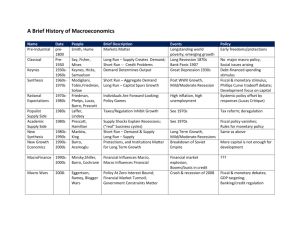

Monetary and Fiscal Policies: Ordinary Recessions and Financial

advertisement