Presentation PPT - West Virginia GIS Technical Center

advertisement

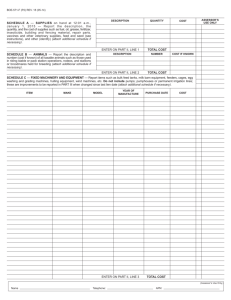

Property Valuation Training & Procedures Commission Tax Map Advisory Committee Kurt Donaldson, GISP • Member, Property Valuation Training & Procedures Commission • Manager, WV GIS Technical Center, WVU 5/22/2013 WV Assessors Conference Tax Map History in WV 1960’s First Tax Maps: County surface tax maps created on linen or mylar sheets and maintained by WV DTR 19901992 State transfers map making responsibilities to counties. First uniform statewide mapping standards approved by the Property Valuation Training and Procedures Commission (PVC) 1995 Mineral Lands Mapping Program: WV DTR begins creating digital surface parcels and mineral parcel maps for all coal bearing lands 20062007 Tax Map Advisory Committee of PVC recommends new tax map rules which includes digital mapping guidelines 2008 Kanawha County Circuit Court orders State Tax Department to provide Seneca Technologies with electronic copies of all county tax maps. New Tax Map Sales Legislative Rule (WV CSR 189-5) withdrawn. 2009 Seneca Lawsuit Overturned 2009 Revised procedural rule WV CSR 189-3 “Statewide Procedures for the Maintenance and Publishing of Surface Tax Maps” becomes effective. 2010 PVC appoints Tax Map Advisory Committee to review mapping regulations. WV Tax Maps 2 Tax Map History in WV 2011 The State Tax Department issues a memorandum that it will no longer provide tax map sales to “other” authorized county agents 2011 The State Tax Department issues a memorandum that it will no longer sell cadastral GIS data (ArcGIS Shapefiles, Maplnfo files, etc.) without first receiving written permission from the County Assessor(s) to do so. 2012 A business plan is developed by the WV Office of GIS Coordination and Rahall Transportation Institute as to how to finish, maintain, and share the statewide cadastral dataset, including both surface and mineral parcels. 2012 Property Tax Division published Tax Map Submission Guidelines for the submission of digital and manual tax maps to the State Tax Department. 2013 A PVC subcommittee was charged review to PVC regulations and monitoring WV Tax Maps 3 §11-1C-4. [PVC] Commission powers and duties; rulemaking • Make Rules: The commission shall have the power to make such rules as it deems necessary to carry out the provisions of this section, which rules shall include procedures for the maintenance, use, sale, and reproduction of microfilm, photography and tax maps. • Devise Training: Devise training and certification criteria for county assessors and their employees and members of county commissions • Evaluate Performance of Assessors & Tax Department: The commission shall establish objective criteria for the evaluation of the performance of the duties of county assessors and the tax commissioner. WV Tax Maps 4 Members of PVC Jeff Amburgey Director, Property Tax Division Chairman, PVC Hon. Janice LaRue Hon. Mickey Brown Mineral County Commissioner Boone County Commissioner Hon. Cheryl Romano Hon. Eddie Young* Hon. Jason Nettles* Harrison County Assessor Fayette County Assessor Calhoun County Assessor Dr. Calvin Kent* Mr. Kurt Donaldson* Citizen Member Citizen Member * PVC Subcommittee appointed to review regulations and monitoring WV Tax Maps 5 Tax Map Advisory Committee (2013) (2007) • PURPOSE: Provide recommendations for updating the WV Code of State Rules relative to the maintenance, publishing, and sale of surface tax maps. • RECOMMENDATION: Repeal and replace existing procedural rules with new guidelines for both manual and digital mapping WV Tax Maps 6 Committee Members (2006-07) • • • • • • Assessors Deputy Assessors County Mappers WVDTR Tax Personnel WV GIS Coordinator Geospatial Professionals NAME ORGANIZATION Preston Gooden Assessor - Berkeley County Larry Clifton Assessor - Braxton County Frank Whitacre Assessor - Hampshire County Joseph Alongi Assessor - Hancock County Jim Priester Assessor - Marion County Ron Hickman Assessor - Mason County Terri Funk Assessor - Preston County Dreama Evans Assessor - Raleigh County Steve Sluss Deputy Assessor - Kanawha County Bill King Mapper - Berkeley County Daniel Tassey Mapper - Brook/Hancock Counties JD Adkins Mapper - Cabell County Vince LaNeve Mapper - Hancock County Jeff Tuttle Mapper - Marion County Dave Tarbett Mapper - Mason County Connie Ervin Mapper - Preston County Doug Shahan Mapper - Preston County Cindy Gorman Mapper - Raleigh County Matthew Mullenax Planner - Berkeley County Chris Fletcher Planner - City of Morgantown Yi-Ning Chen WV DTR GIS Analyst Craig Neidig WV GIS Coordinator Kurt Donaldson WV GIS Technical Center Sam Hicks Commissioner - Lewis County WV Tax Maps 7 Charge to Tax Map Advisory Committee • Regulations: Review all mapping regulations. Ensure mapping definitions and rules consistent and unambiguous for all mapping regulations. – WV State Code – Statewide Procedures for the Maintenance and Publishing of Surface Tax Maps (189 CSR 3) effective 2009 – Tax Map Sales (189 CSR 5) effective 1992 • Monitoring: Review County Monitoring Plans • Training: Review training resources and guidelines • Enforcement: Review enforcement procedures for those entities which illegally distribute tax maps (189-3-7.8.c.6) WV Tax Maps 8 Tax Map Regulations & Monitoring • Regulations – WV State Code • Chapter 11. Taxation • Article 1c. Fair and equitable property valuation – Statewide Procedures for the Maintenance and Publishing of Surface Tax Maps • (189 CSR 3) effective 2009 – Tax Map Sales • (189 CSR 5) effective 1992 • County Monitoring Plans WV Tax Maps 9 WV State Code Chapter 11. Taxation Article 1c. Fair and equitable property valuation WV Tax Maps 10 WV State Code - Review §11-1C-2. Definitions. For the purposes of this article, the following words shall have the meanings hereafter ascribed to them unless the context clearly indicates otherwise: (d) "Valuation commission" or "commission" means the commission created in section three of this article. (h) "Electronic” means relating to technology having electrical, digital, magnetic, wireless, optical, electromagnetic or similar capabilities. Electronic tax maps consist of the digital mapping files, aerial photography, and other mapping data layers associated with tax maps. (i) "Paper” means a tax map or document that is not electronic. WV Tax Maps 11 WV State Code - Review §11-1C-4. [PVC] Commission powers and duties; rulemaking. (3d) The commission shall have the power to make such rules as it deems necessary to carry out the provisions of this section, which rules shall include procedures for the maintenance, use, sale, and reproduction of microfilm, photography and tax maps reproduction, and distribution of paper and electronic tax maps. WV Tax Maps 12 WV State Code 11-1C-7. Duties of county assessors; property to be appraised at fair market value; exceptions; initial equalization; valuation plan. (e) (1) The county assessor shall establish and maintain as official records of the county tax maps of the entire county drawn to scale or aerial maps, … ascertained by reference to the appropriate records: Provided, That all such records shall be established and maintained and the sale, and reproduction of microfilm, photography and tax maps reproduction, and distribution of paper and electronic tax maps shall be in accordance with legislative rules promulgated by the commission. WV Tax Maps 13 WV State Code - Review 11-1C-7. Duties of county assessors; property to be appraised at fair market value; exceptions; initial equalization; valuation plan. (2) The following fees apply in addition to any fee charged by the assessor or the map sales unit of the property tax division of the department of revenue for the sale or reproduction of microfilm, photography and paper and electronic tax maps pursuant to the legislative rules referenced in subdivision (1) of this subsection: (A) For a full map sheet, an additional fee of three dollars per copy shall be charged, which shall be deposited in the courthouse facilities improvement fund created by section six, article twenty-six, chapter twenty-nine of this code; WV Tax Maps 14 TITLE 189 PVC Rules SERIES 5 SERIES 3 Tax Map Sales Statewide Procedures for the Maintenance & Publishing of Surface Tax Maps WV Tax Maps 15 Statewide Procedures for the Maintenance and Publishing of Surface Tax Maps (189 CSR 3) effective 2009 WV Tax Maps 16 Finished Tax Maps Manually drafted or computer generated WV Tax Maps 17 Finished “Surface” Tax Maps • Show the property and lot lines, set forth dimensions and/or areas, and other cadastral and cultural features that assessors are required by state law to maintain and publish for the public. • Created by either manual or automated methods in accordance with standards approved by the Property Valuation Training and Procedures Commission – – – – Cartographic Design / Layout Specifications Map Content Maintenance Procedures / Map Currency Submission Requirements / County Monitoring WV Tax Maps 18 WV Tax Maps 19 WV Tax Maps 20 WV Tax Maps 21 §189-3 Tax Map Rule - Review (References) • §189-3-17 References. – 17.1. International Association of Assessing Officers (IAAO). 2002 2008. Standard on Contracting for Assessment Services. Website: http://www.iaao.org/. – 17.2. International Association of Assessing Officers (IAAO). 2003 2012. Standard on Digital Cadastral Maps and Parcel Identifiers. Website: http://www.iaao.org/. – 17.3. International Association of Assessing Officers (IAAO). 2004. Standard on Manual Cadastral Maps and Parcel Identifiers. Website: http://www.iaao.org/. – 17.4. Federal Geographic Data Committee’s (FGDC) Cadastral Data Subcommittee. 2006 2012. Cadastral NSDI Reference Document. Website: http://www.nationalcad.org/ WV Tax Maps 22 §189-3 Tax Map Rule Review (Text Font Size/Symbol Sets) WV Tax Maps 23 §189-3 Tax Map Rule Review (Text Font Size/Symbol Sets) WV Tax Maps 24 §189-3 Tax Map Rule (Symbol & Annotation Sizes) • §189-3-7.6a Symbols. -- Throughout the finished tax maps, the symbol sets shall be consistent, conforming to the standard mapping symbols and cartographic specifications shown in the Appendix of the Standard on Manual Cadastral Maps and Parcel Identifiers (IAAO 2004). Computerized mapping systems shall follow a similar cartographic standard. All symbols shall be legible when reduced to 50%. • §189-3-7.6a Annotated Features. -- Unless otherwise denoted in these specifications, all lettering on finished cadastral maps shall conform to the character height and orientation shown in the Appendix of the Standard on Manual Cadastral Maps and Parcel Identifiers (IAAO 2004). Computerized mapping systems shall follow a similar cartographic standard. All annotated features shall be legible when reduced to 50%. WV Tax Maps 25 Sample Feedback from County Mapper I have said it before, and I will say it again. I am thinking of joining Virginia, Maryland or Pennsylvania's GIS group because from what I see they are way ahead of WV in all areas, especially [GIS] training. …The other issue I have is that the Statewide Procedures for the Maintenance and Publishing of Surface Tax Maps needs to updated to the 21st century. No, this time [the] 20th will not do. I am working on moving to the parcel fabric and using the ESRI templates. In many areas these maps do not meet the standards set forth in the standards even though they are much nicer, more modern, easier to read, prettier, etc. I feel there is far too much written into the standards and how you should do things. Much of it just needs to be deleted. There needs to be a set of standards but these go too far and, theoretically, prevent me from modernizing. The rest of the state can stay in the past if they want to I am compelled to move forward. WV Tax Maps 26 Sample Feedback from County Mapper The surrounding states are far more advanced and our constituents expect the same from us. I am working hard to deliver that to them with or without the rest of the state. I would prefer that the standards were written to allow me to do that. This is the way we have always done it is not a good reason for anything. It needs to be examined and reworked. There needs to be input at ALL stages from ALL the parcel mappers and not a select few as it was the last time. I know I was not consulted and the result is that it is already out of date. I would be glad to head up this effort if that is what it takes. WV Tax Maps 27 Tax Map Sales (189 CSR 5) effective 1992 WV Tax Maps 28 §189-5 Tax Map Sales – PVC Recommendations • PAPER MAPS: The existing base fees ($5.00 for map sheet, $1.50 for copies) will remain the same. • DIGITAL PRINT-READY IMAGES (PDF, JPEG, etc.) Same fees as for paper maps, or $5 per map sheet. • DIGITAL PARCEL POLYGONS (GIS files: Esri Shapefiles, AutoDesk Drawing files, etc.) Calculate the fee based on the total number of tax map sheets ($5 per map sheet) that covers the area of interest. The Courthouse Facilities Improvement Authority, not the PVC, shall set the additional tax map fees (e.g., $3 per full map sheet, $1.50 per copy) for the courthouse facilities improvement fund. WV Tax Maps 29 §189-5 Tax Map Sales - Review Product Code Total §11-1C-7 (Surcharge CFI)2 Printed Copies or Print-Ready Images of Finished Tax Maps Full Map Sheet $5.00 $3.00 $8.00 1 18” x 24” or larger Small Map Sheets $3.00 $2.00 $5.00 11” x 17” or smaller Reproductions Reproductions $1.50 $1.50 $3.00 8.5” x 11” or 8.5” x 14” Digital Parcel Polygons (GIS files: Shapefiles, DWG files, etc.) Individual Map Sheets $5.00 $3.00 $8.00 of digital parcel per map sheet polygons Countywide Set of $5.00 $3.00 $8.00 x total number digital parcel polygons per map sheet of maps in County 1 An WV 189CSR5 (Base fee) additional processing fee may be applied for customized map services. 2 The percentages of tax map sales revenue submitted to the Courthouse Facilities Improvement Fund range from 37.5% (full map sheet) to 50% (reproductions). WV Tax Maps 30 §189-5 Tax Map Sales – PVC Recommendations • The PVC sets the MAXIMUM charge for tax map sales, while the Assessor sets the MINIMUM charge. An assessor may choose not to charge tax map sales for other governmental agencies, economic development projects, etc. • Don’t plan on tax map sales being a revenue generator. Tax map sales help to cover costs for consumables like paper and ink, but will not generate enough revenue to pay for mappers’ salaries. • Generally, assessors charge the public a nominal amount for map services that require human involvement to distribute the maps. Many assessors choose not to charge for Internet-based Web map applications that allow the public to view parcel maps remotely. WV Tax Maps 31 Taylor County Web Map Application WV Tax Maps 32 Web Map Application – Photo View WV Tax Maps 33 Tax Map Distribution by Assessors • via Internet – Online Map Viewers (print screen only) – Download finished tax maps (PDF, TIFF) – Subscription based • via Office – Assessors Office (paper access, map kiosk) – State Tax Sales Office (mail map requests?) WV Tax Maps 34 County Monitoring Plans WV Tax Maps 35 County Monitoring Plan (Existing Monitoring Questionnaire) WV Tax Maps 36 County Monitoring Plan (Proposed Monitoring Questionnaire) Inspection Item Last Year in Compliance MAP DESIGN & CONTENT: Are the paper or electronic “finished” tax maps created in accordance with the cartographic design, map content and layout specifications set forth in PVC Procedural Rule 189-3? Are the tax maps legible, easily interpreted, visually appealing, and communicate effectively the cadastral information to the map reader? (§189-3-5 to §189-3-7 ) 2012 MAP CURRENTNESS: Is the map maintenance current for all parcel split transfers inspected? (§189-3-11) 2012 TRAINING: Last map training attended by assessors or county mappers. (§ 11-1C-4) 2012 WV Tax Maps 37 County Monitoring Plan (Proposed Monitoring Questionnaire) Inspection Item Last Year in Compliance MAP SUBMISSION: (1) Revised Tax Maps. Revised tax map copies shall be submitted to the Property Tax Division as follows: transfers occurring between July 1st and the following June 30 shall be reflected in the maps and submitted to the PTD no later than February 1 of the subsequent calendar year. Revised finished maps shall be submitted as a hardcopy or print-ready digital image in accordance with exchange specifications set forth by the PVC (§189-3-11.8) 2012 (2) GIS Files. During the month of April, all county assessors who maintain automated systems shall submit their digital parcel boundary files and associated metadata to the State Tax Department in accordance with the prescribed format and submission guidelines. (§189-3-15) 2012 WV Tax Maps 38 County Monitoring Plan (Objectives of New Monitoring Guidelines) • Synchronize assessment and mapping monitoring during same visitation • More responsive and early detection in reporting deficiencies to PVC – Annual monitoring of content and submission guidelines do not require visits to counties – Identify automated ways to review map maintenance through IAS and other means without visiting counties WV Tax Maps 39 Recommendations - Property Tax Div. • STAFFING: Minimize staff changeover. Identify Lead GIS Manager for Surface Tax Maps and Program Supervisor. Provide outreach and technical support services. • OUTREACH: Develop and sponsors GIS training programs for assessors and mappers. Publish resources on Web. • DATA SHARING: Ensure there is reciprocal relationship between the PTD and counties for sharing mineral and surface tax parcels. • STANDARDS: Develop GIS database standards. • GIS/IAS INTEGRATION: Supervise integration of county statewide GIS parcels and IAS records into statewide layer for “viewing only” purposes. Develop an easy process for counties to download IAS data to merge with GIS parcels. • MAINTENANCE: Establish a digital maintenance program for counties that need to outsource parcel maintenance. • MONITORING: Update monitoring procedures. When writing county inspections cite appropriate regulations for deficiencies. WV Tax Maps 40 §189-3 Tax Map Rule - Review (Digital Parcel File/Shapefiles) • §189-3-15. Statewide Digital Parcel Boundary File. Once a year, as part of the State Parcel Management Program, a state parcel boundary file with minimum attributes shall be standardized across jurisdictional boundaries to meet statewide business needs including emergency response and economic development. To fulfill this annual requirement, during the month of April, all county assessors who maintain automated systems shall submit their digital parcel boundary files and associated metadata to the State Tax Department in accordance with prescribed submission guidelines. It is recommended that digital parcel files be geo-referenced, seamless, topologically validated, and linkable to the Integrated Assessment System and follow submission standards set forth by the Property Tax Division. The State Tax Department may provide this information to any federal, state, or local government agency for their limited use. The further reproduction and distribution shall be in accordance with paragraph 7.8.c.6 of this rule. WV Tax Maps 41 Mapping Trends WV Tax Maps 42 Surface Tax Mapping Status (2013) 75% of WV counties have adopted GIS WV Tax Maps 43 Surface Tax Mapping Status (2004) Most counties are migrating to Esri GIS Software WV Tax Maps 44 GIS Adoption – Most Populous Counties WV Tax Maps 45 GIS Adoption – Most Populous Cities WV Tax Maps 46 Future Trends…In Next 15 Years • All 55 counties will have adopted GIS mapping – Successful State Digital Maintenance Program – Digital Conversion Funding Support from State • The Property Tax Division will have integrated all 55 counties into a seamless GIS database linked to the IAS and viewable to authorized users • Map maintenance and publishing standards for manually drafting paper tax maps will be dropped WV Tax Maps 47 Digital Conversion WV Tax Maps 48 Digital Conversion - Steps • Conversion Method (Deeds & Plats, Best Fit, Hybrid) • Conversion Guidelines • • • • • • • • • Geo-reference Tax Maps/Locate Plats Create Base Road Centerlines Build right-of-way widths Add hydro and other reference features Annotation/Attribution Parcel Database Design Build Topology Rules Reconcile with IAS records Electronic Map Books Refer to training resources , standards, samples RFP’s for best practices about digital conversion WV Tax Maps 49 Digital Conversion - Challenges • Maintaining two systems (manual and digital) • Expense • Time • Technical Issues • Organizational Issues - Sharing resources and expenses with other entities can minimize redundancy, ensure interoperability, and maximize benefits. - Conduct pilots to resolve critical issues. WV Tax Maps 50 Digital Map Maintenance WV Tax Maps 51 Digital Map Maintenance • In House: – Counties have their own mapper – Multiple counties share a mapper (Hancock/Brooke, Putnam/Mason). • Out Source: – Counties outsource directly with a qualified vendor for digital maintenance services (Hampshire, Mineral, Pendleton, Lewis, Taylor, Gilmer, Clay) – Counties outsource maintenances services performed by a vendor under contract with the Property Tax Division WV Tax Maps 52 Map Request Change WV Tax Maps 53 Attach Map Plat WV Tax Maps 54 Staff Recommendations IAAO 2012 Standard on Digital Cadastral Maps and Parcel Identifiers 3.11 Staff and Training • An effective digital cadastral mapping and deed-processing program requires approximately one staff person per 10,000 to 20,000 parcels. This number may be modified depending on the following factors: – – – – – – – – – Degree of automation and efficiency in deed processing and mapping work flow Economies of scale in larger jurisdictions Need to create or recreate digital map layer Volume of deed processing work Ratio of ownership name changes to transfers that create new parcels Volume of new subdivision and condominium plats filed Need to respond to public requests for map and ownership information Reliance on contracted mapping services Need to create and maintain layers for non-assessment purposes, such as zoning, transportation planning, and emergency response – Ease of deed processing, especially if transfers contain an accurate parcel identifier WV Tax Maps 55 Cadastral GIS Training WV Tax Maps 56 GIS Training Resources • Scheduled Training Courses – Foundational Training • ArcGIS I & II (June 10-14) – Specialized Training • ArcGIS Advanced Editing (June 19) • ArcGIS Python (July 16-18) • Training Resources – WV Association of Geospatial Professionals (www.wvagp.org) • Mapper ListServe - WVCADASTRAL@LISTSERV.WVU.EDU – – – – – WV Property Tax Division WV Office of GIS Coordination Academic & Research Institutions Software companies Other assessor offices WV Tax Maps 57 What is the most important component of a successful GIS program? • Hardware • Map Software • Map Data • People (the most important) – Assessor is a champion and successful manager of implementing, maintaining, and sustaining a digital mapping system – Qualified and trained mapping staff WV Tax Maps 58 Elements of a Successful GIS Program WV Tax Maps 59 What Constitutes a GIS Program? • Seamless countywide parcel map files • Geo-referenced to a common coordinate system • Linked to an external database via the property identification number • Topologically Validated (e.g., parcels closed, no gaps, and do not overlap; lot lines covered by parcel boundaries) • Digital surface tax maps published according to state guidelines. Electronic map books automate map publishing. • Continual maintenance of parcel files WV Tax Maps 60 Linked to Assessment Database A GIS links locational (spatial) and database (tabular) information + Tax Parcel Record: Anytown, West Virginia Parcel Number: 1 Owner: Mr. John Sebastian Doe Address: 3057 Apis Mellifera Road Address: Anytown, WV 20555 Phone: 1-304-555-7574 Acreage: 116 Appraised Value: 220,000 Mineral Rights: No Zoning Classification Single Family Residential (R1) Tax District: Trap Hill District District Number: 12 Map Number: 21 Spatial Information Tabular Information Database links to parcels via: (1) parcel identifier or (2) standardized address WV Tax Maps 61 GIS = Parcel Features + Database • GIS are a combination of geographic data and attribute data – Parcel polygons are the spatial features – CAMA/IAS records are the attributes • GIS allow two key types of functionality – Point at a graphic feature and retrieve attributes – Query attributes and see graphic result of query on a map WV Tax Maps 62 Topology (spatial relationships) • How to model spatial relationships – Parcels cannot overlap one another – Building footprints must not overlap parcels – Parcel lines cannot have dangles Error / Validation Checks WV Tax Maps 63 Topology – Define Relationships Define Spatial Relationships among different layers WV Tax Maps 64 Seamless Seamless Not Seamless WV Tax Maps 65 Seamless - countywide Seamless between rural districts and corporations WV Tax Maps 66 Electronic Map Books WV Tax Maps 67 Digital Data Sharing WV Tax Maps 68 Tax Parcel Web Map Service WV Tax Maps 69 Surface tax parcels provided by Counties for viewing purposes only WV Tax Maps 70 Mixed Leaf-Off Imagery Recently Received a Broadband Grant to Update Best Leaf-Off Imagery Service High resolution (usually 6”) imagery for Charleston, Huntington, Morgantown, and Weirton areas incorporated into SAMB 2003 statewide leaf-off imagery WV Tax Maps 71 WV Spatial Data Infrastructure Access to over $50 million dollars worth of spatial data WV Tax Maps 72 WV Sheriffs Association WV Tax Maps 73 Display of High-Resolution data in Web Map Services (1:282 Scale) • 2’ foot contours • 4” imagery WV Tax Maps 74 WV Tax Maps 75 WV Sheriffs Imagery – 12” & 4” 12 inch 4 inch Scale 1:1,128 WV Tax Maps 76 Oblique WV Tax Maps 77 Questions? Contact: Kurt Donaldson WV GIS Technical Center, WVU Web: http://wvgis.wvu.edu Phone: (304) 293-9467 E-mail: kdonalds@wvu.edu http://www.wvgis.wvu.edu/resources/standardsGuidelines/TaxMapResources.pdf WV Tax Maps 78