a future share price without cash. Cash was then added which provided a rough estimated stock price in five years. To determine a purchase price, a discount of 10% was applied to the future share price. Based on these calculations, the yellow shaded stock prices are the feasible region (based on historical growth rates) with the green being the predicted future/buy price and the red being the lower bound.

The inputs used were:

Share Price (rough average): $80.00

Shares Outstanding: 47.8 million

Cash Per Share: $5.97

EPS: $3.51

Stock Price (minus cash): $74.03

Dividends/EPS: 2.28%

Retention Ratio: 97.72%

Earnings Yield: 4.741%

Stock Price in 5 Years

10%

12%

$

$

13

79.46

86.39

14% $ 93.83

16% $ 101.81

18% $ 110.36

20% $ 119.51

22% $ 129.30

24% $ 139.74

26% $ 150.88

28% $ 162.76

30% $ 175.39

32% $ 188.83

34% $ 203.11

36% $ 218.27

38% $ 234.35

40% $ 251.38

13.5

$ 82.29

$ 89.48

$ 97.21

$ 105.50

$ 114.38

$ 123.88

$ 134.04

$ 144.89

$ 156.46

$ 168.79

$ 181.91

$ 195.87

$ 210.69

$ 226.43

$ 243.13

$ 260.82

14

$ 85.11

$ 92.57

$ 100.59

$ 109.18

$ 118.39

$ 128.25

$ 138.78

$ 150.03

$ 162.03

$ 174.82

$ 188.43

$ 202.90

$ 218.28

$ 234.60

$ 251.91

$ 270.26

14.5

$ 87.94

$ 95.67

$ 103.97

$ 112.87

$ 122.41

$ 132.62

$ 143.53

$ 155.18

$ 167.60

$ 180.85

$ 194.94

$ 209.93

$ 225.86

$ 242.77

$ 260.70

$ 279.70

15

$ 90.77

$ 98.76

$ 107.35

$ 116.56

$ 126.42

$ 136.98

$ 148.27

$ 160.32

$ 173.18

$ 186.88

$ 201.46

$ 216.97

$ 233.44

$ 250.93

$ 269.48

$ 289.14

15.5

$ 93.59

$ 101.85

$ 110.72

$ 120.24

$ 130.44

$ 141.35

$ 153.01

$ 165.47

$ 178.75

$ 192.91

$ 207.97

$ 224.00

$ 241.02

$ 259.10

$ 278.26

$ 298.58

16

$ 96.42

$ 104.95

$ 114.10

$ 123.93

$ 134.45

$ 145.72

$ 157.76

$ 170.61

$ 184.32

$ 198.94

$ 214.49

$ 231.03

$ 248.61

$ 267.26

$ 287.05

$ 308.01

16.5

$ 99.24

$ 108.04

$ 117.48

$ 127.61

$ 138.47

$ 150.08

$ 162.50

$ 175.76

$ 189.90

$ 204.97

$ 221.01

$ 238.06

$ 256.19

$ 275.43

$ 295.83

$ 317.45

17

$ 102.07

$ 111.13

$ 120.86

$ 131.30

$ 142.48

$ 154.45

$ 167.24

$ 180.90

$ 195.47

$ 211.00

$ 227.52

$ 245.10

$ 263.77

$ 283.59

$ 304.61

$ 326.89

17.5

$ 104.90

$ 114.22

$ 124.24

$ 134.99

$ 146.50

$ 158.82

$ 171.99

$ 186.05

$ 201.05

$ 217.03

$ 234.04

$ 252.13

$ 271.35

$ 291.76

$ 313.40

$ 336.33

*The X axis is EPS growth rate, the Y axis is the P/E ratio

If this value is discounted back today at a 10% rate, the purchase price is $90.48.

6

0% 13.00

13.50

14.00

14.50

15.00

15.50

16.00

16.50

17.00

17.50

10% $ 49.34

12% $ 53.64

14% $ 58.26

16% $ 63.22

18% $ 68.53

20% $ 74.21

22% $ 80.28

24% $ 86.77

26% $ 93.69

28% $ 101.06

30% $ 108.91

32% $ 117.25

34% $ 126.12

36% $ 135.53

38% $ 145.51

$ 51.09

$ 55.56

$ 60.36

$ 65.51

$ 71.02

$ 76.92

$ 83.23

$ 89.96

$ 97.15

$ 104.80

$ 112.95

$ 121.62

$ 130.82

$ 140.60

$ 150.96

$ 52.85

$ 57.48

$ 62.46

$ 67.79

$ 73.51

$ 79.63

$ 86.17

$ 93.16

$ 100.61

$ 108.55

$ 117.00

$ 125.98

$ 135.53

$ 145.67

$ 156.42

$ 54.60

$ 59.40

$ 64.55

$ 70.08

$ 76.01

$ 82.34

$ 89.12

$ 96.35

$ 104.07

$ 112.29

$ 121.04

$ 130.35

$ 140.24

$ 150.74

$ 161.87

$ 56.36

$ 61.32

$ 66.65

$ 72.37

$ 78.50

$ 85.06

$ 92.06

$ 99.55

$ 107.53

$ 116.04

$ 125.09

$ 134.72

$ 144.95

$ 155.81

$ 167.33

$ 58.11

$ 63.24

$ 68.75

$ 74.66

$ 80.99

$ 87.77

$ 95.01

$ 102.74

$ 110.99

$ 119.78

$ 129.14

$ 139.09

$ 149.66

$ 160.88

$ 172.78

$ 59.87

$ 65.16

$ 70.85

$ 76.95

$ 83.48

$ 90.48

$ 97.95

$ 105.94

$ 114.45

$ 123.52

$ 133.18

$ 143.45

$ 154.36

$ 165.95

$ 178.23

$ 61.62

$ 67.08

$ 72.95

$ 79.24

$ 85.98

$ 93.19

$ 100.90

$ 109.13

$ 117.91

$ 127.27

$ 137.23

$ 147.82

$ 159.07

$ 171.02

$ 183.69

$ 63.38

$ 69.00

$ 75.05

$ 81.53

$ 88.47

$ 95.90

$ 103.84

$ 112.33

$ 121.37

$ 131.01

$ 141.27

$ 152.19

$ 163.78

$ 176.09

$ 189.14

$ 65.13

$ 70.92

$ 77.14

$ 83.82

$ 90.96

$ 98.61

$ 106.79

$ 115.52

$ 124.83

$ 134.76

$ 145.32

$ 156.55

$ 168.49

$ 181.16

$ 194.60

40% $ 156.09

$ 161.95

$ 167.81

$ 173.67

$ 179.53

$ 185.39

$ 191.25

$ 197.11

$ 202.97

$ 208.83

Summary

Wabtec is an attractive investment due to its revenue growth relating to Positive Train Control, emerging market penetration, and its defensive business model (mix of aftermarket an d international sales).

7

Appendix: Historical Balance Sheet and Income Statement (5 years)

Source: Morningstar

8