3 year future plan a. research

advertisement

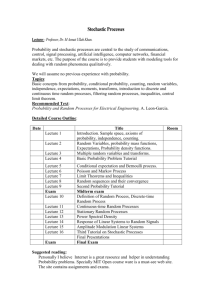

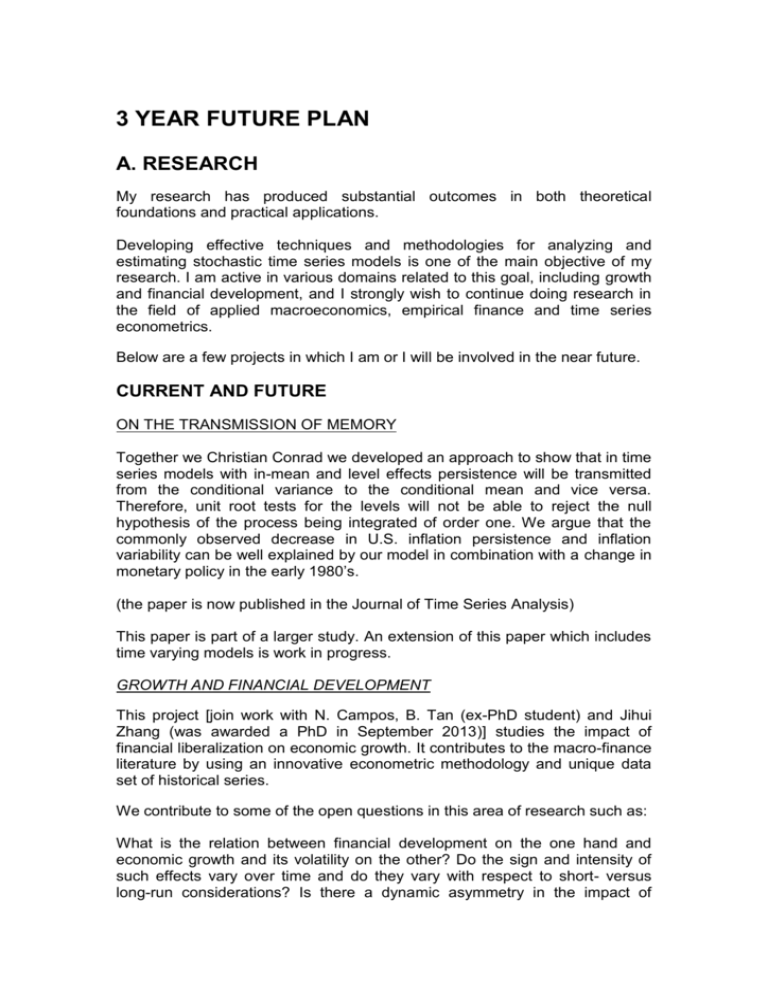

3 YEAR FUTURE PLAN A. RESEARCH My research has produced substantial outcomes in both theoretical foundations and practical applications. Developing effective techniques and methodologies for analyzing and estimating stochastic time series models is one of the main objective of my research. I am active in various domains related to this goal, including growth and financial development, and I strongly wish to continue doing research in the field of applied macroeconomics, empirical finance and time series econometrics. Below are a few projects in which I am or I will be involved in the near future. CURRENT AND FUTURE ON THE TRANSMISSION OF MEMORY Together we Christian Conrad we developed an approach to show that in time series models with in-mean and level effects persistence will be transmitted from the conditional variance to the conditional mean and vice versa. Therefore, unit root tests for the levels will not be able to reject the null hypothesis of the process being integrated of order one. We argue that the commonly observed decrease in U.S. inflation persistence and inflation variability can be well explained by our model in combination with a change in monetary policy in the early 1980’s. (the paper is now published in the Journal of Time Series Analysis) This paper is part of a larger study. An extension of this paper which includes time varying models is work in progress. GROWTH AND FINANCIAL DEVELOPMENT This project [join work with N. Campos, B. Tan (ex-PhD student) and Jihui Zhang (was awarded a PhD in September 2013)] studies the impact of financial liberalization on economic growth. It contributes to the macro-finance literature by using an innovative econometric methodology and unique data set of historical series. We contribute to some of the open questions in this area of research such as: What is the relation between financial development on the one hand and economic growth and its volatility on the other? Do the sign and intensity of such effects vary over time and do they vary with respect to short- versus long-run considerations? Is there a dynamic asymmetry in the impact of financial development and political instability (that is, is it negative in the shortand positive in the long-run)? (a paper from this project has already published in the Journal of Banking and Finance and another one is forthcoming in the Journal of Development Studies) RESEARCH BASED ON EU FP7 GRANT I have acquired an EU FP7 grant for a collaborative project: Macro Risk Assessment and Stabilization Policies with New Early Warning Signals(RASTANEWS). The project focuses on research about the future of macro-economic and monetary integration in Europe. My contribution is aimed at the application of time series analysis for modeling financial and macroeconomic (in)stability. Twelve European universities are working together on this project. Of the more than 100 grant applications RASTANEWS received the highest rating. The grant is € 2.4M in total, of which approximately € 88K for the Brunel University. I have contributed to WP5 part of the project, and directly involved in the preparation of the papers concerning: -Dynamic Correlation analysis of financial spillovers [joint work with S. Yfanti (she awarded her thesis recently)] (this paper is now forthcoming in the International Review of Financial Analysis) -A study of structural breaks and the recent financial crisis [joint work with S. Yfanti and Faek Menla Ali]. This paper is now published in the Journal of Empirical Finance. We will ensure timely and appropriate communication of our research findings to the wider academic community. On January 14th 2014 the first RASTANEWS Annual Dissemination Conference was hosted in the Italian Institute for International Political Studies. The Conference brought together outstanding personalities who discussed ongoing and potential reforms of the economic governance of the European Union: the Italian Ministry of Economics and Finance, the Vice President of the ECB, the Director of Centre for European Policy Studies, and the Director of the Fiscla Policy, DG ECFIN, European Commission. The second RASTANEWS Annual Dissemination Conference took place in March 2015. RESEARCH BASED ON EU FP7 GRANT As part of the above project, in a joint paper with P. Koutroumpis, Y. Karavias and V. Arakelian we study the convergence properties of inflation rates among the countries of the European Monetary Union over the period 19802013. By applying recently developed panel unit root/stationarity tests overall we are able to accept the stationarity hypothesis. This means that some differentials are stationary and therefore there might be clubs of countries which have been in the process of converging absolutely or relatively. Thus next, having also obtained mixed evidence in favour of convergence using the univariate testing procedure, we use a clustering algorithm in the context of multivariate stationarity tests and we statistically detect three absolute convergence clubs in the pre-euro period, which comprise early accession countries. For robustness purposes we also employ a pairwise convergence Bayesian framework. The outcome broadly confirms our findings. We also show that in the presence of volatility spillovers and structural breaks time varying persis- tence will be transmitted from the conditional variance to the conditional mean. If this transmission mechanism is ignored unit root tests will have poor power and size properties. STOCHASTIC TIME-VARYING COEFFICIENT MODELS In a series of joint papers [co-authored by A. Paraskevopoulos and S. Dafnos (PhD student)] we examine, in a rigorous manner the time series properties of stochastic models with deterministic time-varying coefficients. The use of such analytical methods for stochastic time-varying coefficient models, is novel and has not been suggested previously in the literature. One paper from this project will be submitted to Journal of Econometrics: The paper is entitled “A unified theory for time varying models: foundations and applications in the presence of breaks and conditional heteroscedasticity”. I have presented this paper in a number of Universities and International Conferences: Erasmus University (Netherlands), CREST (Paris), University of Nottingham, Imperial College, London, University of Manchester, Birkbeck College, University of London, Queen Mary University of London, Cardiff University, LSE. COMMODITY FUTURES In a join project [with Zannis Margaronis (PhD student) and R. Nath] we use algorithm output profit profiles from the Nixon algorithm (RGZ Ltd) to analyse the benefits of diversification within many commodity and asset class sectors in order to generate a superior portfolio profile. Moreover, in considering daily commodity data for use in practical trading systems, mapping accounting for rollover at contract expiry is required to modify the data. This is because the individual contract data that constitute a conventional time series do not account for contract expiry and the roll that is inherent. We will investigate both mapped and unmapped data series for certain key commodities using econometric Power ARCH models. This will be done across a range of commodities in different sectors in order to observe the significance of roll. A paper entitled “Modelling Time Varying Volatility Spillovers and Conditional Correlations Across Commodity Metal Futures” (joint work with Zannis, Ratza and F. Menla Ali has been submitted to the Journal of Empirical Finance. (two more papers from this project will be submitted to the Journal of Futures Markets and the Energy Journal respectively). SMOOTH TRANSITION MODELS In a series of papers (joint with N. Campos and P. Koutroumpis) we revisit the growth-finance nexus using smooth transition (ST) models and a unique data set. POLITICAL ECONOMY In a paper entitled “The Greek Dra(ch)ma: 5 Years of Austerity. The Three Economists.View and a Comment” (joint work with P. koutroumpis) we summarize the opinion of three renowned economists (alphabetically), namely Paul De Grauwe, Paul Krugman and Joseph Stiglitz, on the Eurozone crisis as well as the Greek case. In support of their claims we provide evidence of the negative impacts of the austerity plans on the Greek economy for a period covering 2010-2014. B. PHD STUDENTS Currently I supervise five PhD students. Two of them (P. Koutroumpis and Z. Margaronis) submitted their thesis in December 2015. Stavros Dafnos transferred to continuation status. Jihui Zhang was awarded a PhD in September 2013 and Stavroula Yfanti was awarded a PhD in 2014. C. TEACHING In my role as director of the MSc degrees at Brunel University I monitoring individual modules and taking into account students’ feedback to look for ways to improve teaching delivery and student satisfaction. I am also contributing to teaching, learning and student support in my role as Director of the MSc degrees. In 2013-2014 we introduced a new MSc in Banking and Finance and a new Business pathway for the MSc Business Finance. A number of modules were constructed or reconstructed partly in preparation for the new Masters degree in Banking and Finance. The intention was to broaden the market for masters students and increase the numbers accepted form the applications we receive. In that respect, a workshop based Business Finance module that brought in outsiders and practitioners was also introduced and this proved extremely popular with students who valued their location in London which allows such a course to take place. It was also decided to widen access to the less rigorous module on Quantitative Methods which had been available only to some students. We also introduced three new modules: Business Finance, Business Economics and Quantitative Methods for Business Finance. D. COLLEGIALITY AND MANAGEMENT I undertake my duties and responsibilities as Director of the BMRC and be available for advice to junior colleagues who are members of the centre (group since 2015). I facilitate career development as a mentor to one or more of the junior members of staff in E&F. I work in order to enhance the employability of our postgraduate students. Finally, I develop further my external network/links to ensure dissemination also outside academia.